Zhuqin Chen/E+ via Getty Images

Published on the Value Lab 7/4/22

I haven’t been to New York in many years. It probably still is a remarkable city, but things have also certainly changed. On one hand we have the work from home trends that have seriously changed demands on employers, and those demands have to be met in many industries due to the tight labour market. On the other hand, there is also the issue that New York governance has always really mattered for the fortunes of the city, especially now with the massive budget they have due to surprise tax income last year. With so many high earners and business profits, New York is an engine that much like a company must be well managed to produce good outcomes, and bad management could mean an exceptional fall from grace. SL Green Realty (NYSE:SLG) is the way to play the fortunes of New York by exposing yourself to the best real estate in the city. While they are optimising for quality and have low vacancy rates, I am disinclined to bet on New York due to uncertainty around politics and governance there, as well as to bet against work from home and the continued fortunes of the legal and financial services sector.

A Look at SL Green Realty

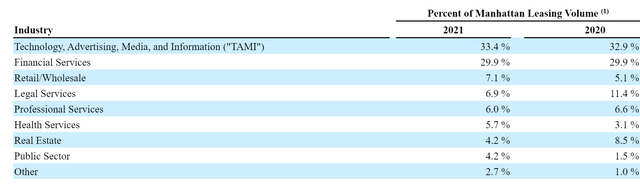

Here is some of the key information around SLG that has helped form our opinion. They are exposed to financial and legal services in their leases, unsurprisingly, and rents have actually fallen slightly.

Signed 159 Manhattan office leases covering approximately 1.9 million square feet. The mark-to-market on signed Manhattan office leases was 2.5% lower in 2021 than the previously fully escalated rents on the same spaces.

Industry Split (SLG 10-K 2021)

They are also exposed to tech, which is a sector that has perhaps been the most open to meeting their employee demands for work from home. Also developers have been the most inclined to demand work from home as well.

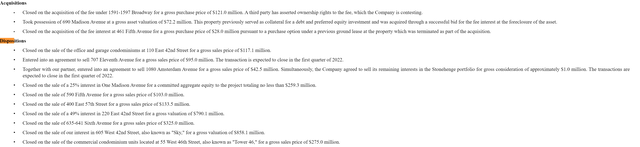

Looking at the company results, they have been disposing of lots of properties.

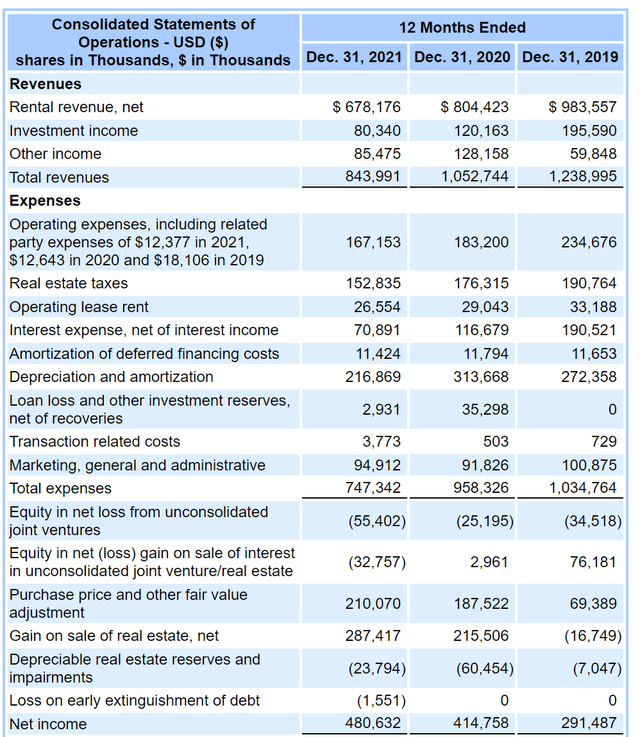

Income Statement (SLG 10-K 2021)

Net income has been meaningfully rising, but this is not so impressive because we would have expected market values of properties to be above book values. Indeed, the difference between revenues and expenses before accounting for non-operating income has declined from 2019 from over $200 million to $100 million in 2021. However, excluding other income and investment income however, which is related to lease termination income and equity returns, there has been at least an improvement of $80 million from 2020, and the profitability of properties on this basis is only very slightly below 2019 levels. Acquisitions have clearly been exceeded by the proceeds from dispositions though, reflecting the declines in absolute levels of profits and revenues.

Acquisitions and Disposals (10-K SLG 2021)

While management didn’t comment specifically on this in the earnings call, and no analysts asked, we get the feeling that they are perceiving a flight to quality among tenants. The SLG portfolio has always been quality, therefore we see the following:

Manhattan market has a vacancy rate of 16% to 18% depending on what source you use and our portfolio is only 7% vacant and shrinking. So, that same story is there, but that 7% vacancy isn’t just our top buildings, that’s every building combined on average.

Marc Holliday, CEO of SLG

So the dispositions are likely to optimise the portfolio towards properties that will attract tenants with deep pockets and strong desires to stay in the city.

About New York

To invest in SLG, you need to have an opinion on the state of New York City. This is a pretty polarising issue that Americans might have a better sense of than me, but I’ll propose some thoughts. The first is that they have a massive budget now because the financial sector has done so well this last period thanks to the M&A boom. New York also has a massive crime issue right now, which I won’t comment on beyond the fact that it will clearly affect the market values of properties in the city and the attractiveness of the city in general. The budget will address the crime issue and hopefully this will succeed, but investors will have to hope that the budget is put to good use for the sake of New York.

Another question about New York that needs to be addressed is how resilient it has actually been. Because this is a polarising issue, there have been many opinions. Some say that New York is defying the doomsayers, and they cite stats about young people moving in enough so that there is a net increase in New York tenants. Of course, this ignores the question that maybe higher earners are on the cusp of leaving, or are already leaving the city. However, what is more certain is that M&A and financial services revenues are unsustainable, and similarly legal services which must have had a boom are probably going to see less mandates this year as we already start coming off the M&A boom, regardless of whether these high earners are leaving the city or not.

Finally, there is the overarching force that is agnostic of New York specifically, that is the work from home trend. In our opinion, WFH is an irreversible inevitability. SLG is quite well protected from this though due to the quality of its portfolio and its movement to portfolio optimisation. But WFH will affect New York City in terms of taxes, budgets and property values, could also reduce city prosperity and contribute further to crime.

SLG Stock – Puts and Takes

The market is not unaware of all these questions. Analysts spent a lot of time on the call asking questions related to the New York budget and what was going on in New York governance. Also, people are aware that New York is dealing with a crime issue, and that it is having problems. Of course, everyone is thinking about WFH as well.

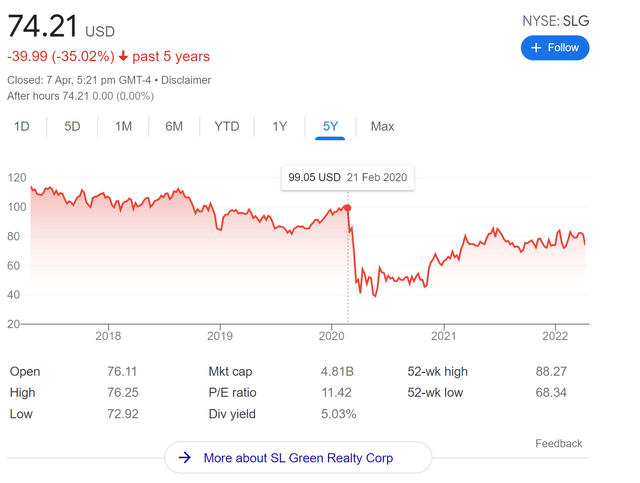

The stock is trading substantially below pre-COVID levels, still 25% discounted. While this may appear attractive, we believe the value is fair. Reversal in fortunes of tenants will also affect the city’s coffers. A bet on good governance of New York and the budget is also a bit of an uncertain one that we are not sure we’d want to make. Also, we worry about investment income due to stagflation. Finally, we actually believe that WFH is going to provide social surplus, and we are morally against it coming to a halt. Regardless, WFH is gaining traction and is difficult to reverse. Just ask Goldman Sachs (GS). For all these reasons, we think that SLG deserves a discount as of now, and with no strong reason to see things getting much better from this point on balance, we’d rather keep our money sidelined from SLG.

Be the first to comment