Anthony Devlin/Getty Images Entertainment

Author’s Note: This is the public version of an article posted on iREIT on Alpha on May 27th 2022.

In this article, we’ll take a look at Stellantis (NYSE:STLA). If you’ve never heard of the company and are wondering just what the heck it is – don’t worry, you’ve not been living under a rock. This is a multinational automotive company that’s less than 2 years old at the time of writing this article.

However, it has bones almost as old as the industrial revolution – and its brands are known across the entire world.

Let’s get going.

Stellantis – What is It?

Stellantis N.V is the multinational automotive corporation founded in 2021, based on a 50/50 cross-border complete merger between what was once the Fiat Chrysler Automobile Conglomeratem and the French PSA Group.

The company ultimately decided to become an N.V, meaning it’s headquartered in the Netherlands, Amsterdam.

The merger of these companies means that Stellantis is the sixth-largest automotive maker in the entire world.

The list goes:

- Volkswagen (OTCPK:VWAGY)

- Toyota (TM)

- Renault-Nissan-Mitsubishi Alliance

- General Motors (GM)

- Hyundai Motors

- Stellantis

The company has revenues of €150B+, a market cap of close to $50Bm and a high, well-covered sort of yield – though at this time, it’s relatively complex to forecast and estimate how things will develop over the next couple of years. The company is BBB-rated, making it one of the lower-rated large automotive out there.

The coupled operations of Stellantis contain the following car brands:

- Abarth

- Alfa Romeo

- Chrysler

- Citroen

- Dodge

- DS

- Fiat

- Fiat Professional

- Jeep

- Lancia

- Maserati

- Mopar

- Opel

- Peugeot

- Ram

- Vauxhall/Opel

The company also now has 300,000 employees represented in 130 countries, with manufacturing in 30 countries, not including its suppliers. The company became through plans beginning in 2019, to create the fourth-largest automotive company on earth. The merger of FCA and PSA was approved in very early January and completed on the 16th of January 2021. The common shares of the company began trading natively on Milan and Euronext 2 days later, and on the NYSE a day after that, under the symbol STLA.

Stellantis will never be seen on any of the cars. It’s merely a corporate identifier, while group names and logos will remain unchanged. Stellantis went out of the gates running, with the CEO issuing a challenge for all brands to prove themselves within 10 years (2031) in order to justify new investments and technology. What will happen to the brands that do not prove themselves, as the company has said, is unclear at this time. We can speculate that they will be divested or chopped up, though.

The company’s lineup contains both brands with massive issues (i would argue like Alfa Romeo/Abarth) and brands that are natural, positive brands such as Opel/Vauxhall, Peugeot and Fiat. The company has some of the best professional vehicles in the world with Fiat Professional, Dodge, Ram, and others – and also contains luxury vehicles, like Maserati.

So, viewing the company as a whole, it’s an Italian-heavy car company with some very appealing French and American (and one German) brands.

The owners of Stellantis are as follows:

- Exor N.V, holding 14.4% (privately-held, family company, owns things like Ferrari (RACE), Iveco, and other things as well)

- Peugeot Family, (Etablissements Peugeot Frères, EPF) at 7.19%

- Bpifrance, holding 6.18% (A French, publically-held investment bank)

- Dongfeng Motor Corp., at 4.5%

- BlackRock (BLK) at 2.52%

The company’s assembly plants are found in every continent on earth.

Stellantis has been an analyst favorite for some time now, since its inception in 2021. The company’s returns have not echoed this confidence, and for the past year, the company is down 12%. YTD, the stock has lost 22%. Stellantis hasn’t exactly had an easy time of it since early 2021. The pandemic and the supply chain disruptions have wreaked havoc with the company, as they have with other businesses, both in the sector and other sectors.

