imaginima

Enterprise Products Partners (NYSE:EPD) is widely regarded a top midstream operator, yet it still yields just under 8% as of recent prices. EPD has a long track record of strong execution – and investors are likely to also reward the company for the increased focus on free cash flow and unit repurchases. While EPD might not possess the same tantalizing upside to commodity prices that E&P names might have, it instead offers greater consistency in cash flows with a distribution that can grow for years to come. EPD remains a buy even amidst a rising interest rate environment.

(Head’s up: EPD issues a K-1 tax form – consider the tax ramifications before investing.)

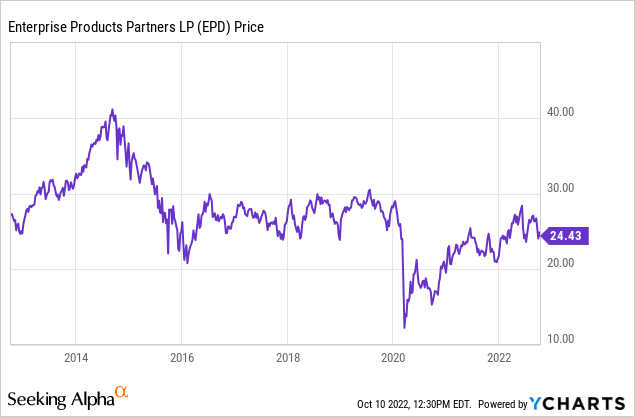

EPD Stock Price

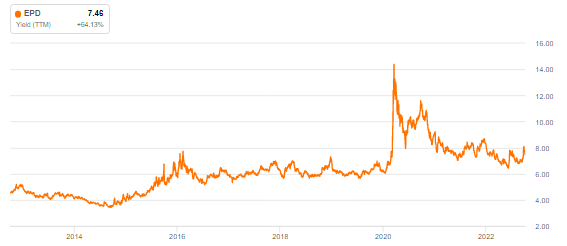

Amidst a period of great volatility in broader markets, EPD has been a source of stability, something that has remained true over the past five years.

Perhaps that may be putting it kindly, as long-time investors in the name may instead interpret the price action as being one of “dead money,” as this is a name which has looked cheap for many years. I last covered EPD in July where I rated the stock a buy on account of the attractive yield and strong management team. EPD has done nothing since then, but it is time for another look at the fundamental outlook.

EPD Stock Key Metrics

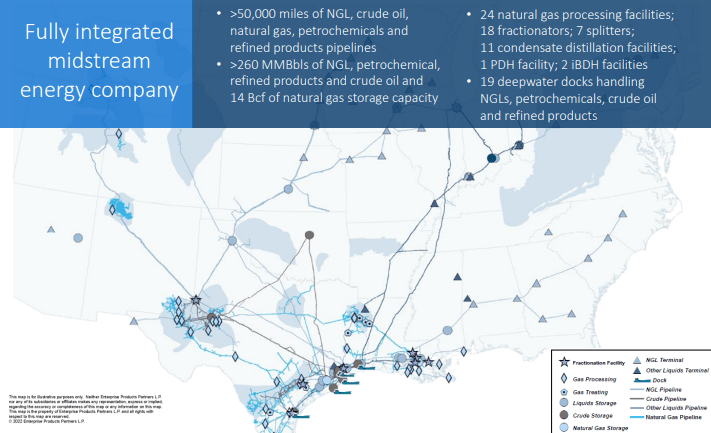

EPD is one of the largest midstream companies in the world with over 50,000 miles of pipelines. For those new to the name, EPD transports commodity resources through its pipelines for a fee.

September Presentation

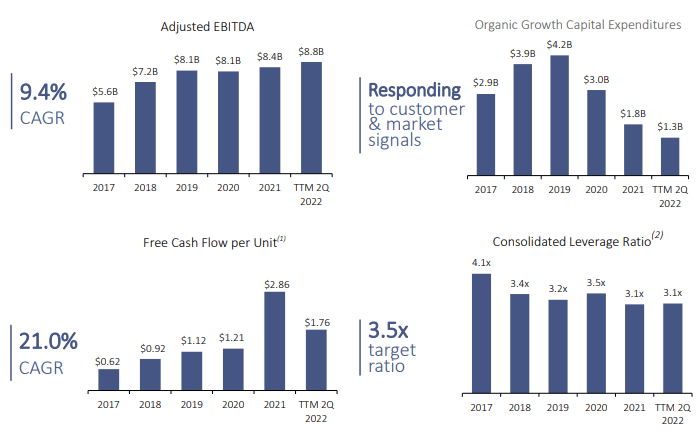

While many exploration & production (‘E&P’) companies are showing record profits, EPD’s financials have more or less shown consistent albeit modest growth. EPD has been gradually growing adjusted EBITDA while reducing growth capital spending – leading to solid growth in free cash flow.

September Presentation

It is worth noting that EPD’s investor presentations now show a greater focus on free cash flow per unit. MLPs have historically instead focused on distributable cash flows (‘DCF’) which do not take into account the capital outlay for growth expansion projects. I warmly welcome the greater focus on FCF as it is clear that this is a market which has placed greater emphasis on unitholder returns.

