WinnieVinzence/iStock via Getty Images

The Starrett Company (NYSE:SCX) is one among many manufacturers of tools and machinery. The company offers more than 5,000 products that are used in several industries, as well as DIY tools for construction and others.

Starrett’s revenues have been relatively volatile for the last decade. Added to a relatively fixed cost structure and one time charges related to pensions and goodwill amortization, the company’s earnings have been volatile as well. Even in the worst scenarios, the company was profitable, and earning between $2 and $5 million in recurrent accrued earnings.

In a situation as the one described above, the company’s stock should be a good opportunity. However, the company has to come up with $8 million in yearly funding to its defined benefit pension plan.

Because the funding either cancels a previously generated liability or is accounted as a prepayment, it is not recognized as an expense. In our opinion, this treatment significantly overstates SCX’s real earnings.

Note: Unless otherwise stated, all information has been obtained from SCX’s filings with the SEC.

Starrett operations and competitive position

Starrett is a global manufacturer of tools and machinery.

The company operates in several segments and serves many different industries, with more than 5,000 products on its different lines. From a competitive position, this means that Starrett’s earnings are not tied to the vagaries of any particular industry but to the general business cycle. From an operational perspective, this means that Starrett has to carefully manage its facilities and fixed expenses, because manufacturing 5,000 products requires specialized machinery and facilities.

Starrett also is a truly global company. It has manufacturing operations in several regions in the US, Brazil, China and Scotland. The company also has commercial operations in Mexico, Singapore, Japan and Australia, among others totalling 100 countries. For the last few years, ex-US countries have accounted for 50% of Starrett’s sales and they have grown faster than US sales. Again, competitively and operationally this provides protection from the movements in one particular country at the expense of higher operational complexity.

Taxation is particularly complicated with global operations companies. The different subsidiaries probably fill different earnings and losses reports with different tax authorities, not being allowed to pair earnings and losses, therefore paying a higher tax rate than a single country company. This is particularly true if revenues are generated at the subsidiary level but expenses are generated at the corporate level.

In order to avoid part of this special treatment, Starrett mentions on its latest 10-K that it does not plan to repatriate earnings of its different subsidiaries but rather to reinvest them in each country, as much as possible. This helps because subsidiary earnings are accounted as equity earnings at a consolidated level, that may not be taxed in some jurisdictions.

Internationalization, particularly in terms of manufacturing operations, is also valuable in the recent context of trade disruptions and trade disintegration. Different subsidiaries may be allowed to sell to countries that others are not allowed to, or to sell under a more preferential treatment. The same is valid regarding suppliers.

In terms of suppliers, the company does not mention that it has any significant one that is material, which is understandable given that it manufactures many different products. This does not mean that the company faces atomized suppliers, because they may be concentrated for each particular supply. However it does mean that it should not face particular supply chain constraints, apart from those that have been common to all industries.

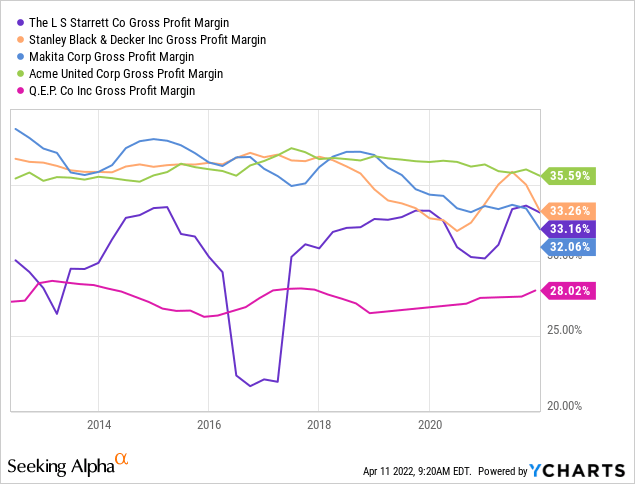

Finally, does the company have a brand or quality moat? It has the same gross margins as some of its peer companies and competitors, some of whom have much bigger operations, like Stanley (SWK) or Makita (OTC:MKTAY), as can be seen in the chart below. In the case of Starrett though, margins have been more volatile, an effect of its extended operations as was mentioned.

Starrett also invests in the maintenance of its brand. For the last few years the company has expended around $4 million in R&D and $4 million in advertising, none of which has been capitalized. This helps the company keep in track with its competitors, because the company mentions no particular patents that allows it to corner a portion of its markets.

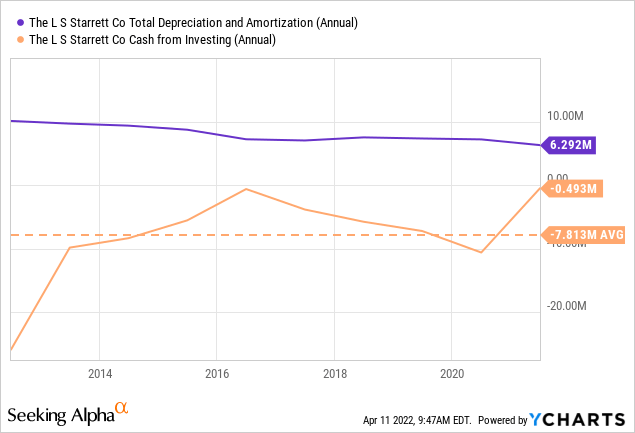

Finally we have to consider how much Starrett has to invest in fixed assets. The chart below shows that investment has been relatively similar to what is charged to depreciation, a good sign from the perspective of earnings quality and maintenance of its asset base.

