sololos

Startek (NYSE:SRT) is an undervalued microcap with a huge catalyst in the coming month related to an offer from December 2021 to take the company private at $5.40 per share or 86% premium to today’s prices. The offer comes from Capital Square Partners who own 56% of outstanding shares already and they expect to have clarity on financing availability within five to seven weeks according to a filing from June 21st, 2022.

Given that range we may see an announcement related to the offer anywhere from July 25th into August. Additionally, we should see quarterly earnings for the company within the first two weeks of August. Both of these events are likely to serve as near term catalysts. And there’s an argument to be made that this is just the beginning of a process which could lead to an even higher buyout price which we will get into.

Aside from the mechanics of this takeout offer is the fundamental undervaluation of the company at current prices. Consider these data points based on SRT priced at $2.90:

-

P/B of 0.56 – priced for terminal decline despite profitability and growth of earnings.

-

Cash position of $52.248m represents 45% of current market cap.

-

Five-year average free cash flow of $17.334m. If we back out the cash position from the market cap SRT is trading for a P/FCF of 3.73.

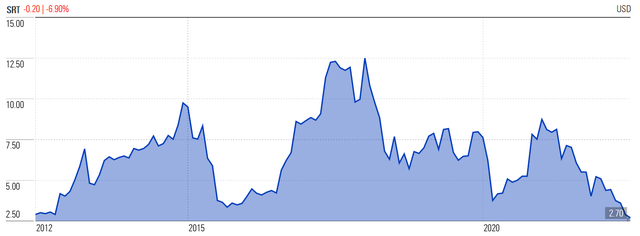

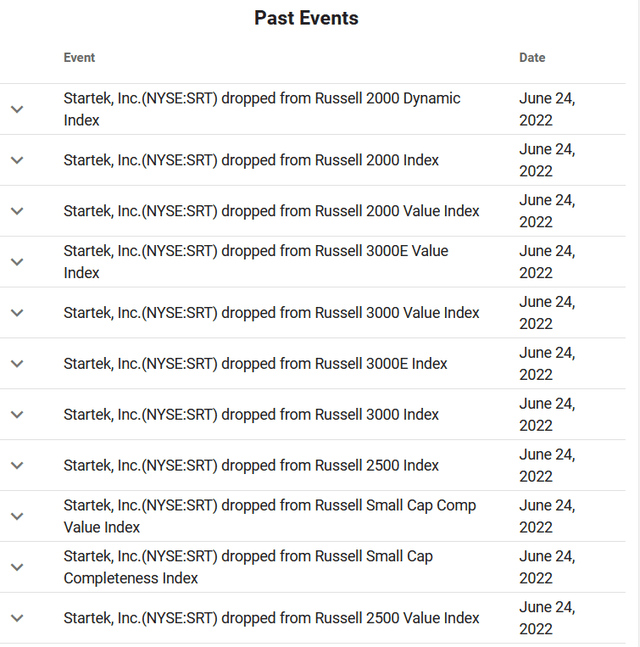

And finally, there is the fact that the stock is not just trading at a 52-week low, it is trading at a 10-year low. This is due in part to forced selling as a result of Startek being removed from 11 Russell indexes on June 24th and represents a market inefficiency we can take advantage of.

This is a rare opportunity to buy a company trading below 4 times its average annual free cash flow with huge near-term catalysts before the end of August. We believe that the $5.40 per share offer from CSP represents a margin of safety in the name and given recent forced selling I suspect we’re near lows. Add to this an optionality that the $5.40 price is quite low compared to recent activity in the sector and we could perhaps see this go up even further.

I highlight some undisclosed legal proceedings the company is exposed to which may or may not turn out to be of significant risk. I’m guessing they will not, but I am not a lawyer. I also note their large goodwill value on the balance sheet being a “critical audit matter” which implies risk here as well.

All in all, I believe there’s an 86% margin of safety represented at current price of Startek and that with or without a takeover transaction the company is undervalued. I estimate a price target of $5.40 over the next 1-2 years.

Startek’s Business History

Startek is a global business process outsourcing (BPO) management company providing omni-channel customer experience, digital transformation, and technology services. The Company services over 190 clients across a range of industries with their staff of over 43,000 distributed around the world. Founded in 1987, they’ve been a public company since 1997 and recently underwent a major business combination with Aegis in 2018. Aegis was a portfolio company of Capital Square Partners and the formation resulted in CSP retaining 56% majority ownership of Startek.

