Zerbor/iStock via Getty Images

Article Thesis

Main Street Capital (NYSE:MAIN) is a business development company that offers a high yield that is paid out in monthly installments. The company is well-managed, has a great track record, and even though it is not ultra-cheap, its valuation has come down over the last couple of months, improving the value proposition.

Main Street Capital Overview

MAIN is an internally-managed business development company that has close to $6 billion in capital under management. Its market capitalization is $3 billion today, while its equity book value is $1.8 billion. Internal management generally is a positive for BDCs, REITs, etc. as management and shareholder interests are better aligned compared to structures where the entity is externally managed.

Most of Main Street Capital’s investments are in the lower middle market, which consists of companies generating around $10 million to $150 million in revenue per year. Accessing capital is not easy for these companies, as they oftentimes are too small to do what would be possible for (much) larger companies, i.e. access bond or equity markets directly. MAIN does offer a range of financing solutions for these companies, including first lien and senior secured debt, but also equity financing. MAIN’s equity investments are made in companies that MAIN knows well due to established business relations, which reduces the risks in Main Street Capital’s equity portfolio. MAIN’s fixed-rate investments make up the majority of its asset base and investment income, but dividends and capital gains from its equity portfolio contribute around 20% of the company’s income during most years.

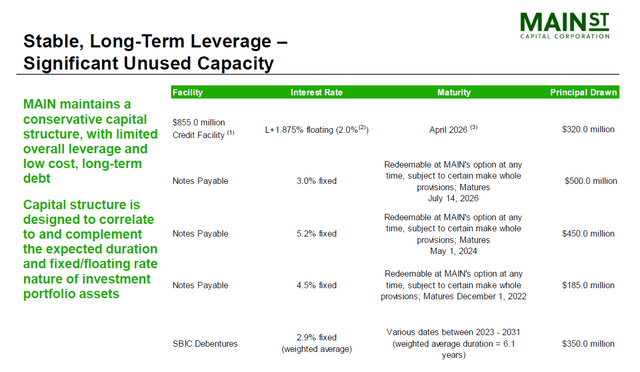

Main Street Capital’s balance sheet is strong. The company has a BBB- rating from Standard & Poor’s. Its investment grade rating allows MAIN to access debt markets at favorable terms, which results in long average maturities and attractive yields:

With yields of as low as 3% for fixed notes that mature four years from now, Main Street Capital can capture highly attractive spreads, considering it is lending out money at much higher rates. The weighted-average effective yield in its private loan portfolio is 8.2%, for example.

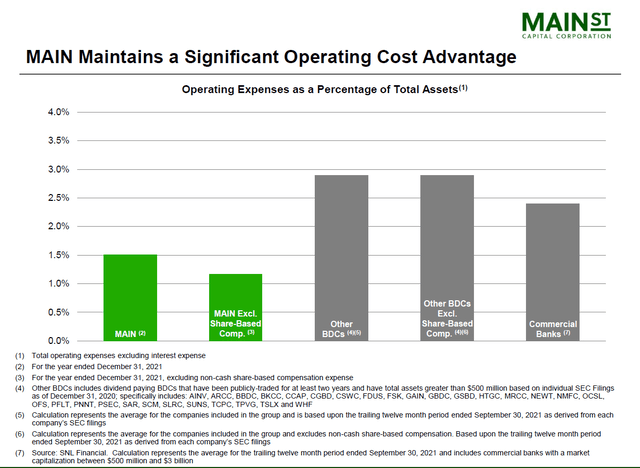

MAIN’s above-average size allows the company to operate very efficiently. Since some of the company’s expenses are fixed or semi-fixed, e.g. a large portion of overhead and administration costs, scale comes with improving efficiency. Compared to its peers, MAIN operates quite efficiently:

MAIN cost advantages (MAIN presentation)

With operating expenses of around 1.5%, relative to the company-wide assets, Main Street Capital’s operating costs are roughly half as high as those of its BDC peers. I do believe that excluding share-based compensation is not the best way to look at expenses. Even though SBC is a non-cash item, there is a real impact on shareholders as they get diluted over time. Still, even when we include SBC expenses, operating expenses are at an attractively low level compared to how other companies in the financial industry are operating – including commercial banks.

Main Street’s Strong Track Record And Valuation

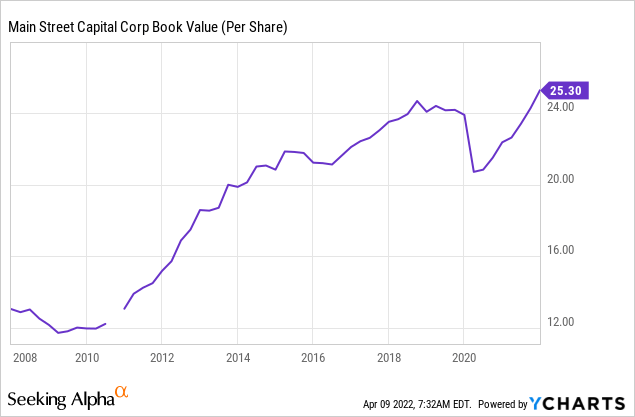

Main Street Capital’s experienced management and its efficient cost structure have allowed the company to grow its business at a compelling pace in the past. Importantly, this holds true on a per-share basis as well. Some BDCs generate meaningful business growth but do so by issuing shares at a rapid rate, which is why their NAV per share is not growing at an attractive pace. In some cases, BDCs even see their NAV per share decline over time, despite business volume growth. That is primarily an issue with externally-managed BDCs, as managers are not necessarily well-aligned with investors in these cases. But when it comes to Main Street Capital, investors have benefitted from the company’s growth since the company went public in 2007:

Since the IPO in 2007, book value has roughly doubled, from $13 per share to more than $25 per share. That was possible despite hefty dividend payments in that time frame, as we’ll see soon. In the above chart, we see two periods when book value declined meaningfully. That includes the financial crisis following the housing crash and the recent COVID pandemic. In those times, book value declined meaningfully, due to equity investments losing value, at least temporarily. More provisions due to higher default risks also play a role. That being said, book value did not drop outrageously much, and we also see that there has been a steep recovery in book value both times. Recently, book value per share has been hitting new record levels, which shows that the pandemic has not damaged the company on a longer-lasting basis. Instead, it is stronger than ever before.

