nespix

A Quick Take On Zeta Global Holdings

Zeta Global (NYSE:ZETA) went public in June 2021, raising approximately $215 million in gross proceeds from an IPO that priced at $10.00 per share.

The firm provides a digital omnichannel marketing platform to enable enterprises to improve their online marketing results.

While Zeta faces a variety of uncertainties, the firm’s position in a changing advertising market, the stock’s low valuation and management’s continued investment in its go-to-market initiatives mean that ZETA is a potential opportunity for patient investors.

For patient investors, my outlook for ZETA is a Buy at around $4.75 per share.

Zeta Global Overview

New York, NY-based Zeta was founded to develop advanced online advertising capabilities for companies to generate greater returns from their online marketing efforts.

Management is headed by co-founder, Chairman and CEO David Steinberg, who has been with the firm since and was previously founder and CEO of InPhonic, a wireless phone and communications products company.

The company’s primary offerings include:

-

Opportunity Explorer

-

Identity Graph

-

Intent Graph

-

APIs

The firm pursues primarily large sized clients across all major industry verticals via a direct sales model.

Zeta’s Market & Competition

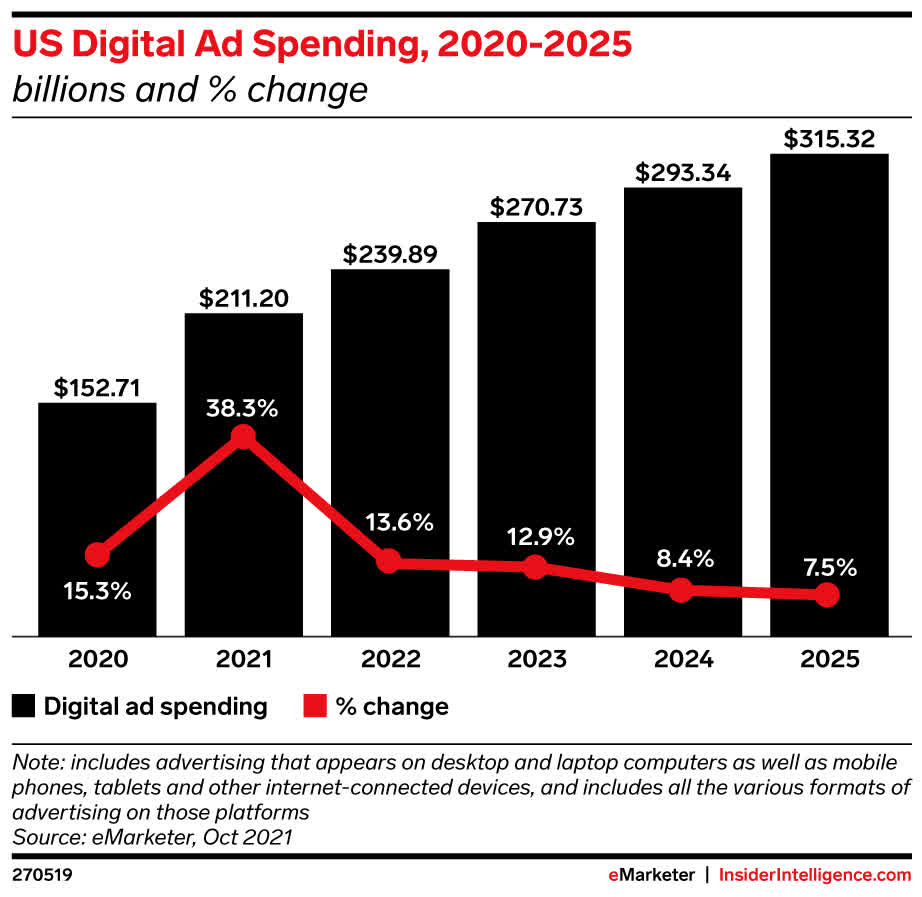

According to a market research note by eMarketer, the market for digital ad spending was an estimated $153 billion in 2020 and is forecast to reach $315 billion by 2025.

In 2020, despite the global pandemic, digital ad spending grew by 15.3%.

The note asserts that 2021 saw significantly increased digital advertising growth after a slower than expected 2020, but that future growth rates will decline through 2025.

The chart below shows the report’s forecasted growth trajectory and digital ad spend percentage of total, from 2020 to 2025:

U.S. Digital Ad Spending (eMarketer)

Potential competitors include:

-

Google

-

Adobe

-

Yahoo

-

Meta

-

Oracle

-

Skai

-

Amazon

-

Criteo

- Salesforce

Zeta’s Recent Financial Performance

-

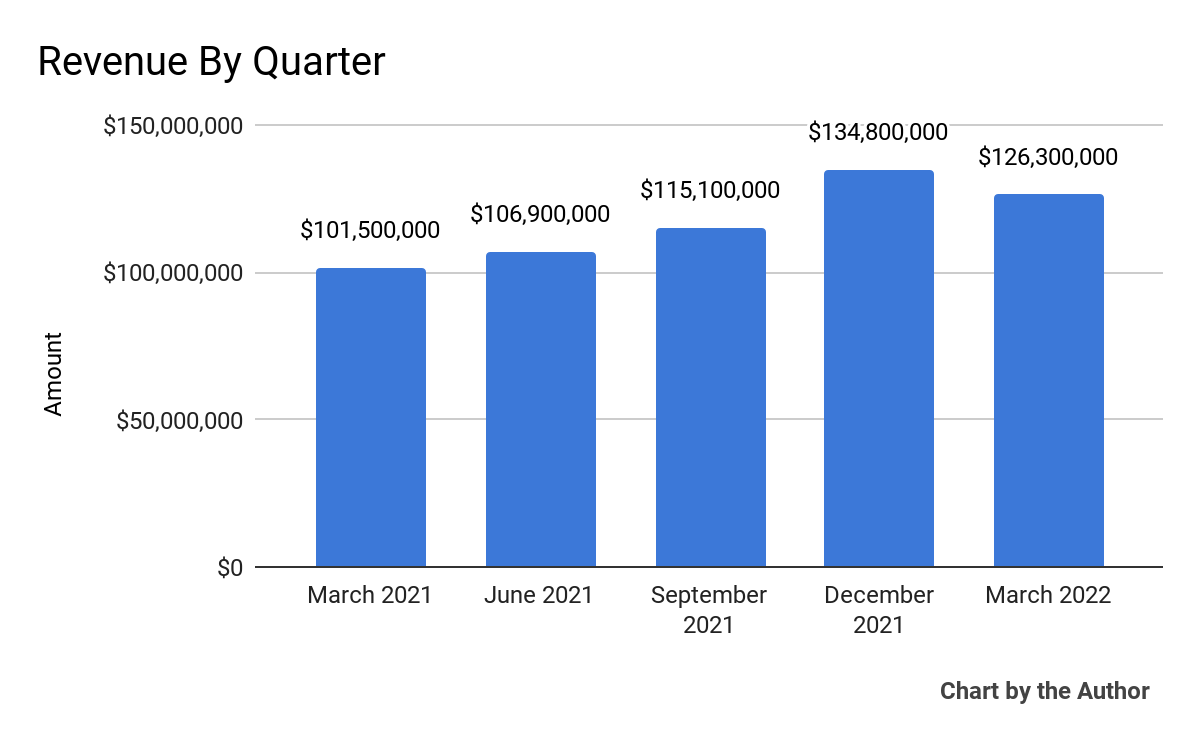

Total revenue by quarter has grown markedly over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

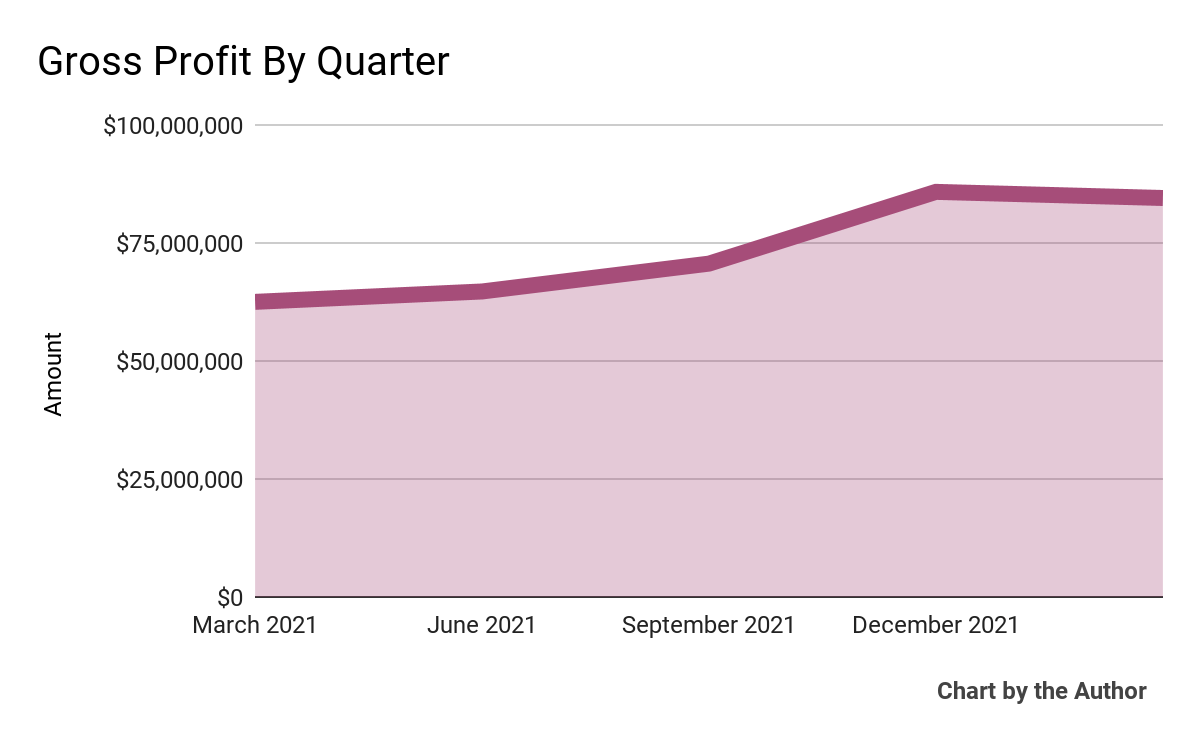

Gross profit by quarter has grown but plateaued recently:

5 Quarter Gross Profit (Seeking Alpha)

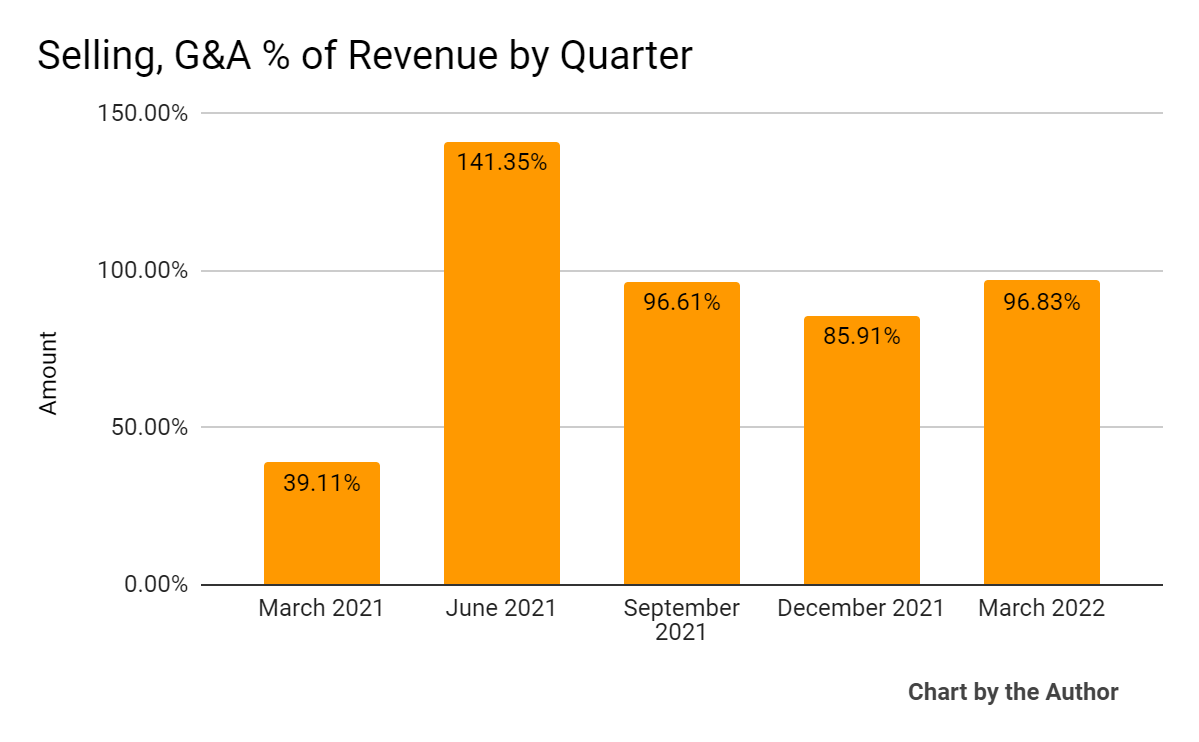

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

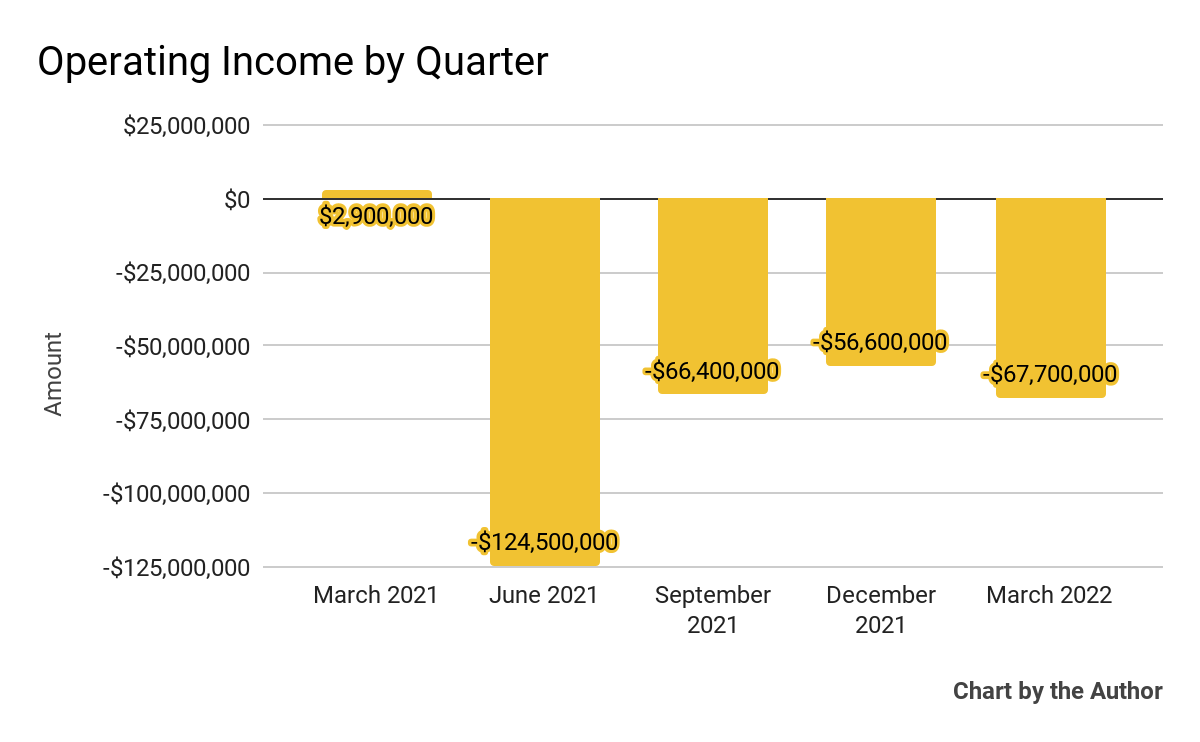

Operating losses by quarter have remained significant in the past 4 quarters:

5 Quarter Operating Income (Seeking Alpha)

-

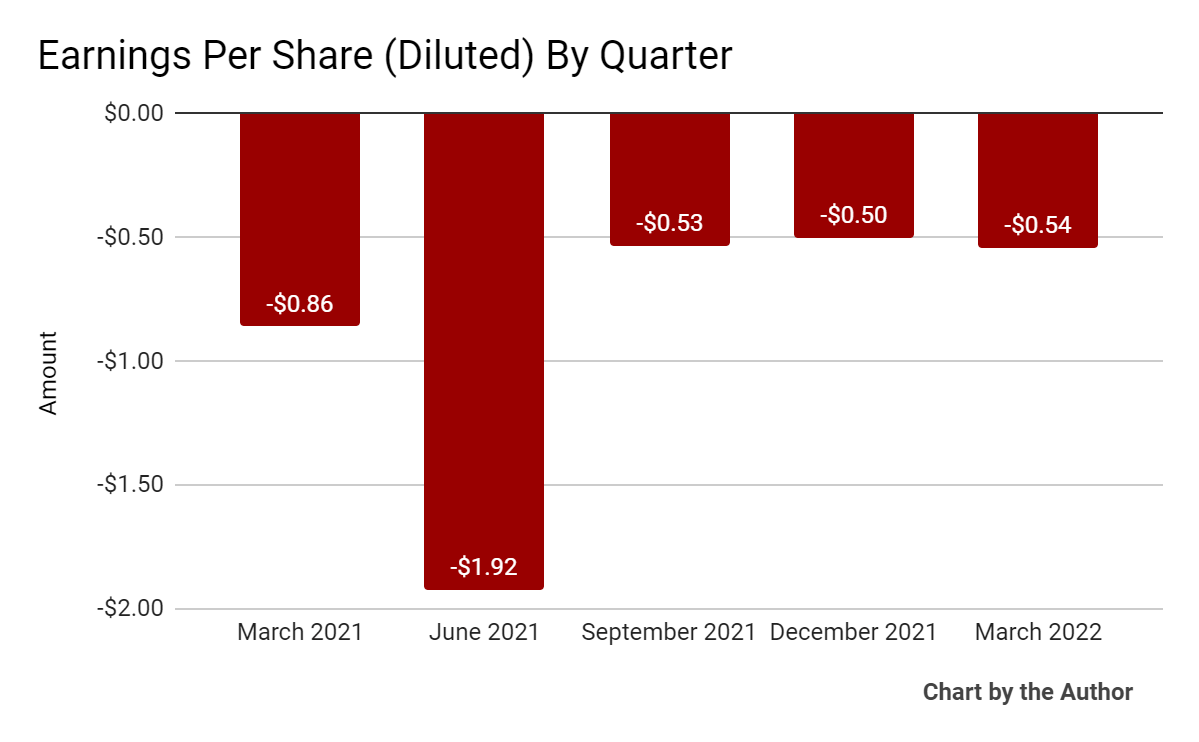

Earnings per share (Diluted) have also remained heavily negative:

5 Quarter Earnings Per Share (Seeking Alpha)

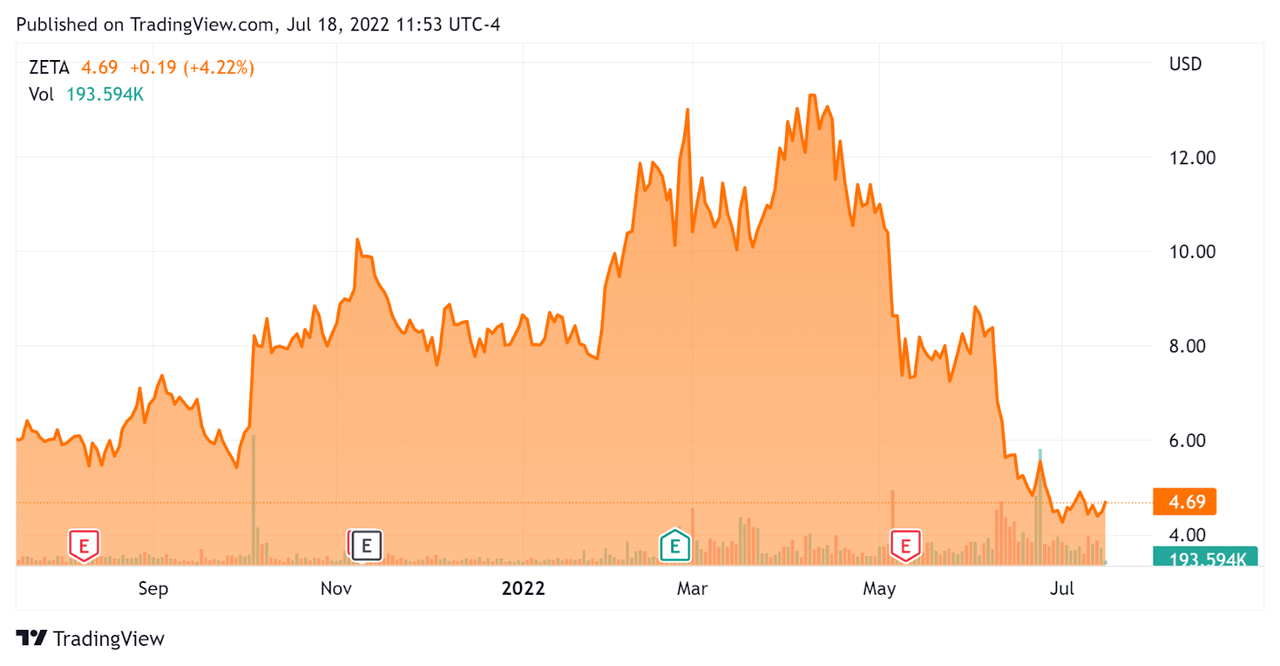

In the past 12 months, ZETA’s stock price has fallen 22.4 percent vs. the U.S. S&P 500 index’s drop of around 10.6 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Zeta

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$993,010,000 |

|

Market Capitalization |

$913,180,000 |

|

Enterprise Value / Sales [TTM] |

2.06 |

|

Price / Sales [TTM] |

1.05 |

|

Revenue Growth Rate [TTM] |

24.42% |

|

Operating Cash Flow [TTM] |

$59,860,000 |

|

CapEx Ratio |

3.74 |

|

Earnings Per Share (Fully Diluted) |

-$3.49 |

(Source – Seeking Alpha)

Commentary On Zeta Global

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the lack of dependency on third party cookies which are being restricted by the major mobile platforms.

Notably, the firm gained a major apparel retailer while replacing the Salesforce Marketing Cloud with its ‘all-in-one’ Zeta Marketing Platform system.

Zeta also recently launched Agile Intelligence, which serves to answer ‘the most pressing questions for an enterprise, such as which markets and customer segments represent the most valuable opportunities for investment.’

As to its financial results, total revenue grew by 24% year-over-year, exceeding guidance driven by customer additions and ARPU expansion.

Also, revenue generated by its direct platform accounted for 81% of all revenue, up considerably from 74% year-over-year.

On the expense side, management is spending more on its go-to-market capabilities, for which it believes it is seeing positive results.

The problem is that operating losses are worsening, which is a distinct negative in the current market environment that is punishing heavy operating loss companies.

For the balance sheet, the company ended the quarter with nearly $104 million of cash and generated free cash of $9.7 million.

Looking ahead, management increased its revenue guidance, which is great, but if operating losses continue without a path to profitability, the market may be unimpressed.

Regarding valuation, the stock has been beaten down significantly, but not nearly as badly as many SaaS companies.

The primary risk to the company’s outlook is a looming recession which may slow new customer wins and marketing spend.

An upside catalyst is the continued pressure on companies to change their digital marketing strategies in light of third party cookie restrictions from major platforms.

While Zeta faces a variety of uncertainties, the firm’s position in a changing advertising market, the stock’s low valuation and management’s continued investment in its go-to-market initiatives mean that ZETA is a potential opportunity for patient investors.

For patient investors, my outlook is a Buy on ZETA at around $4.75 per share.

Be the first to comment