The combination essentially quadrupled the size of the company enabling a diversified $700m revenue base and no client concentrated above 10%. With operations in 13 countries and on 6 continents the new company was truly global and poised to leverage its new scale to grow. Which it did for a bit until the pandemic started which materially impacted all BPO companies. Loss per share was $0.99 in 2020 with 2021 EPS coming in at $0.04. The company seems to have weathered the storm and is optimizing its operations even further given the new environment, including shifting their management team and strategic focus.

Startek is currently led by CEO Bharat Rao who has been with the company as President since October 2021. Rao succeeded Aparup Sengupta as CEO this past February ending Sengupta’s two year tenure. Sengupta previously was the CEO of pre-merger Aegis where he grew them from $60 million to $850 million in revenue over a seven-year period through both organic growth and acquisitions. There have been an additional five C-suite executives brought on this past year as well filling out the latest iteration of the management team.

Of note is that Sengupta and Rao both are involved with majority owner Capital Square Partners. Sengupta is listed as an Operating Partner at the firm while Rao is listed as a Non-Executive Director. Just two months after Rao joined, and less than a year after Sengupta did, CSP made their non-binding $5.40 per share offer to take the company private. The offer represented a 37% premium over Startek’s closing share price of $3.94 on December 17th. Sengupta remains on the company’s board with Rao and two other CSP affiliated folks.

Capital Square Partners’ Website

Rao announced in March that the Board had “formed a special committee of independent directors to evaluate the proposal. They have brought on legal and financial advisors to thoroughly examine the deal.” Another quarterly earnings call passed with no update about the situation. Nearly six months after the original proposal was announced an update came in the form of the June 21st, 2022 SC 13D/A. In that filing CSP certified that they have $20m in equity financing and are seeking to fund the rest of the offer through debt financing which they are actively seeking: “These financial institutions have preliminarily indicated to the Reporting Persons (CSP) that, in approximately five to seven weeks’ time and subject to market conditions, they will know whether they are in a position to commit to providing such necessary debt financing.”

That five-week period will end on July 25th. Quarterly earnings are expected to be announced August 5th as well.

Evaluating Capital Square Partners’ Offer

From my viewpoint, it seems like CSP may be making an opportunistic grab. The offer was made in December 2021 at a 37% premium to the $3.94 trading price at the time, a 52-week low.

Morningstar

Since the offer was made the stock has shed 31% more in value. Languishing in uncertainty, Startek has made not just new 52-week lows since but arrived at its lowest point in the past ten years.

Morningstar

The market seems to entirely discount the plausibility of the CSP offer or has overlooked it. Yet the folks involved with the company have been actively exploring whether or not this offer materially undervalued the company, including former CEO Chad Carlson. Carlson was CEO between 2011 and 2018 when he was replaced during the Aegis merger; he remains a Startek shareholder. An exclusive article from The Deal writer Tom Terrarosa dated March 21st highlighted the following:

Carlson, specifically, has begun having conversations with private equity firms and other call center industry contacts about other possible deal options and even potentially launching a counter offer himself that could value Startek at closer to $600 million.

Carlson has briefly discussed the matter of launching a counter offer with Startek’s new CEO Bharat Rao and explained that a competitive auction process could yield a multiple of 8 to 10 times EBITDA, the sources said. The former CEO has attempted to gauge whether Startek’s majority shareholders would consider a deal worth roughly 8 to 8.5 times Startek’s 2021 EBITDA of $71 million, the sources said.

The impetus for this is the CSP offer values Startek at around 0.4 times revenue and 3 times EBITDA. Historically companies in the sector have been sold for multiples of 0.8 times and 1.2 times revenue and between 6.5 times and 8.5 times EBITDA, according to The Deal article. Recent transactions in the industry have all been done at higher multiples than the CSP offer. One example is Sitel Group’s $2.24b take-private acquisition of Sykes Enterprises at about 11.3 times EBITDA and 1.3 times revenue.

The last time Startek traded this low was under Carlson’s helm so I find it mildly entertaining and encouraging that he is actively involved in pushing for a higher price. While this is not central to my thesis, I believe it may lead to a bidding process on the company and a higher price either from CSP or a strategic buyer.