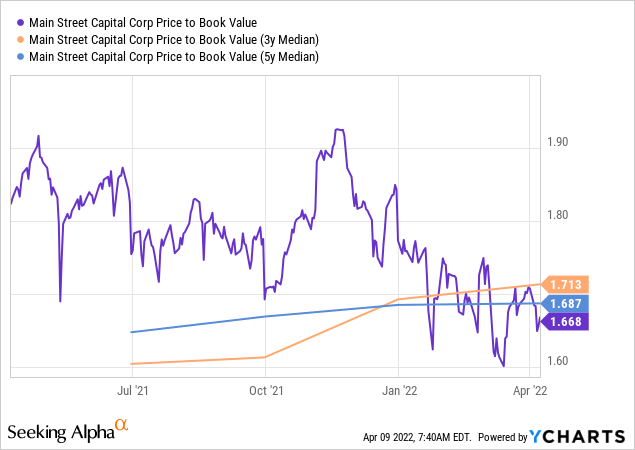

Book value appreciation should lead to share price gains over time, as BDCs are generally valued based on their book value. Depending on the quality of the BDC, book value multiples vary from company to company. But looking at an individual’s historic valuation gives us an indication of whether the company is attractively priced or not. Main Street Capital, due to its strong track record and its high returns on net asset value, generally trades at a meaningful premium to its book value.

In the above chart, we see that Main Street Capital trades at 1.67x book value today. That clearly is one of the lowest valuations the BDC has traded at over the last year, as its book value multiple stood at more than 1.90 at times. We also see the graphs for the 3-year and 5-year median book value multiples. These are both marginally ahead of the current valuation. We thus could say that Main Street Capital is relatively fairly valued, or potentially slightly undervalued today. Main Street Capital’s shares are a better buy today compared to almost all periods over the last year, except for a short period of time in March when its shares dropped to $40.

MAIN Stock – Monthly Dividends And A High Yield

Capital appreciation from BDCs is nice, but most investors buy them for the income they offer. As yield vehicles, their dividends naturally are a very important driver for total returns, and the sole reason to hold these investments for some.

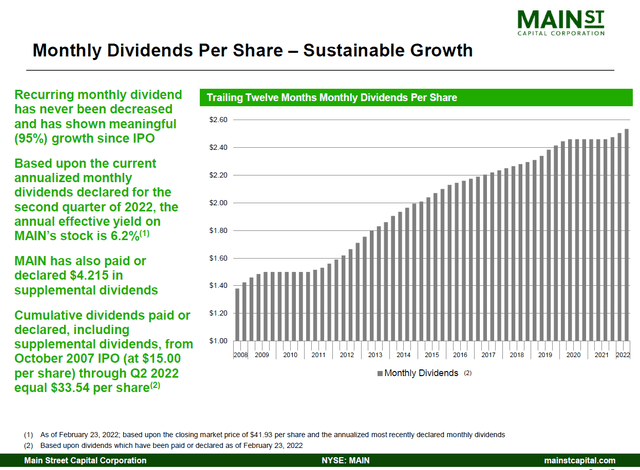

Main Street Capital has a highly compelling dividend track record, as we can see in the following slide:

The company has never cut its dividend, not even during the financial crisis or the pandemic. Instead, dividends were either kept stable or increased during every year since the company went public. Overall, the company has increased its dividend by 95% since its IPO, which makes for a growth rate of 5%.

At current prices, the regular dividend of $0.215 per share per month results in a dividend yield of 6.2%. Since MAIN also makes special dividends from time to time, such as the $0.075 surplus payment in March, the dividend yield on a trailing basis is even higher, at 6.8%. A dividend yield of close to 7%, in combination with annual dividend growth of 5%, is quite attractive. All else equal, one could expect annual returns in the 12% range from this combination. It is, of course, possible that future dividend growth will be more muted. But even if Main Street Capital’s dividend grows at just half the historic rate going forward, i.e. 2.5% annually, the combination with a 6.8% dividend yield could lead to annual returns in the 9% range. For a well-managed, reliable income investment, that’s attractive, I believe. Monthly dividend payments do not automatically make the company a great investment, but monthly dividends can be an added bonus. Those living off their dividends get more regular and easily-plannable income, and those that do not spend their dividends can reinvest them more regularly.

Takeaway

Main Street Capital is a quality business development company with a compelling track record. Its current dividend yield is attractive, and shares look fairly valued, or potentially even slightly undervalued, on a price to book value basis.

Rising interest rates are not a headwind for MAIN, instead, they will be a small tailwind. The company has guided to a $0.12 increase in investment income per share should the interest rate rise by 150 base points. A 100 base point increase would result in a $0.07 per share tailwind for MAIN’s investment income. The fact that shares have pulled back in recent months could thus provide for an attractive buying opportunity in this quality income stock.

Be the first to comment