shotbydave/iStock via Getty Images

The Current Value Drivers

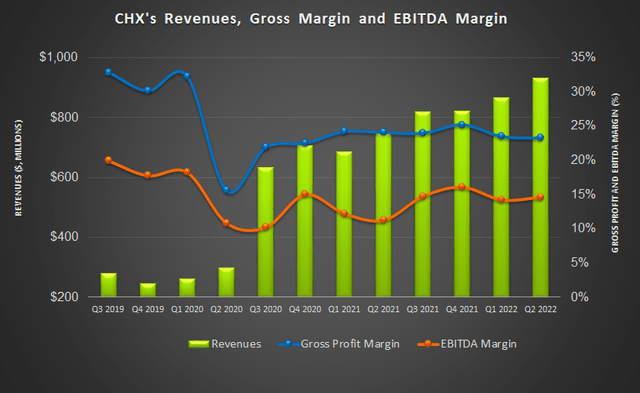

In the middle of 2022, ChampionX Corporation (NASDAQ:CHX) delivered its promise on pricing traction and the synergies from the Ecolab merger. In my previous article, I explored the effects of pricing traction and the synergies from the Ecolab merger. Now, it plans to concentrate on increasing shareholders’ returns with a capital allocation program. Operationally, it looks to explore bolt-on technology additions and high-return organic growth opportunities. Although the topline may not increase much, its cost reduction and productivity enhancement initiatives will likely produce margin expansion for the company.

However, lower cross-supply sales to Ecolab can pull down the Reservoir Chemical-related sales in the near term. Its free cash flow turned negative in 1H 2022 due to a steep rise in working capital requirements. The company has nearly achieved its debt-to-EBITDA target and can indulge in improving shareholder returns. The stock is reasonably valued versus its peers. Nonetheless, investors might want to hold the stock with an expectation of modest returns in the medium term.

Strategies And New Opportunities

Through debt refinancing and operating margin expansion, CHX has reached its targeted debt-to-EBITDA ratio. So, its management is focused on increasing shareholders’ returns. In Q2, it returned 60% of its free cash flow to shareholders through dividends and share repurchases. In Q2, it invested in small bolt-on technology additions and high-return organic growth opportunities. With margin steadying, it will follow a capital allocation program that allows returning a substantial portion of FCF to its shareholders.

The other leg of its strategy revolves around leveraging the position of its Production Chemical Technologies segment. Because the offshore energy market is likely to see increased activities, CHX will utilize its expertise in the technically challenging and chemicals-intensive offshore energy market.

Q3 2022 and FY2022 Outlook

In Q3, CHX’s management expects revenues to increase marginally (at the guidance mid-point) compared to Q2. The company has reached a comfortable point where a price increase exceeds the increase in raw material costs. On top of higher revenues, cost and productivity actions are expected to raise EBITDA by ~11% in Q3 versus Q2.

The company expects revenues to increase in all its operating segments (e.g., Production Chemical Technologies, Production & Automation Technologies, Drilling Technologies, and Reservoir Chemical Technologies). However, there can also be some headwinds in the Reservoir Chemical Technologies business related to the reduction in cross-supply sales to Ecolab.

Overall, the reasonably high growth in the Production Chemical Technologies segment can drive the company’s EBITDA margin to accelerate in 2H 2022. It can exit with an EBITDA margin of 18% in FY2022 compared to 15% in FY2021. The management also exuded confidence that it can reach its intermediate-term goal of achieving an EBITDA margin of ~20%.

Industry Indicators And Their Implications

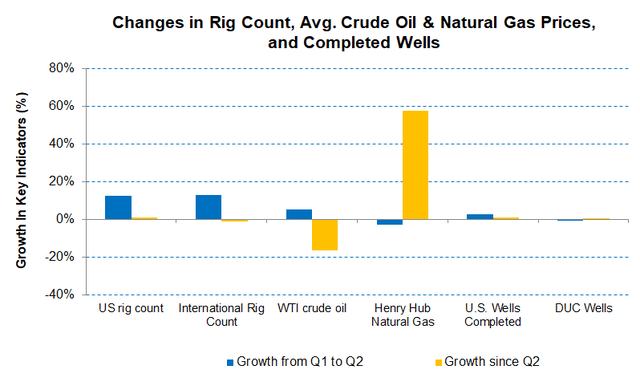

EIA and Baker Hughes’s rig count data

The industry indicators have been interesting so far in Q3. There is uncertainty over the direction of crude oil price, which has declined in Q3 after trending up since the start of the year. The US rig count growth has decelerated (1% up, quarter-to-date). At the same time, the international energy activity decreased marginally. The completion activity and drilled-but-uncompleted wells have been holding up, suggesting that energy production will maintain its course at a modest rate in the near term.

Segments: Performance And Outlook

In Q2 2022, CHX generated much of its revenues from the United States and Latin America (53% and 14% of total sales, respectively). However, the Q2 sales also included cross sales to Ecolab as per the post-merger supply agreements. Raw material and logistics costs also increased during Q2, which held back the EBITDA margin growth.

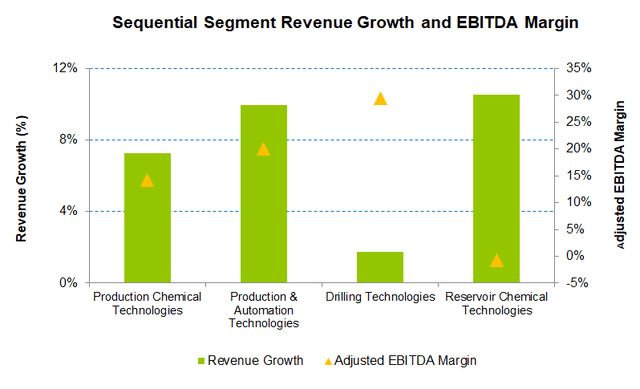

During Q2, its Production Chemical Technologies segment revenues increased by 7.3% compared to Q1. Better pricing and increased volume in North America and international geographies led to higher revenues. However, the adjusted EBITDA margin in the segment decreased following a $22.9 million charge to reduce the carrying value of the Russian operation during Q2.

