Thinkhubstudio

It is better to be surprised by a simulation, rather than blindsided by reality”― Stuart Candy.

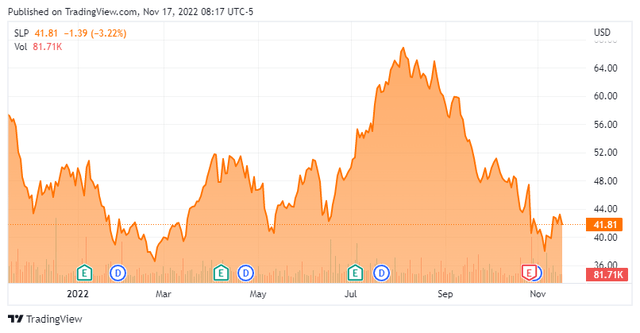

Today, we put Simulations Plus, Inc. (NASDAQ:SLP) in the spotlight for the first time. The company primarily offers specialized modeling and simulation software used primarily in the development of drugs in the pharma and biotech industries. Shareholders have had a roller coaster ride in this stock, as can be seen via the chart below. With the shares near their 52-week low, is the next move higher? An analysis follows below.

Company Overview:

This unique healthcare technology concern is based in Lancaster, CA. The company develops drug discovery and development software for modeling and simulation, and prediction of molecular properties utilizing artificial intelligence and machine learning based technology. The company operates in two main segments, Software and Services.