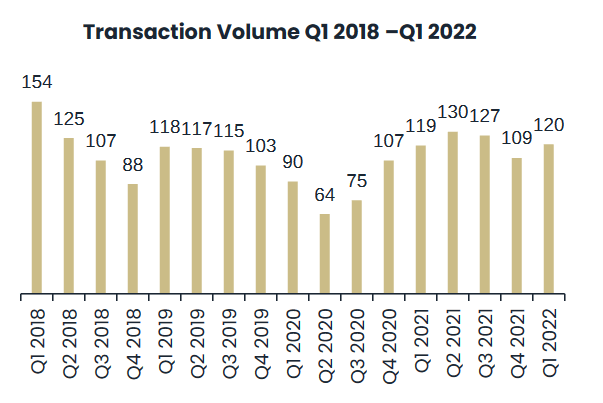

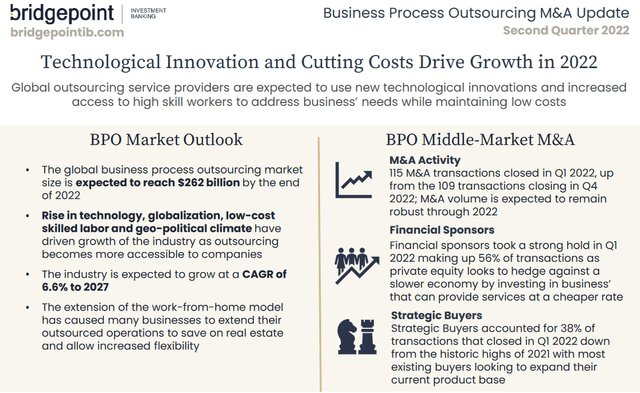

The BPO industry overall is going through significant consolidation currently with 224 M&A transactions reported in the last two quarters alone, according to a report from Bridgepoint. This volume has been consistent over the last four years and is expected to continue as BPO operators seek to build scale in a fragmented industry expected to grow at a CAGR of 6.6% in the next five years.

Bridgepoint Report

Bridgepoint Report

With strong M&A activity in the BPO market, the Startek board has a responsibility to explore all reasonable options to maximize shareholder value beyond the CSP offer. Bridgepoint data highlights that over the last five years the average EV/EBITDA multiple in the BPO sector was 12.6x. If we applied that multiple to Startek’s two-year average EBITDA of $65.3m we’d get an enterprise value of $822.78m. If we back out the total debt of $170m and the minority interest of $59m, and finally add the cash position of $52m we get an implied market capitalization of $645.78m – a 453% increase from current prices.

While I do not expect those returns in this situation, I think this helps to provide a baseline understanding for where peer companies historically trade. From the data above it’s clear the multiple being offered for Startek is low compared to historical average for BPOs and recent valuations of peers in M&A activity. With Startek’s stock price seemingly in terminal decline we should turn to the financials of the company to understand its financial strength and why it may be trading for such a discount.

Startek’s Finances and Buybacks

Starting with the balance sheet we can see that the company has $52m in cash compared to $169.5m debt and seem to be in an overall stable position given cash flow and profitability. Goodwill and intangible assets are both quite high at $183m and $87m, respectively. This is compared to the shareholder equity of $193.424m. Goodwill is of particular note given it’s called out by the auditors as a critical audit matter. They note, “Auditing management’s significant assumptions used in the assessment of the recoverability of goodwill involved especially challenging and subjective auditor judgment.” Any impairment on either of these would be material to the book value of the company so this is a risk to monitor.

Shareholder equity has come down 16% from $231m in 2018. They’ve also had four different CEOs and a pandemic during that time period, so it’s unsurprising that some value in the company has been lost. Solidification of the management team this past year under Rao should help stabilize a strategic vision and approach moving forward. Rao has mentioned his organizational rightsizing approach on both quarterly calls since joining.

From Q4’21 Rao stated, ”We also spent much of the past quarter evaluating consolidation and rightsizing opportunities across our footprint. It has been our goal to maintain a lean and efficient organization that will be increasingly important as we look to produce meaningful revenue growth.” And in the most recent call Rao stated, “As a continuation of our efforts, we have been executing on a number of rightsizing initiatives to go along with our growth strategy. This includes optimizing various locations across the globe and working with our employees to develop the best solution for an evolving hybrid work environment.” While it remains to be seen what impact this would have over the long term, I think it’s illustrative of a management team looking to cut costs and find ways to drive further efficiency in the business. And one potential is possible assets sales of their campuses due to the work-from-home trend.

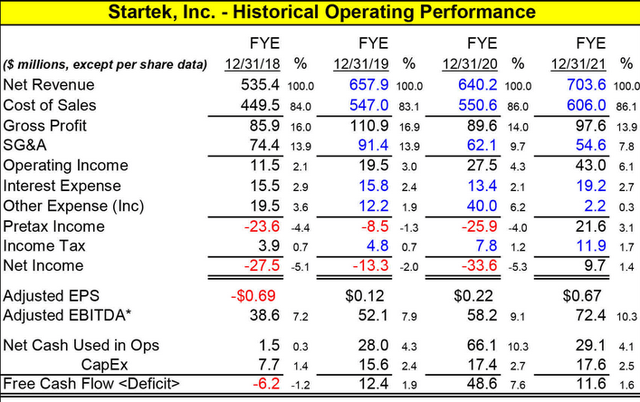

Fellow Seeking Alpha contributor Junk Bondage wrote up Startek in May and included the table below which we are borrowing as it’s still relevant. Junk Bondage’s article also has a useful peer comparison chart and helps provide additional context on the situation for interested readers.

Junk Bondage’s SA Article

We can see from the data above that since the 2018 Aegis merger revenue grew 31%, adjusted EBITDA grew 87.56%, and EBITDA margins expanded by 43%. With growing profitability and $72.6m in FCF from the last three years it seems that this is not a company in terminal decline despite trading at a P/B of 0.6.

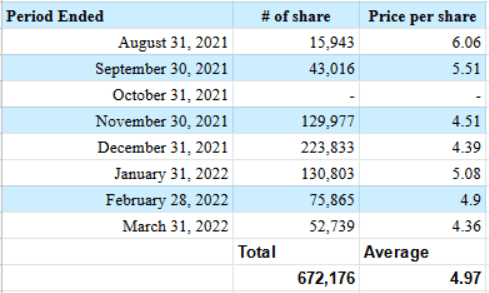

Management has approved $4m in share buybacks in the last year. Since then, they’ve retired 672,176 shares which is about 1.6% of shares outstanding. The average purchase price has been at 4.97 which is 84% higher than prices today. With $831,229 left authorized for share repurchases as of March, it’s likely we’ll see that fully utilized by the next quarter.

Author’s consolidation of company filing data

We can note as well that in two periods in the last year management have been net buyers of the stock at prices above $5.40. The August 31, 2021 period price per share of $6.06 is 109% above current prices. What’s interesting here is that we are given a glimpse into the opportunistic nature of this takeover offer. Consider that management at Startek with Sengupta at the helm believed their stock was undervalued at $6.06 so Sengupta put that money to work by repurchasing shares. They then put even more money to work in the next period at an average cost of $5.51 per share. It seems a bit odd then that Rao and Sengupta’s CSP made an offer below that price implying that the company was not undervalued at $6.06 or $5.51 and in fact is only worth $5.40.

To go from undervalued at $6.06 to fair value of $5.40 in under a year would suggest to me a significant change in perspective on the prospects of the company or some sort of write-down. Neither seems to be the case and in fact management seems bullish as ever about their near-term investments yielding long term results for shareholders. Ronald Gillette, Strategic Advisor and Head of Business Transformation brought on in February, said this of the company’s strategy.

Our approach is simple. We want to capitalize on the opportunities that we’ve set up for ourselves while investing heavily into the future. I want to reiterate that we anticipate seeing limited growth in our bottom line for the near-term. With the work that we are focused on, we are looking to position Startek for long-term success, and we are willing to invest in ourselves to do so. We believe that there is still a lot of untapped potential in this space we operate in and we have a strong foundation in place to pursue these opportunities. We remain as confident as ever in our company’s position and our ability to drive long-term value to our shareholders.

Not to belabor the point here, but again those long-term results just one year ago were believed to be worth so much more than $6.06 that it would be book value accretive to repurchase them –- now they are somehow pegged at a $5.40 valuation. I’m not sure this is a tenable position for CSP and Rao to hold moving forward which could drive the takeout offer higher even without a competitor.

Why Is Startek Trading So Low?

