Blue Planet Studio

Investment Rationale

Canoo Inc. (NASDAQ:GOEV), a mobility technology company, manufactures breakthrough electric vehicles including lifestyle vehicles, lifestyle and multi-purpose delivery vehicles, and pickups. Major innovations in design, leading-edge technologies, and a modular electric platform, purpose-built to deliver maximum vehicle interior space customizable across all owners in the vehicle lifecycle, support a wide range of applications for consumers and businesses.

Advances in manufacturing and a number of critical customer wins have already validated the product mix. An order book of $2billion with $750million binding orders further signals both rapid market adoption via a burgeoning top line and high growth potential. Meanwhile, profitability and positive operating cash flow remain elusive, but a clear path to secure funding is emerging that may include both well-timed equity initiatives and non-dilutive events. At this juncture, valuation analytics seems to portend high appreciation potential for the stock.

Canoo Shares Just Reached an All-Time Low

Momentum has been to the downside. The stock of Canoo reached an all-time low just this past week.

The vast majority of shareholders who bought the stock post-IPO have incurred heavy losses. Can the stock recover? We make the argument that it can, and that the recovery has the potential to be impressive.

Profitability Remains Elusive and So Is Cash Flow from Operations

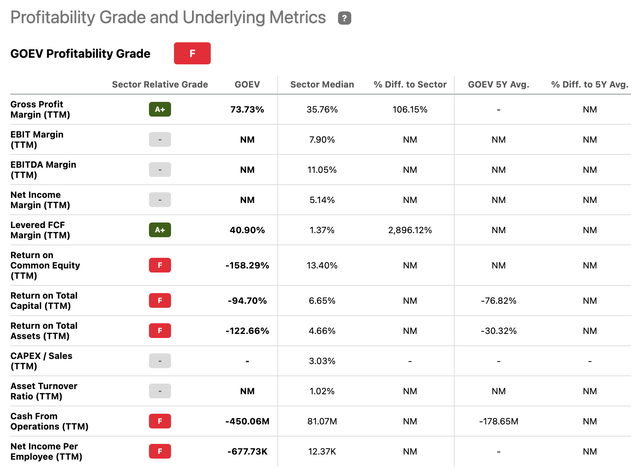

Check out the company’s profitability grade below.

Gross profit is high, but returns on equity and capital, cash from operations, and net income remain deeply negative.

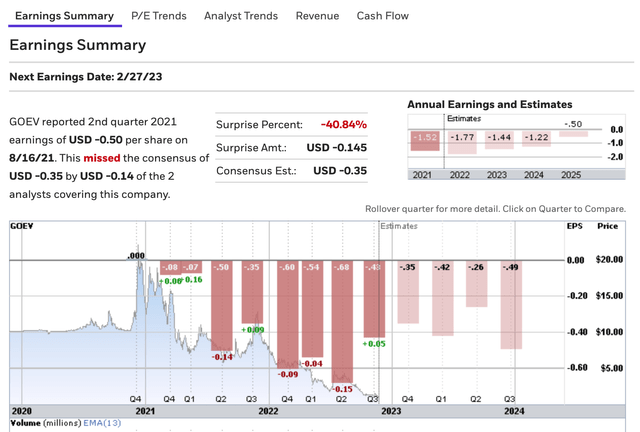

Annual earnings and estimates show the firm is not expected to be profitable for some time, a likely red flag for most conservative investors.

Recent results only confirm the aforementioned trends. The firm just reported GAAP net loss and comprehensive loss of $117.7 million and $407.5 million for the three and nine months ended September 30, 2022, compared to a GAAP net loss and comprehensive loss of $80.9 million and $208.7 million for the three and nine months ended September 30, 2021.

Adjusted EBITDA of $(80.8) million and $(348.1) million for the three and nine months ended September 30, 2022, compared to $(85.8) million and $(212.3) million for the three and nine months ended September 30, 2021, respectively. The profitability picture has thus been worsening recently, at least year-over-year. Now, this is to be expected of any company building a manufacturing footprint and investing in the future. But current shareholders may pay a steep price via dilutive events and other misfortunes; more on this below.