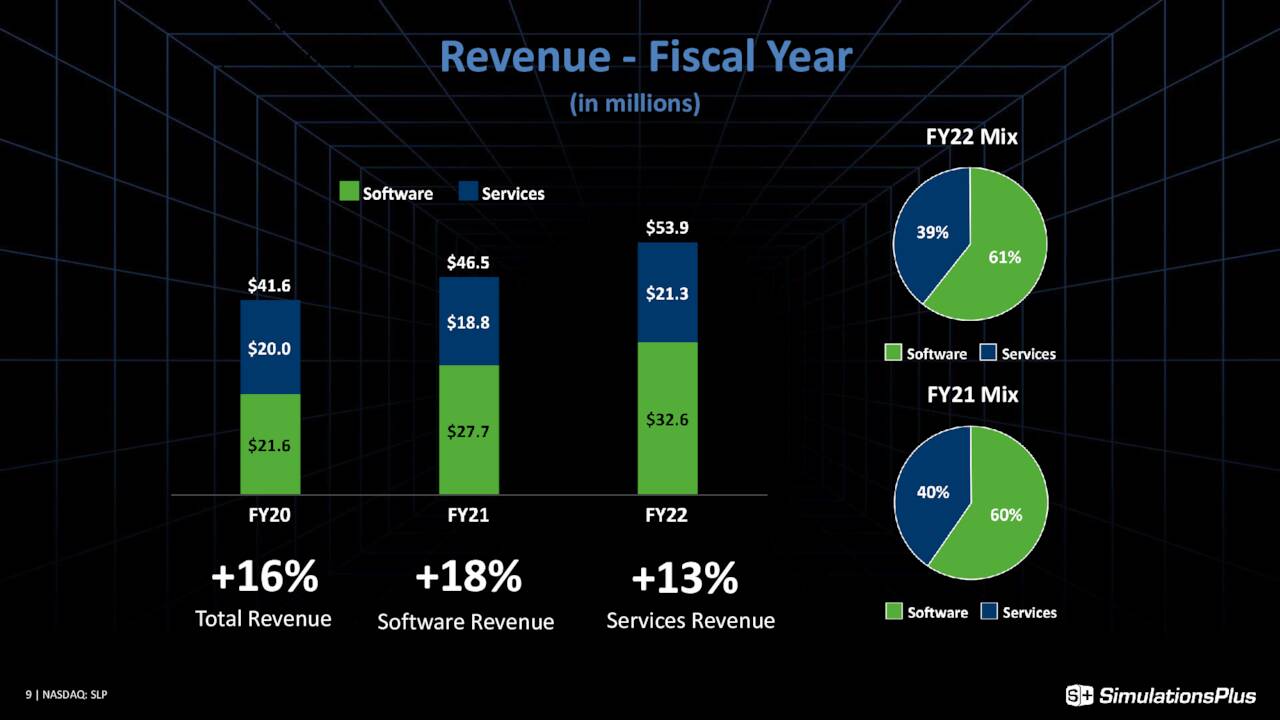

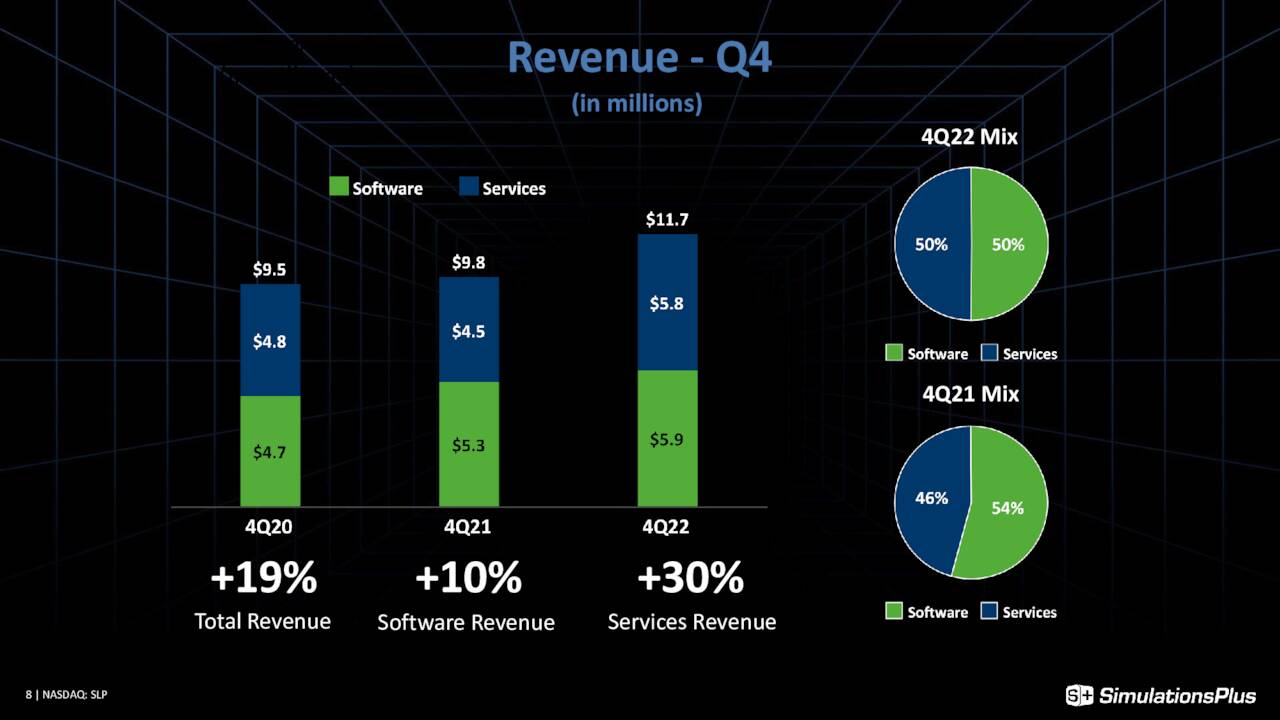

Software products include GastroPlus, which simulates the absorption and drug interaction of compounds administered to humans and animals. The company also offers DDDPlus, MembranePlus and numerous other simulation products. Services encompasses clinical-pharmacology-based consulting services. These include population pharmacokinetic and pharmacodynamic modeling, exposure-response analyses, clinical trial simulations, data programming, and technical writing services in support of regulatory submissions. Sales from both revenue streams are currently split nearly 50/50 as of the fourth quarter of FY2022.

