Petmal

It has been a long time since our initiation of coverage of Stem, Inc. (NYSE:STEM). Last time, we analyzed the energy storage solution provider thanks to a comparative analysis with a European small-cap called Aton Green Storage S.p.A. (not currently traded in the United States). Stem was a clear buy, and we hope you get on board with us. Today, we will provide a company update and a valuation target after a brief comment on Stem’s Q2 performance.

Stem Vs. Aton Green Storage: Another Italian Gem To Add To Your Portfolio (Mare Evidence Lab’s Previous Publication)

Our buy case recap was based on the following macro reasons:

- Implication following the Russia/Ukraine conflict. With the ongoing energy crisis, more energy will be needed. We are positive on the solar PV/BESS trend for B2C/B2B needs for a consequent bill reduction;

- Battery-saving solutions are key for Battery Electric Vehicles. Ahead of times, we previously analyzed Enel X’s implication with a publication called: Chickens And Eggs;

- Related to point 1) many governments are supporting the BESS trend with ongoing and new incentives;

- A diversified energy production coupled with a local storage (supported by AI) will be a cost-saving in countries’ transmission grids (there is a pretty high inefficiency in transporting energy). With the recent energy price hikes, we cannot waste a single KWh.

From Macro to Micro

In our estimates, we estimate a 35% CAGR in global electric storage demand to reach 75 GWh by 2026. The US market will drive the demand due to net-zero emission targets and federal investment tax credit. This is also supported by the Biden administration’s recent infrastructure bill. More importantly, Stem is leveraging its hardware sales over the short-term horizon, but the real opportunity is represented by the software as a service business. This is a less capital-intensive division and serves to optimize energy peak and battery performance. The software division revenues are long-term contracts (10/20 years duration) and will enhance the company’s future profitability. Very briefly, in Q2, Stem recorded $67 million and minus 11 million in revenue and adjusted EBITDA respectively. These results were above Wall Street analyst consensus expectations. Important to note is that Stem was able to pass through price increases over inflationary pressure. Despite the strong performance, Stem has left unchanged its 2022 guidance.

Conclusion and Valuation

Looking to our model and Stem’s order backlog, we value the company with a DCF analysis. This assumes a long-term business with revenue split between software as a service and hardware at 80% and 20% respectively and minimum CAPEX requirements (set at $50 million per year). We forecast a higher demand compared to that in the US market, thanks also to a future international expansion and potential upside from the IRA act. Over the future, we forecast a decrease in hardware COGS, mainly due to lower battery costs (we estimate a 10% decline year-on-year). We set a long-term growth rate at 2.5% with a WACC of 8.5% (a bit higher due to the ongoing execution risk and an EBITDA, which will be positive-only starting from this year). We derive a price target of $22 per share, maintaining our outperforming rating. The next catalyst is scheduled on the 28th of September for an investor day update. Risks that might affect our target price are: 1) higher competition, 2) execution risks, 3) higher commodity prices and supply chain constraints, 4) new technology, and 5) changes in Government incentives.

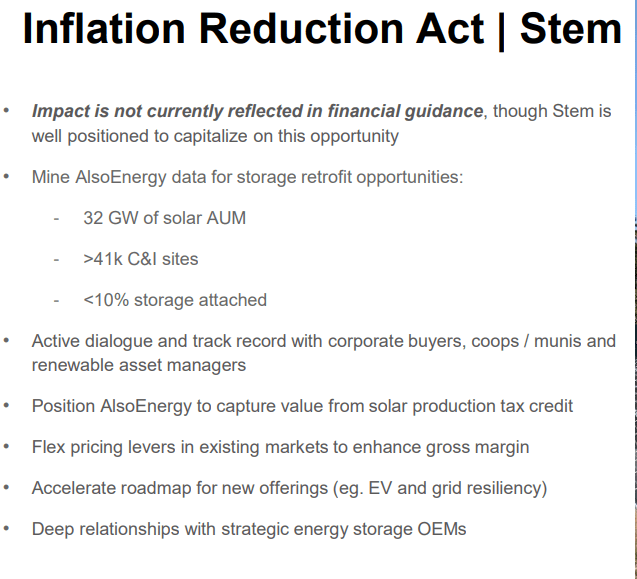

Stem – IRA (Stem Investor Presentation Sept. 2022)

Be the first to comment