Scott Olson

Introduction

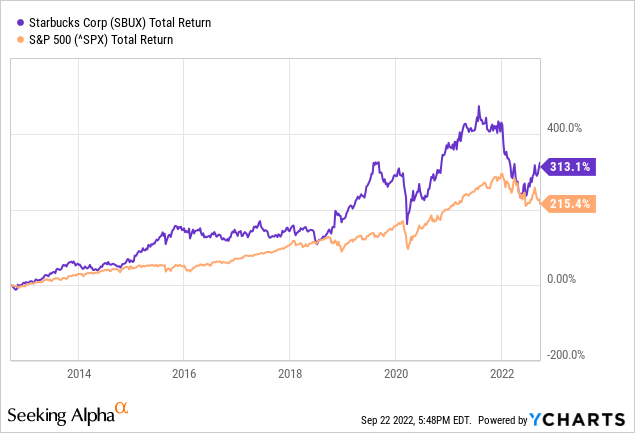

Starbucks Corporation (NASDAQ:SBUX) is known for its delicious ready-to-drink coffee and tea drinks, which everyone enjoys. Starbucks was founded in 1971 and is growing strongly, this strong growth is reflected in the rising share price since then. The stock has grown 15% on average over the past 10 years, while the S&P500 has grown 12% on average.

Starbucks coffee remains my favorite. Coffee also contains caffeine, a substance that keeps consumers addicted. This is a positive feature for Starbucks, as demand for coffee remains during economic recessions.

Starbucks sells coffee to high-income people, and these people will experience fewer financial hardships during economic recessions. Starbucks has weathered the past recessions well, but I have my doubts about their strong outlook.

Using the P/E ratio, the stock is currently valued expensively compared to the P/E ratio of the S&P500. And because I expect headwinds in the economy, I am slightly less positive about the development of the share price. I’d like to see the company in my portfolio, but I’m waiting for a better buying opportunity.

Starbucks’ Outlook Looks Rosy, But I Think It’s Too Optimistic

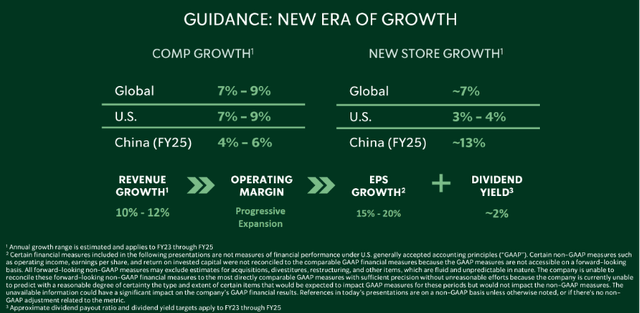

Guidance (Starbucks’ Investor day 2022)

Starbucks expects annual revenue growth of 10% to 12%, an improvement in operating margin and strong earnings per share growth of 15% to 20% for FY23 to FY25. Still, I think these are high expectations in an uncertain time. High inflation leads to the hawkish policy of the Fed, causing the Fed to intervene and raise interest rates. In a previous article, I wrote that an economic recession, with high unemployment, is possible in the coming years. Starbucks offers coffee to high-income people, who will experience less financial hardship than low- to middle-income earners. Still, I remain cautious, I think Starbucks’ strong expected growth is too optimistic.

Global Coffee Market Is Expected To Grow

The global coffee market is expected to grow at a CAGR of 8.8% through 2032, according to a recent study by Future Market Insights. This is due to the increasing demand for coffee products and continuous innovation by the industry’s leading players. Starbucks is mainly located in busy locations in affluent economies. This is a tactical move by Starbucks and has led to strong growth for their business.

Fall is coming and Starbucks offers seasonal products like Pumpkin Spice Lattes, the Apple Crisp Oatmilk Macchiato, the Pumpkin Cream Cheese Muffin, and the Pumpkin Scone. This menu change is seen as additional driver of sales growth. 7 days after the launch of Starbucks’ fall menu, the number of visitors increased by 26% compared to weekly visits in the past 5 weeks.

The secular growth trend is intact and is growing strongly. Starbucks offers seasonal products that are highly valued by consumers. I see these as growth catalysts.

SBUX Dividends And Share Repurchases

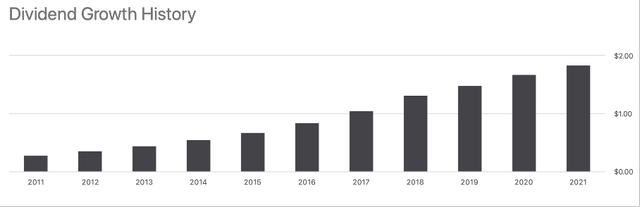

Starbucks rewards their shareholders well. The dividend has been growing steadily for years, with an average annual growth of 21% over the past 10 years. The dividend is $1.96 and the dividend yield is 2.21%.

Dividend growth history (SBUX ticker page on SA)

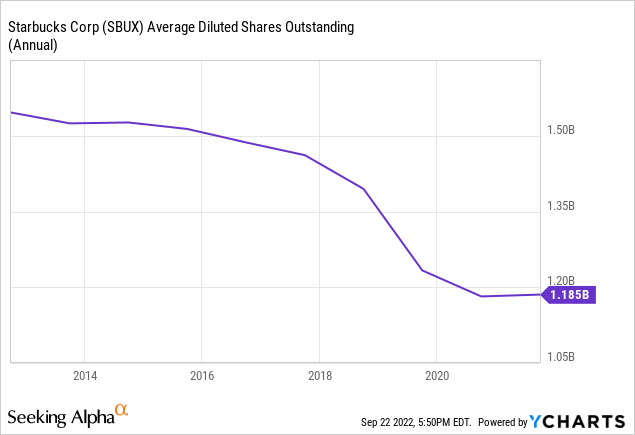

In addition to paying a dividend, management buys back its own shares. In the past 4 years, the number of outstanding shares has been reduced from 1.4 billion shares to 1.2 billion. The share buyback program has been temporarily suspended since the corona crisis, but management recently announced that it will resume the program in fiscal year 2024. Starbucks expects to buy back $20 billion worth of shares in the coming three years.

Because their cash flow is not sufficient, I expect them to use their cash for the share repurchase program as their free cash flow in 2021 was only $4.5 billion. In 2021, Starbucks paid out $2.1 billion in dividends, which equates to a dividend payout ratio of 0.50 (dividend payments / free cash flow).

Valuation Metrics

Starbucks offers high-quality coffee and tea products, but that also means sales are more volatile in times of economic recession. In a previous article, I described that there is a real chance that a recession is looming.

Higher personnel costs can depress the result. Starbucks baristas and managers generally earn well, but unionization can throw a spanner in the works.

That makes it a little difficult to value the stock. That is why I take two valuation metrics, the P/E ratio and the P/S ratio, to gain insight into the valuation.

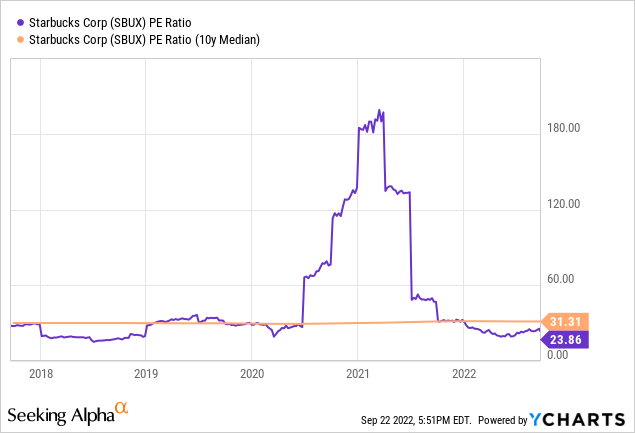

P/E ratio

Looking back at the 2008 financial crisis, Starbucks continued to grow strongly, but the P/E ratio dropped to about 17.

For the end of 2024, analysts expect earnings per share of $3.90. With a P/E ratio of 17, the calculated share price is $66 (decline of -26%). I think this is a worst-case scenario.

Starbucks is optimistic and expects long-term operating margin growth, annualized adjusted EPS growth of 15% to 20% for fiscal year 2023 through 2025, and global revenue growth of 10% to 12%. The 10-year median P/E ratio is 31, but I think a P/E ratio of 31 is too high because interest rates are much higher than they’ve been in the last 10 years. I think a P/E ratio of 25 is more conservative, the expected share price for the end of 2024 is then calculated to be $98 (growth of 11%). Including dividends, this equates to a pre-tax average annual growth rate of 6.7%.

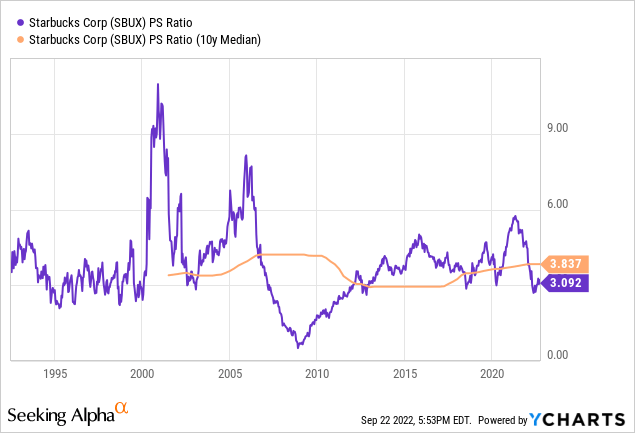

P/S ratio

Another way to gain insight in the valuation of Starbucks is to map its price/sales ratio. This ratio is suitable for companies that are not yet making a profit.

The chart nicely shows that Starbucks is undervalued on a P/S ratio basis relative to the 10-year median P/S ratio. 19 analysts, summarized on Starbucks’ ticker page on Seeking Alpha, expect revenue of $39.5 billion by the end of 2024. The market cap at the 10-year median P/S ratio is calculated to be $150 billion, a gain of 44%. Including dividends, this equates to an average annual growth rate of 19% before tax.

Key Takeaways

Pros:

- Historically strong growth in both sales and profits.

- Starbucks is a fast-growing company that continued to grow strongly during the recession.

- Starbucks expects adjusted EPS growth of 15%-20% and revenue growth of 10% to 12% for fiscal years 2023 to 2025.

- Coffee, especially caffeine, is addictive and therefore the use of this drug can remain sticky even in times of economic recession.

- The coffee industry is expected to grow at a CAGR of 8.8% through 2030.

Cons:

- High inflation will lead to higher personnel costs, which must be passed on to the customer. Does the customer want to pay even more for their coffee?

- The economic outlook does not look rosy.

- The size of the company makes further growth difficult.

Valuation Metrics:

- The share price is expected to fall 26% from the historically low P/E ratio in 2009 (P/E ratio = 17).

- The share price is expected to grow 7% annually using the 10-year median P/E ratio (P/E ratio = 31).

- Based on the P/S ratio, the stock is undervalued. The share price is expected to rise 19% annually based on the 10-year median P/S ratio.

Investing in Starbucks has many pros and cons. However, the current economic situation does not look rosy. I expect the stock to show little movement through 2024 as the Fed raises interest rates. I would like to see the stock in my portfolio, but not at this share price.

Be the first to comment