The stock currently trades just north of forty bucks a share and sports an approximate market capitalization of $875 million. The company’s fiscal year ends on September 30th.

Fourth Quarter Results:

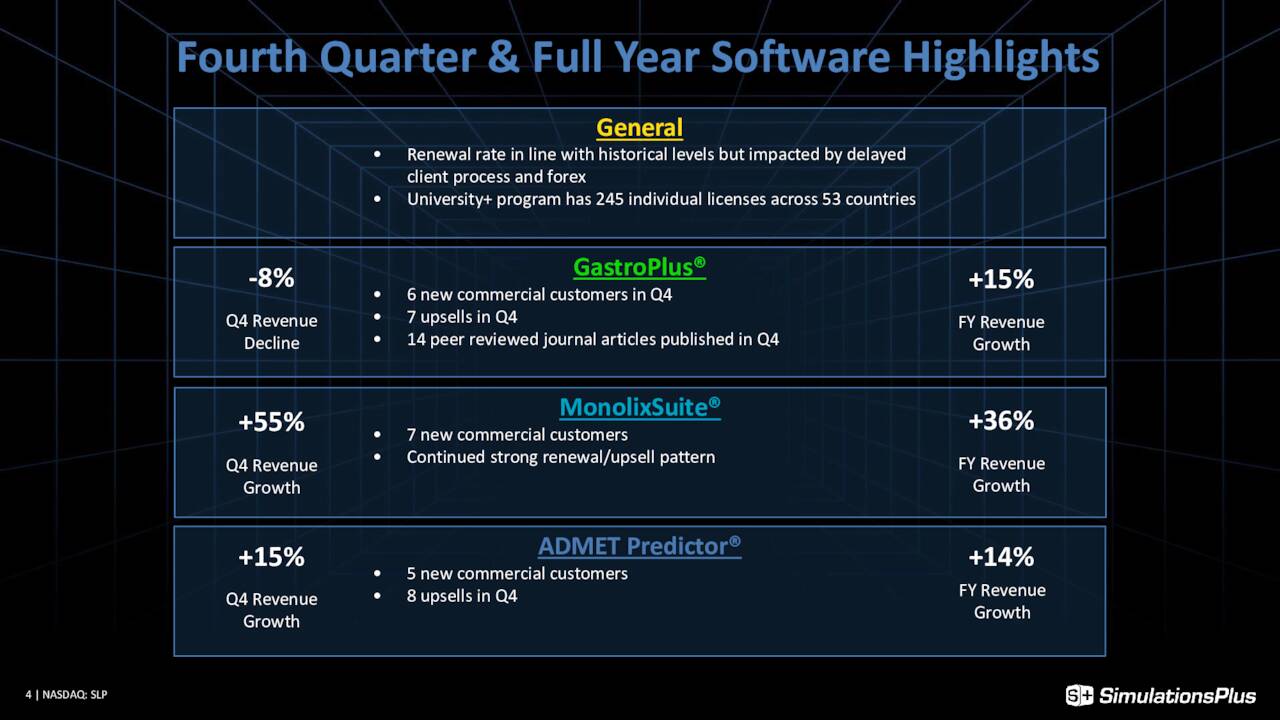

The company posted fourth quarter numbers on October 26th. The company delivered a nickel a share in GAAP earnings as revenues grew nearly 19% on a year-over-year basis to $11.7 million. Both top and bottom line results were slightly over the consensus. The company signed six new commercial clients in the fourth quarter and also made seven upsells.

September Company Presentation

Services were responsible for most of Simulations Plus’ sales growth during the quarter. The division delivered $5.8 million worth of revenues during the quarter, up 30% from the same period a year ago. Order backlog in the Services division increased 22% from the same period a year ago to $16 million. Software sales grew 10% in comparison to $5.9 million in the quarter, as noted in the company’s conference call following posting fourth quarter results.

October Company Presentation

For the quarter, GastroPlus represented 48% of software revenue, MonolixSuite was 20%, ADMET Predictor was 23%, and other software was 9%. For the fiscal year, GastroPlus represented 57%, MonolixSuite 18%, ADMET Predictor 18%, and other software was 7%.” – conference call.

