Khosrork

Many investors hate the Fed these days.

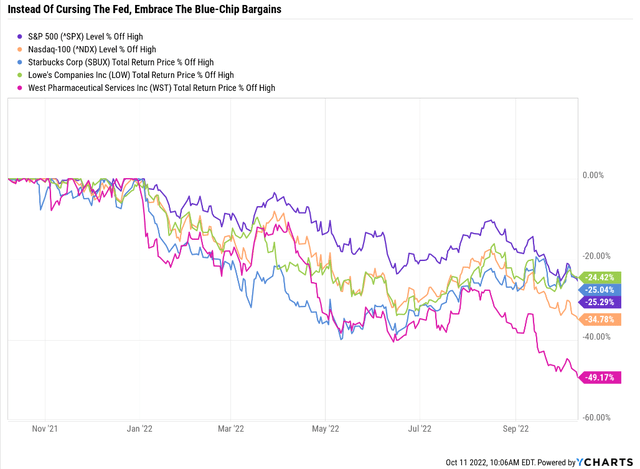

They correctly blame the Fed for partially being asleep at the inflation-wheel in 2021 and thus helping to drive some of the highest inflation in 41 years. This is what’s led to our current 25% bear market, and the short-term pain isn’t over yet.

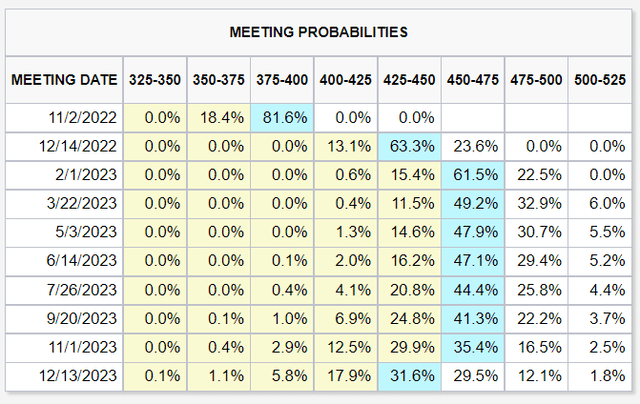

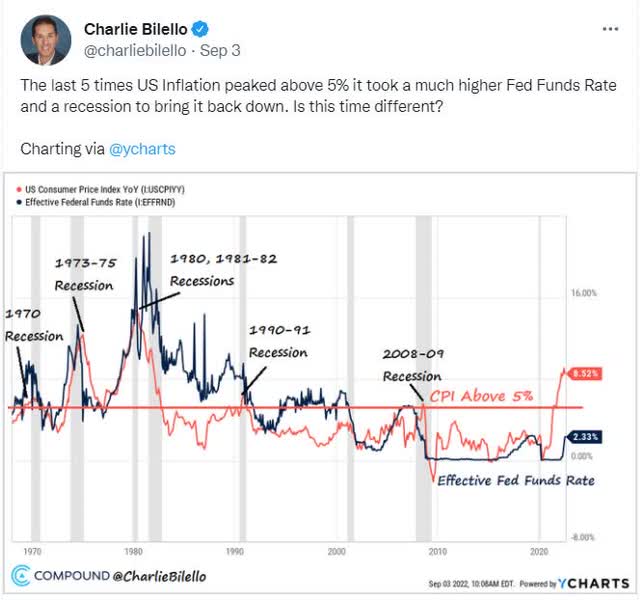

The Fed plans to hike to at least 4.5% in the coming months in an effort to prevent stagflation hell that UBS and Soc Gen warn could be coming if the Fed “pivots” and gives Wall Street what it wants.

This Is What Happens When The Fed Doesn’t Finish The Job

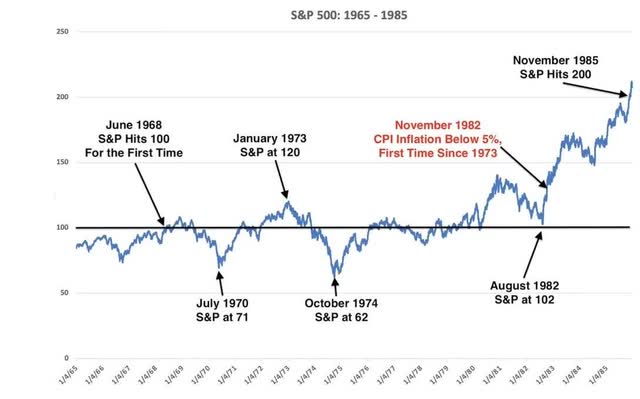

The market in the early 70s said it wanted a Fed pivot. They got several, resulting in four recessions within a decade, 11% unemployment, and interest rates that peaked at 20%.

What the market says it wants, and what’s actually good policy can be very different things.

Does the Fed deserve scorn for letting inflation run riot? Yes.

Do they deserve respect for being the toughest central bank in the G10 so far? You bet they do.

- the Bank of England just expanded its QE bond-buying program to prevent “market dysfunction”

- the European Central Bank has yet to start QT and is preparing a program to buy Italian bonds if their yields get too high

- the Bank of Japan is still buying bonds to this very day, to cap 10-year yields at 0.25%

As painful as a short 2023 recession is likely to be, it’s a lot better than the alternative, a 48% to 53% market crash that comes as part of a lost decade for stocks due to stagflation hell.

The Fed’s inflation-fighting warpath is not good, it’s just the least bad option, and I’m glad they appear to have the steel backbone necessary to ignore the peanut gallery that is the stock market and politicians calling for the Fed to pivot now before they start a recession.

Once inflation goes over 5% there is no realistic alternative to recession. At least we’ve never avoided one in such a scenario. So let’s rip off the band aid, solve inflation by 2025 (the Fed’s plan) and get back to positive growth in 2024.

- Bank of America thinks the 2023 recession runs from Q1 to Q3

- Deutsche Bank Q3 to Q4

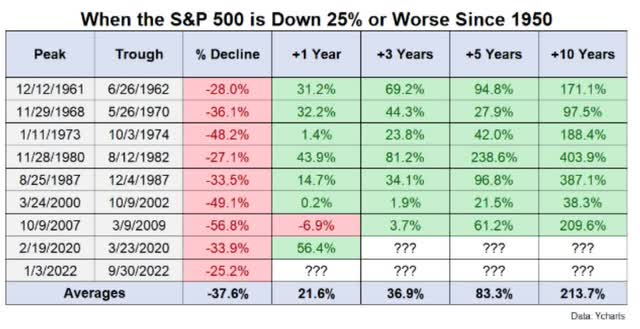

Do you know what the stock market does after a recession? Or even just 25% bear markets?

The average one-year gain is 22%. And that’s not measuring from the market bottom but the first time the S&P hits -25%.

When this stagflationary bear market is over, we’re likely to see a decade-long bull market where stocks historically more than triple.

But if you buy the right undervalued blue-chip you can achieve 6X to 12X returns.

Today 82% of the Dividend Kings 500 Master List is fair value or better. Blue-chip bargains are all around us, raining from the sky like raindrops in a monsoon.

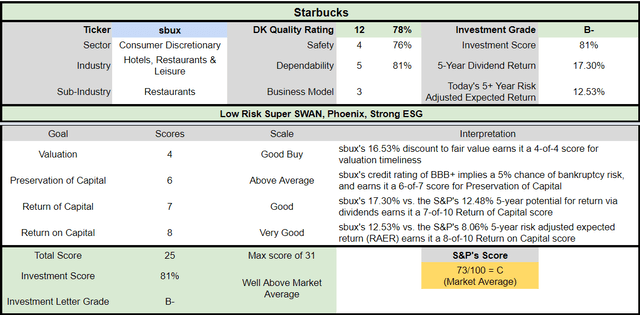

Dividend Kings members have asked me for an update on Starbucks (NASDAQ:SBUX), one of the best dividend stocks in history. After a careful analysis of SBUX, I can confirm it’s a wonderful company, at an attractive price.

If you buy SBUX today, no matter what happens to the market in the next few months, you’re likely to be very happy in 5+ years, and in a decade will probably feel like a stock market genius.

But when everything is on sale, it’s worth considering alternatives. That’s why I always want to highlight West Pharmaceutical Services (WST) and Lowe’s (LOW) as the two fastest-growing dividend aristocrat bargains.

If you can stay calm and look beyond the pain of 2022 and 2023, wonderful income and profits are coming. And if you buy SBUX, WST, and LOW today, you’ll likely be drowning in safe dividends and potentially life-changing profits in a decade.

Why Starbucks Is A Potentially Great Buy Today

Here is the bottom line up front on SBUX.

Reasons To Potentially Buy Starbucks Today

| Metric | Starbucks |

| Quality | 78% 12/13 Super SWAN (Sleep Well At Night) Quality Company |

| Risk Rating | Low Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 321 |

| Quality Percentile | 37% |

| Dividend Growth Streak (Years) | 12 |

| Dividend Yield | 2.5% |

| Dividend Safety Score | 76% |

| Average Recession Dividend Cut Risk | 1.0% |

| Severe Recession Dividend Cut Risk | 2.50% |

| S&P Credit Rating | BBB+ Stable |

| 30-Year Bankruptcy Risk | 5.00% |

| Consensus LT Risk-Management Industry Percentile | 71% Good |

| Fair Value | $103.75 |

| Current Price | $85.93 |

| Discount To Fair Value | 17% |

| DK Rating |

Potentially Good Buy |

| PE | 29.1 |

| Cash-Adjusted PE | 19.4 |

| Historical PE | 28.5 to 31 |

| LT Growth Consensus/Management Guidance | 14.4% |

| 5-year consensus total return potential |

14% to 20% CAGR |

| Base Case 5-year consensus return potential |

18% CAGR (3X the S&P 500) |

| Consensus 12-month total return forecast | 16% |

| Fundamentally Justified 12-Month Return Potential | 23% |

| LT Consensus Total Return Potential | 16.9% |

| Inflation-Adjusted Consensus LT Return Potential | 14.6% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 3.91 |

| LT Risk-Adjusted Expected Return | 11.24% |

| LT Risk-And Inflation-Adjusted Return Potential | 8.95% |

| Conservative Years To Double | 8.05 vs. 15.3 S&P |

(Source: Dividend Kings Zen Research Terminal)

SBUX isn’t a screaming buy, though it is a potentially good buy.

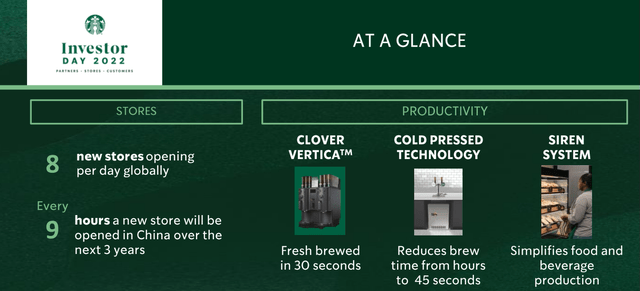

Its growth outlook has been boosted by about 2% annually by the long-term growth plan outlined in its most recent investor day.

(Source: investor presentation)

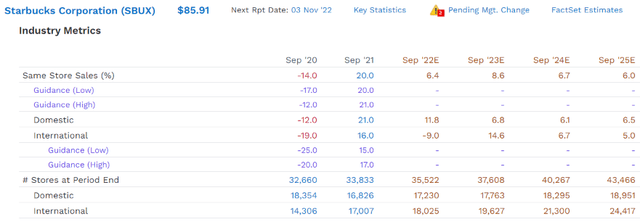

SBUX plans to open almost 3,000 more stores in China over the next three years.

That’s approximately 45% of the 7,000 new stores analysts think SBUX will open on its way to over 43,000 locations in 2025.

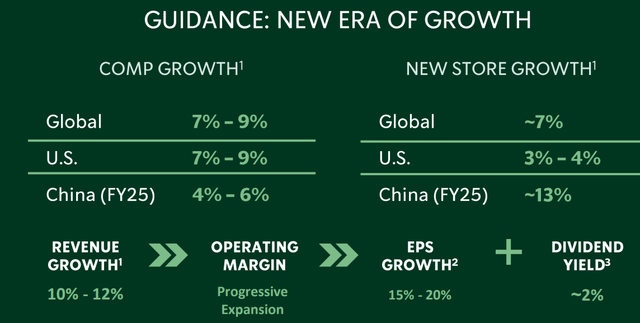

Combined with steady and impressive same-store sales growth of 6% to 7% per year, that’s what has analysts now expecting 10.6% CAGR revenue growth over the next five years.

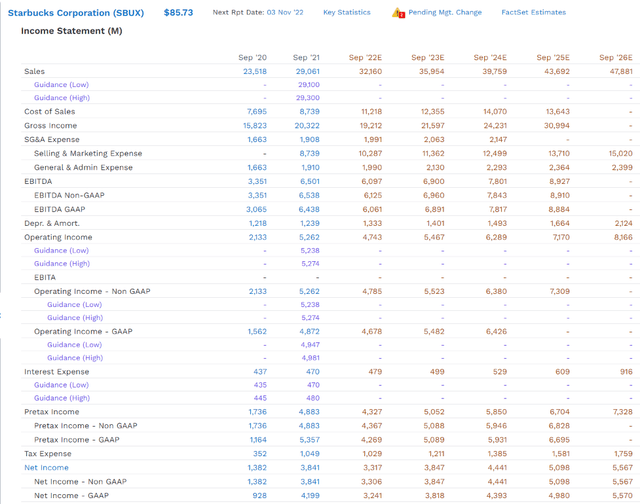

FactSet Research Terminal (Source: investor presentation)

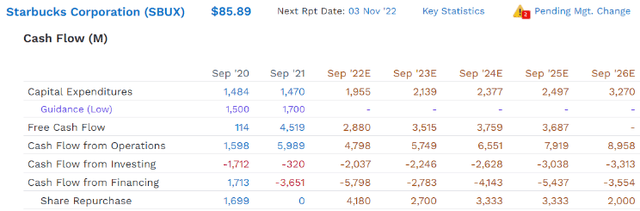

That’s within management’s guidance of 10% to 12% annual sales growth. Combined with cost-cutting and buybacks is expected to deliver 15% to 20% annual earnings growth and 17% to 22% CAGR long-term total returns.

The growth plan is expected to result in SBUX doubling its growth spending to almost $3.3 billion by 2026.

Free cash flow is expected to be healthy but constrained by the growth spending, though analysts expect a very generous buyback program.

- $15.5 billion in cumulative buybacks through 2026

- 15.5% of existing shares at current valuations

Even with the potential for 3.3% annual buybacks, analysts aren’t as bullish as management about SBUX’s growth outlook.

The median long-term growth consensus from all 34 analysts covering SBUX is for 14.4% CAGR growth, which is still exceptional.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| Starbucks | 2.5% | 14.4% | 16.9% | 11.8% | 9.6% | 7.5 | 2.50 |

| Schwab US Dividend Equity ETF | 3.8% | 8.5% | 12.3% | 8.6% | 6.4% | 11.3 | 1.86 |

| Nasdaq | 0.8% | 11.5% | 12.3% | 8.6% | 6.4% | 11.3 | 1.86 |

| Dividend Aristocrats | 2.8% | 8.7% | 11.5% | 8.1% | 5.8% | 12.3 | 1.76 |

| S&P 500 | 1.8% | 8.5% | 10.3% | 7.2% | 5.0% | 14.4 | 1.63 |

(Source: DK Research Terminal, FactSet, Morningstar, YCharts)

If management delivers most of its planned growth, then SBUX could run circles around most popular investment strategies. That includes high-yield blue-chips, the aristocrats, S&P, and even the Nasdaq.

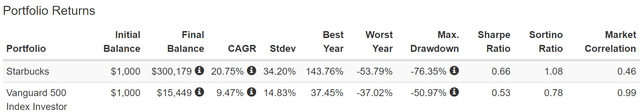

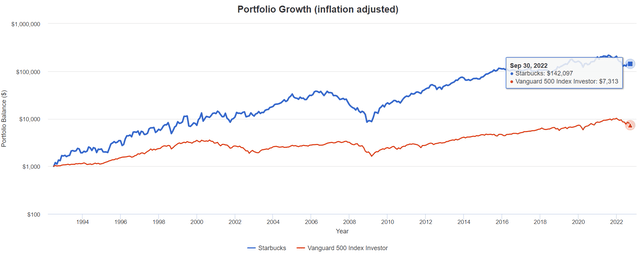

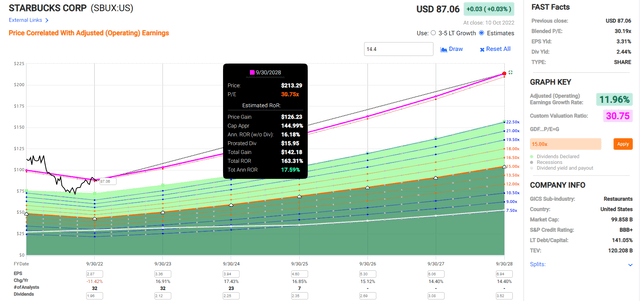

Starbucks Historical Returns Since July 1992

(Source: Portfolio Visualizer Premium)

17% to 22% CAGR long-term returns from SBUX aren’t that outlandish, given that the company has delivered 21% annual returns for the last 30 years.

(Source: Portfolio Visualizer Premium)

That’s a 142X inflation-adjusted return, or 20X better than the S&P 500.

(Source: Portfolio Visualizer Premium)

In fact, 17% to 22.5% CAGR returns are SBUX’s historical returns over the past third of a century.

What if SBUX delivers on that growth guidance, which analysts think is reasonable?

Inflation-Adjusted Consensus Total Return Potential: $1,000 Initial Investment

| Time Frame (Years) | 8.1% CAGR Inflation-Adjusted S&P 500 Consensus | 9.3% Inflation-Adjusted Aristocrat Consensus | 14.7% CAGR Inflation-Adjusted SBUX Consensus | Difference Between Inflation-Adjusted SBUX Consensus And S&P Consensus |

| 5 | $1,474.78 | $1,558.49 | $1,983.53 | $508.75 |

| 10 | $2,174.97 | $2,428.88 | $3,934.38 | $1,759.41 |

| 15 | $3,207.60 | $3,785.39 | $7,803.96 | $4,596.37 |

| 20 | $4,730.50 | $5,899.48 | $15,479.38 | $10,748.89 |

| 25 | $6,976.43 | $9,194.27 | $30,703.80 | $23,727.37 |

| 30 | $10,288.69 | $14,329.16 | $60,901.86 | $50,613.17 |

(Source: DK Research Terminal, FactSet Research)

If SBUX is able to achieve management’s growth guidance, even the low end of it, then SBUX could potentially deliver similar stellar returns in the future, as much as 61X real returns over the next three decades.

| Time Frame (Years) | Ratio Inflation-Adjusted SBUX Consensus/Aristocrat Consensus | Ratio Inflation-Adjusted SBUX Consensus vs. S&P consensus |

| 5 | 1.27 | 1.34 |

| 10 | 1.62 | 1.81 |

| 15 | 2.06 | 2.43 |

| 20 | 2.62 | 3.27 |

| 25 | 3.34 | 4.40 |

| 30 | 4.25 | 5.92 |

(Source: DK Research Terminal, FactSet Research)

That’s potentially 4X more than the dividend aristocrats and 6X more than the S&P 500.

But you don’t have to wait for decades to make a lot of money on SBUX.

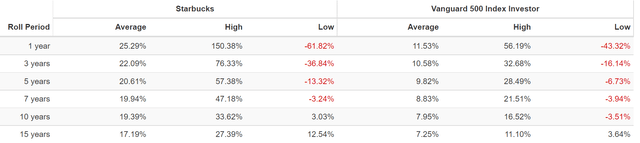

Starbucks 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If SBUX grows as expected and returns to historical fair value, then it could deliver nearly 80% returns or almost 20% annually through September 2025.

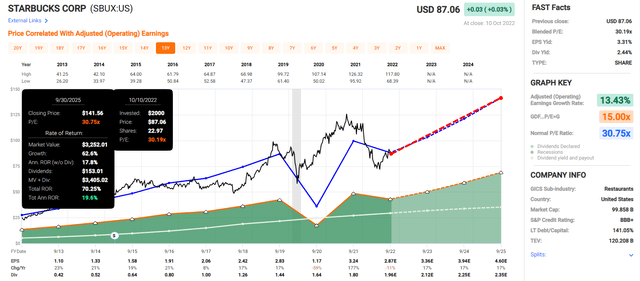

Starbucks 2028 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If SBUX delivers the low end of management’s growth guidance through 2028, a return to fair value could deliver 164% total returns or a very impressive 18% annually.

- 14% to 20% CAGR growth consensus range

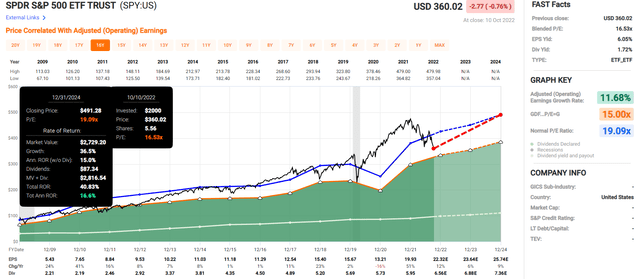

Now compare that to the 10% undervalued S&P 500.

S&P 500 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

At the moment, analysts expect almost 17% annular returns from the market in the coming years, a nice reward for those who have been patiently waiting for stocks to become attractively valued.

S&P 500 2027 Consensus Total Return Potential

| Year | Upside Potential By the End of That Year | Consensus CAGR Return Potential By the End of That Year | Probability-Weighted Return (Annualized) |

Inflation And Risk-Adjusted Expected Returns |

| 2027 | 66.29% | 10.71% | 8.03% | 5.81% |

(Source: Dividend Kings S&P 500 Valuation Tool)

Over the next five years, analysts think the market can deliver a solid 11% annual return or 66%.

- SBUX has almost 3X better return potential than the S&P

SBUX Corp Investment Decision Score

DK (Source: Dividend Kings Automated Investment Decision Tool)

SBUX is a potentially good fast-growing dividend blue-chip opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 17% discount to fair value vs. 10% S&P = 16% better valuation

- 2.5% very safe yield vs. 1.9% S&P (but growing much faster)

- 70% higher annual long-term return potential

- 50% higher risk-adjusted expected returns

- 50% more consensus 5-year income

Anyone buying SBUX today is making a reasonable and prudent long-term decision.

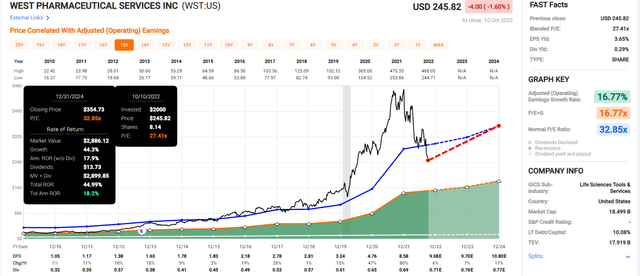

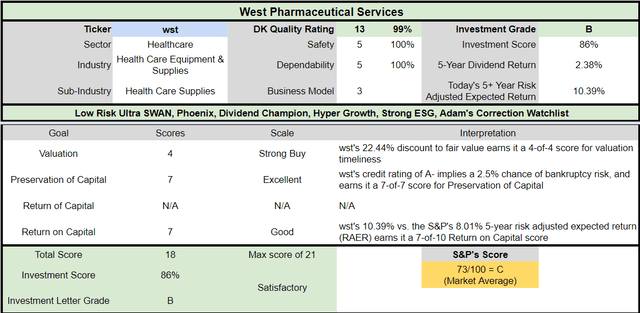

West Pharmaceutical Services: The Fastest Growing Dividend Aristocrat

Further Reading

West Pharma is one of the best dividend champions you’ve never heard of.

- 29-year dividend growth streak

What West Pharma Does

West Pharmaceutical Services is the global market leader in injectable therapeutics’ primary packaging and delivery components. Primary packaging is the material that first envelops a drug product, and safe production of drug-delivery packaging is critical for the successful delivery of pharmaceutical products. Packaging must ensure drugs don’t leak into the surrounding material and vice versa. Because of the mission-critical nature of these components, it’s important for customers to trust the quality of manufacturing and design.

West maintains a roughly 70% share of the market in injectable primary packaging, with the remaining 30% split between Switzerland’s Datwyler and narrow-moat AptarGroup. West competes in an oligopoly, and while price can be a factor, West is primarily chosen as a vendor for its quality reputation and supply chain expertise. The firm’s massive scale, at more than 40 billion components per year, limits the chance of component shortages, as many components can be made in a different facility if any one plant faces difficulties. – Morningstar

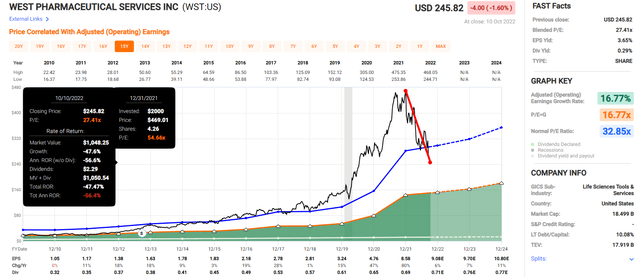

WST is the dominant name in injectable packaging for drugs with a 70% market share, and naturally, the Pandemic was a major boon to growth.

WST became massively overvalued and has now been cut in half in just nine months.

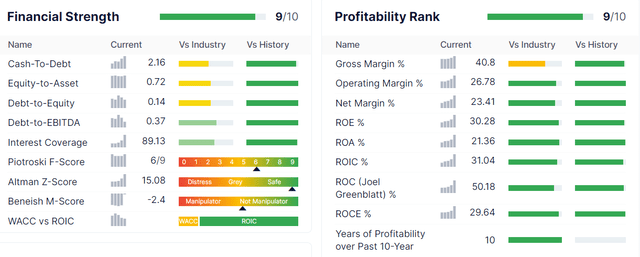

But there’s nothing wrong with the cash-rich, wide-moat business.

The balance sheet is a fortress, with more than 2X as much cash and contractual obligations.

- effectively an A-rated company if it bothered to pay for a rating

- 2.5% 30-year bankruptcy risk

And despite a slowdown in short-term growth, analysts are very bullish on WST’s growth prospects.

WST has the fastest long-term growth consensus of any dividend champion…not just in America but the entire world.

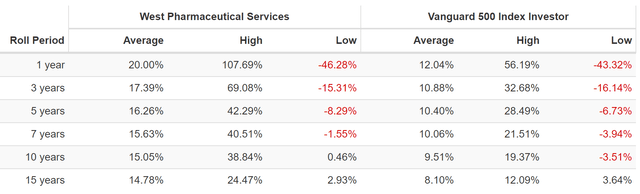

WST Rolling Returns Since 1988

The demand for injectable drug packaging is expected to grow with an aging population and potentially drive WST’s long-term growth to even more than its historically impressive 20% annual rate.

Reasons To Potentially Buy West Pharma Today

| Metric | West Pharmaceutical Services |

| Quality | 99% 13/13 Ultra SWAN (Sleep Well At Night) Quality Dividend Champion |

| Risk Rating | Low Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 11 |

| Quality Percentile | 98% |

| Dividend Growth Streak (Years) | 29 |

| Dividend Yield | 0.30% |

| Dividend Safety Score | 100% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.00% |

| S&P Credit Rating |

Effective A- stable |

| 30-Year Bankruptcy Risk |

2.5% |

| Consensus LT Risk-Management Industry Percentile | 72% Good |

| Fair Value | $311.81 |

| Current Price | $241.68 |

| Discount To Fair Value | 22% |

| DK Rating |

Potentially Strong Buy |

| PE | 25.6 |

| Cash-Adjusted PE | 17.7 |

| Historical PE | 25 to 37 |

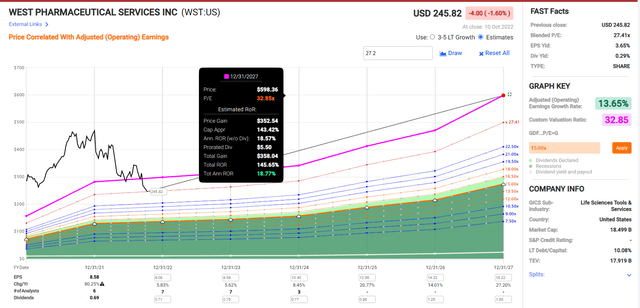

| LT Growth Consensus/Management Guidance | 27.2% |

| PEG Ratio | 0.65 (hyper-growth at a wonderful price) |

| 5-year consensus total return potential |

9% to 29% CAGR |

| Base Case 5-year consensus return potential |

18% CAGR (3X the S&P 500) |

| Consensus 12-month total return forecast | 59% |

| Fundamentally Justified 12-Month Return Potential | 29% |

| LT Consensus Total Return Potential | 27.5% |

| Inflation-Adjusted Consensus LT Return Potential | 25.2% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 9.47 |

| LT Risk-Adjusted Expected Return | 19.19% |

| LT Risk-And Inflation-Adjusted Return Potential | 16.90% |

| Conservative Years To Double | 4.26 |

(Source: Dividend Kings Zen Research Terminal)

WST’s sub-18 cash-adjusted PE gives it a PEG ratio of 0.65, a very reasonable valuation for a company of this quality and growth potential.

West Pharma 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

WST growing as expected and returning to historical pre-pandemic valuations could result in 18% annual returns through 2024 or an attractive 45% total return.

West Pharma 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If WST grows as expected through 2027, it could deliver nearly 150% total returns or 19% annually.

- Buffett-like return potential from one of the best dividend champion bargains you’ve never heard of

WST Corp Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

WST is a potentially good hyper-growth aristocrat opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 22% discount to fair value vs. 10% S&P = 12% better valuation

- 3X higher annual long-term return potential

- 25% higher risk-adjusted expected returns

If you’re looking for supreme quality and the fastest consensus growth rate of any dividend aristocrat, WST is a potentially strong buy option today.

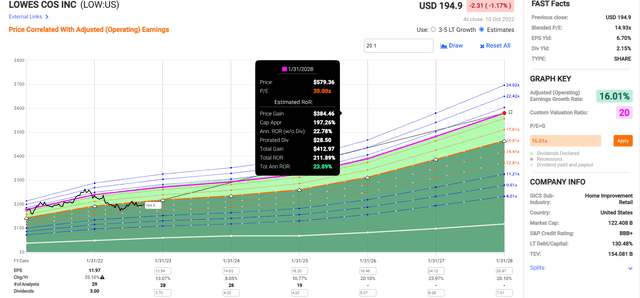

Lowe’s: As Close To God’s Own Dividend Stock As Exists On Wall Street

Further Reading

- Lowe’s: This Buffett-Style Dividend Aristocrat Could Potentially Triple In 5 Years

- a full deep dive on LOW’s growth plans, growth outlook, risk profile, valuation, and total return potential

Reasons To Potentially Buy Lowe’s Today

| Metric | Lowe’s |

| Quality | 100% 13/13 Ultra SWAN (Sleep Well At Night) Quality Dividend King |

| Risk Rating | Very Low Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 1 |

| Quality Percentile | 100% |

| Dividend Growth Streak (Years) | 60 |

| Dividend Yield | 2.1% |

| Dividend Safety Score | 100% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.00% |

| S&P Credit Rating | BBB+ Stable |

| 30-Year Bankruptcy Risk | 5.00% |

| Consensus LT Risk-Management Industry Percentile | 72% Good |

| Fair Value | $283.95 |

| Current Price | $197.70 |

| Discount To Fair Value | 30% |

| DK Rating |

Potentially Very Strong Buy |

| PE | 13.5 |

| Cash-Adjusted PE | 11.1 |

| Growth Priced In | 5.2% |

| Historical PE | 19 to 21 |

| LT Growth Consensus/Management Guidance | 20.1% |

| PEG Ratio | 0.55 (Hyper-growth at a wonderful price) |

| 5-year consensus total return potential |

20% to 26% CAGR |

| Base Case 5-year consensus return potential |

24% CAGR (3.5X the S&P 500) |

| Consensus 12-month total return forecast | 41% |

| Fundamentally Justified 12-Month Return Potential | 46% |

| LT Consensus Total Return Potential | 22.2% |

| Inflation-Adjusted Consensus LT Return Potential | 19.9% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 6.15 |

| LT Risk-Adjusted Expected Return | 14.76% |

| LT Risk-And Inflation-Adjusted Return Potential | 12.47% |

| Conservative Years To Double | 5.77 |

(Source: Dividend Kings Zen Research Terminal)

LOW scores 100% safety and quality on the DK 300-point quality system, as close to a perfect dividend growth stock as exists on Wall Street.

- the highest quality company on the DK 500 Master List

That Master List includes:

- every dividend aristocrat

- every dividend king

- every dividend champion (including foreign ones)

- every Ultra SWAN (wide moat aristocrats and future aristocrats, as close to perfect quality companies as exist)

- the 15% highest quality REITs in America according to iREIT

- 40 of the best growth stocks

To be #1 in quality among the world’s best blue-chips means LOW is as close to God’s own dividend stock as exists in this world.

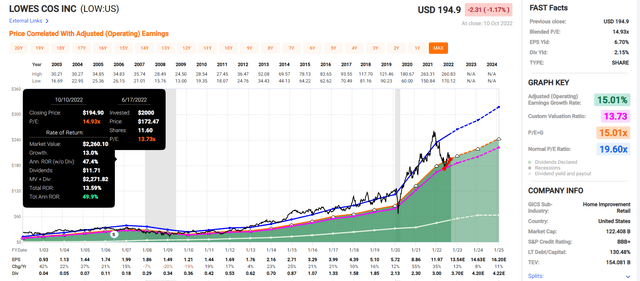

LOW hit a PE that it normally only achieves in recessionary bear market lows a few weeks ago.

LOW is up 14% off its lows but remains so undervalued that analysts expect it to soar 41% in the next year alone.

- a 46% gain in the next year would be justified by its fundamentals

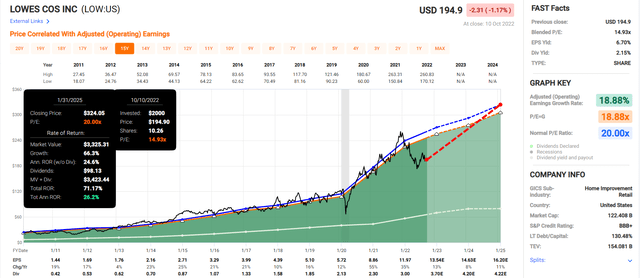

Lowe’s 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If LOW grows as expected and returns to historical market-determined fair value of 20X earnings, then investors can make 26% annual returns over the next few years.

Lowe’s 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

LOW can still potentially more than triple over the next five years, delivering a Buffett-like 24% annual return or 211% by early 2028.

- 3.5X more than the S&P 500

- almost 50% more than SBUX

LOW Corp Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

LOW is a potentially good hyper-growth aristocrat opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 30% discount to fair value vs. 10% S&P = 20% better valuation

- 2.1% very safe yield vs. 1.9% S&P (slightly higher but growing over 20%)

- 120% higher annual long-term return potential

- 2.5X higher risk-adjusted expected returns

- 50% more consensus 5-year income

Bottom Line: Starbucks Is A Bargain But So Are These Faster-Growing Dividend Aristocrats

Let me be clear that safety and quality, including Sleep Well at Night quality, have nothing to do with stock price.

Sleep Well At Night doesn’t mean “can’t fall hard in a bear market.”

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck

While I can’t predict the market in the short term, here’s what I can tell you about SBUX.

SBUX is a wonderful wide-moat Super SWAN quality blue-chip with a beloved brand that continues to gain traction overseas, especially in China.

Management’s plans to aggressively growth its store count while maximizing the value of its app to drive 6% to 7% same-store sales are reasonable and could drive 10% to 12% sales growth.

Combined with margin expansion from cost-cutting and up to 3.3% per year worth of buybacks, has management guiding for incredible (but historically proven) 17% to 22.5% annual returns.

Analysts “only” expect 17% long-term returns from SBUX, but that’s almost 70% more than the S&P 500.

Today SBUX is about 16% historically undervalued and a potentially good buy for long-term investors who are looking beyond the 2023 recession.

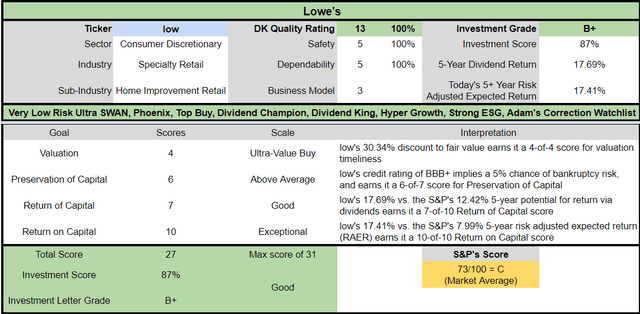

But WST and LOW are two faster-growing and higher quality dividend aristocrats that potentially can run circles around even a growth power-house like SBUX.

I own SBUX and LOW myself, but if I were forced to buy just one of these companies today, it would be Lowe’s for a few reasons.

- 100% quality Ultra SWAN dividend king = as close to God’s own dividend stock as exists on Wall Street

- 60-year dividend growth streak

- the lowest cash-adjusted PE

- 30% historically undervalued

- the potential to more than triple in five years

But with any of these world-beater blue-chips investors who can look past the doom and despair stalking Wall Street today are likely to be very happy over the next five years.

And in 10+ years? You’ll likely feel like a stock market genius. And you know what? You will be.

To paraphrase Napoleon, a stock market genius is:

The investor who can do the average thing when everyone else around him/her is losing their mind.

Be the first to comment