Nickbeer/iStock via Getty Images

When investing in stocks for the long haul, the ideal scenario is to generate positive returns. However, there are cases in which even breaking even or generating a small loss can be considered a win. Although this may not seem to be the case, it is when the broader market falls significantly. One company that has declined in price in recent months but that has fared well compared to the broader market is Steelcase (NYSE:SCS). Truth be told, things could be far better for the company than it is today. But considering where the market is, overall performance on both the top and bottom lines is promising. Add onto this just how cheap shares are on a forward basis, and I do believe that the firm is likely to outperform the broader market moving forward as well.

A look at recent performance

Back in early March of this year, I wrote an article that took a favorable view of furniture, architectural, and technology product business Steelcase. In that article, I acknowledged that the company had struggled since the beginning of the pandemic. At the same time, I praised the improvements the company had experienced over the past couple of years and said that it was probable that financial performance would revert back to what it was in prior years. Ultimately, I felt as though the recovery following the pandemic would help to push shares higher. And that led me, as a result, to rate the business a ‘buy’, reflecting my belief that the company would outperform the broader market for the foreseeable future. Since then, shares have not gone up. But they have, undoubtedly, outperformed the market as a whole. Since publication, shares of the enterprise are down by 4.5%. That compares to the 9.7% decline the S&P 500 has experienced.

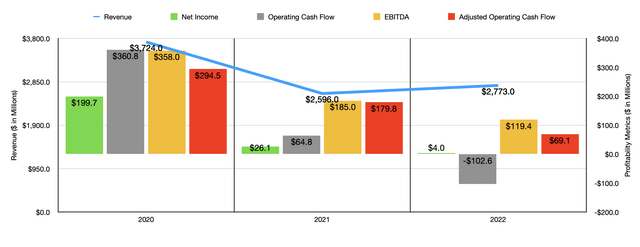

Although the market can be random in its fluctuations, there is little that is random, in my opinion, about the performance experienced by Steelcase. To see what I mean, we need only look at financial performance posted by management. For the 2022 fiscal year as a whole, for which I only had available data covering the first three quarters in my last article, management reported revenue of $2.77 billion. That represents an increase of 6.8% over the nearly $2.60 billion generated in 2021. There were really three drivers of this expansion. The smallest contributor to the rise was a $16 million positive impact caused by foreign currency translation. Next, the company benefited to the tune of $44.8 million from acquisitions that management had made. The most important driver, meanwhile, was a $115.7 million increase caused by organic growth. This was driven by particularly robust demand in the EMEA (Europe, Middle East, and Africa) regions of 15% collectively.

The company, unfortunately, did not show an improvement during this timeframe on the bottom line. Net income, for starters, dropped from $26.1 million in 2021 to $4 million the same time this year. There were several contributors to this, but the largest impact was associated with $80 million of higher inflation costs. $26 million worth of impact came from higher costs associated with labor and logistics inefficiencies because of supply chain disruptions. This decrease in net income hit the company’s other profitability metrics. Operating cash flow declined from $64.8 million to negative $102.6 million. Even if we adjust for changes in working capital, it would have plunged from $179.8 million to $69.1 million. Meanwhile, EBITDA for the company also declined, dropping from $185 million to $119.4 million.