In a similar vein, net cash used in operating activities totaled $329.9 million for the nine months ended September 30, 2022, compared to $180.6 million for the nine months ended September 30, 2021. However, net cash used in investing activities did decrease to $58.4 million during the nine months ended September 30, 2022, compared to net cash used in investing activities of $100.1 million during the nine months ended September 30, 2021. Still, it’s a lot of cash going out, not in.

If profitability and positive operating cash flow are elusive, there are clear reasons to be bullish about the stock, including top management, solid manufacturing onramp, a number of critical customer wins validating the product mix, major top line growth potential, a clear path to secure funding, and very favorable valuation metrics.

Canoo Has Top Management Including a CEO Who Keeps Buying the Stock

Tony Aquila is the CEO, investor, and entrepreneur at the helm of Canoo; he’s also an inventor associated with 100+ patents in the automotive, aeronautics and cybersecurity sectors.

The company’s website provides further insight into the CEO’s background:

Growing up on the fringes of Silicon Valley with a mathematical and entrepreneurial mind, Tony founded in his garage, grew, and sold several technology start-ups during the dot-com years, ultimately founding Solera in 2005. Solera is an automotive technology company, that Tony founded with GTCR as his capital partner. Under his leadership as Founder, Chairman and CEO, the company went public through a $1 billion initial public offering in 2007 and private again in 2016, at a valuation of $6.5 billion. Significantly growing the total addressable market by executing over 50 acquisitions during his tenure, it employed 7,000 people in more than 90 countries.

In 2019, based on his proven track record of 70+ transactions with $15bn+ in aggregate value and an industry leading return profile, Tony founded AFV Partners LLC, a long-term sustainable capital vehicle that invests globally in assets that contribute to a net positive impact on the environment.

Canoo is currently one of AFV’s significant investments. Tony initially agreed to provide rescue capital to the company in July 2020. This was followed by his participation in the PIPE. His investments in Canoo were based on his assessment of the company’s competitive advantage: its industry unique focus on proprietary engineering and technology. In preparations for the SPAC merger, Tony was asked to join the board and, effective with the completion of the merger and de-SPAC with Hennessy Capital Acquisition Corp. IV in December 2020, became its Chairman. In April 2021, in the midst of maturing pains as a public company and the increased market scrutiny of SPAC businesses, particularly in the EV space, Tony accepted the CEO position, based on his deep belief in the design and engineering team, to accelerate the transformation of the business to set it apart from the herd. Since that time, Canoo expanded the executive team, announced three new vehicle trims, a Phase 1 advanced industrialization facility and established a landmark partnership for a Phase 2 owned mega-micro manufacturing facility on tribal land in Pryor, Oklahoma. Under Tony’s leadership the business grew to more than 700 engineers across five locations. He and his team are committed to their mission to bring EVs to everyone.

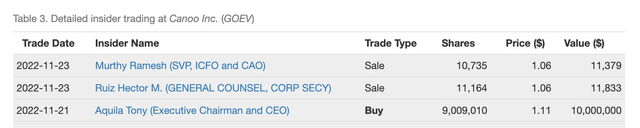

Clearly, the CEO has both a solid entrepreneurial track record and technical expertise. He’s also a big believer in the stock, recently purchasing $10 million worth of shares.

His total holdings now represent more than 19% of Canoo’s outstanding shares. Aquila surely does not anticipate bankruptcy anytime soon, nor do a number of key customers.

Canoo Shows Strong Manufacturing and Sales Momentum

Canoo has secured a number of agreements to bolster its manufacturing arm. One is to acquire a Vehicle Manufacturing Facility in Oklahoma City that enjoys easy access to road and rail. The facility will produce LDV and LV vehicles for delivery in 2023. Another, an EV Battery Module Manufacturing Facility in Pryor, OK, will be capable of approximately 3200 MWhs of battery module manufacturing capacity.

