oatawa

National Retail Properties Inc. (NYSE:NNN) is a long-term bet on both the U.S. real estate market and the U.S. economy. National Retail Properties is a large, diverse, and expanding net-lease real estate investment trust with a low payout ratio and strong funds from operations growth.

I believe the trust will deliver robust dividend growth in the future due to its Dividend Aristocrat status and low AFFO-based pay-out ratio.

Based on funds from operations, the stock is attractively valued, and National Retail Properties should be able to increase its dividend payout even during a recession.

National Retail Properties: A Top Bet On U.S. Real Estate

As a broadly diversified real estate investment trust with a national presence, National Retail Properties provides investors with strong diversification and excellent portfolio health.

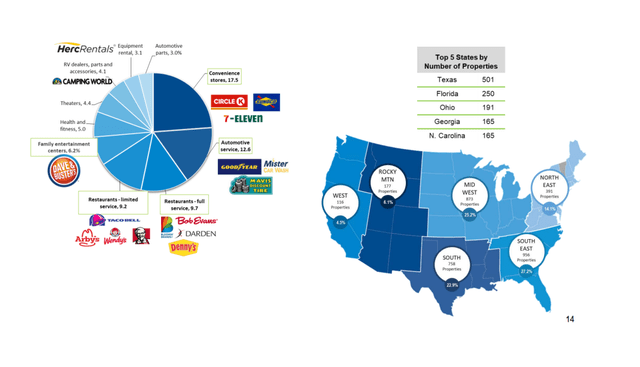

The trust’s portfolio contained 3,305 property locations in 48 states totaling 33.8 million square feet as of June 30, 2022.

National Retail Properties focuses on the retail market in the United States, renting its properties to large retail and restaurant chains such as 7-Eleven, Wendy’s, Denny’s, and Circle K.

National Retail Properties is effectively a bet on the U.S. economy as a whole due to its national presence. With approximately 500 different property locations, Texas is the largest state for National Retail Properties, as diverse as the trust is.

Portfolio Diversification (National Retail Properties)

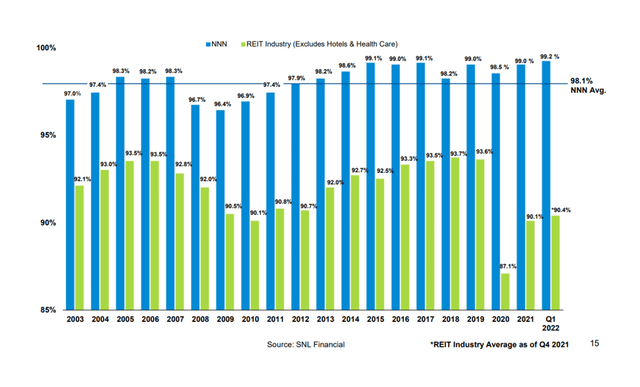

The trust’s strong portfolio health is what stands out about National Retail Properties. At the end of 2Q-22, the real estate investment trust’s portfolio occupancy was 99.2%, and National Retail Properties’ occupancy rate has historically been significantly higher than the national REIT average.

Occupancy Rates (SNL Financial)

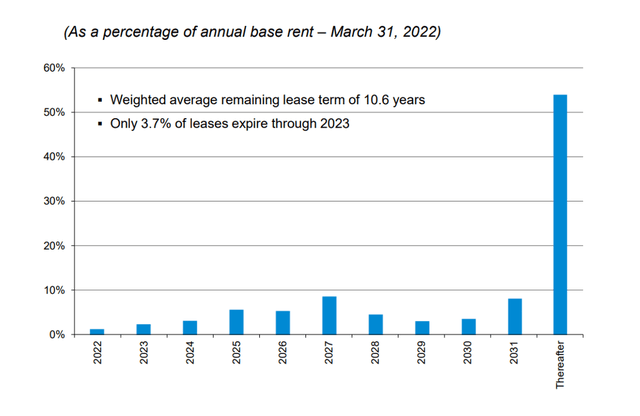

National Retail Properties’ weighted average remaining lease term at the end of 2Q-22 was 10.6 years, which was longer than Realty Income Corporation’s (O) average lease term of 8.8 years.

