Metha Andreasen/iStock via Getty Images

Earnings of First Internet Bancorp (NASDAQ:INBK) will likely somewhat increase this year thanks to the recent surge in the net interest margin. Further, the loan portfolio will likely grow in the year ahead on the back of economic factors. On the other hand, the provision expense will likely be higher than last year as it’ll trend towards a more normal level. Overall, I’m expecting First Internet Bancorp to report earnings of $4.88 per share for 2022, up 1.2% year-over-year. Compared to my last report on First Internet Bancorp, I’ve revised upwards my earnings estimate mostly because of the first quarter’s surprise surge in the net interest margin. The year-end target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on First Internet Bancorp.

Prolonged Declining Loan Trend Likely to Reverse Soon

First Internet Bancorp’s loan portfolio declined for the fifth straight quarter by the end of March 2022. I had previously expected the declining loan trend to turn around during the first quarter, hence, I was disappointed with the results. Now that the agreement to acquire First Century is off, the balance sheet will grow at a slower pace than previously anticipated. Further, high interest rates can discourage borrowing, especially for home purchases.

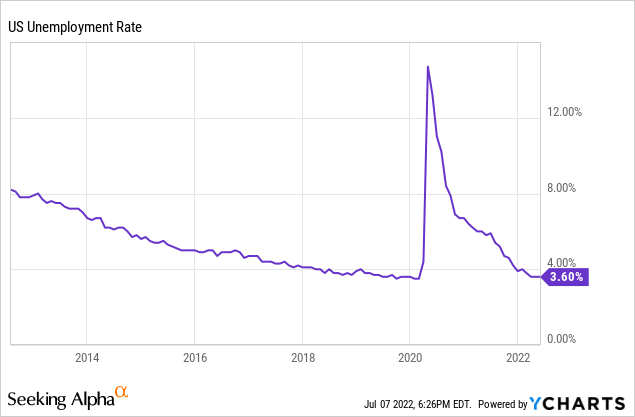

On the other hand, a strong job market bodes well for credit demand. First Internet Bancorp has a loan book that is well diversified in terms of geography and type of loans. Therefore, the national unemployment rate is a good gauge of future loan demand. As can be seen below, the unemployment rate is near record lows.

Moreover, the outlook on construction loans remains positive. As mentioned in the conference call, unfunded commitments in the construction line of business totaled $183 million at the end of March 2022, which the management expects to continue to draw down leading to healthy growth in outstanding balances. To put this number in perspective, $183 million was 6% of total loans outstanding at the end of March 2022.

Overall, I’m expecting the loan portfolio to increase by 2.8% by the end of December 2022 from the end of 2021. In my last report on First Internet Bancorp, I estimated loan growth of 6.1% for the year. I have revised downwards my loan balance estimate because of the first quarter’s poor performance as well as a deterioration in the loan growth outlook.

Meanwhile, deposit growth will likely match loan growth for the last three quarters of 2022. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | |

| Financial Position | ||||||

| Net Loans | 2,076 | 2,698 | 2,942 | 3,030 | 2,860 | 2,939 |

| Growth of Net Loans | 67.5% | 30.0% | 9.0% | 3.0% | (5.6)% | 2.8% |

| Other Earning Assets | 587 | 704 | 981 | 1,018 | 1,146 | 1,194 |

| Deposits | 2,085 | 2,671 | 3,154 | 3,271 | 3,179 | 3,315 |

| Borrowings and Sub-Debt | 447 | 559 | 584 | 595 | 619 | 638 |

| Common equity | 224 | 289 | 305 | 331 | 380 | 410 |

| Book Value Per Share ($) | 31.3 | 30.4 | 30.4 | 33.6 | 38.1 | 41.5 |

| Tangible BVPS ($) | 30.7 | 29.9 | 29.9 | 33.1 | 37.7 | 41.0 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Asset Mix Improvement to Counter the Damage from Higher Rates

First Internet Bancorp’s net interest margin surged by 26 basis points during the first quarter of 2022, which surpassed my expectations. As mentioned in the earnings presentation, the margin growth was partly attributable to tax refund advance loans. A surge in securities yields also helped the margin.

An improvement in asset mix can further help the margin in the year ahead. First Internet currently has a large cash balance that can be easily and quickly deployed into higher-yielding assets as rates rise. The management mentioned in the conference call that it plans to steadily deploy balance sheet liquidity into commercial and consumer loan growth this year.

On the other hand, the rising interest-rate environment is likely to hurt the net interest margin. This is because the liability side is more sensitive to rate hikes than the asset side.

The management mentioned in the conference call that it doesn’t believe increases in market interest rates will have a significant impact on deposit pricing because of the heightened balance sheet liquidity across the industry. However, I believe the management is overly optimistic. Unfortunately, the deposit mix is heavy on interest-bearing transactional accounts that are quick to re-price after rate changes. Around 59% of the deposit portfolio will re-price soon after rate hikes, according to details given in the presentation. As a result, a surge in average deposit costs amid a rising rate environment appears imperative to me.

Moreover, now that the acquisition agreement has been terminated, First Internet will no longer get the previously planned $300 million of low-cost deposits from First Century. As a result, the surge in deposit costs will be higher than previously anticipated.

The management’s interest-rate sensitivity analysis given in the 10-Q filing shows that a 200-basis points increase in interest rates could REDUCE the net interest income by 2.05% over twelve months. Considering these factors, I’m expecting the margin to decline by six basis points in the last three quarters of 2022, leading to a full-year margin expansion of 20 basis points. Compared to my last report on First Internet Bancorp, I’ve revised upwards the margin estimate because of the first quarter’s surprise.