The company has also secured major customer wins. As has been well advertised by now, it signed a definitive agreement with Walmart for the retailer to purchase 4,500 all-electric delivery vehicles, beginning with the Lifestyle Delivery Vehicle, with the option to purchase up to 10,000 units. The vehicles will be used to deliver online orders in a sustainable way which will also contribute to Walmart’s goal to achieve zero emissions by 2040. A plan to kick off advanced deliveries to refine and finalize vehicle configuration in the Dallas Fort Worth metroplex seems well on track.

Because it validates Canoo’s product lineup and ascertains market adoption, the Walmart deal likely is the most pivotal win, but it only constitutes one of many market breakthroughs. Just on Oct. 17, 2022 Canoo announced a binding order for 9,300 American-made electric vehicles from Kingbee, a leading national work-ready van rental provider, with an option to increase to 18,600 vehicles.

Kingbee will upfit, wrap, and deliver Canoo vehicles as work-ready fleets solutions for enterprise and small & medium sized business customers across the U.S. Just a few days prior, Canoo and Zeeba, a growing national fleet leasing provider, signed an agreement for Zeeba to purchase 5,450 American made electric vehicles, with an initial binding commitment of 3,000 units through 2024. Zeeba will add Canoo Lifestyle Delivery Vehicles and Lifestyle Vehicles to its long-term fleet leasing portfolio.

Canoo seems to be gaining traction with a number of government agencies, as well. It has been awarded by the U.S. Army a contract to supply an electric vehicle for analysis and demonstration. This contract supports the U.S. military’s focus to incorporate scalable capabilities in operational and garrison environments. In April 2022, the National Aeronautics and Space Administration (NASA) also selected Canoo to provide Crew Transportation Vehicles (CTVs) for crewed Artemis lunar exploration launches. Canoo will deliver multiple customized all-electric LV models to NASA by June 2023.

These major wins show the company has a unique edge in the marketplace. An order book of $2 billion with $750 million binding orders further signals a booming top line, and both market adoption and high growth potential.

According to a new market research report published by Meticulous Research, the electric vehicle market is expected to grow at a CAGR of 33.6 % from 2020–2027 to reach $2,495.4 billion by 2027. The light commercial vehicles segment is expected to grow at the highest CAGR during the forecast period, the very same niche that Canoo is pursuing the most assiduously. Lots of runway ahead.

Canoo Has a Clear Path to Secure Funding

A non-profitable small cap with negative operating cash flow, Canoo has had to secure capital via repeat equity offerings. On August 08, 2022, the company filed a follow-on equity offering in the amount of $200 million. It had filed one in the amount of $250 million just three months prior, on May 10.

Based upon current projections, Canoo expects in Q4 2022 alone operating expenses (excluding stock-based compensation and depreciation) of $70 million to $90 million, and capital expenditures of $30 million to $50 million. As of September 30, 2022, it had cash and cash equivalents of $6.8 million.

Access of up to $200.0 million through an “at-the-market offering” program allows the firm to raise capital opportunistically, i.e., by taking advantage of a temporarily higher stock price or an upcoming milestone event – periodically, over time, on an as-needed basis. Canoo also issued Walmart (WMT) a warrant to purchase up to an aggregate of 61,160,011 shares at an exercise price of $2.15 per share, good for $120 million. (That share amount is more than 20% of all the outstanding shares. The firm agreed not to supply any vehicles to Amazon as part of the deal.)

Oklahoma has also given Canoo $15 million from the state’s “Quick Action Closing Fund” as part of an incentive package valued at $300 million intended to bring thousands of new tech and manufacturing jobs to the state. The $15-million Quick Action Closing Fund incentive is the largest the state has ever awarded since the program was created under Gov. Mary Fallin in 2011. Oklahoma has also agreed to purchase 1,000 of Canoo’s electric vehicles.

