Bennett Raglin/Getty Images Entertainment

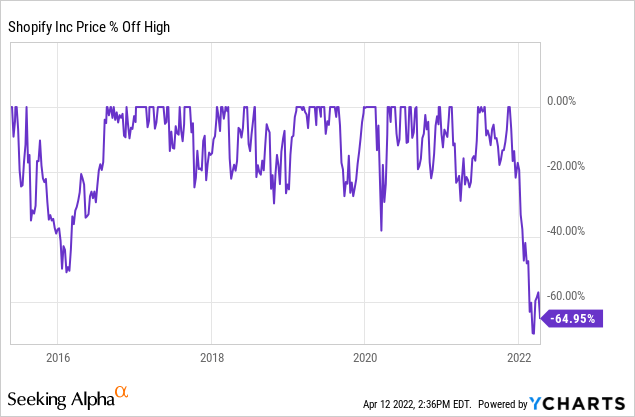

Your opinion on Shopify (NYSE:SHOP) might depend on when you bought your first share. I started my position in 2017 at $100/share, so Shopify remains a big winner in my portfolio. It’s a seven-bagger, even after the ~65% sell-off.

I recently added to my Shopify position for the first time in almost five years! While I’ve been a happy shareholder all along, the recent sell-off made me a buyer again. The stock is close to the cheapest it has been in the past five years. SHOP has grown into one of my top holdings, but it’s still a small position on a cost basis (~1%). I love adding to my favorite companies when they fall out of favor temporarily.

The company delivered a tremendous Q4 FY21, beating consensus by +$40M and growing revenue +41% Y/Y vs. challenging comps. However, subscription revenue was a bit soft, and management warned of a slowdown in the first half of 2022. Additionally, new investments are expected to ramp up (new technology and services, international expansion, fulfillment), which will impact margins in the near term.

For someone with a multi-year time horizon like me, temporary headwinds are not particularly relevant, and the re-investments for future growth are what I want to see. However, things could get worse before they get better. Shopify has historically benefited from a valuation premium, giving it more room to fall in a challenging macro environment. I fully recognize that I can’t time the bottom.

While I’ve added to my position, I’m still far from a full position and would be happy to accumulate more in the quarters ahead. So now, while SHOP is an excellent fit for me and my portfolio, it doesn’t mean it’s a good fit for you.

So what should you consider before you buy?

Let’s review.

SHOP Stock Key Metrics

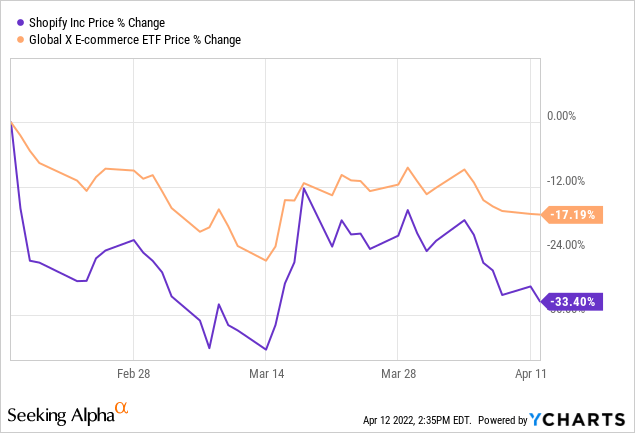

SHOP was already a beaten-down stock heading into the Q4 FY21 earnings call on February 16 in the context of a broad market sell-off for growth stocks. But it went from bad to worse, with shares down more than 33% since then.

The Global X E-Commerce ETF (EBIZ) is down almost 17% over the same period, so a good chunk of the current stock performance has to do with the macro environment.

So was Q4 FY21 that bad? It has more to do with the outlook.

Q4 FY21 Highlights:

Top Line:

- Gross merchandise volume grew +31% to $54B (vs. +35% Y/Y in Q3).

- Subscription revenue grew +26% to $351M (vs. +37% Y/Y in Q3).