Provisioning to Normalize After Remaining Subdued Last Year

The asset quality of First Internet Bancorp’s loan portfolio continued to improve during the last twelve months. Nonperforming loans almost halved to 0.25% of total loans by the end of March 2022 from 0.48% at the end of March 2021, as mentioned in the presentation. However, there are chances that asset quality will worsen in the coming months because of heightened interest rates that can hurt borrowers’ debt servicing ability. Further, the threats of a recession may encourage the management to augment its loan loss reserves.

Overall, I’m expecting the net provision expense to make up 0.18% of total loans in 2022. In comparison, the net provision expense averaged 0.19% of total loans in the last five years.

Expecting Flattish Earnings Growth

The subdued loan growth and margin expansion will likely lift earnings this year. On the other hand, higher provision expenses relative to last year will likely drag the bottom line. Overall, I’m expecting First Internet Bancorp to report earnings of $4.88 per share for 2022, up 1.2% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Income Statement | |||||||

| Net interest income | 54 | 62 | 63 | 65 | 87 | 103 | |

| Provision for loan losses | 5 | 4 | 6 | 9 | 1 | 5 | |

| Non-interest income | 11 | 9 | 17 | 36 | 33 | 31 | |

| Non-interest expense | 37 | 43 | 47 | 58 | 62 | 73 | |

| Net income – Common Sh. | 15 | 22 | 25 | 29 | 48 | 48 | |

| EPS – Diluted ($) -Adjusted | 2.13 | 2.30 | 2.51 | 2.99 | 4.82 | 4.88 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

In my last report on First Internet Bancorp, I estimated earnings of $4.42 per share for 2022. I’ve increased my earnings estimate because the margin expanded by more than I expected during the first quarter of 2022.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation.

High Price Upside Justifies a Buy Rating

First Internet Bancorp is offering a dividend yield of 0.7% at the current quarterly dividend rate of $0.06 per share. The earnings and dividend estimates suggest a payout ratio of 4.9% for 2022, which is close to the five-year average of 8.8%. Further, First Internet Bancorp has maintained its quarterly dividend at $0.06 per share since 2013. Therefore, I’m not expecting an increase in the dividend level.

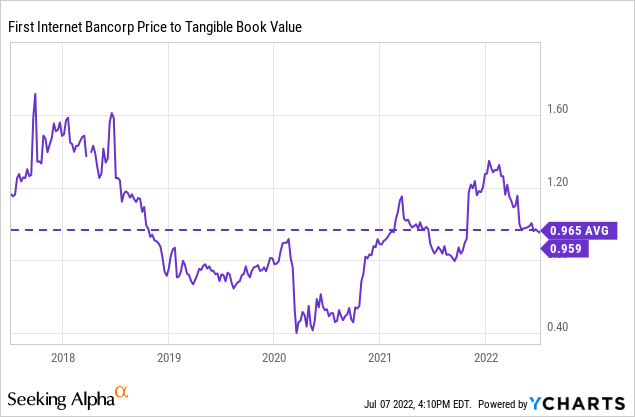

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First Internet Bancorp. The stock has traded at an average P/TB ratio of 0.97 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $41.0 gives a target price of $39.6 for the end of 2022. This price target implies an 8.2% upside from the July 7 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.77x | 0.87x | 0.97x | 1.07x | 1.17x |

| TBVPS – Dec 2022 ($) | 41.0 | 41.0 | 41.0 | 41.0 | 41.0 |

| Target Price ($) | 31.4 | 35.5 | 39.6 | 43.7 | 47.8 |

| Market Price ($) | 36.6 | 36.6 | 36.6 | 36.6 | 36.6 |

| Upside/(Downside) | (14.2)% | (3.0)% | 8.2% | 19.4% | 30.7% |

| Source: Author’s Estimates |

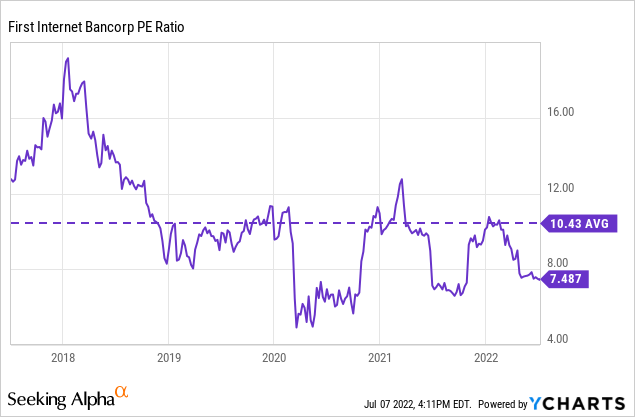

The stock has traded at an average P/E ratio of around 10.4x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $4.88 gives a target price of $50.9 for the end of 2022. This price target implies a 39.1% upside from the July 7 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.4x | 9.4x | 10.4x | 11.4x | 12.4x |

| EPS 2022 ($) | 4.88 | 4.88 | 4.88 | 4.88 | 4.88 |

| Target Price ($) | 41.2 | 46.0 | 50.9 | 55.8 | 60.7 |

| Market Price ($) | 36.6 | 36.6 | 36.6 | 36.6 | 36.6 |

| Upside/(Downside) | 12.4% | 25.8% | 39.1% | 52.4% | 65.8% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $45.3, which implies a 23.7% upside from the current market price. Adding the forward dividend yield gives a total expected return of 24.3%. Hence, I’m maintaining a buy rating on First Internet Bancorp.

Be the first to comment