Per the latest earnings report, the firm is finalizing multiple equity initiatives & evaluating non-dilutive capital sources on a $500 million asset appraisal. Given the above, it’s quite possible that it’ll have to resort to both. Some selling pressure via dilutive events (hopefully, when the stock gains altitude, not at current price or under $1) remains a significant possibility given current capital raise requirements and configurations. This said, the company retains other options, as well. Its debt-equity ratio has degraded over the past couple of years, but, with total liabilities of $217 million and total stockholders’ equity of $228 million (as of Sept. 30, 2022), it is just under 1. While it is not particularly low, it does offer some flexibility, and the firm may be able to borrow.

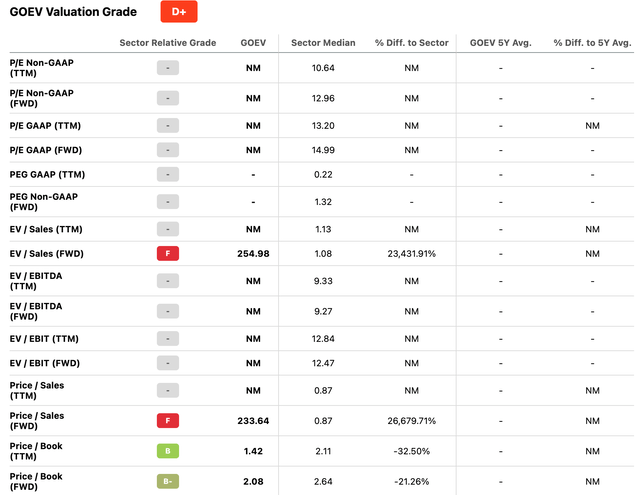

Valuation Metrics: Dig and Find Gold

A first look at valuation invites caution. Canoo is not profitable or generating positive operating cash flow, so valuation based on factors such as price to earnings, price to EBITDA, and price to cash flow hardly makes sense. All numbers are deeply negative. The company being pre-revenue, enterprise value over sales (twelve months trailing) can only be very high (or rather infinite). Even forward, it is a vertiginous 250+, well above sector median of just about 1. The same holds for price per sales, of course.

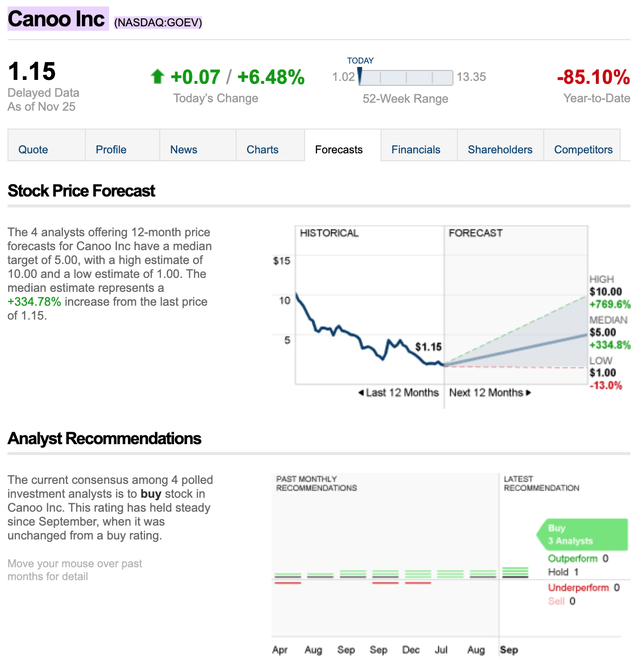

This said, the 4 analysts offering 12-month price forecasts for Canoo Inc. have a median target of $5.00, with a high estimate of $10.00 and a low estimate of $1.00. The median estimate represents a +344.44% increase from the last price of 1.13.

The small cap is pre-revenue, but, as indicated above, it does have an order book of $2 billion, with $750 million binding orders.

The company expects to start delivering orders in 2023, with the Walmart LDV scheduled to begin hitting the road in 2023.

