US CPI, US Dollar Analysis and News

- US CPI Seen Hitting 8.1%, Core at 6.0%

- Lower Than Expected CPI Print Can Fuel Further Recovery in Risk Appetite

As market participants await the US CPI report, it appears markets are somewhat front-running a possible lower than expected number with the US modestly, while bonds and equities have edged higher. However, this does raise the risk of disappointment should we even see an in-line print. The table below highlights the recent market reactions to the CPI report and should we inflation falling short against expectations, I would expect a similar response to last month.

What Does This Mean For The Fed?

Arguably, it does not change an awful lot in the sense that they will remain steadfast in tightening monetary policy. However, a lower than expected number would further diminish the probability of a 75bps hike (good news for stocks + bonds) which the is the main question for markets at present.

Cross Asset Reaction to US CPI Data

Source: DailyFX, Bloomberg

CPI Data

- CPI Expected 8.1% (Previous 8.5%), Range 7.9%-8.5%

- Core CPI Expected 6.0% (Previous 6.5%), Range 5.8%-6.6%

The CPI and Forex: How CPI Data Affects Currency Prices

While the aforementioned table above shows anything short of a sizeable upside surprise, results in USD depreciation. With the bias seemingly shifting towards peak hawkiness, which is the premise of my bullish bond trade, I would expect even 0.1ppt upside surprise would lead to renewed USD dollar.

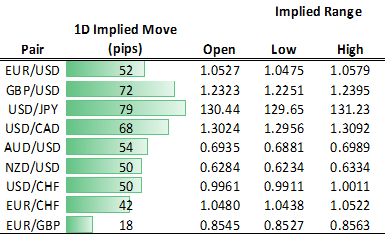

FX Option Implied Volatility Notable in USD/JPY

Ahead of the CPI report, FX options are implying a good sized move for USD/JPY, which will also take its cue from the move in yields. The Japanese Yen breakeven straddle is at 79pips (meaning, USD/JPY is expected to move in either direction by 79pips). To learn more on implied volatility, click the link below.

Implied Volatility: What it is & Why Traders Should Care

Source: DailyFX, Refinitiv

Be the first to comment