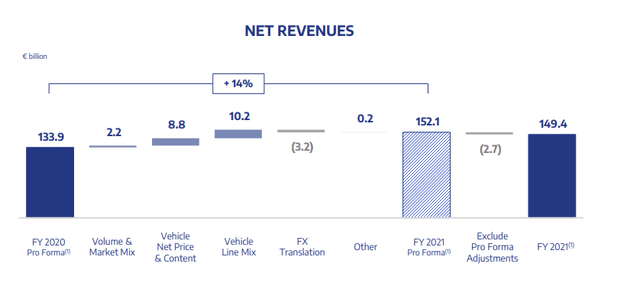

Now, despite this, the company actually posted pretty good 2021 results, showcasing how the business immediately started to tighten things up. Revenues were up 14% pro forma, just south of €150B with some adjustments.

Stellantis 2021 Results (Stellantis)

The company close to doubled its overall profitability, bringing in some of the truly profitable brands and operations to weigh up the not-so profitable operations. An adjusted pro forma 2020 OI of €9.2B at 6.9% OM became $€18B ex-adjustments, with a close to 12% operating margin. These annual results were well ahead of the company’s overall strategic plan. They also beat most expectations set by analysts, including my own.

However, a big reason for Stellantis outperformance was the stellar performance of its American brands, even if outperformance was seen across all regions. The other reasons for the outperformance was simple positive pricing and mix lifting revenues, coupled with very high demands. Again, NA margins were superb, especially in pick-up trucks and SUVs, which really outperformed.

Stellantis NA segment (Stellantis IR)

A lot of investors ask where Stellantis differs from the competition – and given the company’s structure, that’s a question that’s now something clearly answerable. The company is able to extract very impressive margins out of those higher-priced and semi-luxury vehicles, including US SUVs and pickup trucks. The 16.3% OM in 2021 puts the American segment of Stellantis on pair with Daimler (OTCPK:DDAIF) as well as Porsche (OTCPK:POAHY). And the company seeks to keep this rolling through new models and new customer options.

Stellantis American Brands (Stellantis IR)

So, the difference? Cash flows well above expectations. Industrial FCF was at €6.1B, which is well above my own €4.5B FY21 estimate, deriving from very impressive synergy executions. The company may, based on €3.2B net cash effects, reach the promised €5B run rate well before the promised 2024 time period.

The company’s CEO, a very, very solid automotive background from Renault, and in the automotive industry for almost 40 years, said that this performance primarily came from addressing what were considered “low-hanging fruits” in terms of overall efficiencies.

Stellantis FY21 results show that the company is able to weather a tough operating environment and deliver strong results, and appears confident that it will continue to deliver in 2022 in spite of the current industry headwinds, aiming for double-digit operating margins in the year. My expectation for the 2022 result is around €16B, increasing to €17.5B by 2023 once the operating environments and supply chain issues start winding down. The company will likely be able to weather increased input costs and labor inflation through efficiencies and price actions – at the very least, I don’t see the company massively being impacted by inflation to a degree that hurts the company’s bottom line.

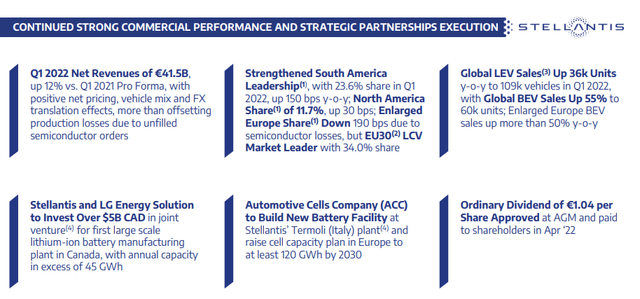

Stellantis Presentation (Stellantis IR)

This positive view on 2021 was further cemented by a positive 1Q22. Despite a 12% shipping decline YoY, the company reported higher revenues with continued sales increases from North And South America. The company reiterated guidance for 2022. The noteworthy fact is that this beat was despite supply chain bottlenecks caused by continued semi shortages.