Canoo’s Vehicle Manufacturing Facility will be equipped to ramp to a 20,000 unit annual run rate by the end of 2023, with additional capacity to scale on the 120+ acre site.

As indicated above, binding orders of $750 million correspond to deliveries of 4,500 vehicles (Walmart) + 9,300 (Kingbee) + 3,000 (Zeeba) + miscellaneous (Oklahoma State, government agencies, etc.), likely close to the 20,000 unit annual run rate soon applicable. This means the firms should start to see sales ramp up in 2023 and reach full throttle in 2024, securing $750 million within a year. To quote CEO Tony Aquila:

Today we are excited to announce our manufacturing facility, which begins our path to scaled production in 2023 and delivers on our plan to bring high-paying light-blue collar jobs to Oklahoma. The Oklahoma City facility has significant room for expansion and is a proven location for large scale production, with an established transportation ecosystem, including rail. We are working with our third-party manufacturing partners to achieve SOP on our own equipment this month. Following these initial builds, we will aggressively shift all our equipment into our new facility during 1H’23 with production ramp in 2H’23.

A sector median EV/Sales of 1 implies the firm’s market cap should near $750 million within a year or 2, more than two times the current market cap of $350 million. Because Canoo has additional capacity to scale on the 120+ acre site, an additional book already secured (beyond binding orders), and a higher EV/Sales multiple may apply given how fast its book is growing (after all, Tesla operated at a median EV/revenue of 5.8x from fiscal years ending December 2017 to 2021 and even peaked in December 2020 at 23.8x!), it’s quite possible the stock of Canoo will rerate powerfully over the next two to five years.

If the leading retailer in the world, a couple of commercial leasing companies, and key U.S. government agencies are willing to give Canoo a try, this sure bodes well for the top line. Lots of large retailers and commercial and government entities may embrace the vehicles and underlying technologies, as well, and a rerating of growth potential is sure to lead to a rerating of shares via an expansion of the valuation multiples.

Consider the case of Rivian Automotive (RIVN), a direct competitor (selling to Walmart-archrival Amazon), which is not profitable and likely not growing any faster than Canoo, but already trades at an EV/Sales ratio of around 15 (TTM) and 9 (forward). Apply similar multiples to Canoo, and there is a surprising but rather clear 10- to 100-bagger potential long-term.

Market Risks

It is best to consult the company’s 10-K to get a sense of all the risks involved in investing in Canoo.

Canoo is an early-stage company with a history of losses. The company has not achieved positive operating cash flow and its ability to do so remains uncertain at this juncture. It will likely continue to incur significant expenses and losses for at least a couple of years. Given its projected funding needs, the risk of dilution looms large.

This, at a time when inflation remains a major threat to economies worldwide (including the U.S.) and interest rates are on the rise. The stock market thus tends to punish long-duration stocks, i.e., those of companies whose positive cash flows are expected well into the future.

Manufacturing ramp-up is another key risk factor. Developing its own manufacturing facilities for production of its EVs has the potential to increase Canoo’s capital expenditures and delay or inhibit production. The firm’s ability to develop and manufacture EVs of the expected quality to customers on schedule and on a large scale remains unproven. The company has no experience to date in high-volume manufacture.

Finally, Canoo’s limited operating history makes evaluating its business and future prospects difficult and increases the risk of investing in the firm.

Conclusion

Canoo may constitute a significant wealth creation opportunity for long-term investors. The firm qualifies as:

- A market disruptor and technology leader at the leading edge of the expanding light EV market segment,

- Endowed with more-than-competent leadership well-vested in the stock, a high growth profile, a clear path of secure funding (but dilution remains a risk), and favorable valuation metrics.

- Negative momentum and market sentiment have punished the stock, presenting bargain hunters with an opportunity.

Solid appreciation potential exists within the next five years, but this is a high-risk, high-reward investment opportunity. Bullish investors should start accumulating decisively. The more cautious ones – i.e., those waiting for greater visibility into Canoo’s future top line, operating cash flow, and earnings – might prefer to dollar average.

Be the first to comment