monticelllo/iStock Editorial via Getty Images

The price of coffee futures continues to move higher due to higher inflation and supply and demand issues. This is a threat to the bottom line of Starbucks (NASDAQ:SBUX) and we may see disappointing forecasts from the company in coming quarters.

Coffee prices remain elevated on supply and demand

Coffee prices were at one week highs this week as commodities remain supported by inflation.

Supply and demand was mixed with stronger demand from China and higher supply from Vietnam. The USDA Foreign Agricultural Service projected that China’s 2022 coffee imports would grow by +5% this year to 4 million bags. Also supportive of higher prices was dry weather in Brazil, with rainfall in the Minas Gerais area, which makes up 30% of Brazil’s arabica crop, was only 40% of the historical average.

On the bearish side, the Green Coffee Association reported this week that US March green coffee inventories rose +1.0% m/m and +2.5% y/y to 5.82 million bags.

With no end in sight to the Ukraine tensions, there are fears that Russia’s invasion of Ukraine will add to inflation, curb consumer spending, and reduce coffee consumption as consumers tighten their belts.

For Starbucks, that may not mean that coffee house visits are reduced, but that the average spend is reduced.

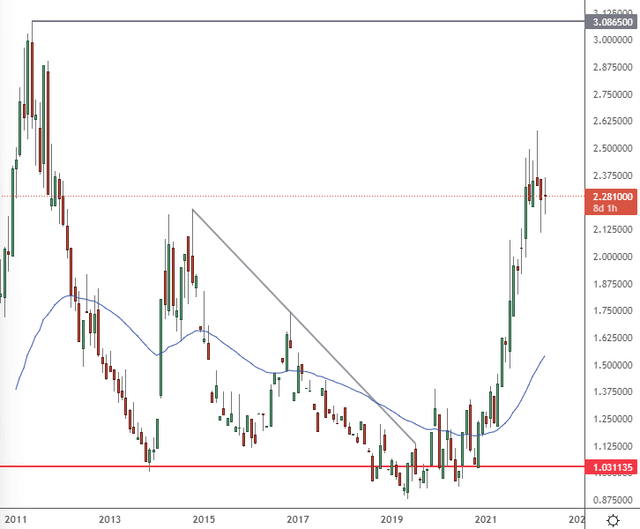

Signs of tighter global coffee supplies are providing a bullish stimulus for prices and pushed arabica coffee up to a 10-1/2 year nearest-futures highs on Feb 10. The International Coffee Organization also cut its global 2020/21 supply estimate to a deficit of -3.13 mln bags from a previous estimate of a +1.2 mln bag surplus.