Stellantis 2022 Guidance (Stellantis IR)

NA was the star in 1Q22 as it was in FY21. Given the constrained production situation given the tight supply of semis, Stellantis inventories remain at very low levels. This continues to support my view that inflationary/cost pressures and macroeconomic headwinds won’t threaten the strong underlying consumer demand. The car market should remain supply-constrained, which facilitates strong pricing trends shown across all OEMs that are unlikely to disappear.

The company also has big news in acquisitions, buying the SHARE NOW company. Share Now is the child of the 2019 merger of BMW’s Drive Now car-sharing service and its Daimler counterpart Car2Go. For Stellantis, the Share Now acquisition will grow their Free2move service enormously, adding 14 new European cities to Free2move’s seven existing mobility hubs in the United States and Europe.

Free2move comprises a fleet of more than 450,000 cars, 500,000 parking places and a network of 250,000 charging stations. This includes B2B and rental or leasing services. The company runs 2,500 vehicles for car-sharing, with Share Now adding another 10,000 cars to Free2move’s existing car-sharing fleet. It is unclear how many of these are electric. Share Now, at the last count in 2021, ran 2,900 BMW, Mini, Smart and Fiat electric cars.

(Source: Electrive)

The company views the asset as an interesting opportunity to improve its mobility efforts. In Stellantis 2030 strategic plan, the company targets €2.8B in net revenues from its mobility services, including a mid-term objective of €700M to be reached by 2025. This acquisition should allow the company to be well on its way to reaching these strategic objectives.

Stellantis has several upsides. A swift turnaround of former FCA in the hand of Carlos Tavares, such as Opel, will greatly improve this company’s future prospects. The economies of scale Stellantis now operates under put it in a prime position to absorb not only investments for electrification and battery tech, but also the impacts of the shortage. PSA modular electric platforms are another massive upside here.

The two complementary geographical exposures of the merging companies are made for synergies, which are currently being captured to the target of €5B, I view these as very achievable.

This means the company is, as far as automotive go, a potential winner at the right price.

Let’s look at some risks.

Stellantis – The risks

Still, Stellantis comes with high-level risks. Here are some of them.

To the first, Stellantis now owns a portfolio of 14 different, wildly varied brands from separate continents. As management has indicated, these brands will need to prove themselves. The implication is that the brands won’t be able to do this – at least not all of them. The company could face sizeable write-downs and impairments, not to mention that Stellantis can face the necessity of having to sell off some of those assets.

To the second, unlike almost every other car company out there, Stellantis’ exposure to China is extremely weak. German OEMs are strong in China – both BMW and Mercedes – Stellantis is among the weaker ones. This may be a missed growth opportunity going forward.

To the third, when the company was formed, the company management made clear that they will avoid plant closures at all costs, keeping its 300,000-strong staff. This is akin to putting a ball and chain to your leg. I believe it will only be a matter of time before this needs to be reconsidered. Saying this in the first place was not a good idea.

There’s also the fact that Stellantis is one of the weaker businesses in terms of credit rating. I’m also not counting the extraordinary dividend paid in 2021 and focusing on ordinary distributions, payable in April. For this year, the payout in 2022, was at €1.04, which comes to 7.6%.

This is massively high, but can also pose a risk – though not necessarily in the near term, given an EPS of between €3-€4 for this and the coming years.

Stellantis Valuation

Evaluating Stellantis is very difficult. On a straight-line valuation, this company currently is valued at less than 5X P/E on a 2022E basis. Comparing the company to either peers, constructing a DCF, and looking at NAV still contains a lot of uncertainty even in the best of scenarios.

Nonetheless, we’ll give it a shot.

From a peer perspective, this company is at a severe discount to any of its peers. VW, Daimler, and BMW all trade between 5-7X P/E – Stellantis is currently at below 4X. Its yield is far higher, its P/B is more favorable, and overall, the company is, based on a peer perspective, implied to be worth at least 50% more than we’re currently seeing today.

I assign a discount to Stellantis, being a new player and things uncertain, at around 10-15% from a peer perspective.

For NAV/SOTP, we assign EBIT multiples between 2-5X, depending on the geography. Automotive companies trade at significant discounts to EBIT. I give NA the highest multiple, given solid sales and profit margins of 4.5-5X on a range. I give the Middle East and Africa the lowest, given the volatility – around half that. This comes to total net assets, including net cash, of around €81B for the company. Based on 3.3M shares, this comes to an average NAV/share of €24.4/share. Do you see how high that implied discount is, even though I use some of the most conservative multiples out there?

We’ll look at DCF as well. I refuse to assign more than a 1.3% growth estimate in Sales as well as a 1.5% in EBITDA, given the characteristics of automotive. But even assigning that low a growth ratio, and calculating a 10% WACC from a cost of debt of 3.36% (still extremely cheap), we still get an implied EV/share of €24.

No matter how much we impair or discount the company, staying within any sort of realistic range, many of these valuations call for a price target of above €20/share.

I’ve tried various approaches to get below these targets, but most of those approaches include discounting the company at unrealistic levels. There’s simply a lot of value in the business, and the market is severely discounting that value.

That’s obviously a problem for me.

Í can go to €20/share. The peer valuations support such an approach, given a slight EV/EBITDA premium – but going below, and you’re essentially saying 1+1 isn’t two, or that Stellantis should be viewed with wildly different approaches to other automotive businesses.

I disagree with that notion.

S&P Global considers Stellantis a “BUY” with €21.74 on average, with a target range of €13-€34/share. 20 out of 23 analysts are at a “BUY” or “Outperform” here. (Source: S&P Global)

There is undoubtable value here.

Based on these valuations, I view Stellantis as a “BUY” with a PT of €20/share.

Thesis

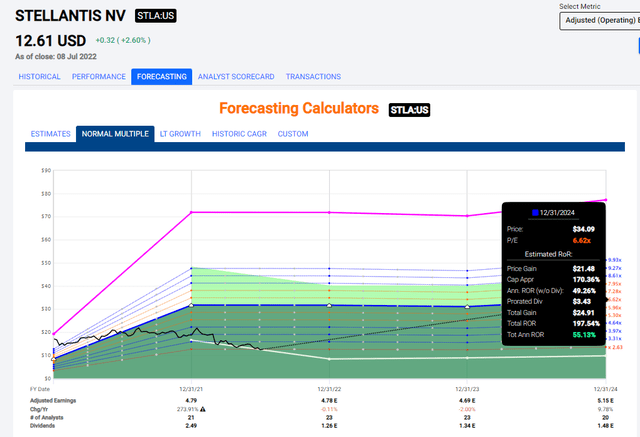

Stellantis of course has a very liquid NYSE listing. It’s not an ADR either, and it’s STLA, which currently trades at an implied 3X P/E. How exactly we should consider this company going forward is a hard question, but I would say at least 5X P/E is a “fair” view here.

Even just at a 6.3X forward P/E, you’re looking at more than doubling your money until 2024.

Stellantis Upside (F.A.S.T graphs)

And that’s conservative. Even trading entirely flat from today’s levels, you’re still seeing an upside of over 15% annually, and that’s if Stellantis doesn’t go above 3.3X P/E for the next few years. It can still, easily, pay out the current dividend, meaning that this is actually a 7%-yielding company with a covered dividend.

The arguments against, and why I don’t yet own a large position in the company are fairly simple. Stellantis is very volatile – and it’s likely to remain volatile for years at this point, if not forever, given the company’s sector – and I don’t like that sort of volatility going into this market situation.

However, how likely is it that an automotive business of this size actually goes down or sees a fundamental threat? The risk is low. It’s all about value.

And the value today is convincing – perhaps the most convincing valuation in the entire automotive sector, basically giving us an upside of nearly 50% at this price.

Be the first to comment