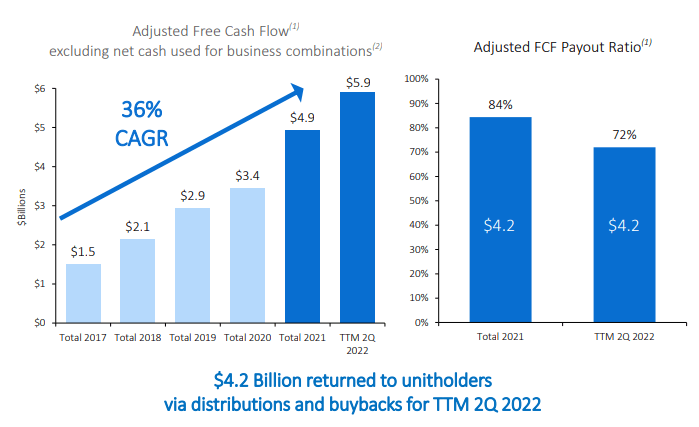

September Presentation

In the latest quarter, EPD generated $2 billion of DCF, providing 1.9x coverage of the distribution. Due to management having reduced its growth capital, the free cash flow payout ratio stood at just 72% over the trailing twelve months. EPD repurchased $35 million worth of units in the quarter, bringing its total to $235 million over the past year. That represents 0.4% of units outstanding. That might not sound like a huge amount, but remember that EPD pays a huge 7.6% distribution yield. On the conference call, EPD noted that it planned to repurchase up to $300 million of common units over the remainder of the year, noting that the “common units are a more expensive cost of equity versus the cost of the equity embedded in the hybrids.”

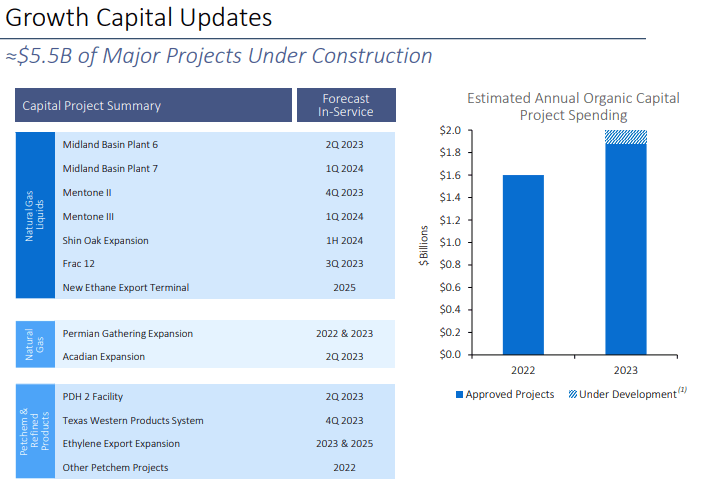

EPD did increase its outlook for up to $2 billion of growth capital spending in 2023, up from $1.5 billion previously.

September Presentation

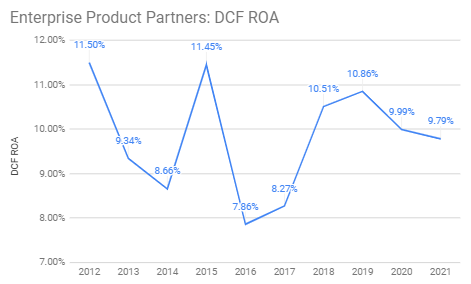

I view that outlook change with a mixed bag. On the one hand, this represents a step in the opposite direction of increasing unitholder returns. Perhaps one instead hoped for a more aggressive buyback program. On the flipside, it is hard to blame management for continuing to invest in growth projects considering that they have one of the best track records in the sector. I measure management execution based on a metric I call ‘DCF ROA’ which is calculated as distributable cash flows divided by total assets. As we can see below, EPD has consistently sustained a double-digit DCF ROA – and this is in spite of also keeping a conservative leverage ratio.

Author, data from company filings

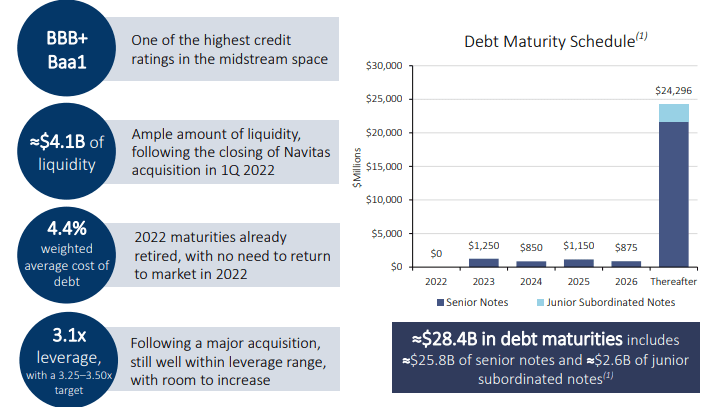

EPD maintains one of the strongest balance sheets in the midstream sector rated BBB+ or equivalent. Leverage stood at 3.1x debt to EBITDA – below their 3.25x-3.5x target and debt maturities are well staggered.