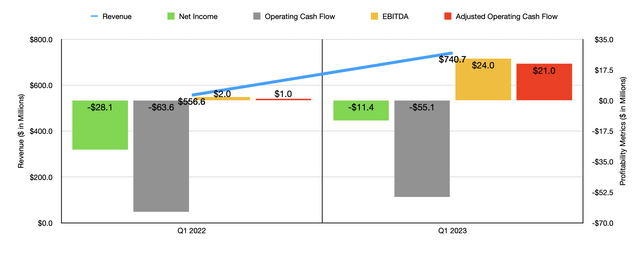

Despite the pain experienced in the 2022 fiscal year, the company has shown some nice improvements so far in 2023. In the first quarter of the year, revenue came in strong at $740.7 million. This is 33.1% higher than the $556.6 million generated in the first quarter of 2022. It’s worth noting that substantially all of this increase came from organic growth, with management saying that organic growth year over year was 35%. This was driven by a 38% rise in the Americas and a 36% increase in the EMEA regions. Had it not been for foreign currency translation, revenue would have been $12.6 million higher. Management said that, year over year, orders for its products grew by 22%, with backlog of $927 million coming in 52% higher than what it was just one year earlier. Of the increase in sales, $145 million was attributable to a higher volume of products sold, while only $45 million was associated with pricing actions taken to pass on inflationary costs to its customers. Moving forward for the rest of the year, one thing that might help the company further its acquisition of HALCON. That deal, which involves $125 million for the purchase price with $9.5 million in contingent consideration possible over a three-year window, brought in revenue of $70 million on an annualized basis into the company and involves $56 million worth of backlog.

As revenue rose, the company’s bottom line improved as well. The firm went from generating a net loss of $28.1 million in the first quarter of 2022 to generating a net loss of $11.4 million in the first quarter of this year. It’s really interesting when you dig into the numbers here. Relative to sales, costs of sales rose by 1.8%, largely because of $12 million of higher inflationary costs even after management raised prices on customers. This was more than offset, however, by a 6.4% decrease, on a percentage of revenue basis, associated with operating expenses. This was driven by a Smaller than anticipated rise in marketing, product development, and sales expenses, as well as other related operating costs. Naturally, these improvements had a positive impact on other measures of profitability. Operating cash flow went from negative $63.6 million to negative $55.1 million. If we adjust for changes in working capital, it would have risen from $1 million to $21 million. Meanwhile, EBITDA for the company also improved, climbing from $2 million to $24 million.

When it comes to the 2023 fiscal year as a whole, management expects organic revenue to climb by between 15% and 20%. Ignoring the aforementioned acquisition, hitting the midpoint here would imply revenue of roughly $3.26 billion for the year. They also anticipate earnings per share of between $0.50 and $0.70. At the midpoint, this would translate to net income of $67.7 million. Unfortunately, given the company’s historically volatile bottom line results, I don’t believe that net income is all that important a measure. If, instead, we look at the company’s historical profit margins and apply those to revenue, then a realistic assumption would be adjusted operating cash flow of $279 million and EBITDA of $339.2 million.

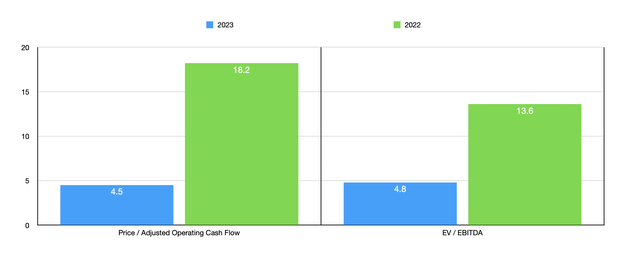

Given these figures, we can see that the company is trading at a forward price to adjusted operating cash flow multiple of 4.5. This compares to the 18.2 reading we get using 2022’s results. The EV to EBITDA multiple should be similar at 4.8. That’s down from 13.6 using 2022’s figures. As part of my analysis, I also compared the company to five similar firms. On a price to operating cash flow basis, four of the five companies had positive results, with multiples of between 4.7 and 23.9, respectively. And when it comes to the EV to EBITDA approach, the range was between 6.2 and 17.2. In both scenarios, our prospect was the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Steelcase | 4.5 | 4.8 |

| Interface (TILE) | 5.4 | 6.7 |

| NL Industries (NL) | 23.9 | 17.2 |

| ACCO Brands (ACCO) | 4.7 | 6.2 |

| HNI Corporation (HNI) | 7.5 | 7.8 |

| Kimball International (KBAL) | N/A | 7.2 |

Takeaway

Given the recent performance figures we have seen and considering the likely outlook for business, I do believe that Steelcase will likely continue to outperform the broader market for the foreseeable future. Revenue is climbing again and profitability is improving markedly. Shares are also cheap, both on an absolute basis and relative to similar players. I wouldn’t call the company a high-quality player by any means. It definitely is an okay business as opposed to a great one. But given how cheap shares are, it likely will be a solid prospect for value-oriented investors who like this space.

Be the first to comment