However, both depreciation and investment are relatively small compared to the revenues generated by the company. The effect is that Starrett does not suffer from excessive operating leverage.

Improvement of operations in recent years

Starrett lost revenue between 2011 and 2017, to later recover from then on. In the process however, gross margins improved a few points, from around 30% to 33%.

On the way down, the company started streamlining its operations and reducing operating expenses. The good thing is that while revenues and gross profits recovered after 2017, operating expenses continued descending.

This has allowed Starrett to generate a much higher operating profit than it was possible years ago with the same level of revenue. This is a great sign of improved profitability.

To put an example, while the company lost $1 million at the operating level with $244 million in revenue in 2012, it generated $21 million at the operating level with $239 million in revenue in 2021.

Financially sustainable but indebted

Starrett has not sustained elevated levels of debt in the last decade, nor has it been required to pay important sums in terms of interest expenses.

As of December 2021, according to the company’s latest 10-Q, Starrett held approximately $13 million outstanding in a credit facility paying 3.5% + LIBOR, $5.5 million on a term loan paying 4% and $11 million in Brazilian debt paying between 3% and 6%. That comes up to a total of maturing debt of $16.5 million plus $13 million in the credit facility. These debts against $9 million in cash.

As we have seen, the company should be able to repay the maturing debts based on its operating profits, and could reduce its indebtedness further. However, these levels of indebtedness could become more difficult to manage in a recessionary context, with revenues falling and reducing operating income.

Additionally, Starrett’s cash requirements financed through debt signal what to us seems like the main risk.

Significantly underfinanced pension liabilities

Starrett has two already discontinued defined benefit pension plans that have been under pressure with the low rates environment prevalent in the last few years. Defined benefit plans suffer from low interest rates because the defined benefits are discounted at a lower rate, requiring more outflows in current periods.

The problem is that Starrett has to contribute today for a pension plan that was expensed previously, when accrued, and that will be paid in the future.

When people worked for Starrett and gained the right to a defined benefit pension, Starrett generated a pension liability. After 2016, when the plans were discontinued, the liability moved with interest rates, higher rates reduce the current liability, lower rates increase it. Those movements can be recognized in OCI or in regular income depending on Starrett’s decision.

But in order to pay those liabilities, Starrett has to contribute to its plans today. This is not treated as an expense but represents a tremendous cash drain. In particular and under the interest rate conditions prevalent in 2021, Starrett expected to contribute $8 million a year to its pension plans for more than 10 years in the future.

This represents a financial risk for Starrett, because that cash cannot be used to finance growth or repay debts, and its drain is not shown in accrual earnings.

The situation may improve if interest rates increase as that would mean lower required contributions to the pension plan in the present. However, the other side of that coin is that under higher interest rates, portfolio values tend to decrease, meaning that what Starrett has already contributed is less valuable.

What the net effect will be is difficult to forecast, but we have seen a reduction in contributions to the plan from $3.5 million in the last six months of 2020 to $2 million in the last six months of 2021. This may well be the effect of higher interest rates.

Until that problem is solved, we prefer to reduce Starrett’s earnings by an expected contribution of between $5 and $8 million yearly.

Miscellaneous

In this section we list some items that are interesting but did not need a fully dedicated discussion.

First, Starrett is a company without a strong owner. Management controls approximately 8% of the votes and the pension plans control another 7.5%. However, that 13.5% of votes translates only to 8% of earnings, given the double class structure of Starrett. The rest is divided among undisclosed small shareholders.

In connection with having no significant owner, Starrett’s management receives relatively high compensation. In 2021, the CEO, CFO and one out of two VPs received $2 million in compensation, and the board received another $300 thousand. If we assume the remaining VP makes the same as his colleagues, management’s bill could easily reach $3 million.

Finally, Starrett may need to move out from NYSE if its share price does not improve in the following months. NYSE requires companies to have a minimum market cap of $50 million to trade on its exchange. Starrett currently does not pass that test. This does not seem like a significant risk given that Starrett could move to Nasdaq, of course at a cost.

Summary and conclusions

Starrett is showing revenue growth coupled with improved operations. As we have analyzed, its competitive landscape is not particularly beneficial but is not dangerous or risky either.

Starrett’s main operational risk stems from a global downturn in business, something that does not seem so far away these days. Such an event, generating a reduction in revenues, could reduce Starrett’s operating profits and put debt repayment at risk.

At the core of the problem are Starrett’s pension plans. Without them, Starrett could repay debt or accumulate cash and reduce market risks. Its situation could improve with higher long term interest rates.

The final conclusion is a difficult call because Starrett is truly trading at a significant discount, even after subtracting $5 million to $8 million from last few years’ earnings to account for the cash drain.

Our final opinion is that Starrett has improved its operations in such a way that it could withstand a significant reduction in revenues, for example a fall from $260 to $200 million yearly, without compromising debt repayments or plan contributions. Of course that would mean earning literally zero but this is a worst case scenario. In a middle ground scenario, pension contributions are reduced by higher interest rates while revenues continue at current levels, slowly ameliorating the financial position.

The situation is therefore quite speculative, but we believe that the discount is so big that it justifies some speculation, and therefore we rate with a buy.

Be the first to comment