- Merchant solutions grew +47% to $1,029M (vs. +51% Y/Y in Q3).

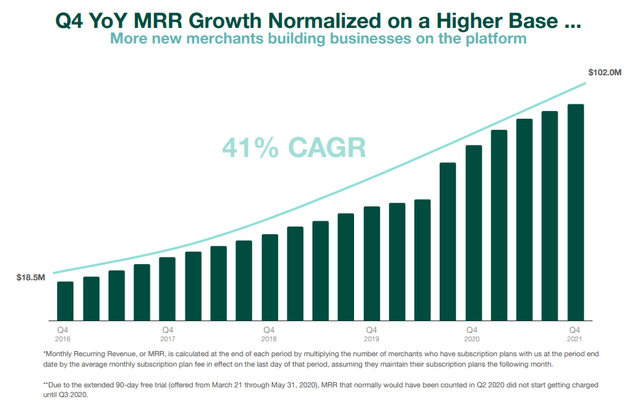

- Monthly Recurring Revenue grew 23% to $102M (vs. +33% Y/Y in Q3).

- Revenue grew +41% Y/Y to $1.38B, beating consensus by +$40M.

The biggest slowdown affected Shopify’s recurring subscription revenue.

Margin Trends:

- Gross margin was 50% (-2pp Y/Y).

- Operating margin was 1% (-11pp Y/Y).

- Adjusted operating margin was 9% (-11pp Y/Y).

Cash flow and balance sheet:

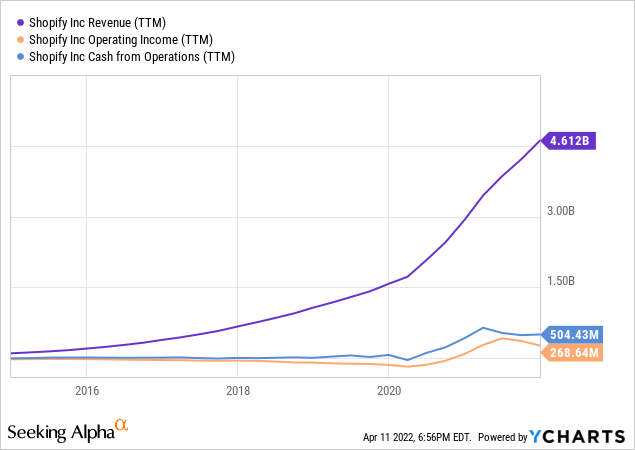

- Cash from operations was $504M in FY21 (+19% Y/Y).

- Cash and investments on the balance sheet: $7.8B.

- Long-term debt: $1.2B.

Guidance:

- Management expects a slowdown in the first half of 2022 due to tough pandemic comps and some subscription headwinds due to changes in revenue share (namely, the elimination of Shopify’s rev share on the first $1M revenue annually for partners).