September Presentation

Rising interest rates will likely increase cost of capital, but the conservative leverage position and staggered debt maturities may help ease the pace of that growth.

Is EPD Stock A Buy, Sell, or Hold

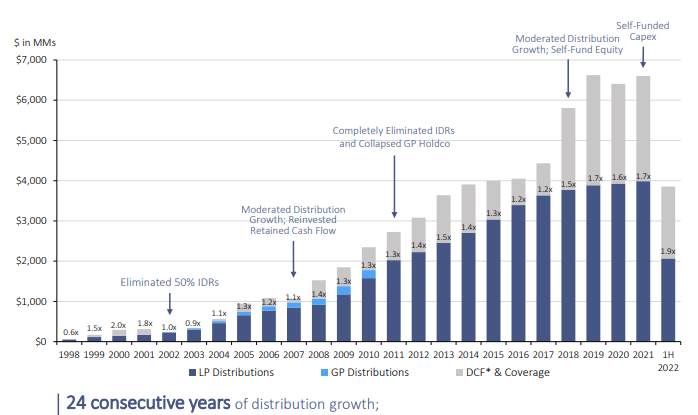

In the current environment, EPD still may not be considered a “sexy” investment. While it is in the energy sector, it has little correlation with commodity price fluctuations, giving it minimal torque to the upside amidst record oil prices. Meanwhile, the crash in tech stocks has made growth stocks look very enticing (though that may be a story for another day). In return, however, EPD offers a distribution growth story backed by cold-blooded execution. But the 24 consecutive years of distribution growth does not tell the whole story. EPD led the industry by slowing down distribution growth to improve the sustainability of its growth projects – eliminating the need to issue equity in 2018 and the need to issue debt in 2021. The company now can fund both distributions and growth projects through free cash flow alone.

September Presentation

In spite of the company being on its strongest footing arguably ever, EPD still trades at the high end of its yield range over the past decade.

Seeking Alpha

It is worth noting that EPD has increased its distribution twice this year, with the latest distribution of $0.475 per unit representing 5.6% YOY growth. That is the fastest pace of growth since 2015. Management explained their reasoning below:

The board comes in and takes a look at the distribution rate every quarter. I want to say we went through a period, call it 2017 to 2021 where we were really – or 2020, really, where we were coming in and trying to make a shift in a financial model. And the old model was where you finance of substantial amount of your growth capital expenditures in the capital markets with a pretty good reliance on the equity capital markets.

And the pivot that we began to make in 2017 was to come in and be more self-sufficient and coming in and funding our growth capital investments. And so that was – we were more deliberate on distribution growth and I think that’s paid off. This year, I think one of the differences in this year – and then we’ve worked through the pandemic too, pandemic question mark, but the business has performed very well.

We came in earlier this year and made in an attractive acquisition and that we talked about that being accretive. So that provided us an opportunity to come in and do a mid-year increase in the distribution and in light of what was going on from an inflation standpoint, we thought it made sense to do a midyear boost. I don’t know if this is necessarily going to change what we do going forward, but we take a look at it every quarter, but we thought it was appropriate this quarter to go ahead and do a midyear bump.

Between the increase in growth capital expectations and the more aggressive distribution growth, my interpretation is more simple: EPD is gushing cash flow. I personally would prefer a greater emphasis on unit repurchases as I would expect a consistent and sizable repurchase program to eventually lead to multiple expansion – enabling EPD to perhaps even use its units as cheap currency to accelerate growth projects. But management’s preferred approach of increasing growth capital and bumping up the distribution is satisfactory as well. I can see EPD generating 3% growth over the long term – a reasonable target is a 6.5% yield, representing a $29 unit price and 27% total return upside. Assuming that multiple expansion takes place over the next several years, EPD may be able to generate 10% to 12% annual returns.

While that might not sound too enticing, we must consider that the risk profile has improved substantially. It no longer seems likely for there to be tenant credit risk considering the long period of high commodity prices – EPD is arguably a defensive play. A double-digit return from defensive stocks is quite attractive.

What are the risks? I am doubtful that EPD over-steps its plans for growth capital considering its history of strong execution, but there is always the possibility that management increases its growth capital outlay and does not achieve satisfactory returns. That would likely cause EPD to lose its relative premium to peers. Another risk is if commodity prices turn south. I have no crystal ball, but I have a gut feeling that the longer gas prices remain high, the greater the demand will be for electric vehicles. With most automakers committing to delivering all electric vehicles over the next few years, it is possible that commodity prices are having their “last hurrah” before the great crash. In that scenario, EPD would not be defensively positioned and I could see units re-rating to as high as a 10% yield.

I rate EPD a buy due to the attractive near-term outlook – I find the upside to be most probable considering the high yield and ongoing distribution growth.

Be the first to comment