ipopba

Investment Thesis

SLB (NYSE:SLB) or Schlumberger as it was previously known, is attempting to position itself beyond oilfield services toward embracing a more balanced portfolio that includes clean energy.

Last week, SLB had an Investor Day where it announced that SLB was increasing its capital return program, via dividends and buybacks.

Altogether, there’s a lot to be compelled towards SLB.

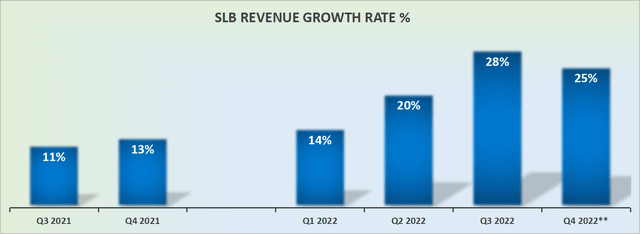

Revenue Growth Rates See Revenue Jumping Higher

SLB is an oilfield services provider. After a few years of negative y/y revenue growth rates, SLB is now looking to reposition itself in clean energy solutions.

SLB’s revenue growth rates

Given the positive traction in the oil sector, SLB also saw its revenues for Q3 2022 come out very strong.

Looking further ahead, SLB guides for approximately 15% CAGR into 2025. Needless to say, 2025 is a very long time away for a sector as volatile as the oil sector.

However, if SLB can indeed sustain a 15% CAGR into the end of 2023, investors would be quite willing to look at SLB in a very different light.

Near-term, SLB noted during its earnings call that Q4 should see revenues increasing by mid-20s%.

Profitability Profile in Focus

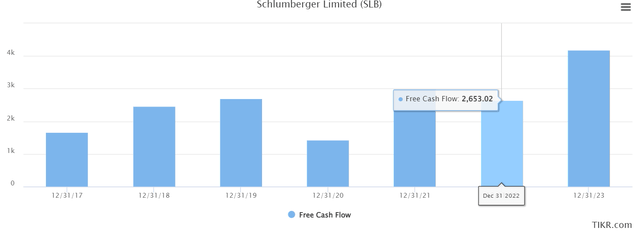

In Q3 2022, SLB saw its free cash flow increase to $1.1 billion. This was up from $671 million in the same period a year ago, an increase of approximately 64% y/y.

Without going any further, one can immediately understand the appeal of investing in SLB. The company is clearly oozing free cash flow right now.

Does that mean that its free cash flows continue to increase at this rate? On the contrary, the more pertinent insight considers the likelihood that its free cash flows could go in the other direction. Are these free cash flows sustainable?

If one believes that oil prices are going to remain elevated over the near term, there’s no reason to doubt the sustainability of these elevated free cash flows.

Clearly, given SLB’s capital return program, SLB fully believes in the sustainability of its free cash flows.

SLB Increases Capital Return Program

Looking ahead to April 2023, SLB is going to increase its quarterly dividend by 43% to $0.25. This annualizes at a dividend yield of 1.9%. That’s an increase from the 1.3% that the stock currently yields, but this increase isn’t likely to meaningfully change the investment thesis.

But what it does accomplish is that it provides a compelling narrative. As SLB renames and embraces a new vision for the company, it also substantially increases its base dividend payout by 43%. Said this way, doesn’t this look like an attractive narrative?

SLB also notes that it will resume its capital allocation program starting Q1 2023, but further details were absent. However, I believe that makes sense. What the market craves is a steady flow of good news, rather than getting all the good news all at once.

SLB Stock Valuation — 32x 2022 Free Cash Flow

SLB notes during the Q&A section of its earnings call that it expects working capital to reduce in Q4, leading to improved free cash flows relative to earnings.

With that in mind, let’s attempt to gain some perspective on SLB’s full-year free cash flows.

For Q3 2022 SLB reported $1.1 billion of free cash flow, bringing SLB’s trailing 9-month FCF to $563 million. Recall, the first half of 2022 saw working capital drag on free cash flow.

Could Q4 report $1.3 billion of free cash flow? Given everything we presently know, that seems possible. If that’s so, this would bring its full-year 2022 free cash flow to approximately $1.9 billion. This figure compares with analysts’ estimates of $2.7 billion.

TIKR.com

While I believe that $2.7 billion of free cash flow in 2022 might be a bit of a stretch, I’m inclined to meet halfway with analysts at approximately $2.3 billion.

That puts SLB priced at 32x this year’s free cash flow.

The Bottom Line

If one believes that we are in a new energy supercycle, and if one believes that SLB can indeed grow its revenues by 15% over the next few years, given SLB’s significant operating leverage, we could easily see SLB’s free cash flow in 2023 reaching close to $3.5 billion.

That would put the stock priced at approximately 21x next year’s free cash flows.

For its part, SLB signals that its stock is cheap, and is looking to return capital to shareholders via increased dividends and resuming its repurchase program.

The idea here is that SLB is embracing a new direction, and wants to be part of the new ”energy supercycle”. And if 2022 has taught investors and consumers globally anything is that energy is no longer as cheap and reliable as we previously assumed.

Hence, SLB is more likely than not to continue to benefit from this strong upstream demand. And print free cash flows along the way.

Be the first to comment