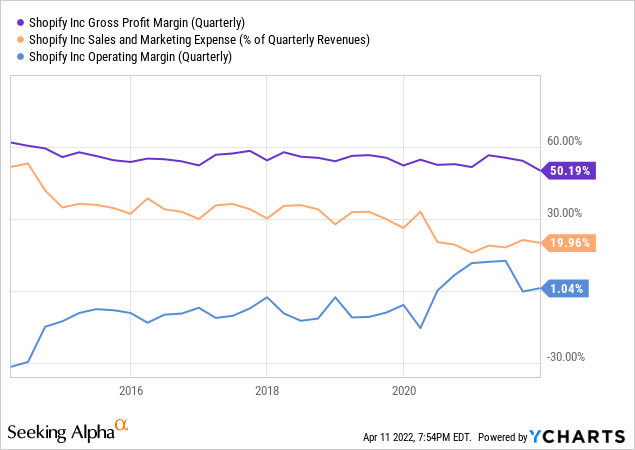

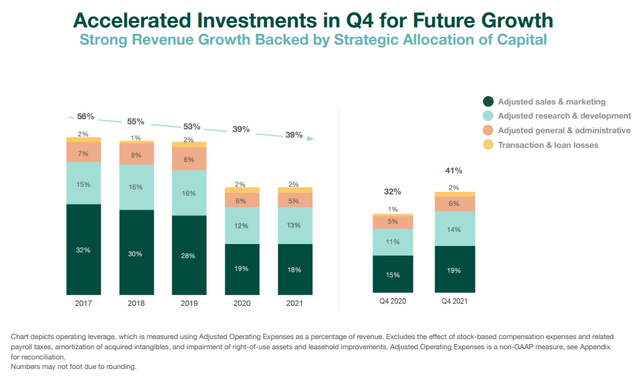

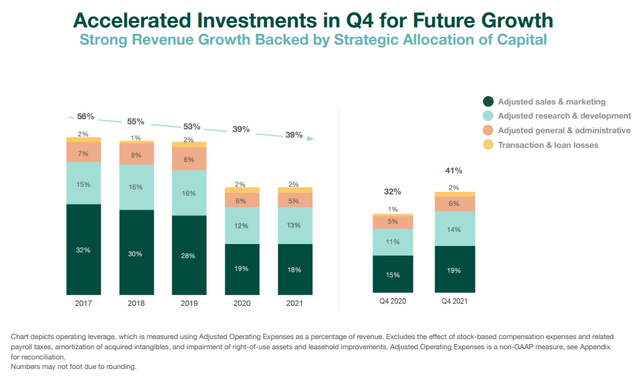

The margin trends look good over multiple years with sales efficiency and improved profitability since 2020:

- Gross margin remains high at 50% in FY21.

- Sales & marketing costs are trending down at 20% in FY21 (-1pp Y/Y).

- Operating margin was 1% in FY21 (-2pp Y/Y).

While Q4 FY21 showed some margin compression, the company has a demonstrated history of operating leverage.

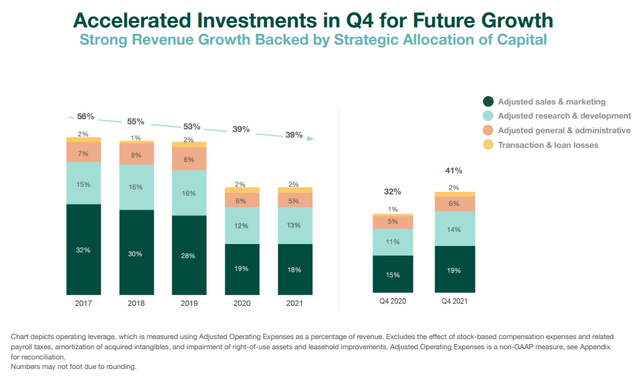

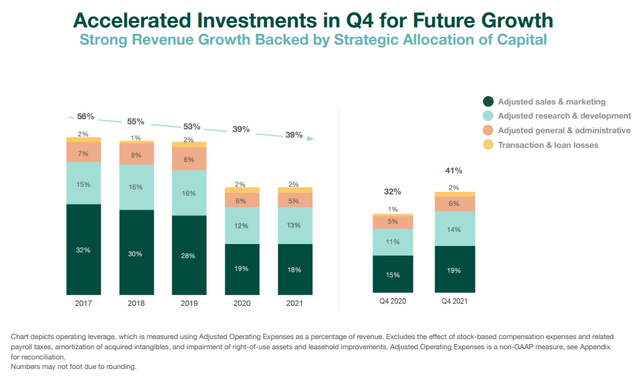

Shopify Q4 FY21 Earnings Slides

The company’s most recent financial results can be summarized as follows:

- Rapid top-line growth (+41%) – showing strength.

- High gross margin at 50% – showing long-term potential.

- Flagging sales & marketing costs, at 20% – showing scalability.

- Expanding operating margin over the years, showing operating leverage (even though Q4 FY21 showed margin compression).