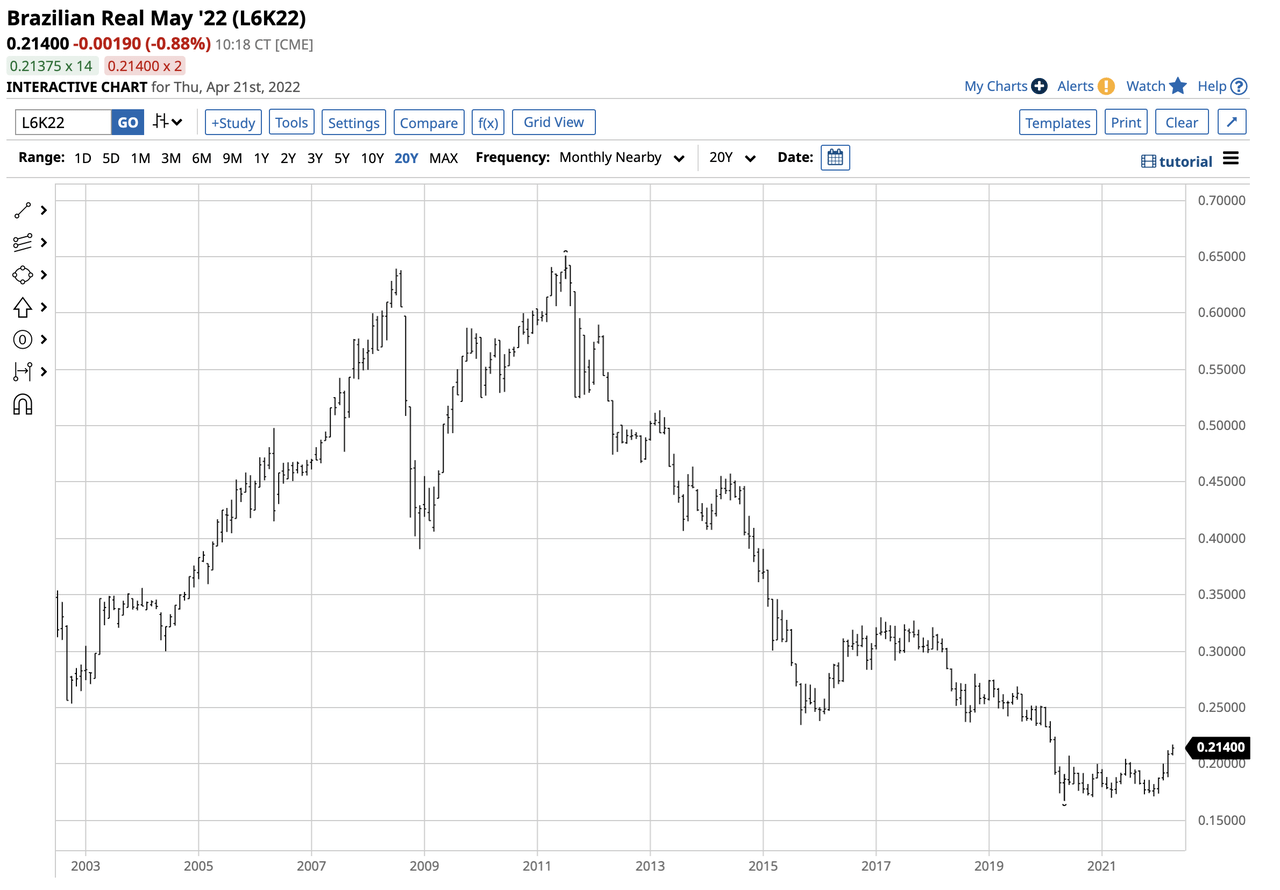

Another headwind would come from a potential structural low in the Brazilian Real. Brazilian production costs, including labor and other expenses, are in the Brazilian real. A falling real weighs on Arabica coffee’s price as Brazilian supplies have lower production costs and can fetch more dollars. A rising real has the opposite impact, pushing coffee prices higher.

Brazilian Real (v USD) (Barchart.com)

We can see a definite low in the Brazilian Real and the currency may look to test higher levels in the months ahead.

Higher input prices could hurt Starbucks

Starbucks could now face a tricky mix of lower consumer spending and higher input prices. If we take a look at the monthly chart of coffee prices on the NYMEX exchange, Starbucks has actually been supported by lower prices over the last six years. Price has now vaulted above the 2013-14 highs and with support here could test the highs of 2011.

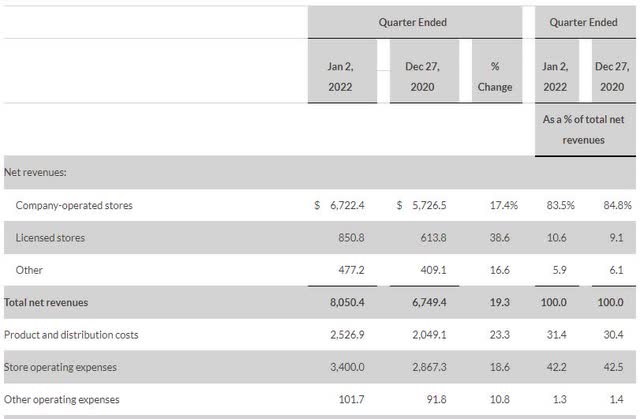

The company reported first quarter sales previously and showed that total net revenues were 19.3% higher from December 2020, but that product and distribution costs were up 23.3%. That gap could start to widen with higher costs for coffee.

