bymuratdeniz

Thesis

Investors in leading Canadian oil and gas producer Crescent Point Energy Corp. (NYSE:CPG) have benefited tremendously from its March 2020 bottom. CPG also posted a remarkable YTD return of 32%, despite having fallen nearly 37% from its June highs.

We assess that CPG is at a critical juncture as its growth cadence is expected to be impacted by worsening macroeconomic headwinds, leading to further demand destruction. Coupled with a less aggressive hedging strategy over the next 12 months, CPG could face increased volatility in its revenue and profitability profile as the world’s energy markets come under increased pressure after a massive run in 2022.

We also assessed that the market had not re-rated CPG in anticipation of a worse-than-expected global recession that could cause significant estimate cuts. Our analysis suggests the Street remains confident in Crescent Point’s execution through the cycle as its hedges roll off.

However, we believe investors need to accord further caution as these estimates could be revised significantly if the underlying commodity markets worsen further. Consequently, it could compress CPG’s valuations markedly to reflect these headwinds.

As such, we now rate CPG as a Hold and discuss the critical levels for investors considering adding more positions to watch moving ahead.

Don’t Underestimate The Risks From A Global Recession

We believe energy investors have yet to accord sufficient weight to the looming global recession that’s lurking under the surface. The IMF and World Bank had already revised their growth forecasts markedly for 2023. In addition, the IMF also sees increased risks for financial instability, which in our opinion, could result in a severe market downturn if not managed carefully.

Hence, we believe energy stocks are primed for a steeper fall, as investors sitting on massive gains could rush to sell and protect their profits in such a scenario.

Furthermore, the supply/demand dynamics could shift dramatically in a global recession, reversing the bullish thesis on structural supply constraints. RBC Capital also highlighted its bearish case of $60 Brent (down nearly 35% from the current levels) by mid-2023 if we fall into a severe recession.

Therefore, the attendant risks to the energy markets are rising, which could put further pressure on oil and gas stocks that have outperformed the market over the past two years as investors potentially rush for the exit.

Crescent Point Energy’s Growth Is Expected To Moderate

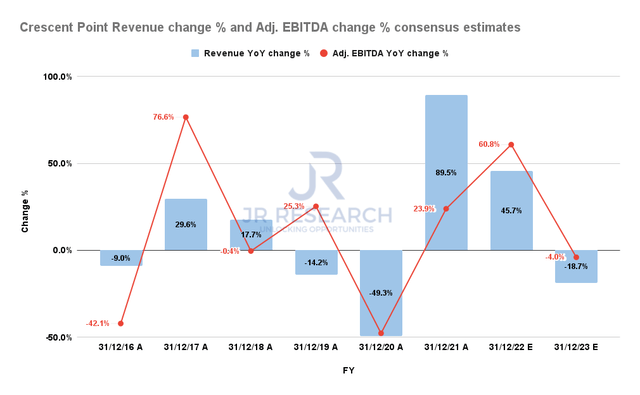

Crescent Point Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Moreover, even the bullish Street analysis also modeled Crescent Point’s revenue and adjusted EBITDA growth to slow further through FY23. Hence, we postulate it could put further pressure on CPG to continue outperforming as its growth normalizes through the economic cycle.

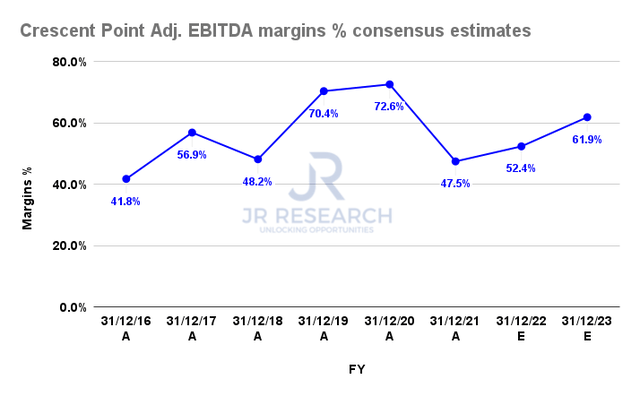

Crescent Point Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

Moreover, we deduce that the consensus estimates could have been overly-optimistic about Crescent Point’s ability to execute through the global recession. As seen above, Crescent Point’s adjusted EBITDA margins are estimated to increase from 52.4% in FY22 to 61.9% in FY23.

Therefore, we believe Wall Street expects CPG to benefit markedly as it moves to a less aggressive hedging program (20% of volume) in 2023, compared to its current hedging program (40% to 50% of volume).

However, our observation of the underlying market indicates investors need to be wary that oil prices could still maintain their bullish bias throughout 2023 as we move closer to a recession.

Is CPG Stock A Buy, Sell, Or Hold?

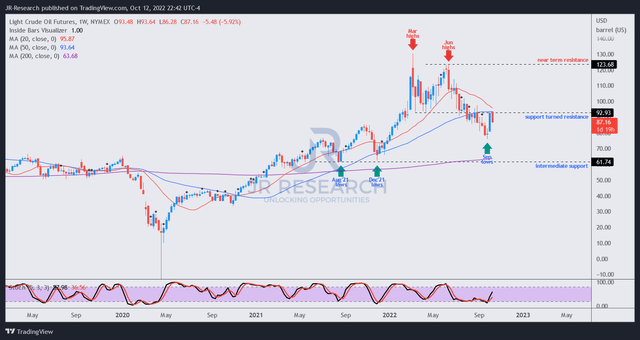

WTI crude oil futures price chart (weekly) (TradingView)

We gleaned that the price action in WTI crude futures (CL1:COM) has continued to demonstrate weakness, despite the recent optimism over the 2M barrels per day cut initiative by OPEC+.

As seen above, the sellers have continued to prevent CL1 from retaking its critical support level that has undergirded its medium-term uptrend since its COVID bottom. Hence, a failure to retake that level would likely see more selling downside moving ahead, indicating the early stages of a significant trend reversal lurking underneath the surface.

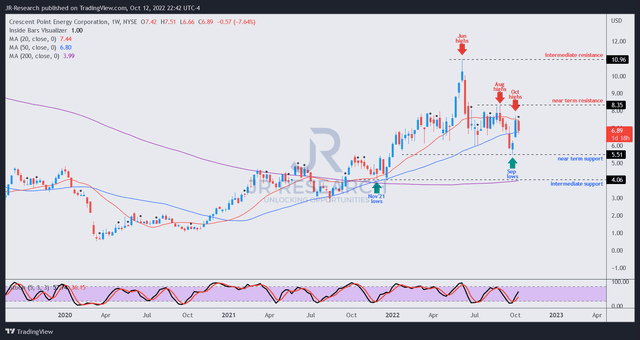

CPG price chart (weekly) (TradingView)

Similarly, we also gleaned weakness in CPG’s price action as it failed to break above its August highs in its recent post-OPEC+ rally. A failure to retake its near-term resistance (below June’s highs) could indicate the end of its medium-term uptrend, mirroring the weakness in the underlying markets.

Hence, we urge investors considering adding exposure to be patient here. The underlying price action dynamics seem to be going through a significant trend reversal if CPG is unable to retake its August highs decisively, moving ahead. We also postulate a potential re-test of its September lows is in store if the selling pressure persists.

As such, we believe it’s appropriate to be more cautious at the current levels and urge investors to watch the action from the sidelines for now.

We rate CPG as a Hold.

Be the first to comment