- Strong net cash position and positive cash flow margin – showing sustainability.

Shopify Q4 FY21 Earnings Slides

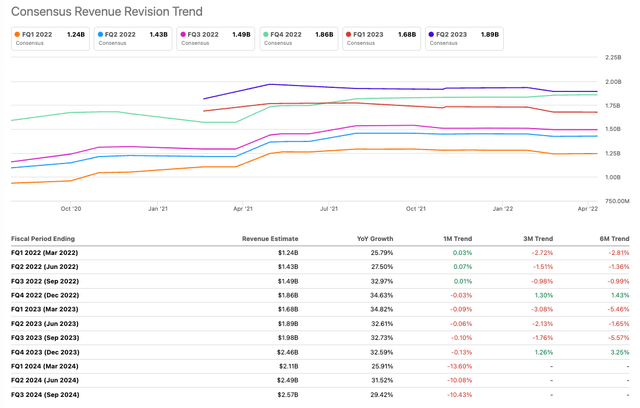

The market was already assuming a growth normalization if you look at the past consensus for FY22 and beyond. At this point, the consensus on Seeking Alpha has been revised slightly down:

- FY22 Revenue: $6.0B (+31% Y/Y).

- FY23 Revenue: $8.0B (+33% Y/Y), a re-acceleration.

Shopify Q4 FY21 Earnings Slides

Cons Of Buying Shopify Stock

I see two reasons contributing to the drop specific to Q4 FY21:

- A slowdown in subscription revenue: The growth deceleration was more pronounced in the subscription revenue, which is an important piece that justifies SHOP’s higher multiple, causing a re-rating. MRR growth was soft sequentially and only +23% Y/Y (vs. +33% Y/Y in Q3). It will be something to watch in the quarters ahead.

- Margin contraction: Shopify is adding more engineering and commercial talent and is focusing on four critical investments:

- Building direct-to-consumer solutions (e.g., Shop app and POS).

- International expansion.

- Lowering technical barriers and adding services.

- Simplifying fulfillment.

These investments are what I want to see as a long-term shareholder. I wouldn’t want management to prioritize profitability over growth at this stage. Notably, Shopify remains cash flow positive and has a robust balance sheet with close to $8B in cash. So I’m glad to see management put this cash to use and fuel future growth.

However, these re-investments could continue to put pressure on the share price in the next few quarters. So it all comes down to the time horizon. The short-term uncertainty creates a good entry point for the long-term investor, but there could be more pain in the short term. COVID darlings like Zoom Video (ZM) and DocuSign (DOCU) are good examples of what can happen if the business fundamentals start faltering.

Management usually doesn’t provide specific guidance, and Q4 FY21’s earnings call was no exception. However, CFO Amy Shapiro provided a cautious outlook:

Our outlook for 2022 assumes continued secular tailwinds for entrepreneurship and digital commerce transformation against a more measured macro environment relative to 2021. While we believe that the COVID triggered acceleration of e-commerce that spills into the first half of 2021 in the form of lockdowns and government stimulus will be absent from 2022, and there is caution around inflation and consumer spend near term. For the full year, we see economic growth supporting the continued penetration of retail by e-commerce.

In short, management expects FY22 revenue growth to be:

- Lower than FY21 (it was +57% Y/Y).

- Still outpacing e-commerce (thanks to added services and international expansion).

More specifically, Amy Shapiro explained that revenue growth is expected to be the lowest in Q1 FY22 and highest in Q4 FY22 due to three factors:

- Tough COVID comps in the first half (revenue grew +110% in Q1 FY21, partially due to lockdowns and government stimulus).

- New terms with developers eliminating Shopify’s rev share on the first $1M of revenue and resets in January (a great customer-friendly initiative). These terms will be a headwind for subscription revenue because it launched in the second half of FY21.

- Specific commercial initiatives are expected to gain momentum in the second half of 2022.

