Daniel Grizelj

Enovix (NASDAQ:ENVX) is a next-generation battery producer that is starting to get serious traction with serious customers.

Its 3D-silicon anode technology claims to have solved the four problems associated with silicon anodes (see company website for a description and the excellent Q2/22 earnings deck for further technical details).

The result is battery cells that have a number of advantages (again see the Q2/22 earnings deck for further technical details):

- Significantly higher energy density

- Increased safety (BreakFlow, see video)

- Fast charging times

- High-temperature tolerance

- Long cycle life

- Enabling whole new form factors

- Domestic production (China controls 80% of the market)

- Only minor changes in the standard manufacturing process required

We are not here to debate these, which is more stuff for engineers. What we do notice is that there is the beginnings of commercial validation (see below), and there is also significant third party validation (see their Auggust 2022 Letter to Shareholders for details).

Our investment thesis is simple, we think it’s likely that at least some of these claims are factual, and given the explosion in demand for lithium ion batteries in the coming years this will likely make the company supply, rather than demand, constrained and enabling premium pricing.

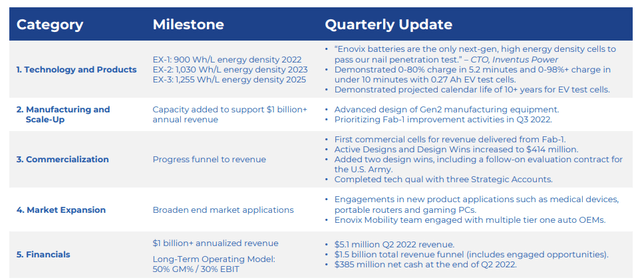

Commercial validation

Again a very useful slide from the earnings deck listing all the recent progress on various dimensions. We urge investors to read the Letter to Shareholders where there are additional comments on these items, more especially on third-party validation of the advantages of their technology (but certainly not limited to that).

Here the most relevant part is commercialization:

During the Q2CC, management stressed the importance of that first commercial shipment:

it’s kind of a trigger for them when they see the company go commercial and so, that was the big milestone for this last quarter commercial product going out of the factory. And when they see that it’s a trigger, it’s a trigger for them and it makes them realize that this thing is going to go, and then everybody’s worried about, maintaining a competitive advantage. And so you, you get into this competitive dynamic where, where people start to get a fear of missing out, because there’s a limited amount of capacity and relative to the opportunity there

Management also stated that they now have three mega-cap companies which they call strategic accounts, which are companies with a market capitalization in excess of $200B and multiple applications for Enovix batteries.

They just won a fourth strategic account, one that paid the company $5M in service revenue (Q2CC):

we completed the initial phases of our product development program in the second quarter with a fourth strategic account after shipping commercial sales from Fab-1 and recognize $5 million in revenue from this customer.

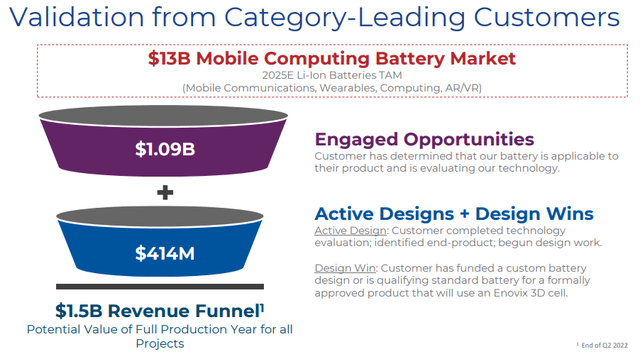

The company shipped batteries to 10 different customers and 4 distributors (they recently refocused on Asian distribution), but few of these are commercial quantities yet. There is a $1.5B funnel of engaged opportunities and active designs and design wins:

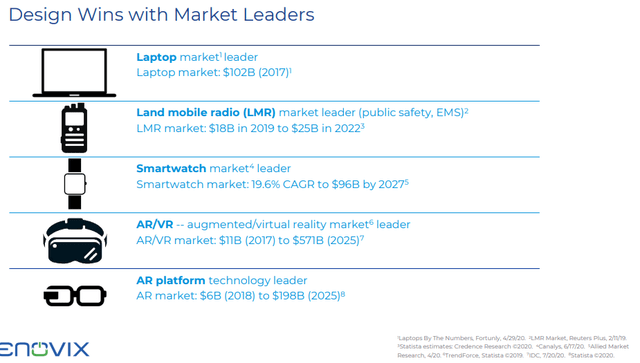

And here are some of these design wins:

Is it a coincidence that this slide largely matches the slide below where companies and products are actually provided?

What is also notable is that each of these companies chose a different product for the initial introduction, and this is a great showcase for the variety of form factors and market segments that are addressable for Enovix and the competitive advantage they provide. According to analyst Marc Cohodes who spoke to one of their strategic customers (Q2CC):

One of them said that without the OVS battery, our product would not exist.

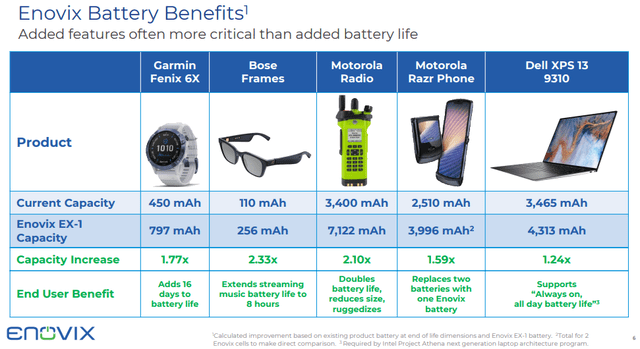

Quantitative change can enable qualitative change if they are large enough and that seems to be the case with the higher energy density Enovix cells as they enable new features and form factors.

Here are a number of examples based on comparing batteries in existing products with an Enovix alternative (Q2/22 earnings deck):

Management on the Q2CC:

we’re definitely seeing a mentality shift where these large companies are, are thinking about battery as being a strategic lever in their businesses. It can affect essentially everything that their, their products ultimately do in terms of performance, in terms of form factor, et cetera… one of these large said they want to try to move us across their entire product line as soon as possible right. So they’re going to be probably pulling on us pretty hard

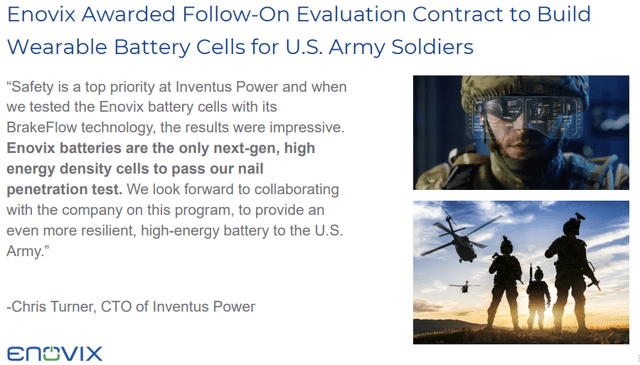

US Army

Then there is the US Army, which gave Enovix a follow-on contract on August 10 this year. This is a huge opportunity, a $350M market although that will take several years to materialize. The second phase is about validation of the safety, from the press release:

Harrold Rust, Co-Founder, President and Chief Executive Officer of Enovix. “Soldiers in the field need reliable, lightweight and long-lasting batteries and we’re thrilled Enovix has been chosen to demonstrate the advantages of our domestically-manufactured technology.”

“Safety is a top priority at Inventus Power and when we tested the Enovix battery cells with its BrakeFlow technology, the results were impressive,” said Chris Turner, CTO of Inventus Power. “Enovix batteries are the only next-gen, high energy density cells to pass our nail penetration test. We look forward to collaborating with the company on this program, to provide an even more resilient, high-energy battery to the U.S. Army.”

It is of course also an important advantage that Enovix is a domestic producer in a Lithium Ion battery market that is dominated by the Chinese (with 80% market share).

EV market

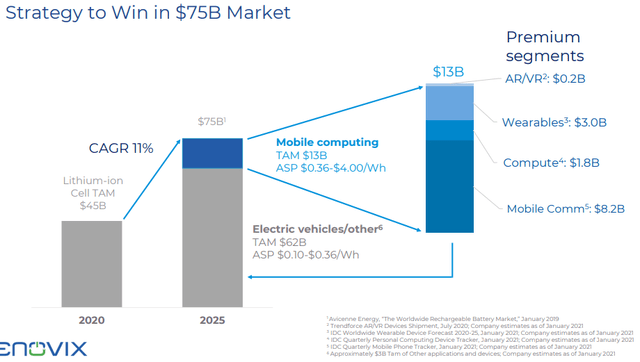

Two slides from the earnings deck are important here. The first shows that by far the largest segment is the EV battery segment. However, from a pricing point of view, it’s not necessarily the most attractive one:

This, given the company’s production capacity constraints, provides much of the logic as to why the company is concentrating on a variety of devices under the banner of mobile computing where pricing and margins are likely to be considerably better. It simply doesn’t have the capacity to service a large-scale segment as EVs yet, and this likely won’t happen for another couple of years:

That doesn’t mean the company isn’t in active talks with multiple EV producers, it is. Here too advantages such as faster charging times, increased capacity, and its BreakFlow technology are potential game changers, speaking about BreakFlow (Q2CC):

And I think your question was specifically about EV cells and yes, this technology is really interesting to EV customers also because as everybody knows, that is a primary factor in consideration on how these customers look or how these OEMs look at safety. So they are, I think equally interested in this technology and really it is something that is uniquely enabled by our technology, by our architecture and answer another part of your question. It has really a negligible impact on the cost and the pro productivity of the line. There is some minor modifications that have to be made.

Production capacity

It’s clear that demand doesn’t seem to be a problem (Q2CC):

No, we can’t satisfy demand for customers at all now or even next year or the year after

Next year the Fab-1 can produce several million units, but demand is already outstripping that hence the company is in a race to increase production capacity.

Most of the efforts in Q3 will be dedicated to optimizing production in their present Fab-1 facility and the lessons here will be included in the design of Gen-2, which is slated for production in H1/24.

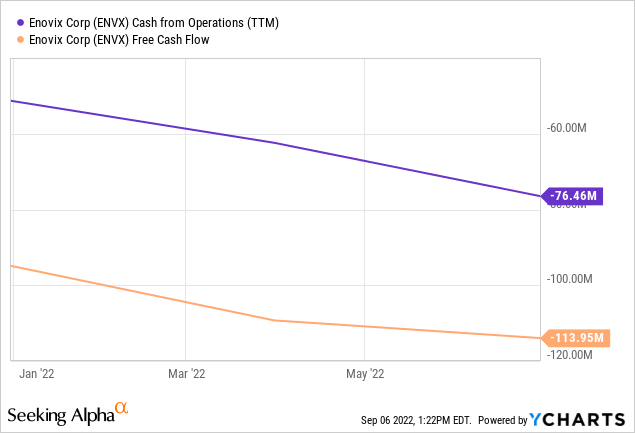

Finances

Investors should forget about finances this year as the company is tweaking their Fab-1 in Q3 and guides for FY22 revenues between $6M and $8M. They also argue that they will spend between $160M and $180M in FY22, half of that is CapEx and $57.8M has already been spent in H1/22 so there is $102M-$122M to go.

At the end of Q2 they had $385M in cash left so they’ll still have at least $263M left for next year, that looks enough to get them through the year, as CapEx might be less with much of the Gen-2 materials ordering already happening in H2.

Above there are some long-term projections in a slide from the earnings deck suggesting a $1B run rate, 50% gross margin and 30% EBIT margin, which is quite high for battery producers but the one argument is that they are picking the most profitable segments first.

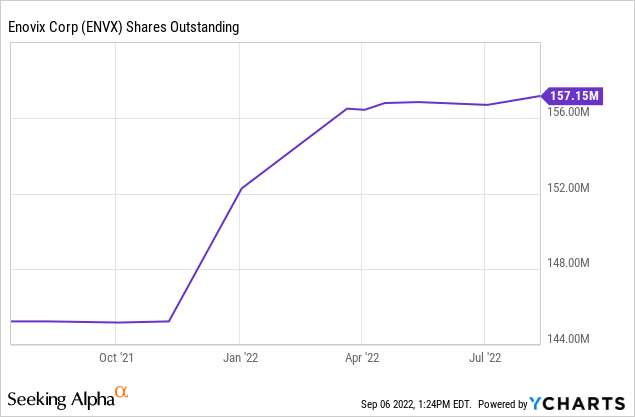

There is a fairly substantial short position and some insiders seem to be on an automatic selling program, although there was considerable insider buying until recently as well.

Competition

A pretty strong case can be made for arguing:

- Enovix has a timing advantage over other next-generation battery producers (like Sila Nano, Solid Power, SES, and QuantumScape).

- Enovix has a performance advantage (likely over multiple dimensions) over existing battery makers (the likes of Panasonic, BYD, CATL, etc.).

We have to point out that the timing advantage over Sila Nano (a private company) isn’t all that obvious as their batteries are also in a mobile device, the WHOOP 4.0, a fitness tracker. Sila also uses silicon as anode and are (PR):

We are going to mass-produce electric vehicle battery materials in early 2025

Mercedes Benz is an investor in Sila, but 2025 is pretty far off. It’s certain there is a lot of potential in Enovix but, as management argues (Q2CC):

The technology has to work, the product has to work. It has to be reliable. You have to meet certifications, you have to meet quality, you have to be able to manufacture it.

They showed that, but can they manufacture at scale and compete? Again, the signs are promising but it’s fairly early days. And it’s always possible there are breakthroughs at other companies.

We’re not overly worried about competition for the simple fact that the EV market in particular promises to grow much faster than companies can scale their production capacity and Enovix improvements seem large and significant enough to earn a slice of that market.

Potentially, Lithium-metal based batteries are better still but these are 5 years off.

Comments and conclusion

- The company’s proprietary battery technology has a host of advantages over today’s Lithium Ion batteries and there seems to be solid third-party and commercial support for most of these if not all.

- These advantages open up whole new form factors for clients and can provide significant competitive advantages for others in terms of performance or other dimensions.

- The company seems to have a headstart on other next-generation battery producers with actual commercial batteries shipping and going into products.

- It looks like the commercial breakthrough is the bursting of the dam as it is now plain to see the tech is real and there is fear of missing out as production capacity is limited.

- The company needs to build production capacity fast in order to be able to service the increasing demand, and this isn’t going to be cheap but they’re doing just that by tweaking their Fab-1 lines and applying the lessons in the Gen-2 plant design.

- In order to reduce the CapEx needs, the company can license and/or enter in JVs.

- Investors need to keep in mind that while the company looks to have a breakthrough product that brings advantages in almost any segment, the economics of battery production (capital intensive, generating little free cash flow) are, as a rule not terribly favorable.

- There are additional risks in dilution, production delays, and competition.

- From a financial point of view, there isn’t much to appreciate as this is a $4B company with a little over $5M in revenues and the next quarters isn’t going to be much better.

- So the stock price is likely to be driven mostly by news and sentiment, insider transactions and short counts are additional factors that could impact the share price, as is the general market sentiment towards risky investments.

- What to do? Buy in tranches on downdrafts, and perhaps sell a few on the euphoria. Directors bought at $14, we think it will take a really bad market for the stock to go back to that level, so we think a first tranche here around $20 likely can’t hurt if you can stomach the volatility.

Be the first to comment