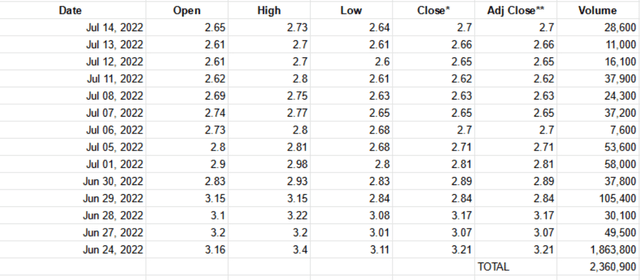

At a base level we can see that the market has clearly not ascribed any meaningful value to the CSP offer of $5.40. For nearly six months there was no information on the deal which didn’t help matters and the announcement on June 21st didn’t seem to change the market’s perception of the deal with the stock closing lower the day of the announcement. It’s continued lower due in part to forced selling related to delisting from 11 Russell indices which occurred on June 24th.

Tikr

Average volume for SRT in the weeks before delisting was around 70k shares a day. On delisting day there was a ~2500% surge in volume to 1.86m trading hands. And in the weeks since delisting the average volume has increased above 100k per day. Given how widely used the Russell indexes are, tons of indiscriminate selling are happening as a result of this change and putting downward pressure on the stock price. This pressure is compounded by the low amount of shares likely actually trading hands. Let’s look at share ownership for a second by viewing their 2021 proxy.

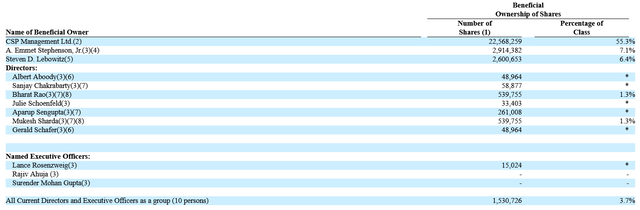

FY21 Proxy

From the table above we can see that 72.5% of the shares are owned by this group of people who are not likely to be trading them. A. Emmet Stephenson, Jr. is a retired chairman of Startek and Steve D. Lebowitz has been invested since February 2020. If we assume these shares are not floating around with 40.296m shares outstanding, we can estimate that only about 11m shares are being traded.

That kind of puts the delisting day in a different perspective as 1.86m shares represents 16.9% of shares estimated trading. If we add up all volume from June 24th, we can see that 2.36m shares have exchanged hands or about 21% of shares estimated trading. At this point we may have seen the bottom in terms of forced selling due to delisting as the volume trend has been downward.

Author’s calculations

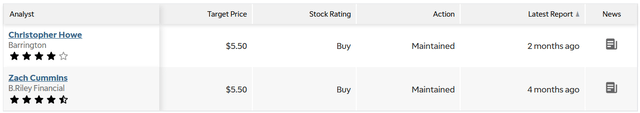

Another reason Startek is trading so low could be that as a microcap this deal, and the company have gone simply unnoticed. I’ve identified just two analysts with coverage on the name. Christopher Howe of Barrington and Zach Cummins of B. Riley Financial both have a $5.50 price target reported in the last four months.

TD Ameritrade

A Caution Flag: Kirtley v. Startek and Harris et al v. Startek USA, Inc.

While the above information doesn’t account for the share price being low, perhaps this does. Kirtley v. Startek, Inc. is a class action lawsuit against Startek due to a 2021 data breach involving employee personally identifiable information (PII). Plaintiffs are seeking payment for damages incurred given leak of their sensitive data. Here’s the context according to Console & Associates, P.C. who are investigating Startek:

According to the most recent data breach letter issued by StarTek, Inc., on June 26, 2021, the company experienced what it characterizes as a “network disruption.” No further details were provided. After investigating the incident, the company determined that an unknown party gained access to and obtained data from the StarTek network without authorization.

On December 23, 2021, StarTek, Inc. subsequently determined that the breach exposed the personal information of 24,819 customers and employees. This information included affected parties’ first names, last names, Social Security numbers and dates of birth.

Around January 21, 2022, StarTek, Inc. sent out written data breach notifications to all affected customers and employees, informing them of the breach and what they can do to protect themselves.

The case was filed in January 2022 and yet both the 10-K and 10-Q filed since do not disclose any legal proceedings. Clearly that is an oversight as they do have pending legal proceedings and were in court as recently as June 16th. Additionally, it seems odd that it took them six months to determine that the data breach impacted PII. Having worked in IT and data privacy I’d be surprised to have a known breach and yet not have identified the root cause for six months. Typically, it would be investigated immediately. On the other hand, it could reflect the complexity of the breach itself in that it took them six months to understand the impact.

Either way, it’s not a good look for a company to have a data breach. It’s even worse that the case hasn’t been disclosed directly in their filings even as they’ve disclosed the cyber security incident overall. While I can’t speak to the merits of the case and potential payout, it is a caution flag amidst the thesis that there may be more under the surface at play.

The Deal article referenced earlier mentioned data breaches as well. It stated, “Also, Startek has had some cybersecurity breaches that sources claim it may have not properly disclosed to some of its largest customers in recent years, including Amazon.com Inc. (AMZN) and Expedia Group Inc. (EXPE), which has led to a reduction in sales to those customers.” I’m not clear on whether or not this is in reference to the same June 2021 data breach or not, though it likely is. If not, that compounds the risk here.

But there isn’t just one case, there are two. Harris et. al v. Startek USA, Inc was filed in February and I haven’t been able to dig up much information on it. I can see it’s related to the Fair Labor Standard Act and a quick look at the plaintiff lawyers suggests this might be another class action lawsuit brewing. One of the lawyers, Kevin Stoops, is described as “nationally recognized as one of the preeminent plaintiff class action wage and hour attorneys.”

So that’s two undisclosed legal proceedings that are ongoing. Gauging the impact and risk here is well beyond my circle of competence though I do note the oversight in not disclosing these proceedings so far. A quick review of the lawsuits won listed on Kevin Stoops’ page show a highest payout of $6.255m for the nation’s preeminent class action plaintiff. Assuming worst case scenario and both cases achieve a payout of $6m then we can estimate a $12m loss overall or around $0.30 per share. This is purely speculative but gives some estimate on the risk here which to me is small and not materially significant to the thesis. Ongoing monitoring of the cases is required.

Startek In Summary

At this point I’ve endeavored to make the case that Startek is significantly undervalued at current prices. The CSP offer of $5.40 represents an 86% margin of safety in the name given the offer values Startek well below industry average multiples and recent BPO M&A multiples. I believe management made an opportunistic offer at 52-week lows which the market has completely discounted with the stock trading 31% below the pre-offer price of $3.94. Selling pressure has been compounded by last month’s delisting of SRT from 11 Russell indices with the stock now trading at a ten-year low. And despite undisclosed legal proceedings I believe there’s an opportunity presented to investors here.

Startek trades at a P/B multiple of 0.6 yet has generated an average of $17.334m in free cash flow the past five years. If we back out the cash on the balance sheet Startek is trading for 3.73 P/FCF. Based on five different valuation approaches we get an average implied return of 107.74%.

| Valuation | Current | Target | Implied Return |

| P/B Re-rate for profitable company | 0.6 | 1 | 66.67% |

| Average EV/EBITDA BPO Multiple | 4.32 | 12.6 | 191.67% |

| Former CEO Discussed Offer EV/EBITDA Multiple | 4.32 | 8 | 85.19% |

| Capital Square Partners Offer | $2.90 | $5.40 | 86.21% |

| Recent Share Repurchase Avg. High | $2.90 | $6.06 | 108.97% |

| Average | 107.74% |

In the coming month we could see Capital Square Partners announcing a move forward with the deal and at the least we will see quarterly earnings. With near term catalysts and a winding down of forced selling I expect any positive news to cause a big jump in the name. I’m also happy holding the position moving forward if the deal does not go through given the undervaluation of the company. Overall, I’m setting a minimum price target at the CSP offer of $5.40 with a 1-2-year time frame which will have upside optionality in the case of a bidding war.

Risks

-

If Capital Square Partners announces they are not moving forward with the deal, it’s possible SRT will fall lower. Though we note the current price is well below the pre-offer price of $3.94.

-

Undisclosed legal proceedings are a known unknown. The financial impact and risk of these seem unclear yet the fact they are undisclosed is not encouraging.

-

Furthermore, the data breach incident from June 2021 does not inspire confidence and may reflect deeper operational and leadership challenges.

-

CSP owns a majority of shares and effectively runs the company with CEO Rao also being part of CSP. Additionally, the majority of the board are representatives of CSP. Due to this CSP has outsized influence and could use that to have their way regardless of minority shareholders.

-

The makeup of the Special Committee designed to evaluate the CSP offer has not been announced. It remains to be seen if it’s truly independent.

-

Goodwill and intangible assets are at $183m and $87m, respectively. This represents 95% and 45% of the $193.424m in shareholder equity. A write-down in either would be significant to the thesis.

- The company may experience revenue and earnings pressure moving forward that could erode profitability beyond sustainability.

Be the first to comment