photoman/E+ via Getty Images

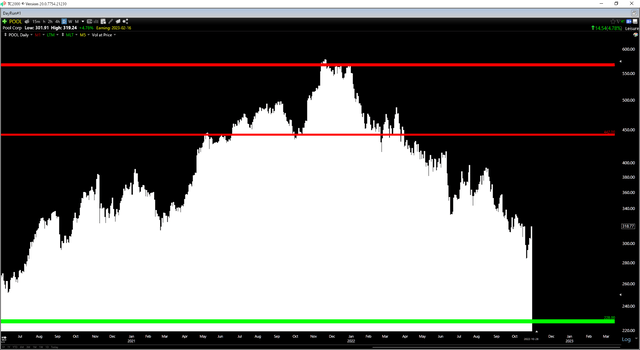

Just over 10 months ago, I wrote on Pool Corporation (NASDAQ:POOL) (“Party’s Over, Everyone Out Of The Pool”) and noted that while the company was seeing insatiable demand with record sales of $1.41 billion, there was no margin of safety left in the stock at 35x forward earnings. Worse, the stock was highly extended from a technical standpoint, and previous extensions above its key moving averages had led to median one-year forward drawdowns of 30%, as discussed below with the accompanying chart:

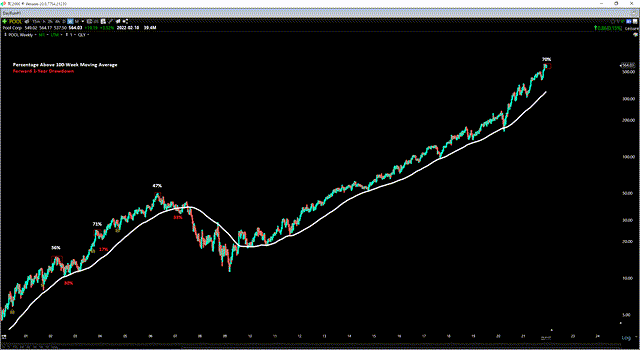

Looking at the technical picture from another view (weekly chart), we can see that Pool Corporation is now the 2nd most extended it’s been in the past 20 years, sitting 70% above its 100-week moving average (white line). Since 2002, we’ve seen three similar overbought signals, with the stock trading 47%, 56%, and 71% above its 100-week moving average (2002, 2004, 2006). In all instances, mean reversion set in, and the stock suffered an average one-year forward drawdown of ~26% and a median 1-year forward of 30%.

– Pool Corporation Article, Dec. 9, 2021

POOL December 2021 Chart (TC2000.com)

Since December, Pool Corporation (“PoolCorp”) has slid 51% from its highs, exceeding its average and median drawdown by a wide margin on a one-year forward basis. This can be attributed to the general market weakness, which has put a severe dent in most stocks, combined with a moderation in the issuance of new pool permits. Fortunately, Pool Corporation benefits from ~60% of its business being maintenance and repairs, with the other 40% of sales coming from renovations, remodels, upgrades, and new construction. Hence, even if we do see an unfavorable macro backdrop, PoolCorp is in a solid position, benefiting from a sharp spike in its installed base in post-COVID-19 lockdowns. Let’s take a closer look at the stock below:

Q3 Results

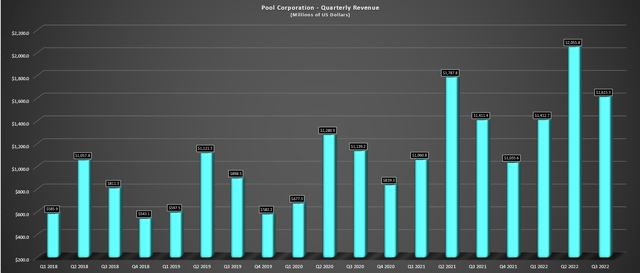

PoolCorp released its Q3 results earlier this month, reporting quarterly revenue of $1,615 million, a 14% increase from Q3 2021, representing a two-year average revenue growth rate of 19%. The record Q3 sales performance in a tough environment was helped by increasing pricing and acquisitions, offset by a minor headwind from closures (Hurricane Ian). This solid performance has helped the company to surpass $5.0 billion in sales year-to-date, which is just shy of its FY2021 sales with one quarter (albeit a seasonally weak one) left to go. For those unfamiliar with PoolCorp’s business, 95% of its sales come from the United States, Canada, and other countries, with approximately ~4% of sales from Europe. Its segments include Maintenance/Repair, Reno/Remodel/Upgrade, and New Construction.

Pool Corporation – Quarterly Revenue (Company Filings, Author’s Chart)

During the company’s prepared remarks, the company noted that Pinch A Penny sales were up 16% year-over-year, part of PoolCorp’s acquisition of Porpoise Pool & Patio. The strength in this segment was related to its position in stronger-performing markets with ~260 independently owned and run franchised stores in Florida, Texas, Louisiana, Alabama, and Georgia, with two of these markets called out as having very strong quarters (Florida, Texas) up 20% and 10%, respectively, in terms of PoolCorp’s base business revenue. PoolCorp also noted that it saw increased demand for higher-value products and customizations for new pools and remodeling projects. Finally, it didn’t notice any signs of trading down when questioned on the call.

Pool Corporation Pools (Company Presentation)

On the negative side, the company noted that issuances of new pool permits have moderated and estimates that new pool construction could be down 10%-15% from a unit standpoint vs. the previous period. Meanwhile, its European business had a very rough quarter, with sales sliding 24% year-over-year or 11% on a constant currency basis. Given the soaring energy costs, a challenging economic environment, and a war ongoing in neighboring countries, it’s understandable that installing a new pool is not top of mind, explaining the softness within this geography. Fortunately, Europe represents just 4% of sales, so even if it were to decline 30% and worsen, this would still be only a 1.2% hit to total sales.

Overall, this was a satisfactory quarter, especially given the challenging macro environment. As pointed out by the company, maintenance and repairs make up a significant portion of its sales, and the pool installed base grew 6% vs. 2019 levels, and the overall pie has grown even further, given inflation of ~30%. So, with PoolCorp’s dominant portion of its business tied to maintenance/repairs, representing primarily highly predictable revenue, it’s less impacted by a macro slowdown than peers focused solely on landscaping and new pool construction. In fact, even if its new pool construction and remodel/renovate businesses were to decline by 15%, this would still represent only a 6% hit to sales, which is being offset by higher pricing and the growth in its installed base.

A Much Less Favorable Macro Backdrop

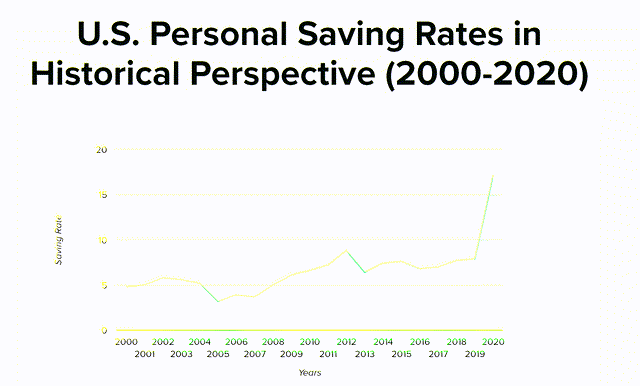

PoolCorp benefited from a surge in new pool construction with the emergence of COVID-19, given that personal savings rates soared, vacations weren’t an option for most, and many consumers weren’t in a rush to dine out either – contributing to higher savings. On top of this, many were saving money working from home. The result was a significant increase in savings that led to many investing heavily in their homes. This increase in pool construction and upgrades/renovations helped PoolCorp to enjoy a well above-average rise in annual earnings per share, which nearly tripled from FY2019 to FY2021 ($15.18 vs. $5.26).

Personal Savings Rates (2000-2020) (Time.com)

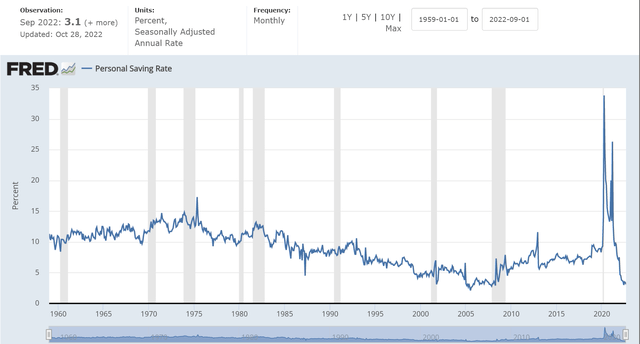

Unfortunately, we’ve gone from a personal savings rate that was more than triple the trailing 20-year average to a personal savings rate of 3.1%, trailing well below the 20-year average and at its lowest levels in the past 50 years. This is not ideal for companies with a portion of their revenue from discretionary purchases, which explains why casual dining and retail stocks have suffered so much year-to-date.

In PoolCorp’s case, the stock may have ~40% of its business tied to more discretionary purchases, but it benefits from a significant portion of its business mainly being “recurring,” with pool owners not going to stop maintaining their pools because they’re tighter suddenly from a financial standpoint. Hence, PoolCorp is better positioned with a very diversified business and is the leading worldwide distributor of pool-related outdoor living products. This means that it’s in great shape to weather any severe pullback in demand, and due to its scale and experience, it may actually benefit from the current environment as independents remain under pressure.

Personal Savings Rates Current vs. Historical (St. Louis Fed, FRED Economic Data, U.S. Bureau of Economic Analysis)

Additionally, PoolCorp has noted that we’re seeing a smart pool evolution, with significant growth in several products, including robotic cleaners, variable speed pumps, automation controls, sanitizing systems, and LED lighting since 2019. With less than 30% of existing pools estimated to have automation and most new pools incorporating automation, this is a tailwind for PoolCorp and the industry, which could partially help offset the new pool construction’s slowdown. Finally, PoolCorp is operating from a position of strength after two record years, generating significant free cash flow and having relatively low debt (~$1.5 billion), suggesting that if the market continued to soften, it could play offense vs. smaller companies that might be playing defense as they have less diversified businesses than PoolCorp.

To summarize, while the pullback in new pool construction and weaker consumer backdrop doesn’t help PoolCorp and has led to a significant deceleration in earnings growth, I don’t see any major risks to the business here. Besides, there was no reason to believe that annual EPS growth would continue its high double-digit growth trajectory, and even with the slowdown, PoolCorp is on track to report another year of record annual EPS.

Earnings Trend

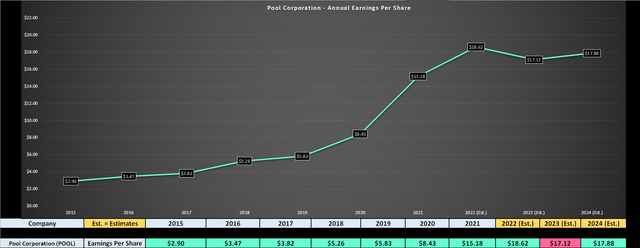

Moving to PoolCorp’s earnings trend, we can see that annual EPS is expected to increase 23% year-over-year, benefiting from acquisitions and pricing actions. However, it looks like we will see a pullback in annual EPS based on current FY2023 estimates, with an impact from a further pullback in pool construction/upgrades and what could be continued softness in Europe. That said, even with this slowdown, PoolCorp’s annual EPS will be up over 225% vs. FY2018 levels, representing much better retention of earnings than companies in the Retail Sector (XRT) that have seen earnings fall off a cliff. Therefore, I see this simply as an aberration in a long-term uptrend, with earnings likely to hit new highs above in FY2025 as PoolCorp benefits from a larger installed base and a continued trend toward pool automation.

POOL Earnings Trend (YCharts.com, FactSet, Author’s Chart)

Valuation and Technical Picture

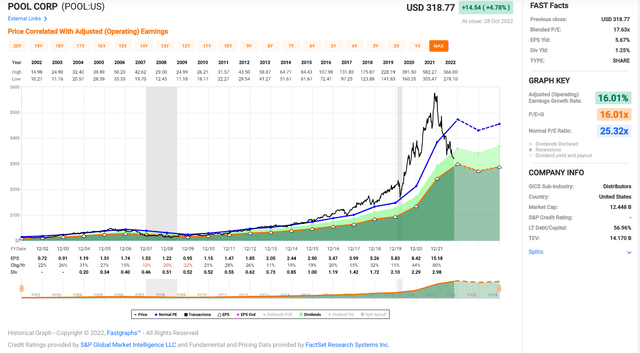

Looking at PoolCorp’s valuation below, we can see that the stock has historically traded at ~25.3x earnings, which is explained by its impressive 16% earnings growth rate and a phenomenal dividend growth rate of ~16%, which has made it a favorite among long-term investors. Based on a current share price of $319.00 and FY2023 annual EPS estimates of $17.12, PoolCorp is trading well below its historical earnings multiple at 18.6x earnings, a very reasonable valuation considering that even in 2007-2009, the stock oscillated between 12-18x forward earnings. Even if we use its historical earnings multiple, which is conservative relative to its 10-year average (~32.1x earnings), PoolCorp’s fair value would come in at $433.15.

Pool Corporation – Historical Earnings Multiple (FASTGraphs.com)

Although this represents more than a 30% upside from current levels, I prefer to bake in a significant margin of safety when entering new positions. In the case of large-cap stocks, I prefer a minimum 35% discount to fair value to justify entering new positions. After applying this discount to PoolCorp, I see the ideal buy point for the stock coming in at $281.55, translating to roughly 10% below current levels. There’s no guarantee that the stock will get this cheap, but with no strong support until $228.00 and the stock in a steep downtrend, I believe it makes the most sense to be patient for lower prices or pass.

POOL Daily Chart (TC2000.com)

Looking at the technical picture above, we can see that PoolCorp has no strong resistance until $442.00, but its next major support level doesn’t come in until $228.00. Generally, I prefer a 4.0 to 1.0 reward/risk ratio for large-cap names. and based on $123.00 in potential upside and $91.00 in potential downside to support, POOL’s reward/risk ratio comes in at 1.35 to 1.0, not offering a favorable enough reward/risk just yet. That said, if the stock were to undercut its recent lows at $278.00 and head closer to $273.00, its reward/risk profile would meet this criterion, setting up a low-risk buy point from a technical and fundamental standpoint.

Summary

PoolCorp had a solid Q3 and may be more insulated from the difficult macro backdrop than many investors assume, given the high proportion of sales from maintenance and repairs. However, we look to have seen peak earnings short term, and the S&P 500 (SPY) remains in a cyclical bear market, which often leads to stocks overshooting fair value to the downside, as we saw when recession-resistant luxury goods retailer Capri Holdings (CPRI) which fell to just 6.0x earnings in September. So, while I see POOL’s valuation being more palatable, I see the ideal buy point coming in at $275.00 or lower, which would be an undercut of its low and might help to shake out the remaining weak hands.

Be the first to comment