The earnings call occurred a few days before the Russian invasion of Ukraine. So the cautious tone for Q1 FY22 was before any headwind considerations from the war in Europe, which could add further pressure.

Finally, there is no denying that the stock has been out of favor in the past few months and could remain so in the current macro environment, with most investors avoiding growth stocks. In the short term, SHOP could hit $400 before it hits $800. So only investors willing to hold their nose and invest with a multi-year time horizon should consider it.

Pros Of Buying Shopify Stock

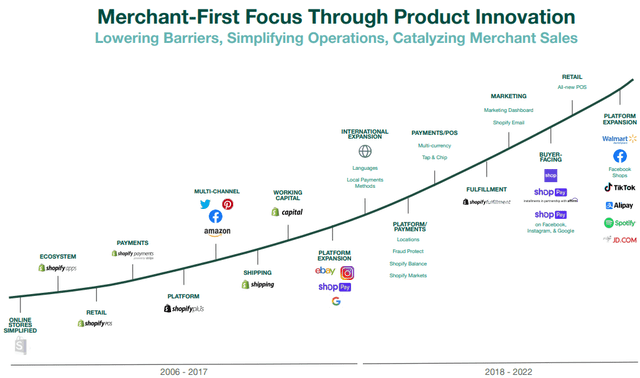

Shopify is boxing in a category of its own. As illustrated below, the company continues to expand its total addressable market by offering new use-cases, expanding its platform features, and creating a consumer-facing app called Shop. From payments to social commerce, this is what optionality looks like.

Shopify Q4 FY21 Earnings Slides

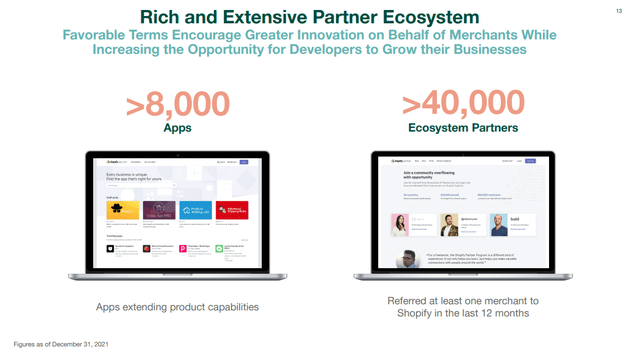

This fast pace of innovation has led to an impressive partner ecosystem:

- More than 8,000 apps are built on Shopify to extend product capabilities. These apps include ways to get products in front of shoppers on Facebook (FB), Instagram, Snapchat (SNAP), Pinterest (PINS), easily create TikTok video ads, marketing automation tools, loyalty programs, accounting, etc.

- More than 40,000 ecosystem partners: agencies, app developers, designers, etc. Shopify’s partnerships are often celebrated as a critical competitive advantage of the business that is hard to replicate for new entrants.

The company started new partnerships with Spotify (SPOT), JD.com (JD), and TikTok in the past few months. The partnership with JD.com opens Shopify’s merchants to China, the biggest e-commerce market in the world. They can now reach JD’s 550M active users.

About TikTok, Shopify President Harley Finkelstein explained during the call:

Since introducing our TikTok channel, more than 100,000 merchant creators have installed the channel and merchants are starting to sell via our Spotify integration. Creators selling through these channels have more power to connect directly with their buyers in an inspired moment and offer them a great shopping experience by a Shopify Secure checkout while owning their brands.

The company covers all needs of its merchant, from “first sale to full scale.” That includes seamless checkout via Shopify Payment, simplifying money management (Shopify Balance), funding (Shopify Capital), or cross-border commerce (partnership with Global-e (GLBE)).

Shopify continues to scale and simplify its global fulfillment network. They are consolidating into larger facilities and expect to deliver packages in two days or less to more than 90% of the US population.

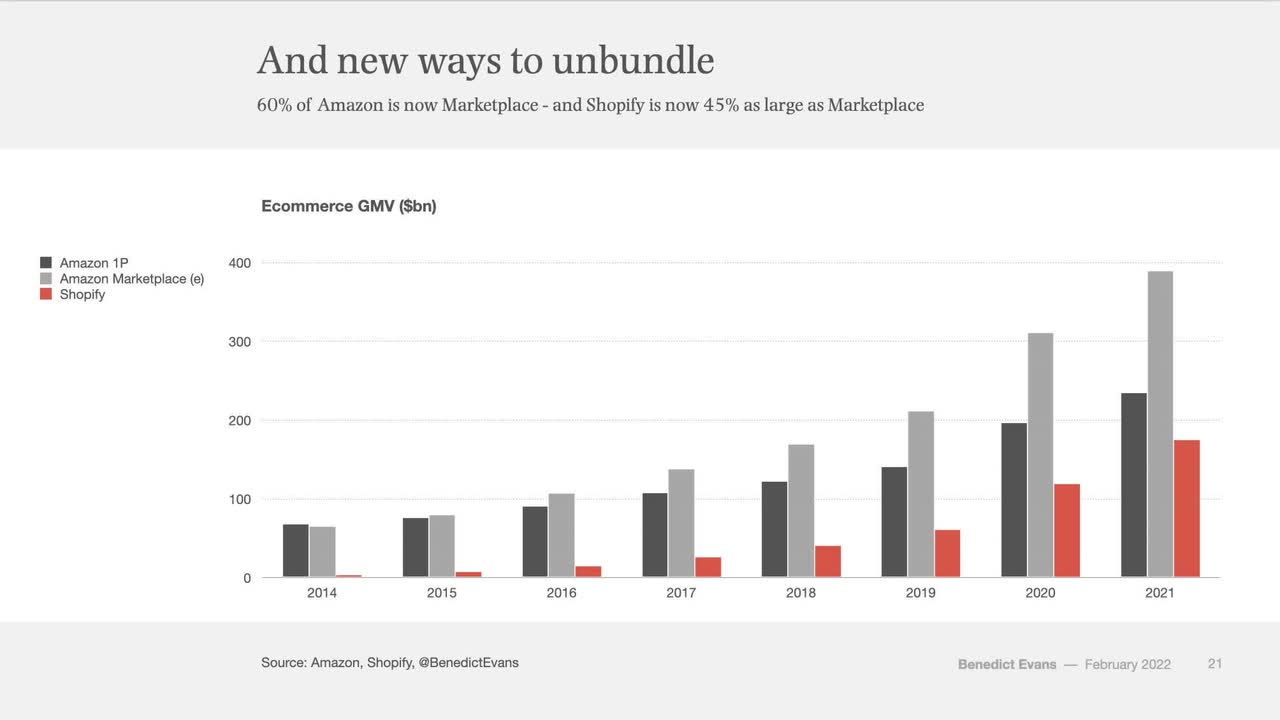

What about the competitive landscape? Shopify is catching up to Amazon in a big way. As illustrated by Benedict Evans below, Shopify went from $7.7B in GMV in 2015 to $175B in 2021.

Shopify Consensus Revenue Revision Trend (Seeking Alpha)

The bear case against Shopify tends to focus on valuation and not on business momentum. Why? Because it’s tough to argue that Shopify isn’t on a stellar trajectory.

The graph below shows that 60% of Amazon’s (AMZN) GMV is now Amazon Marketplace. And Shopify’s GMV is now ~45% as large as Amazon Marketplace, and growing. So Shopify is eating Amazon’s lunch, not the other way around.

Shopify Q4 FY21 Earnings Slides

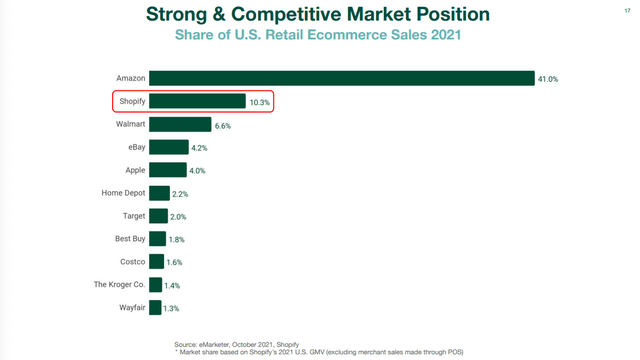

Shopify has an estimated 10.3% market share of US Retail e-commerce in 2021, followed by Walmart (WMT) with 6.6%.

Shopify Q4 FY21 Earnings Slides

Shopify just crossed $100M in monthly recurring revenue from subscription solutions (Basic, Shopify, Advanced, and Shopify Plus). Subscriptions represent a quarter of the business and explain why Shopify trades at a higher multiple.

As a reminder, Shopify receives accolades and awards every year for its distinctive culture and leadership. So again, you are looking at one of the top employers in the world.

Benedict Evans – February 2022

Shopify Q4 FY21 Earnings Slides

The company announced updates to its governance structure that would preserve founder-CEO Tobi Lutke’s voting power and provide sunset provisions that prevent him from transferring that power.

Shopify will issue Tobi Lutke a Founder share with a variable number of votes that will represent 40% of voting power (from 34% previously) when combined with his other holdings.

Robert Asher, Shopify’s lead independent director, explained:

Tobi is key to supporting and executing Shopify’s strategic vision and this proposal ensures his interests are aligned with long-term shareholder value creation.

Is SHOP Stock Worth Investing In?

How timely is the opportunity with Shopify?

The stock is down almost 65% as of this writing. It’s the first time the stock has been beaten down this much since going public in 2015. SHOP was cut in half in 2016 and was down almost 40% during the market bottom in March 2020.

Shopify Q4 FY21 Earnings Slides

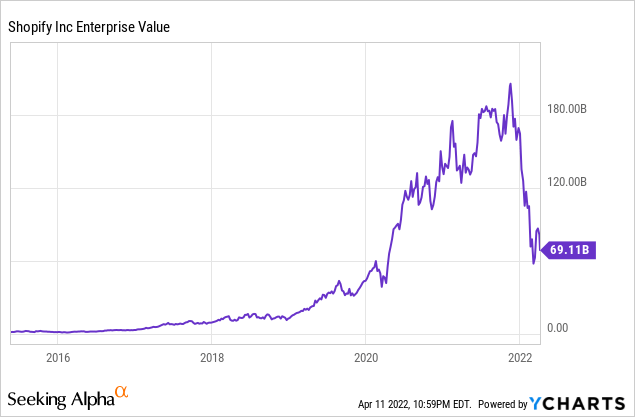

Shopify is a ~$70B company today. Let’s contextualize the valuation further.

Shopify Awards & Accolades (Glassdoor)

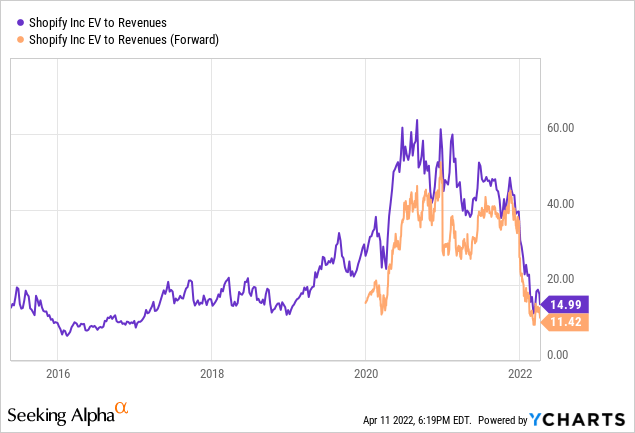

SHOP is trading at:

- ~15 times FY21 revenue.

- ~11 times FY22 revenue estimates.

- ~9 times FY23 revenue estimates.

- ~7 times FY24 revenue estimates.

That’s why you hear about companies “growing into their valuation.” What looks expensive today can look cheap later. SHOP is trading close to its lowest revenue multiple of the past five years. It could undoubtedly continue to fall further, but the upside potential is starting to look attractive.

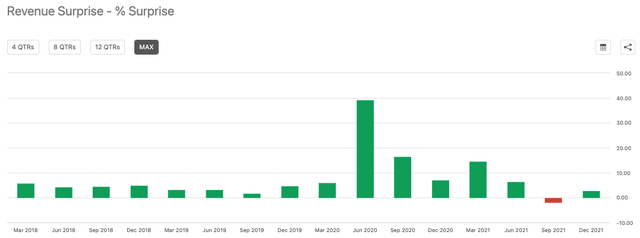

Revenue estimates for 2022 and beyond could prove conservative. Historically, Shopify beats consensus by ~8% on average in the past 16 quarters.

Shopify Reviews (Glassdoor)

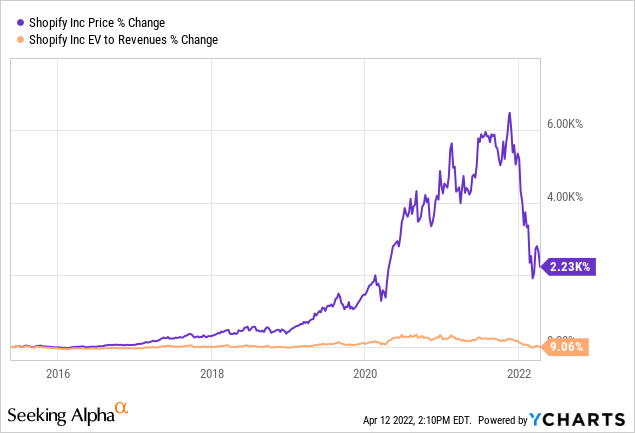

If we look at the valuation spectrum, SHOP is back to its historical range after a “COVID bump.” One could make the case that Shopify has always been overvalued and still is today. My point is not that SHOP is cheap today (it never was), merely that it’s not on the high end of its historical spectrum.

I love putting the stock performance in perspective with the valuation. SHOP’s valuation has been almost flat since the 2015 IPO, while the stock has been a 23-bagger. It would be hard to argue that SHOP has never been a good investment or that it was always “too expensive.” The stock chart speaks for itself. But again, your perception might depend on when you bought your first share.

Shopify is a company that’s always been hard to value. A quarter of its revenue is a recurring subscription business with tremendous growth over the years. This type of revenue deserves a higher multiple.

The chart below shows where SHOP stands on the SaaS Rule of 40, comparing companies based on revenue growth and operating margin. As you can see, SHOP is one of the rare cloud businesses that are both profitable and growing at a brisk pace.

Shopify Revenue Surprise (Seeking Alpha)

Now let’s look at how it translates into EV-to-Sales multiples:

With an EV-to-revenue of 15, SHOP trades at a discount to HUBS, PAYC, TEAM, or NOW. Multiple compression can always happen. However, given the revenue’s upward trajectory, such compression would only temporarily impact the stock price. If a company like Salesforce (CRM) trades at seven times revenue while growing in the mid-20s with a breakeven operating margin, Shopify deserves trading at a premium.

Wall Street is still expecting revenue growth north of 30% in the years ahead, making the current re-rating look like a buying opportunity.

No matter how compelling this opportunity looks, I’m taking my time. I recognize that the stock might be considered “dead money” by swing traders and those focused on the immediate upside potential over the next few weeks or months. Should this be the case, I will likely be happy to add more to this position in the year ahead.

In my review of the Top Buys from The Best Money Managers for Q4 2021, Shopify was a top-five holding at the following funds:

- Abdiel: 10% allocation.

- Lone Pine: 8%.

- Whale Rock: 6%.

- Baillie Gifford: 4%.

Be the first to comment