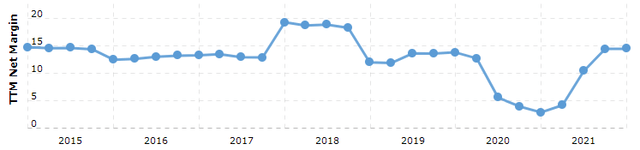

We can also see that net margins at the company are stagnant over that period where coffee prices were trailing the low levels.

SBUX Net Margin (Macro Trends)

The effects of elevated coffee prices will not be immediate due to hedging and the company’s cost structure but the company referred to the recent price increase as “volatility”. That means they are not expecting the higher prices to become the new normal for the sector.

“The volatility in the coffee market does not impact retail pricing plans, and our pricing strategy remains unchanged,” a Starbucks spokesperson told CNN.

Then CEO, Kevin Johnson, said they were able to avoid raising prices for customers because of its purchasing strategy. Starbucks has employed a number of tactics to make sure it can buy coffee beans at an “attractive cost,” according to Johnson. Those include buying coffee in advance to lock in prices, Johnson added.

“It gives us a significant advantage relative to our competitors who, if they don’t buy this far in advance, will certainly not have that cost structure that we put in place,” he explained.

“Usually coffee chains are hedged well ahead, but the length of coverage varies from company to company,” said Carlos Mera, head of Rabobank’s agricultural team.

Starbucks has had a good run on coffee prices since 2014, but if prices remain higher, the company will have to start locking in coffee at higher levels. That may not be as ‘transitory’ as the sector thinks.

Johnson said that the company buys green coffee “12-18 months” ahead. That means any locked-in prices at the lows of early-2021 in coffee futures are expiring in the second quarter.

SBUX stock looks bearish ahead of earnings

Starbucks announced this week that the company will release its second quarter earnings after the close on May 3.

The stock price has come under pressure in the last month and if see this bearish activity at the close of April then the next path is lower.

Starbucks stock has support coming in below at the $60-64 level. The company recently announced a dividend of $0.43 per share. That will be available to shareholders of record on May 13, 2022. That means investors will have to cross their fingers in the ten day period that follows earnings.

The stock was also downgraded recently by Citi due to the change of CEO, with the price target being downgraded from $120 to $91. The investment bank wanted to see more clarity from the founder Howard Schulz as he returns to the driving seat.

China sales and the elephant in the room

A further headwind for the company will come from the strict lockdowns in China, which are being enforced due to Coronavirus. The US and China make up 61% of the company’s global footprint and Starbucks also wanted to start a more aggressive expansion in China. In the first quarter results, China comparable store sales were down 14% and it is hard to see that getting better with the prolonged lockdowns.

There is actually an even bigger elephant in the room for Starbucks in China and that comes from sanctions. Senator Marco Rubio proposed sanctions against China if it helped Russia to get around the SWIFT monetary system ban. We also had Senator Lindsey Graham visiting Taiwan, which the Chinese referred to as “treading a dangerous path”. If hostilities continue between the US and China, will Starbucks have to suspend business operations in China in the same way they have done with Russia? That is a big problem for the coffee chain and its growth ambitions.

Starbucks is expected to post quarterly earnings of $0.60 per share in its upcoming release, which represents a year-over-year change of -3.2%. Revenues are forecast to be $7.63 billion, up 14.4% from the year-ago quarter. Production and distribution costs will be an important factor in this report.

I believe there is a chance that sales could underperform for this period into the end of March. However, the real problem will come from forward guidance and the following quarters. Operations have been suspended in Russia, while Chinese consumers are locked down in big cities like Shanghai. At home and in Europe, consumers are being squeezed by soaring inflation that could see them reduce their average spend.

Conclusion

Starbucks has benefited from cheap input costs for coffee for six years, but there is a risk that coffee prices remain elevated. Soaring inflation and supply and demand changes could change the dynamic for coffee companies. The company’s 2021 performance would have benefited from its hedging and purchasing strategy but it may not be so easy in 2022-23. The company buys 12-18 months ahead and will now see prices at almost ten-year highs. Add the headwind of a cost-of-living squeeze for consumers and I would not expect favorable conditions for net margins. There is also a threat coming from US and China relations which would dent Starbucks’ earnings and expansion plans in the country.

Be the first to comment