pidjoe/iStock via Getty Images

Introduction

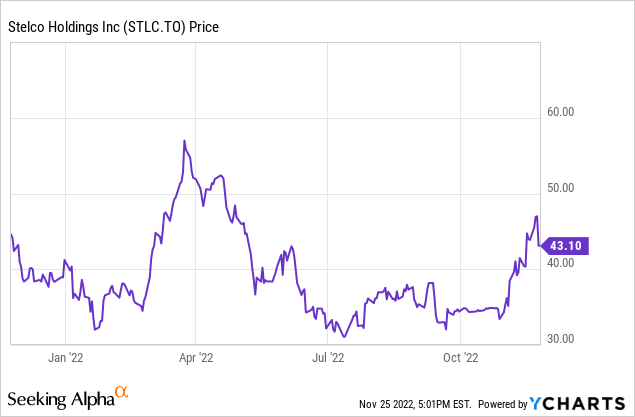

It’s been more than six months since I last discussed Stelco Holdings (TSX:STLC:CA) (OTCPK:STZHF), a Canadian steel producer. Stelco has benefited tremendously from the strong demand for steel toward the end of 2021 and in the first half of 2022, but as the steel market softened, Stelco’s net income and free cash flow is obviously being hit as well. That being said, the company remains profitable and free cash flowing, and although Q3 2022 was one of the worst quarters in a while, the company still announced a special dividend as shareholder rewards are high on its priority list.

Q3 was weak, but not as weak as I anticipated

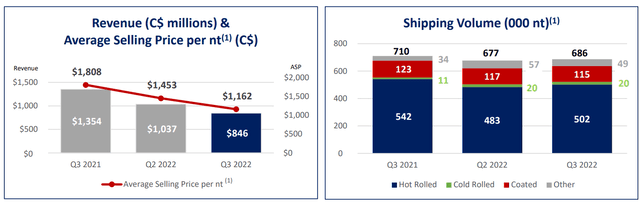

It goes without saying the entire steel industry is in a down-cycle but fortunately the cost of the materials needed to produce steel are coming down as well. In the third quarter of this year, Stelco reported an average selling price of just over C$1,160 per tonne. That’s a 20% QoQ decrease and a 36% YoY decrease. While that sounds problematic, Stelco was able to keep the damage limited and the company remains profitable despite these headwinds.

Stelco Investor Relations

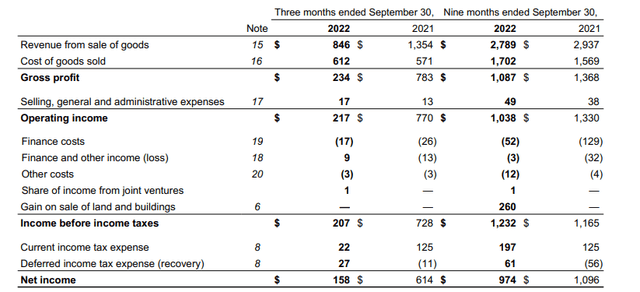

The total revenue in the third quarter fell to C$846M, resulting in a gross profit of C$234M. That’s a 70% decrease compared to the third quarter of last year. Fortunately some of the other operating expenses are decreasing as well so Stelco remained profitable with a pre-tax income of C$207M, but it’s clear this is one of the worst quarters in the company’s recent history.

Stelco Investor Relations

The net income of C$158M represented an EPS of C$2.33 based on the average share count of 67.8 million shares but keep in mind Stelco is aggressively repurchasing shares and it ended the quarter with a net share count of just under 63.4M shares as it repurchased a total of in excess of 25 million shares since December 2020.

This also means that if we would divide the C$158M net income over the current share count of 63.4M, the EPS would actually have been C$2.49.