October Company Presentation

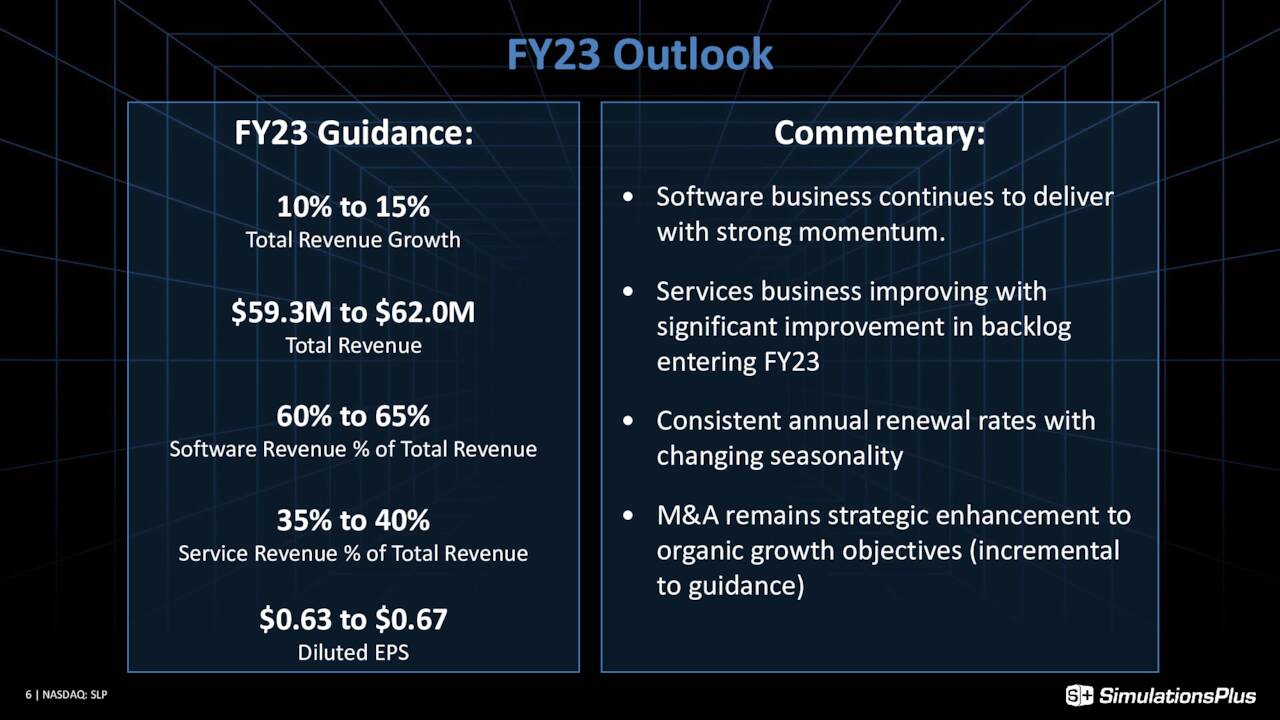

Management adjusted down their projection of FY2023 EPS to a range of 63 to 67 cents a share from just over 70 cents a sharer previously, and their sales forecast was reduced slightly as well to between $59.3 million to $62 million. The revised earnings projections implies five to ten percent earnings growth in FY2023.

September Company Presentation

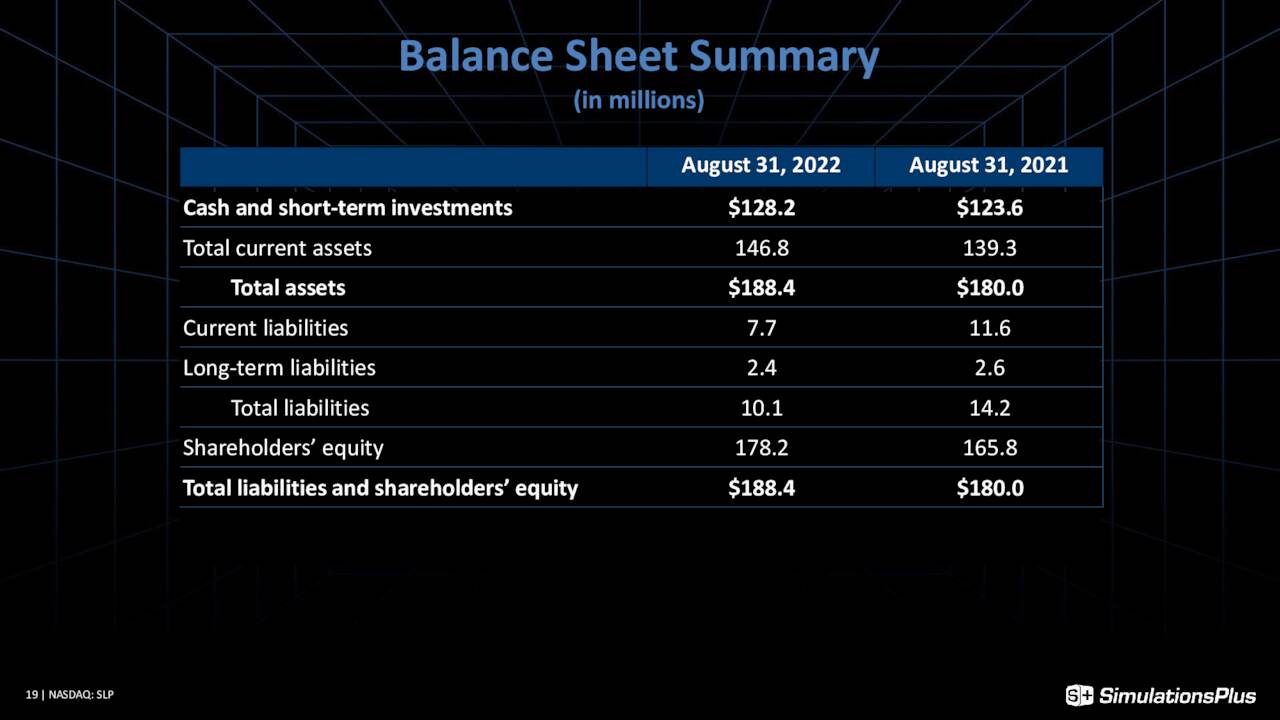

Analyst Commentary & Balance Sheet:

Approximately nine percent of the shares outstanding are currently held short. One director and beneficial owner has been a frequent seller of stock throughout 2022. She has sold just over $800,000 worth of shares so far in the fourth quarter after disposing of more than $4.5 million of equity in the third quarter. She still retains holdings of just north of four million shares, it should be noted.

October Company Presentation

The company ended their FY2022 year with just under $130 million in cash and marketable securities against no long-term debt. The company currently pays a small six cent a share quarterly dividend.

Verdict:

The current analyst firm consensus is that Simulations Plus, Inc. will make 64 cents a share in FY2023 as sales grow just over 13% year-over-year to $61 million. Similar revenue growth is projected in FY2024, along with 73 cents a share in profit.

Simulations Plus, Inc. appears to be a leader in a niche that has a long-term growth runway. The company is already profitable and its balance sheet is solid. The question is what multiple do investors want to pay for that growth within the current market environment where growth concerns have been hampered as global interest rates have spiked up and the global economy appears likely to be heading towards recession in 2023.

Even with the equity trading near its 52-week lows, Simulations Plus, Inc. trades north of 14 times forward revenues and approximately 65 forward earnings projections. Both metrics are a bit cheaper if taking the company’s net cash into account. This still seems more than pricey for a company growing sales in the low to mid teens and seeing slower profit growth. Therefore, I am passing on making any investment recommendation around SLP at this time.

Reality is merely an illusion, albeit a very persistent one.”― Albert Einstein.

Be the first to comment