balipadma

Here at the Lab, we extensively cover Volkswagen AG’s shareholder structure. Our internal team has already analyzed the relationship between Preferred shares and Ordinary shares as well as the recent P911 IPO and the Porsche Automobil Holding SE’s (OTCPK:POAHF; OTCPK:POAHY) involvement. Today, we focus on Volkswagen AG Preferred Stock (OTC:VLKPF), benefitting from our previous publication keynote. Below are the most significant key takeaways:

- Volkswagen AG (OTCPK:VWAGY ;OTCPK:VWAPY) is a holding enterprise with worldwide production and a few of the most iconic brands across the globe (many of these entities are run independently such as Lamborghini, Ducati, and of course Porsche).

- Volkswagen AG has two types of shares: preference shares with no voting rights (called VOW3 in its home market and VLKPY in the United States) and ordinary shares (called VOW in its home market and VLKAY in the United States).

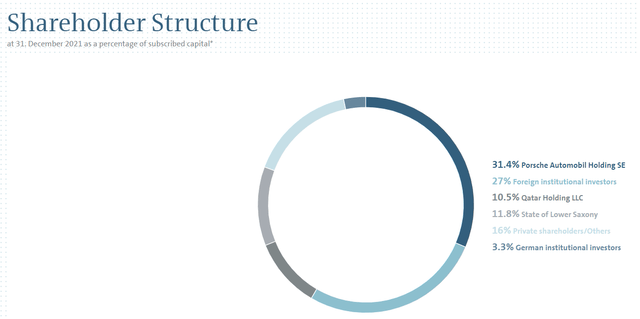

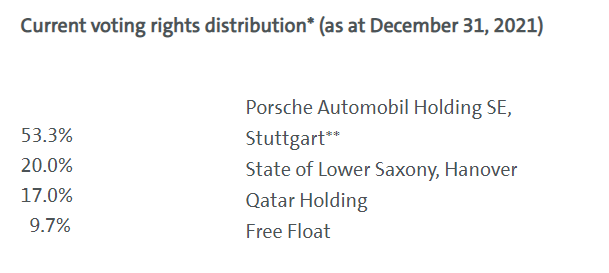

- Volkswagen AG’s main shareholder is Porsche Automobil Holding SE which controls 31.9% of the company’s preferred shares (after an additional 2.6 million stock purchase in May) and 53.3% of the company’s ordinary shares.

Preference Shares with no-voting rights VOW3 and VLKPY Ordinary Shares with voting rights VOW and VLKAY

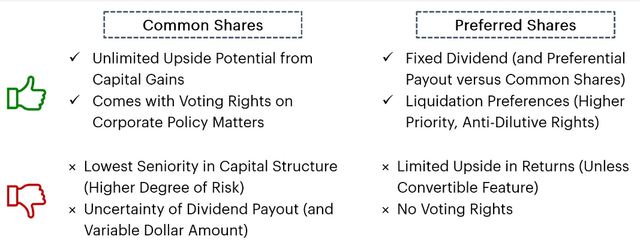

Generally speaking, below is a good representation of the different upsides/downsides of owning both types of different share classes.

Preferred Shares vs. Common Shares details (Wall Street Prep)

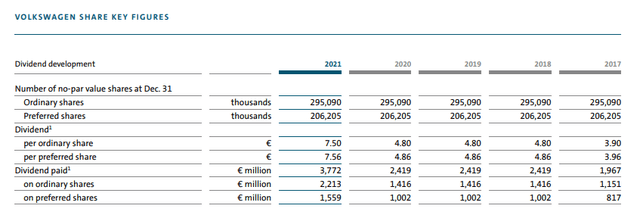

In case of a liquidation event, preferred shares have a priority in reimbursement versus ordinary shares. In addition, preferred shares have dividend priority and especially in Volkswagen’s case, the dividend payment is equal to the common shares adding a plus €0.06. It is well presented in the snap below in the last five years.

Volkswagen preferred shares dividend payment (Volkswagen AG Annual report 2021)

On the account of the fact that Porsche Automobil Holding SE controls more than 50% of Volkswagen’s ordinary shares, voting rights are pointless. In addition, another higher equity stake representing 20% of the total shareholder structure is owned by the State of Saxony, which moreover, probably has no intention to sell. Consequently, over time, preferred shares have traded at a liquidity premium due to a larger free float.

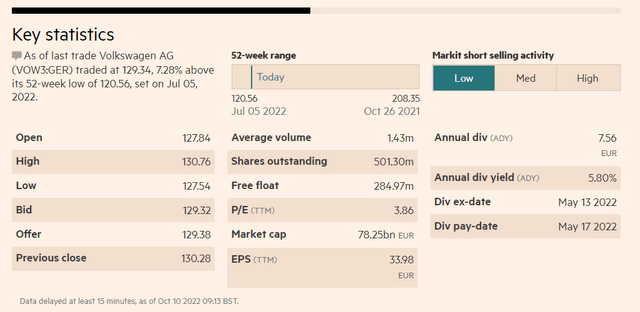

VOW3:GER – Larger free float (FT)

Conclusion and Valuation

Even if the ordinary shares are almost in the Porsche family hands, we believe that the discount on the preferred share is not justified. Here, there is something that does not add up, due to the fact that Porsche Automobil Holding SE shares are also heavily discounted by the market (we recently rated the holding company with a clear buy). Here’s some more detail, following our analysis: “just the 31.9% value of Volkswagen AG’s market cap is higher than Porsche Automobil Holding SE’s equity value. €24.5 billion versus €17.98 billion respectively”.

In a back-to-basic valuation, no matter voting rights or not, Volkswagen itself is really undervalued. The company is financially well structured and has strong cash flow generation to finance its EV revolution. The company’s next key catalyst could be a CMD in 2023 with an IPO from Lamborghini (after the 911 success). According to our team estimates, using a multiple of 22x on EBITDA, Lamborghini could be valued at almost €9 billion, providing full support for our Sum-of-the-Part valuation.

Be the first to comment