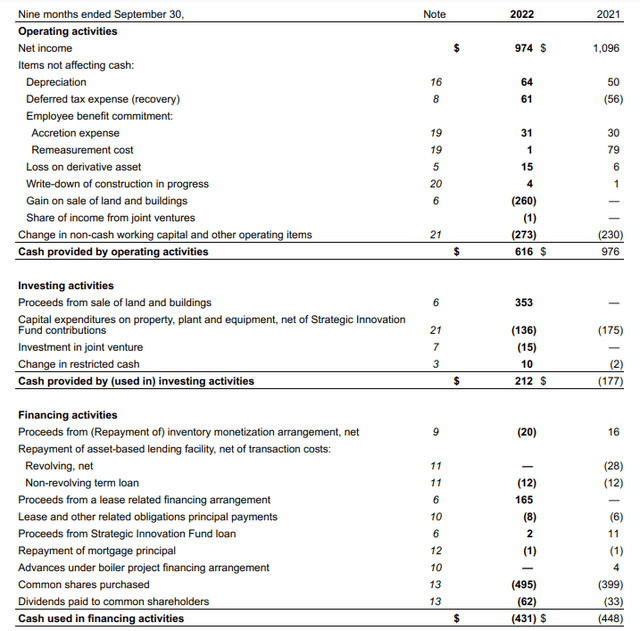

Unfortunately Stelco does not provide a detailed Q3 cash flow statement, but it’s not too hard to just compare the 9M 2022 results with the cash flow statement of the first semester of this year as that allows me to distill the specific Q3 cash flows.

During the first nine months of the current financial year, Stelco reported an operating cash flow of C$616M. This includes a C$273M investment in the working capital position and excludes the C$8M in lease payments. This means that on an adjusted basis, the operating cash flow was approximately C$881M. And as you can see below, the total capex was just C$136M (excluding the investment in a joint venture) resulting in a free cash flow of C$745M during the first three quarters of this year.

Stelco Investor Relations

We also know the adjusted operating cash flow in the first half of this year was C$668M and the total amount of cash spent on capital expenditures was C$97M. This means that in the third quarter of this year, Stelco generated C$213M in operating cash flow and incurred about C$39M in capital expenditures, resulting in a C$174M adjusted free cash flow. Divided by the current share count of 63.4 million shares, the adjusted free cash flow per share in Q3 was C$2.74. And of course, keep in mind that subsequent to the end of the third quarter, Stelco completed a Substantial Issuer Bid which allowed Stelco to repurchase 8.3 million shares at C$35 per share. This means the current share count is approximately 55 million shares (and decreasing).

The balance sheet remains very strong

So despite a weak steel market, Stelco remained profitable and free cash flow positive. The company hiked its quarterly dividend by 40% to C$0.42 and announced a special dividend of C$3 per share. The stock already is trading ex-dividend, and the special dividend and the normal quarterly dividend will be payable on Dec. 1.

The company can clearly afford to do so. As of the end of September, its balance sheet indicated the net working capital position was a positive C$1.3B with just under C$1.4B in cash. With just C$72M in financial debt, Stelco ended the third quarter with a net cash position of in excess of C$1.3B. While this excludes the C$392M in “other liabilities” (with the vast majority of this related to lease liabilities) and the C$286M in retirement-related liabilities, it’s a fair representation of Stelco’s current financial situation. Which is exceptionally healthy.

Even if the company does not generate a single dollar of free cash flow in the fourth quarter, it will still end with a net cash position of in excess of C$800M as it “only” spent C$475M so far on the combination of the share buybacks and the dividends.

Investment thesis

This means that if I would use a net cash position of C$850M and a share count of 55 million shares, the company still has a net cash position of in excess of C$15 per share. And as Stelco’s capital expenditures are relatively low, I expect the company to generate a positive free cash flow in the fourth quarter. The weakening Canadian Dollar definitely helps as well. Also keep in mind that Stelco will see the cost input prices decrease from next year on, as it currently still is working through existing coal and natural gas contracts at a higher price.

I have no position in Stelco right now as I’m holding onto my Algoma Steel (ASTL) shares and I didn’t want to own both steel companies. Both companies will have to deal with the same headwinds but I am definitely keeping an eye on Stelco because of its aggressive share buyback policy. I strongly believe that is a good way to create value down the road as the total share count will be much lower when the next upcycle starts.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment