Torsten Asmus

Investment thesis: The decline in oil prices we experienced in the summer helped to stabilize the growth in inflation, at least in the U.S. It led to speculation that the U.S. Federal Reserve as well as other central banks around the world may be able to pause or even reverse some of the inflation-fighting measures and concentrate on sustaining economic growth instead.

Recent events and actions suggest that the global energy crisis is still on and is about to intensify this winter. A brief summer respite is about to give way to a perfect storm of factors that lead to the potential to trigger massive global and regional spikes in energy prices. Other scarcity issues are likely to emerge, ranging from food shortages to shortfalls in manufactured products. A collapse and seizing up of the global supply chain is now becoming a high-odds possibility, as chain reaction effects, such as social unrest threaten widespread disruptions, where demand destruction will not happen fast enough to keep up with supply shortfalls.

If the worst comes to pass, central banks will have no choice but to raise interest rates and start reducing their balance sheets in order to prevent high inflation rates from spiraling and entering hyperinflation territory. Europe needs to be watched very closely because it is emerging as the canary in the coal mine in this regard. Its growing energy scarcity problems threaten to turn it into a trigger for a global economic crisis.

Europe is the epicenter of the crisis and things are getting worse by the day. Institutional collapse is starting to look like a possibility for the EU.

A large protest against high energy prices and the sanctions against Russia that triggered the situation occurred in Prague at the beginning of this month. Media and Europe’s mainstream political elite are expressing their worry about social discontent, and the possibility that it may push the EU to take a softer more conciliatory position in the economic conflict with Russia.

My main worry is entirely different. I am concerned about the widespread use of the invoking of historical grievance as a means to keep people, especially in the former communist Eastern part of the EU, on board with the confrontational position. I have been seeing it in Romanian as well as Hungarian media outlets, as well as on forums and on social media, where Russia’s occupation and imposition of communism on the region are hailed as a reason to keep up the proxy conflict and seek to defeat Russia at any cost. I am now seeing an intensification of it and it should start to worry people in regards to where this concept might lead. I see this as a far more dangerous societal factor than any other factor because it goes without saying that once the concept of historical grievances is revived and made popular, it will spread beyond the intended target, namely Russia.

In fact, it may be what triggered Poland’s decision to officially demand recently $1.3 Trillion in reparations from Germany over WW2. Europe is a place of much history, which is what makes it so charming and fascinating for outsiders. It is also what makes it such a potential powder keg. It might not take a lot of stirring up of such concepts for EU unity to suffer a terminal blow.

I by no means suggest that Poland & Germany are about to go to war. Neither will Austria with Italy over the South Tyrol issue, and so on. It is, however, a sign that historical animosities have been reignited and it may have happened at the worst possible time. We are seeing more and more recognition of the fact that Europe is about to go on a severe natural gas diet. By the beginning of next year, it may also have to go on a crude oil diet, unless it wiggles out of the Russian oil import ban by the end of this year. This will be a very challenging situation, which will require maximum collaboration & solidarity within the EU. The revival and popularizing of the concept of historical grievance among European nations do very little to promote solidarity within the EU.

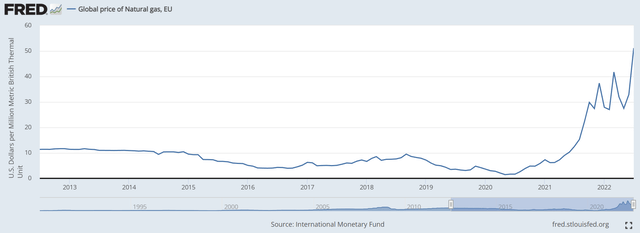

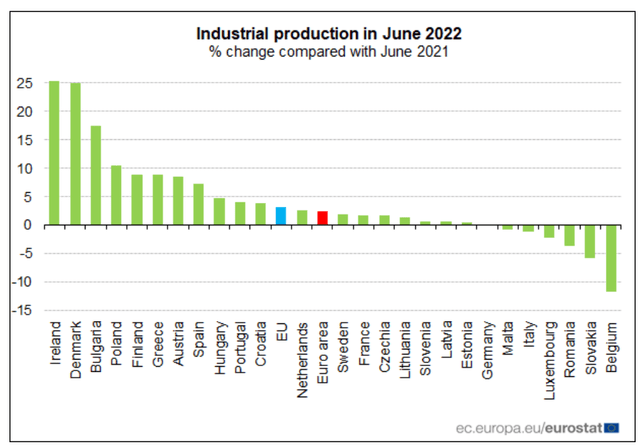

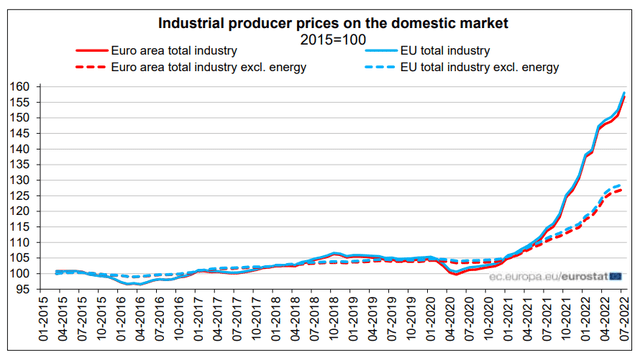

The surge in EU natural gas prices we see above in the chart has dented Europe’s economic activities so far, but a combination of subsidies, bailouts, and other government aid has prevented much permanent scarring of the economy. Most companies reduced production or engaged in temporary shutdowns of activities in industries ranging from ceramics manufacturing to fertilizer plants. Despite all the headwinds, EU industrial production continued to expand, at least as of June of this year.

There are seemingly few signs of stress in the EU economy to date, at least based on most traditional data points available. Most data is a few months old and there are some anecdotal suggestions that things have taken a turn for the worse recently, but it is currently hard to tell to what extent this may be occurring. The one data set that suggests that there is a serious problem with the EU economy is the precipitous decline of the euro.

At the beginning of the summer of 2021, one euro could buy 1.18 U.S. dollars. Today it buys about .99 U.S. dollars. The more or less constant weakening of the euro since then coincides with the start of the EU energy crisis, which began more than a year ago, triggered by significant renewable energy generation shortfalls in places like Germany & elsewhere.

What this tells us is that the EU economy is currently shrinking dramatically in U.S. dollar terms, even if many other data points would suggest otherwise. My guess is that we will see a continuation of this trajectory, where data points such as GDP growth, consumer spending, industrial production, and other data will show a modest deterioration going forward, while the continued weakness of the euro will provide a constant downward readjustment to the size of the EU economy relative to the rest of the world.

FX exchange rate changes are not typically seen in this light, given that there tends to be a lot of volatility. In the case of the euro, the volatility is set to be trending towards one particular direction for the foreseeable future and that direction is constantly down, which makes for a less than typical dynamic in regards to FX movements.

Industry and labor organizations in Germany have been sounding the alarm, warning that there can be widespread damage to industrial production, with entire sectors potentially facing outright collapse. Germany’s government just announced a $65 billion package meant to help consumers as well as industries to cope with higher energy prices. The folly of it is that when there is an actual physical shortage, demand destruction needs to occur. Throwing more money at the problem does not resolve the shortage. It only allows for the price to go even higher before the demand destruction takes place.

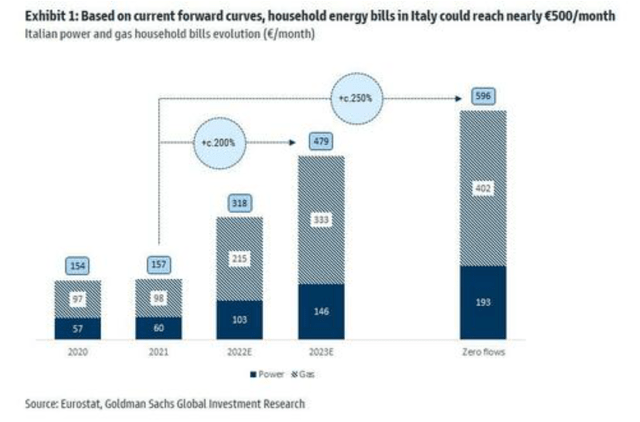

In regard to just how high prices might go, a recent Goldman Sachs study is starting to make the media rounds. It suggests that average monthly household energy bills in countries like Italy could increase from about 160 euros in 2021 to as high as 500-600 euros next year.

It should be noted that this estimate does not include any potential spikes in oil and motor fuel prices, which is a real possibility, especially given current efforts to try to reduce Russia’s oil export revenues. We could potentially see a major disruption to Russian oil exports at the end of this year, which has the potential to trigger an oil super spike.

An aspect of the effect that bailouts and support schemes will have is that it automatically shifts at least some of the EU-wide demand destruction that is needed, towards the countries that have less fiscal power to engage in similar schemes. Italy, Spain, Greece, and Portugal, as well as arguably Eastern members of the EU, are more likely to encounter market resistance to them issuing more debt in order to bail out companies and provide support to consumers, than countries that have a stronger fiscal position such as Germany, Denmark, Austria or the Netherlands.

This is likely to cause much animosity among nations, even as solidarity will be needed to get energy supplies where the need will be the greatest. For instance, it might not take very long for Poland to ban all coal exports as heavily government-subsidized German energy firms will buy up a growing proportion of Poland’s own domestic resources. The recent episode of citing historical grievances against Germany should make it easier for Poland to cut Germany off in this regard. Hungary already announced that it is not interested in exporting energy this coming winter, after declaring an energy crisis earlier this summer.

In 2018, as a longer-than-expected winter cold period lingered over the EU, Russia came to the rescue of Europe with a substantial injection of gas supplies, even as EU nations were increasingly contemplating calling on the industrial sector to shut down in order to be able to provide a minimum of comfort and safety to households. That situation occurred under normal EU-Russian trade circumstances.

As things stand right now, even if we are to assume a mild winter, EU gas storage facilities could run out well before March if Russia will not resume normal deliveries. It is estimated that the EU needs to cut consumption by 15% in order to avoid severe cuts in the middle of winter. My guess is that most EU nations will fail to do their part since it will involve making painful decisions that are very unpopular in the name of EU solidarity. An environment of growing hostility among EU nations, on top of the economic difficulties, will make for a difficult social environment.

The EU could be a colder than average winter away from complete institutional collapse. It could happen this winter or next winter or any winter after that. In the meantime, its industrial base is set to continue shrinking as more and more companies give up on holding out for a better tomorrow and are closing shop. The EU consumers are also being systematically impoverished as their euros are buying less and less, especially when it comes to imports, but also in terms of domestic goods, given that the costs of producing anything in the EU are skyrocketing.

If one wants to trade in a manner that keeps in mind the growing risk of an outright collapse of the EU economy, the timing of it is likely to be as uncertain as the weather. Within the context of imminent energy shortages this winter, a particularly cold winter, or a prolonged period that will be excessively calm in terms of wind velocity, where wind power generation will see severe shortfalls as it did in 2021 could serve as a trigger. In a worst-case scenario, a cold winter, combined with a lack of wind activity that will last a prolonged period will completely paralyze economic activities.

As absurd as it may seem, watching weather forecasts for the European continent may now be the most important tool available for investors in terms of risk management. While the global importance of the EU economy has diminished significantly in the last few decades, at roughly 15% of global GDP, it would still provide enough of a shock to the global economy and to financial markets that a severe crisis there is likely to drag down prospects for the entire global economy and for the markets.

EU may be the epicenter of the crisis, but many other crisis points around the world can also contribute to a global economic deterioration of significant proportions.

The EU situation is by far the most critical at the moment, and it has the potential to do the most harm to the global economy and to investment portfolios if things will go into full crisis mode. There are many other crisis points, however, which could further contribute to global economic instability and further exacerbate the already dire situation in Europe for instance. There is growing social unrest, as it should be expected when the price of food and fuel rises, and the global poor are the first ones who are priced out of the market. There are currently waves of conflict and unrest sweeping through places like Iraq and Libya, both of which are major energy exporters. We are likely to see a significant spread of such crisis hotspots around the world in the coming months, which can add to global supply chain disruptions.

China is still threatening global economic wellbeing with its zero COVID policies, where its massive industrial output potential is constantly threatened by brutal lockdown policies. Trade frictions are not helping things either, as the U.S. continues to attempt containment of China’s technological modernization. There is no telling how China might respond. The fact that it has not responded very forcefully in past years to such flare-ups of economic coercion does not mean that it may not do so at some point in the future.

It is important to remember that with every such action, we are making it less and less worthwhile for China to keep from an outright confrontational path with us. It may choose to act at the worst possible moment for us, at a moment of vulnerability. For instance, it may execute a massive dump of U.S. dollar and euro assets, just as our central banks will be struggling to contain inflationary pressures.

Whether the EU will go through with its Russian oil import ban, set to begin in just a few months, or whether it will drop it in favor of the G7 Russian oil price cap scheme, we are likely to experience a global oil price shock this winter, in addition to the threat we are seeing from regional energy price shortages, global food price inflation as well as other sources of potential economic disruption. Even if the global market will lose 1 mb/d of Russian oil, the market is currently very tight, therefore it will cause a surge in prices starting at the beginning of next year. There has been some demand destruction occurring, which has the market betting on lower oil prices going forward. I personally do not think it will be enough to keep oil prices from rising significantly next year. We may even see a spike in prices beforehand, as early as this fall, as the markets will anticipate the loss of some Russian oil exports due to these measures. Inflation will likely resume its upward trajectory if oil prices will resume their upward trend.

Investment implications

There is currently far too much risk for markets to sustain any significant upward momentum. In fact, in my view, the current risk environment is not fully priced in, even though markets are down significantly from recent record highs. I am, therefore, keeping cash levels in my investment portfolio at around 30% currently. I also increased my exposure to gold-related assets recently, on expectations of growing fiat instability.

I am also cutting my position in investments that have very direct exposure to the most likely regional industrial sectors to be affected first and foremost. I already cut my BASF SE (OTCQX:BASFY, BFFAF) position from about 1% of my portfolio to just about .5%. I am currently considering cutting my position in this stock completely, given that there seems to be no upside in the near term, while the odds of this stock seeing a severe selloff are rising dramatically. It may have to cut its dividend in order to cope with the financial fallout from the EU energy crisis. Revenues and profits will most likely be negatively impacted, given that it may be asked to suspend operations at all of its EU plants this winter.

Where there is a crisis, there are also opportunities. One of the main responses to the energy crisis that the EU is going through is to ramp up subsidies for green energy adoption. As I pointed out in a recent article, there is no way to make an energy system dominated by intermittent energy sources fit, without transforming a large portion of the energy generated into another source of energy that can be easily stored and transported. For this reason, I started investing in Fusion Fuel Green PLC (HTOO) stock, which is currently in the process of ramping up the production of green hydrogen from solar power, as well as selling hydrolysis units to other would-be producers. While I have little faith in the green transition being the savior of the EU in this regard, Fusion Fuel may benefit from a significant infusion of EU cash, which it can use to pay for its expensive capital costs involved in producing and installing hydrolysis units. The subsidies may spur other companies to buy its product.

Oil prices have been trending downwards for most of the summer, mostly driven by expectations that demand is being curtailed by a slowing global economy. I personally think that there is a good chance of yet another spike in oil prices before we get the full-blown recession that will cause enough demand destruction to occur for prices to fall far below current levels. For this reason, I continue to maintain a significant position in Canadian oil sand companies. I am currently invested in Suncor Energy (SU) and Canadian Natural Resources Limited (CNQ), which I see as least exposed to geopolitical factors as well as geological constraints within the global oil industry. I am also invested in Cameco Corporation (CCJ). I foresaw a turn in the uranium market back in late 2015, it turned out I was right, and the current situation offers uranium mining stocks another potential leg up, as the world scrambles to secure reliable energy sources.

I reduced my stock position in Suncor slightly this year when oil prices were close to this year’s highs. I will sell some more if I am correct and there will be a secondary spike in oil prices. If it turns out that I am wrong, I will just hold my current position and ride out any recessionary downturn. My view of the long term in regards to the global oil market is a bullish one, therefore I do not see any long-term threats to these positions, as long as one is willing to ride out temporary recession-induced oil demand downturns.

While there are certainly potential investment opportunities within the current geopolitical and global economic context, there is growing evidence of a rough ride for investors at best. In a worst-case scenario, we could see a collapse of the EU economy if a range of human actions, together with some unfavorable weather conditions will combine to disrupt its economy and financial system. A deep economic crisis is very likely to fan the flames of animosity that have already been ignited by certain institutions as well as individuals with shortsighted goals, namely to maintain public support for the continued deterioration of the EU-Russia economic relationship, by invoking historical grievances. There is a growing risk of a breakup of the EU, which would have a dramatic impact on the global economy and on the global financial system, at a time when there are already many other challenges, which on their own pose a significant enough threat, that it should worry investors.

There is no shortage of risk, that is currently largely not priced in by markets. Investors should consider how they need to be positioned, for when the market will fully price in those risks ahead, or even worse, for the prospect of the risks becoming reality.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment