AnuchaCheechang

Much has changed since I last wrote about VEON Ltd. (NASDAQ:VEON) in my article VEON: Value So Deep Otto Lidenbrock Wouldn’t Find It. For the past five months Dr. Lidenbrock has been on the quest and I just received a transmission (fictional):

Value located. Beneath mountain of risk. Waiting for explosive catalyst.

Mountain of risk? Explosive catalyst? Let us dig a little deeper.

Since the start of the Russian invasion of Ukraine on February 24 VEON has suffered from one unfortunate event to the next. First, shares trading on the NASDAQ lost 82% top to bottom over eight days. Next, Fitch and S&P downgraded the company’s credit ratings. Then, due to the share price being below $1, the company received notification of delinquency to meet minimum NASDAQ listing requirements.

The company provides telecommunications services, including internet and 4G services, to customers in Russia, Ukraine, Pakistan, Uzbekistan, Bangladesh, Kazakhstan, Kyrgyzstan, and Georgia. While the company has suffered minor losses to revenue as a result of the war in Ukraine the majority of share price weakness is due to potential risks.

The end of the war is a geopolitical catalyst event that would effect most markets. I am not a geopolitical expert and most people have a better chance of guessing the next number at a roulette table than predicting the end of this war. But I wrote about the reasons why this conflict is pressuring politicians globally in my article Russia: Why Peace Might Be Sooner Than You Think. In short, the world needs resources that Ukraine and Russia produce.

VEON is waiting for the four stages of this geopolitical catalyst to play out. If they do, the results will be explosive.

Stage 1. Fuel: The Russian Ruble Recovers

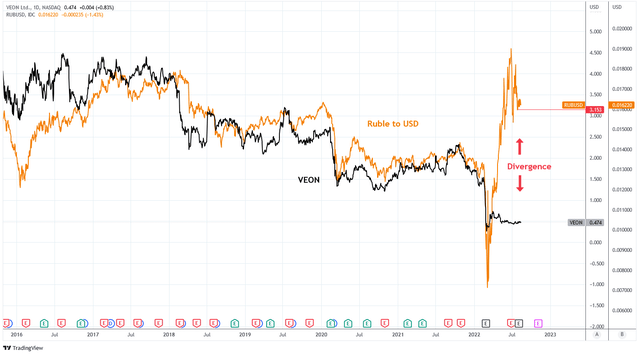

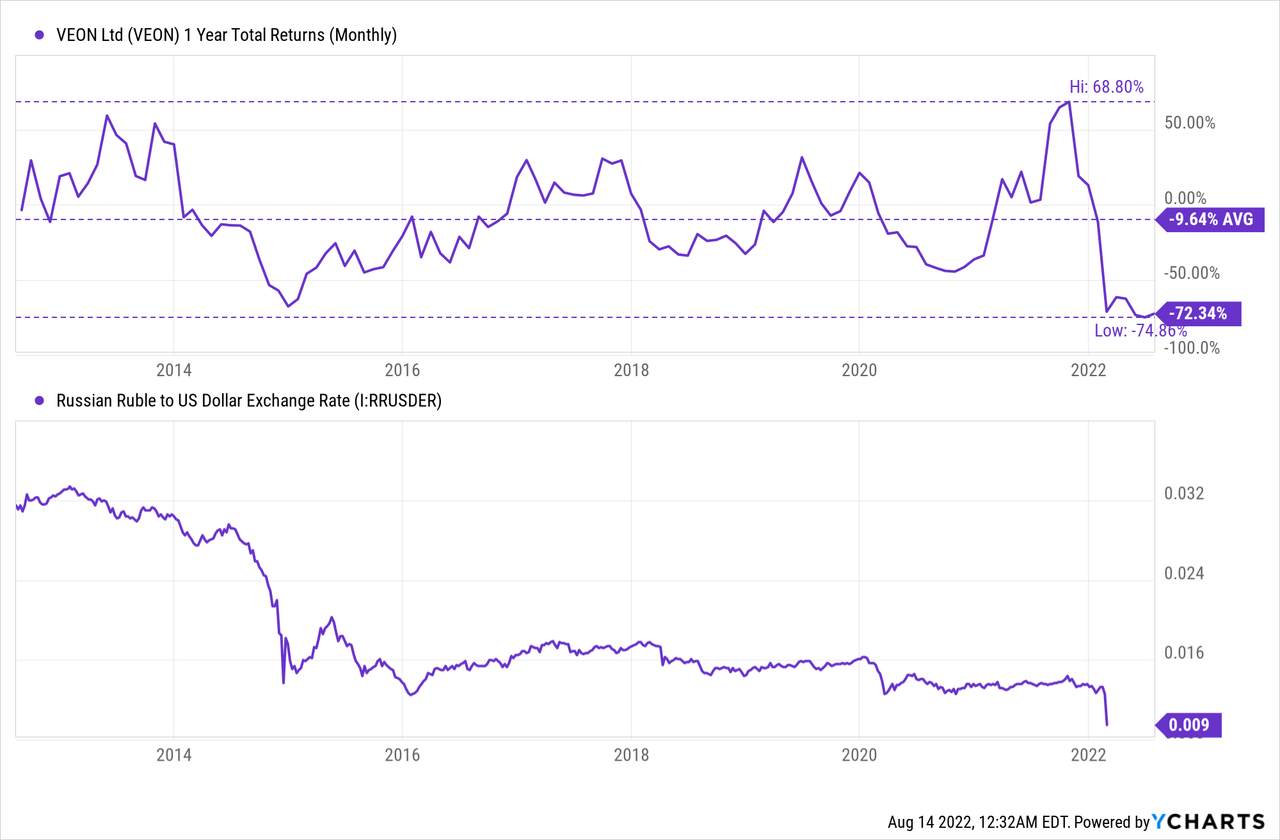

For years the performance of VEON has been tightly correlated with the Russian Ruble to USD exchange rate. This is because Russia accounts for roughly 50% of company EBITDA. As the Ruble depreciates it reduces revenues and earnings relative to USD denominated shares and debts.

After the start of the war the Ruble depreciated considerably in the face of sanctions and elevated sovereign debt risk. Then, to the surprise of many, the Ruble recovered. In fact, it not only recovered but surpassed its pre-war exchange rate.

Russia accomplished this by a series of financial interventions. This included raising interest rates, requiring Russian companies to convert international earnings into Rubles, and establishing a gold to Ruble exchange. It also helped that the price of commodities which Russia exports continued to move higher. But notice that VEON’s share price has not followed the Ruble higher, resulting in a significant divergence due to the risk premium of sanctions.

Charts by TradingView (adapted by author)

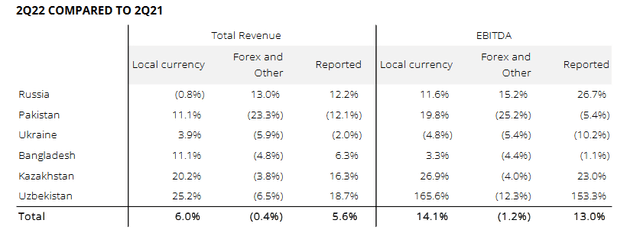

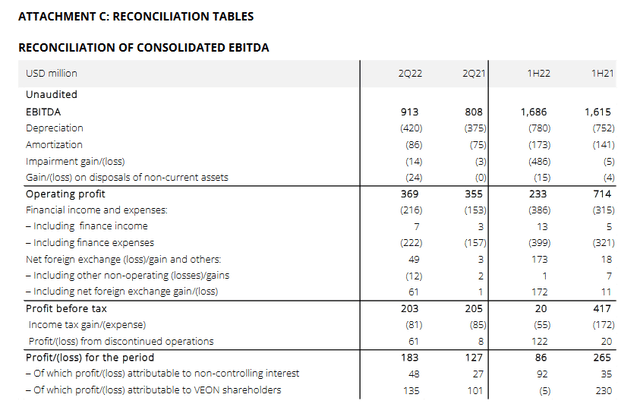

As a result, VEON had a stronger Q2 2022 than I expected. VEON reported a 5.6% YoY increase in revenue and a 43.5% YoY increase in net income which ended the quarter at $183 million or $0.10 per share. It was notable that 4G users increased 19.2% YoY.

This improvement to financials is being driven by the positive currency effects of the Ruble appreciation. It allowed operations in Russia to report a 26.7% QoQ increase in EBITDA. This is while Pakistan and Ukraine, the company’s #2 and #3 highest earning jurisdictions, reported QoQ declines to revenue and EBITDA (see table below).

Seeking Alpha (company Q2 2022 Earnings Presentation)

The decline in revenues from Ukraine is a consequence of the physical conflict in the country. During the Q2 conference call management stated that 90% Ukrainian Kyivstar network sites remain functional and they were able to upgrade 3,000 stations and built 230 new ones.

Absent this sanction risk premium I would expect VEON to trade in line with the Ruble. The current exchange rate implies a share price of about $3.15.

Stage 2. Primer: Freeport LNG Terminal Accident

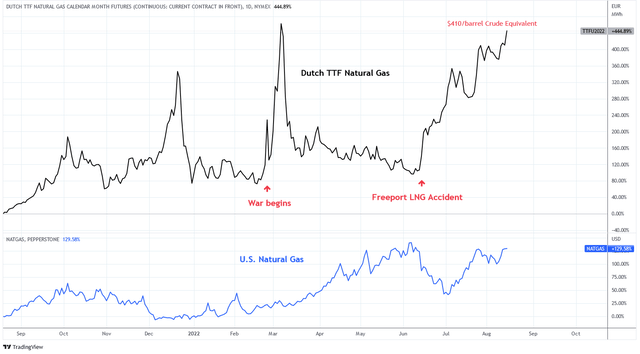

On June 8th the Freeport LNG Terminal, a major export terminal of U.S. Natural Gas, experienced a fire accident that took the plant offline. Natural gas prices in the U.S. then dropped by 40%.

You’re probably wondering, what’s the connection between an LNG terminal in Texas and a multi-national telecommunications service company in the Netherlands?

Following the incident, the price of natural gas in the U.S. dropped and the price of gas in Europe, as measured by the Dutch TTF futures, skyrocketed 176%.

Charts by TradingView (adapted by author)

Most countries in the European Union import 5-40% of their natural gas from Russia. The IMF estimates that natural gas exports from Russia are down 60% since last year and that a reduction of up to 70% can be managed by global economies in the short term. Nonetheless, the increased cost and constrained supply of natural gas is impacting European industries and contributing to the likely recession in the EU and the depreciation of the Euro which has lost 9% against the USD since the start of the war.

The issue is particularly acute in the EU’s largest economy of Germany. Because natural gas is used for electricity generation the shortages have caused the price of electricity futures in Germany to increase 400% since the start of the year.

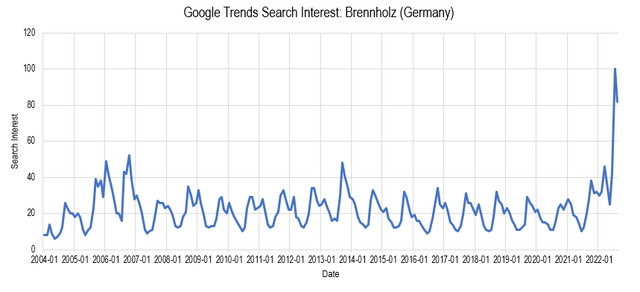

The situation is becoming dire for German households and industries alike. Winter is a critical period of natural gas and electricity demand for residential heating. As a result, web searches in Germany for the term “Brennholz” has exploded, according to Google Trends. Brennholz means firewood.

Chart by author (data from Google Trends)

Approximately 10% of the EU’s natural gas comes from Russia via pipelines that pass through Ukraine. Despite the war, Ukraine has not compromised those pipelines. The revenue those pipelines generate is used to fund war operations. What an awkward situation.

Europe’s dependence on Russian gas is the top reason why the conflict may not escalate as witnessed by Ukraine exercising restraint. I expect that as winter approaches the pressure will increase in Europe to solve the problem. There is potential that they will need to capitulate and either reverse sanctions against Russia or save face by pressuring the two countries to reach a ceasefire.

Stage 3. Ignition: Lifting of Sanctions

Stage 1 and 2 of this catalyst have already transpired. Stage 3 is next. The catalyst for VEON will fully engage when the risk of sanctions has subsided. An end to the war would accomplish this.

I have no prediction about when that may occur.

It is apparent, however, that both sides are suffering significant losses. Retired Colonel Andrew Milburn described how stressed the situation is in Ukraine in his article “Time Is Not on Kyiv’s Side: Training, Weapons, and Attrition in Ukraine.” He writes about how there isn’t enough time to properly train new soldiers. Here is what he said about the current situation:

The Russian army now occupies an area comprising one-fifth of Ukraine’s total land mass—far more than it did at the outset of the war. President Vladimir Putin’s overall objective remains opaque. The low threshold for declaring victory is likely to be annexation of the entire Donbas region, a goal that Putin has almost accomplished, but with a recent resurgence in Russian confidence, that may not be enough to satisfy him.

Ukrainian President Zelensky has said that he wants the war to end by 2023 but that Ukraine would “only negotiate from a position of strength.” Ukraine has been able to maintain fighting thanks to military aid from the U.S. and allies. However, enthusiasm for additional support may be waning and any significant loss by the Ukrainians could prompt talks for peace.

Sanctions against Russia have already impacted VEON’s ability to build infrastructure in the country due to import restrictions. Sanctions can limit the company’s ability to move capital in or out of the country, impact its ability to obtain financing, and compromise the trading of shares on equity exchanges. CEO Kaan Terzioğlu said this regarding sanctions during the Q2 2022 Earnings Call:

Let me be very open. VEON is currently not the target of U.S., EU or U.K. sanction laws. We are aware that Bloomberg has opined that our securities might be subject to U.S. sanctions or restrictions. We did not have an advanced notice on this and our legal team is assessing the impact of Bloomberg’s opinion. We are fully committed and we are in compliance with all applicable sanction laws and we are looking into this issue with our legal team to carefully review the full range of options to enable VEON to address this matter.

That may be how Kaan feels but this week TD Ameritrade suspended trading of VEON due to sanctions.

The world needs this war to end. The conflict is contributing to a global food crisis. Ukraine and Russia account for 12% of the world’s calories in food production. The war has reduced exports of food commodities from both countries causing food costs to move higher. There is no telling when we may get peace in Ukraine, but the precursors are mounting.

It is also possible for this stage to execute if the company sells its Russian assets, assuming that they receive a fair market price. The move would likely be detrimental in the long term. Russia accounts for 23% of company customers and 40% of operating profit. Still, I’m interested in this company for the catalyst only.

Stage 4. Accelerant: Restoration of NASDAQ Listing, Dividend, & Credit Rating

Once the risk of sanction has subsided VEON can begin a path to normalcy. Along the way the company will encounter three accelerating events which constitute Stage 4 of this catalyst.

Credit Rating

The stability of peace will benefit the company by prompting upgrades to its credit ratings. In the Q2 earnings press release, VEON states that after being downgraded by Fitch and S&P both credit rating agencies have withdrawn ratings for VEON. Restoration of these ratings will move the share price higher.

Seeking Alpha (company Q2 2022 Earnings Presentation)

Nasdaq Listing

VEON has been notified by the Listing Qualifications Department of the Nasdaq Stock Market that they are in violation of the minimum share price requirement. Shares need to trade above $1.00 USD to meet this requirement. VEON must meet the requirement by October 4 unless they receive a 180 day extension. The company may choose to execute a reverse stock split to meet the requirement. After Stage 3, I expect shares to trade above $1.00 which would resolve this issue and prompt further investor interest.

Seeking Alpha (company Q2 2022 Earnings Presentation)

Dividends

VEON has not paid any dividends in 2022 after omitting a dividend in 2021. Management has stated that it plans to pay $95 million of dividends in 2022. This would be approximately $0.054 per share or 11.8% at current share price. A return of the dividend would also drive investor interest.

Seeking Alpha (company Q2 2022 earnings presentation)

Company Risk and Outlook

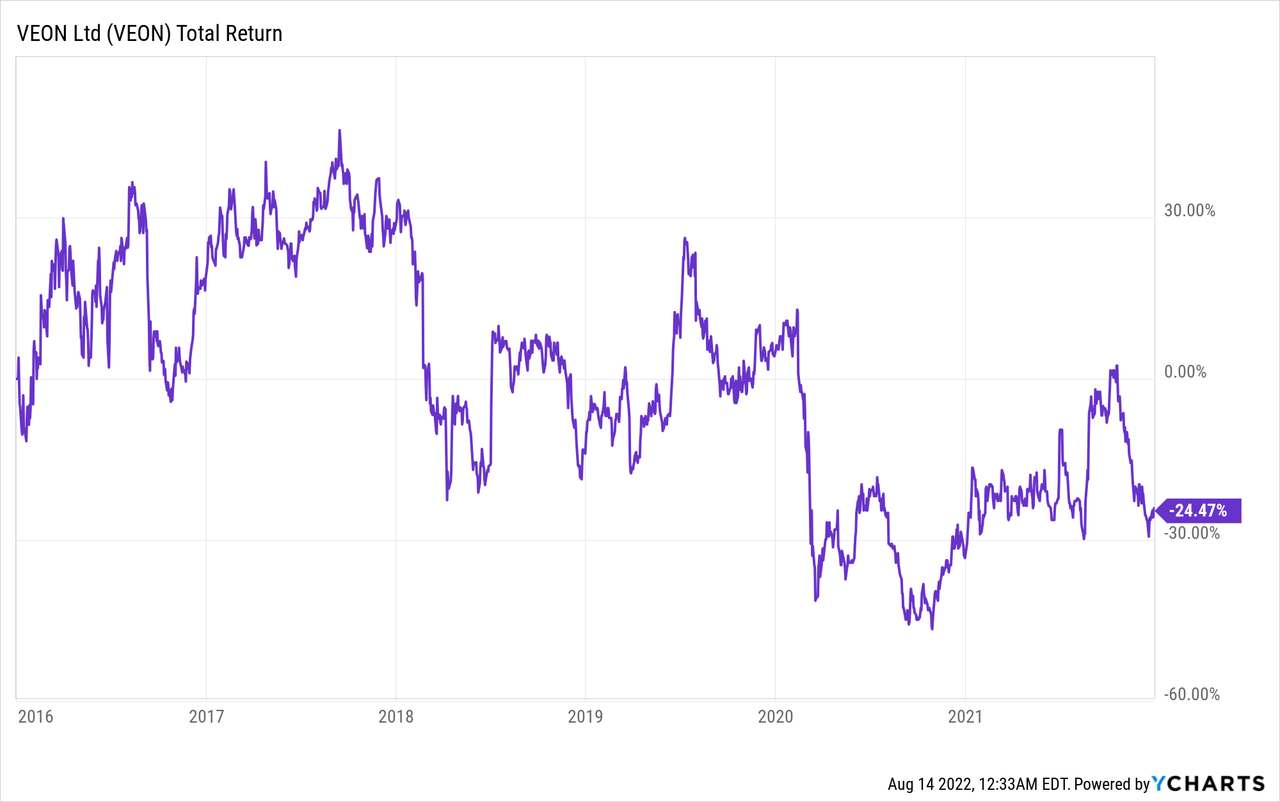

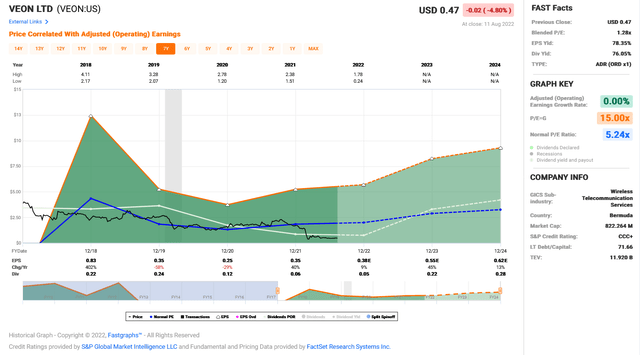

To put it bluntly, VEON is not a good company. Between 2016 and 2021, before the war began, shares returned a total of -24.47%. Since 2013, the average 1-year total return has been -9.64%. This poor performance is partly due to the Russian Ruble performing poorly against the USD. But it is also due to poor execution and management.

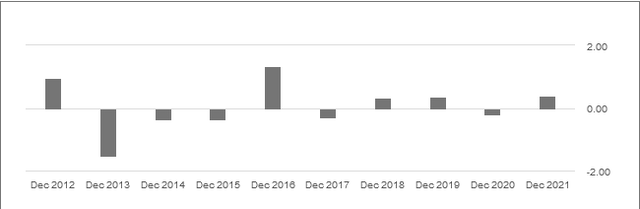

The share price has suffered because earnings were inconsistent and often negative. The chart from SA below shows that the company produced negative earnings in 2013, 2014, 2015, 2017, and 2020.

Diluted EPS for VEON (Seeking Alpha)

There is no shortage of risk with VEON. These are some of the risks that can damage VEON and its shareholders:

- Escalation to sanctions against the company which may occur in response to an escalation of the war

- Failure to service company liabilities

- Loss of U.S. stock exchange listing

- Acute loss to earnings from geopolitical events or confiscation of company assets

Debt

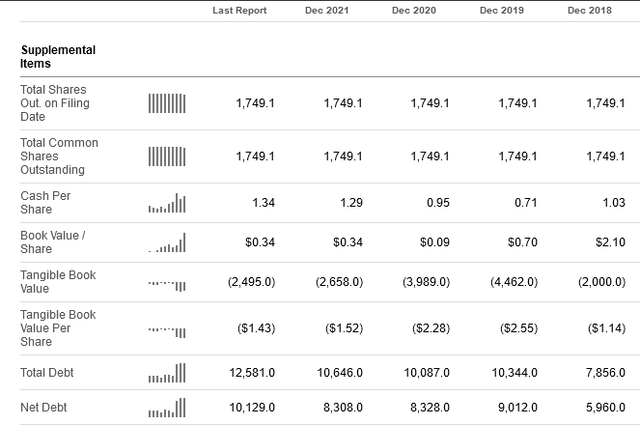

VEON is heavily leveraged with an unattractive cost of capital. The company’s net debt level is $10.13 billion compared to a market cap of $0.83 billion. The data table from Seeking Alpha below shows that net debt has been rapidly increasing since 2018 and the current book value is only $0.34 per share.

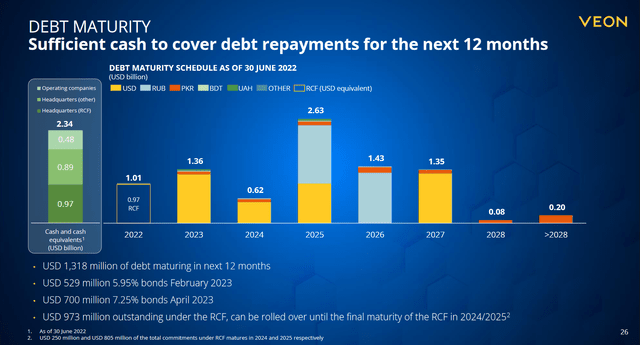

VEON had $2.3 billion in cash during the Q2 teleconference but have since closed on the sale of its stake in Djezzy Algeria which increased their cash position to $3.1 billion, of which $2.5 billion is domiciled in its Amsterdam headquarters. They have $1.318 billion maturing in the next 12 months with an average debt maturity of 3.2 years. The company now has enough cash to cover debt repayments through 2023.

VEON Q2 2022 Earnings Call Company Presentation

The debt is denominated in USD, Russian Ruble, and Pakistan Rupee with an average cost of debt of 7.0% while the average cost of USD debt is 4.6%. This results in a Q2 2022 interest expense of $222 million. As a result, $135 million of profit is attributable to shareholders for the quarter which is $0.078 per share or $0.309 per share annualized.

Seeking Alpha (company Q2 Earnings Presentation)

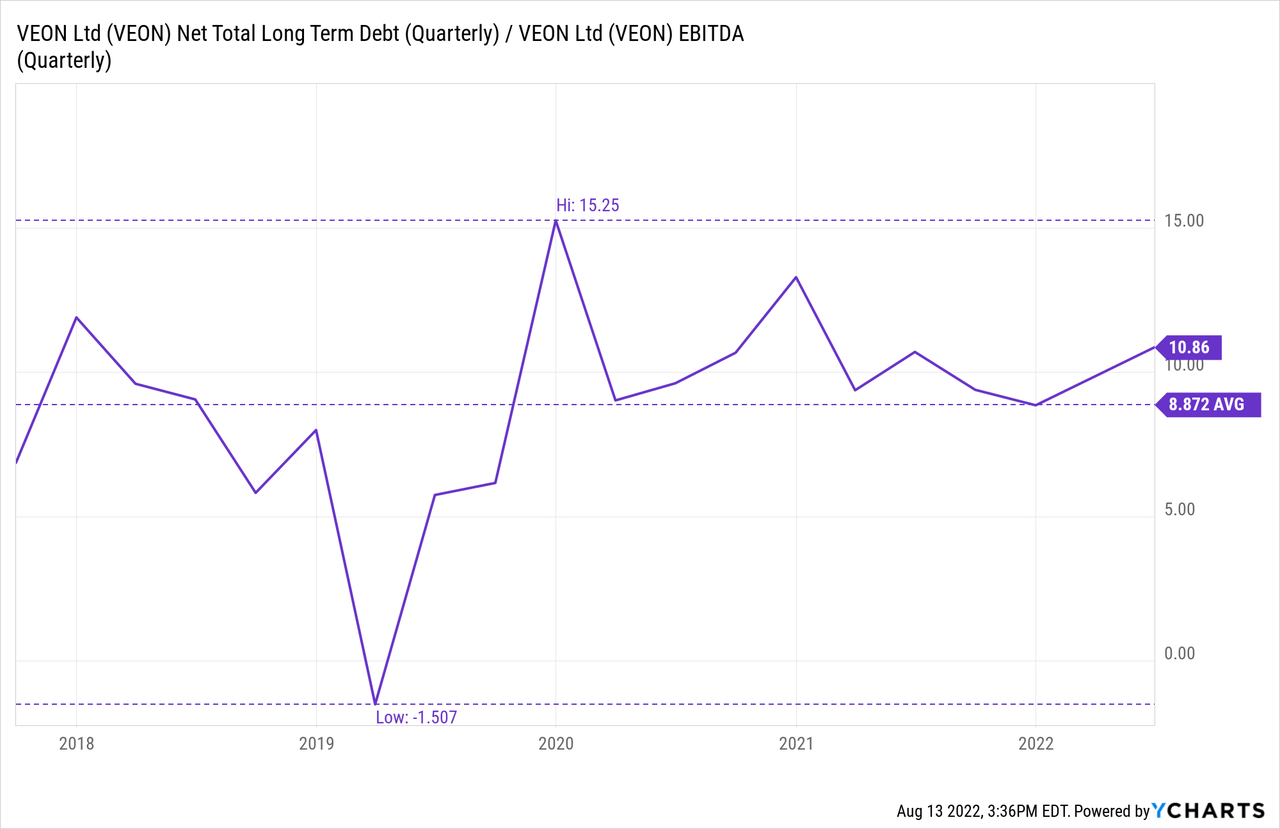

VEON has a net long term debt to EBITDA ratio of 10.86. This is higher than the company 5 year average of 8.872 and much higher than a healthy company should be. Adding to concern is the current ratio which is below 1.0 at 0.875. VEON does boast a fair EBIT to Interest Expense ratio of 2.265, although it would be ideal to be above 3.

Stock Valuation

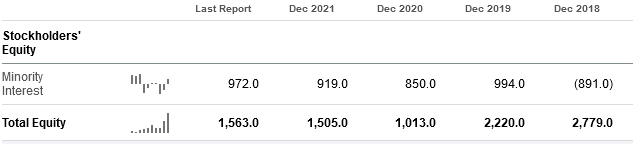

VEON’s poor performance manifests itself in shrinking total equity which has declined from $2,779 million in 2018 to $1,563 million in 2022. The issue is that retained earnings has not been positive since 2012. Dividend distributions do not account for the negative retained earnings, particularly in 2021 and 2022 when no dividends were paid.

This poor track record and over-leverage results in low valuations. The five year normal Price to Adjusted Operating Earnings multiple is 5.24x. During the last trading day the shares were priced at a P/E of 1.29x.

If this catalyst occurs I would expect share price to quickly move up to $1.00 in a matter of days. Next, I would expect a minimum of $1.69 per share with upside potential to $2.45 per share. Given these targets, VEON could return 200-300% in capital appreciation in addition to possible dividends. There is not much of a floor on the downside if conditions degrade further. Book value of $0.34 per share lends some support unless the company experiences material losses to assets or earnings.

Summary

There are few U.S. listed equities that have the same potential in response to a catalyst as VEON. This circumstance is a result of immense risk. That risk may not resolve quickly.

Stages 1 and 2 have concluded. The Russian Ruble has recovered and is adding to the company bottom line. The accident at the Freeport LNG Terminal is exacerbating natural gas shortages in Europe. The world wants the war in Ukraine to end, as do I.

VEON is an over-leveraged and poorly performing company that is priced for the brink of destruction. Peace in Ukraine would bring VEON back from the edge in amazing fashion.

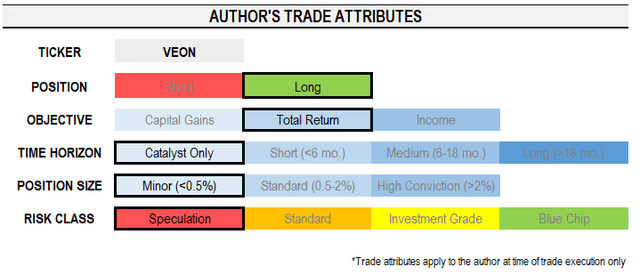

I want to be perfectly clear that I consider VEON to be very speculative. I have no interest in VEON as an investment aside from this catalyst. I hold a trivial long position in VEON that is less than 0.5% of my portfolio. This position is more for amusement than investing.

Be the first to comment