Longer weighted average lease terms mean fewer leases expire, providing the trust with long-term cash flow visibility. Less than 4% of leases at National Retail Properties will expire before the end of 2023.

Weighted Average Remaining Lease Term (National Retail Properties)

Low Pay-Out Ratio Ensures Dividend Growth

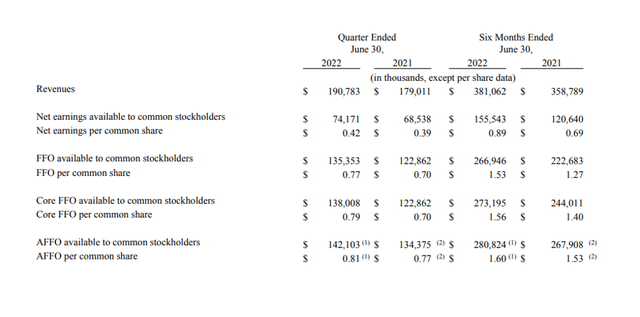

In 2Q-22, National Retail Properties’ adjusted funds from operations increased 5.8% YoY to $142.1 million. AFFO per share was $0.81, up 5.2% YoY, owing to the strong performance of the real estate portfolio and lease activity.

Based on adjusted funds from operations, National Retail Properties has a very low pay-out ratio. The trust paid out only 66% of its adjusted funds from operations in the first six months of 2022, giving National Retail Properties a lower pay-out ratio than Realty Income.

Realty Income has a pay-out ratio in the mid-seventies, implying that National Retail Properties’ dividend is even more secure than Realty Income’s.

Adjusted Funds From Operations (National Retail Properties)

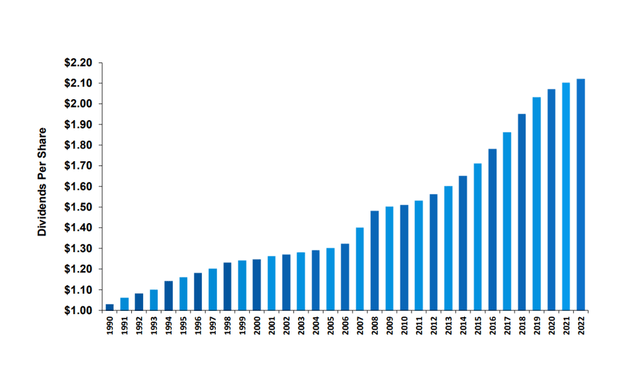

In terms of dividends, National Retail Properties is a Dividend Aristocrat, which means that the trust has increased its payout to shareholders for at least 25 years in a row.

National Retail Properties increased its dividend by 3.8% in 2022, marking the company’s 33rd year of consecutive dividend increases.

The stock of NNN yields 4.9% based on a quarterly dividend payment of $0.55 per share, and the trust’s history suggests that National Retail Properties will continue to raise its dividend.

Given the trust’s low pay-out ratio, National Retail Properties should have no trouble increasing its dividend in the future.

Dividends Per Share (National Retail Properties)

NNN Stock Guidance And Multiple

National Retail Properties’ guidance for 2022 has been raised from $3.08 to $3.15 per share to $3.14 to $3.19 per share. Based on the new guidance and a stock price of $44.60, National Retail Properties’ stock is trading at a 14.1x AFFO multiple, which is lower than Realty Income’s 17.5x AFFO multiple.

STORE Capital Corporation (STOR) is the only REIT I value more than National Retail Properties (see thesis here).

Why Realty Income Could See A Lower Valuation

National Retail Properties is a well-diversified, broadly positioned real estate investment trust with significant real estate holdings across the United States.

The trust’s diversification and portfolio health are excellent, providing shareholders with a reasonable degree of downside protection in the event of a recession or market correction.

National Retail Properties is a very well-managed REIT, which is why I see a real estate market correction as the trust’s most significant potential risk factor.

My Conclusion

National Retail Properties’ stock is currently on sale, and investors may want to consider purchasing this solid 4.9% yielding real estate investment trust while it is on sale.

National Retail Properties provides consistent dividend income, and as a Dividend Aristocrat, it represents top dividend value for investors who don’t want to worry about dividend coverage, cash flow growth, or portfolio health.

Be the first to comment