Increased demand for shorter-cycle North American onshore product lines, higher international volumes, and price hikes resulted in 10% quarter-over-quarter revenue growth in the Production and Automation Technologies segment. However, the segment operating profit margin decreased in Q2 due to cost inflation and supply chain disruptions.

As I discussed above, higher well construction and completion activity in the US led to performance improvement. The segment EBITDA margin was 29.5% in Q1, translating into a 93-basis point sequential deterioration due to an adverse product mix. The Drilling Technologies segment (2% revenue up) underperformed the other segments in Q2. The Reservoir Chemical Technologies segment saw a 10.6% revenue rise in Q2.

Cash Flow Decline And Debt

In 1H 2022, CHX’s cash flow from operations (or CFO) decreased significantly compared to 1H 2021. Despite higher revenues, cash outflows went up due to higher inventory, and increased accounts receivable led to higher working capital requirements. Free cash flows (or FCF), in its turn, turned negative in 1H 2022.

CHX’s debt-to-equity ratio was 0.39x as of June 30, 2022, while the net debt-to-adjusted EBITDA was approaching 1x. It had $740 million in liquidity as of that date. Its liquidity increased by $200 million compared to a quarter ago as it refinanced its existing credit facilities and redeemed its senior notes.

CHX’s forward dividend yield is 0.69%, which is lower than its peer, Cactus (WHD), having a forward dividend yield of 1.05%.

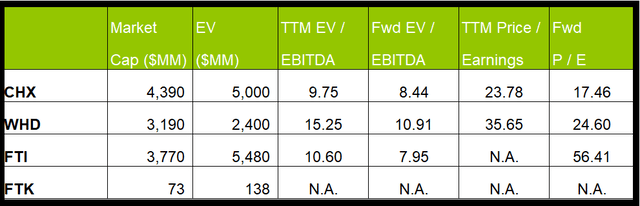

Relative Valuation And Analyst Rating

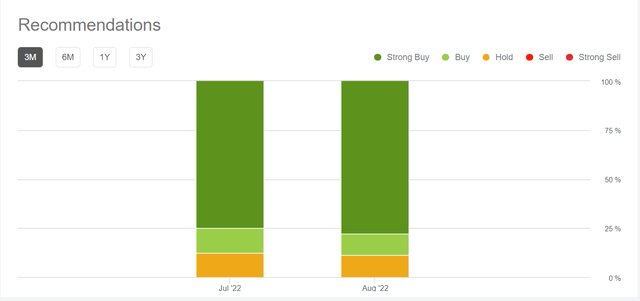

According to Seeking Alpha, eight sell-side analysts rated CHX a “buy” in August (including “strong buy”), while one recommended a “hold.” None of the analysts rated it a “sell.” The Wall Street analysts’ estimates suggest a 35% upside at the current price.

The stock’s current EV/EBITDA is lower than its peers. The stock’s EV/EBITDA multiple compression is less steep than its multiple compression for its peers (WHD, FTI, and FTK). This typically reflects in a lower EV/EBITDA multiple than peers. So, the stock is reasonably valued at the current level. Still, I think the stock has modest upside potential in the short term.

Why I Kept My Recommendation Unchanged?

In my previous article, I pointed out that the company’s chemical and artificial lift businesses would outperform in Q2 as pricing traction would outweigh cost inflation. I wrote:

Improved productivity in the Chemical Technologies and Artificial Lift businesses can expand the operating margin in 2022. The pricing traction looks to outweigh the cost inflation.

However, CHX’s cash flow from operations turned negative in Q1 2022 due to a steep rise in working capital requirements.

After Q2, the management expects revenue growth in the production chemical technologies business to exceed the previous guidance of “mid-teens percentage” and achieve a “high teens percentage.” It also views its market as having a favorable multi-year outlook. However, I have some reservations about its relative valuation and cash flows. So, I maintain my “hold” rating.

What’s The Take On CHX?

ChampionX’s pursuit of pricing traction has paid off as it now has reached a comfortable point where a price increase exceeds the increase in raw material costs and adds to the margin. Its Production Chemicals business has started exploring the chemicals-intensive offshore energy market with a modular fit-for-purpose approach. The Ecolab merger’s revenue synergies and cost reduction initiatives will continue to push its bottom line higher.

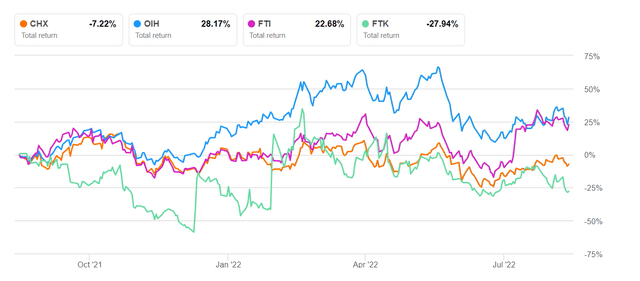

One of the critical challenges in the near term is the cross-supply sales headwind related to Ecolab. So, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. The falling cash flows did not disrupt its debt reduction target. Lower leverage has let it pursue a shareholder return maximization policy, which can expand its valuation multiples. I expect its margin expansion and debt reduction strategy to produce moderately positive returns in the medium term.

Be the first to comment