Evgeny Gromov/iStock via Getty Images

Introduction

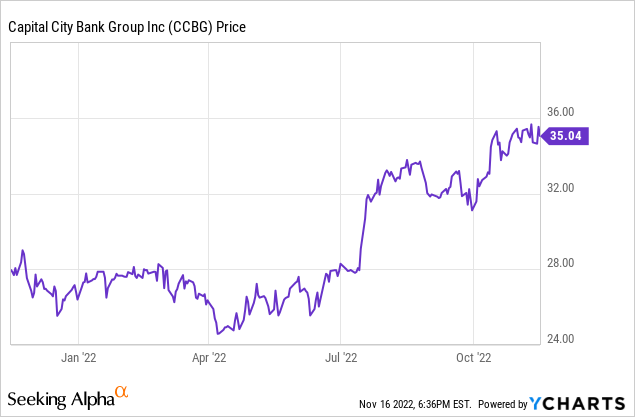

In an August article, I thought Capital City Bank Group (NASDAQ:CCBG) was a bit too expensive for me. We are now about three months later and the bank has reported its Q3 results, so I wanted to check if I need to update my opinion on this local bank. As a reminder, Capital City is headquartered in Florida and is a rather small bank with a total balance sheet size of just over $4.3B.

A strong net interest income boosts the bottom line

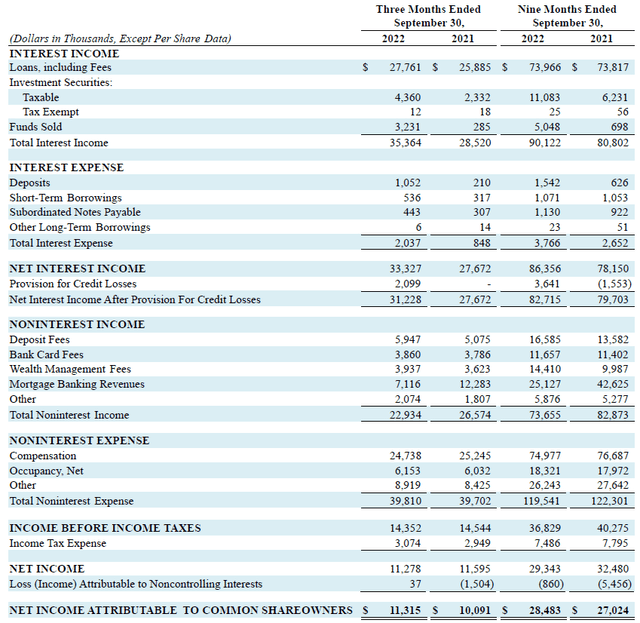

The third quarter was pretty good for Capital City. Although the interest expenses almost tripled compared to the third quarter of last year, the bank only had to pay a few hundred thousand dollars per quarter in interest expenses last year and even the $1.2M increase in the third quarter of this year was mitigated by a strong increase in the interest income. Indeed, the interest income increased by almost 25% to $35.4M and this means the net interest income increased by approximately 20% to $33.3M.

The bank reported a total non-interest income of just under $23M while the non-interest expenses remained virtually unchanged at just under $40M for a total net non-interest expense of $17M. Throw in the $2.1M in loan loss provisions, and you end up with a pre-tax income of $14.4M which resulted in a net income of $11.3M attributable to the shareholders of Capital City Bank. As the current share count is currently just under 17 million shares, the EPS in the third quarter came in at $0.67.

A very decent result and we clearly see an acceleration in the attributable profit which increased to $28.5M or $1.68 per share, although the total amount of loan loss provisions in the third quarter was relatively high.

The bank currently pays a quarterly dividend of 17 cents per share and this dividend is obviously very handsomely covered as the payout ratio is approximately 25%. Of course, this does mean the dividend yield is not great as Capital City is only offering about 2% right now.

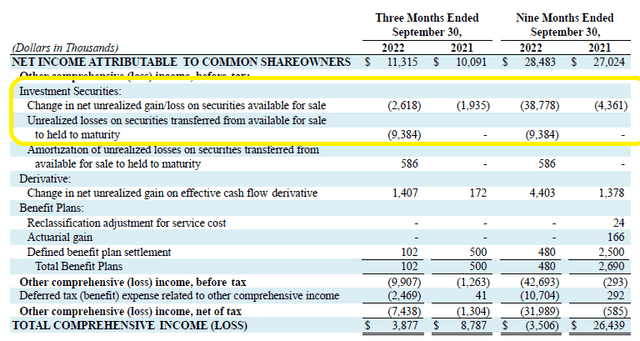

Despite the strong earnings result, the bank’s book value is still lower than where it was at the end of last year. That’s mainly due to the losses on the securities available for sale. These have to be marked to market, and as interest rates started to increase, the market value of these securities started to decrease. Based on the comprehensive income statement provided by Capital City, the bank had to record just over $49M in losses from these securities as well as on the securities that were originally classified as for sale but subsequent moved to securities held to maturity. About $12M of those losses were incurred in the third quarter.

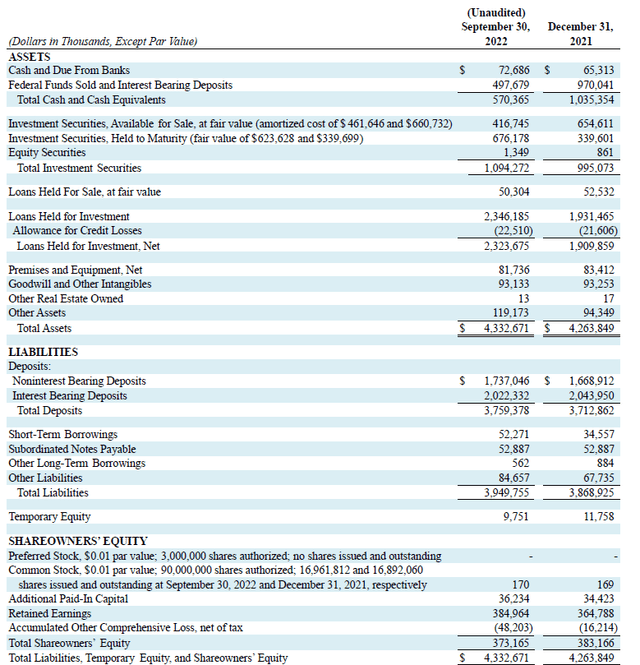

This does not show up on the income statement, but it is the main reason why the equity value of the bank is still lower than at the end of last year. This should start to stabilize soon as the retained earnings in the next few quarters should be sufficient to cover the impact from potential further losses on those securities. The equity value currently stands at just over $373M and divided by the almost 17M shares outstanding, the book value is currently approximately $21.94/share.

Unfortunately, the balance sheet contains a sizeable amount of goodwill. As you can see below, the total amount of goodwill and intangibles came in at $93.1M which means the tangible equity value is just around $280M.

Divided over the current share count of just under 17 million shares, the tangible book value per share is approximately $16.47 per share. But as the worst should now be behind us when it comes to the losses on securities available for sale, I think Capital City is getting close to the tipping point where retained earnings will actually boost the book vale and tangible book value again. Based on the Q3 earnings and the current dividend policy, CCBG should be able to increase the tangible book value by approximately $2/share which means it’s not outrageous to expect a tangible book value of approximately $19 per share by the end of next year.

Investment thesis

That’s good to know but that still doesn’t make the stock attractive at the current levels. At the current share price of just under $35, the bank is trading at more than twice the tangible book value while it is also trading at in excess of 13 times earnings. While I appreciate the strong financial performance and the rather safe balance sheet with just under 40% of all assets in liquid assets like cash and securities, the valuation is a bit too high for me.

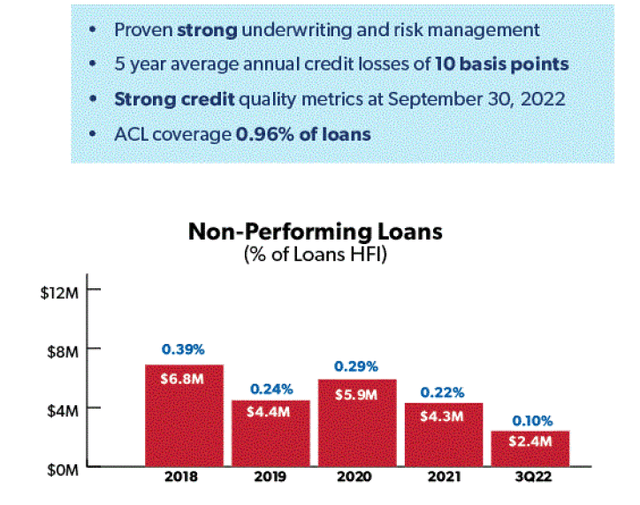

I will keep an eye on this Florida-based bank as it could perhaps use its ‘expensive’ stock to pursue M&A opportunities. Additionally, the total amount of loans past due and loans that are no longer accruing are pretty low.

So it looks like this bank is very well-run, and that’s why the market is willing to pay a premium valuation.

Be the first to comment