Oselote/iStock via Getty Images

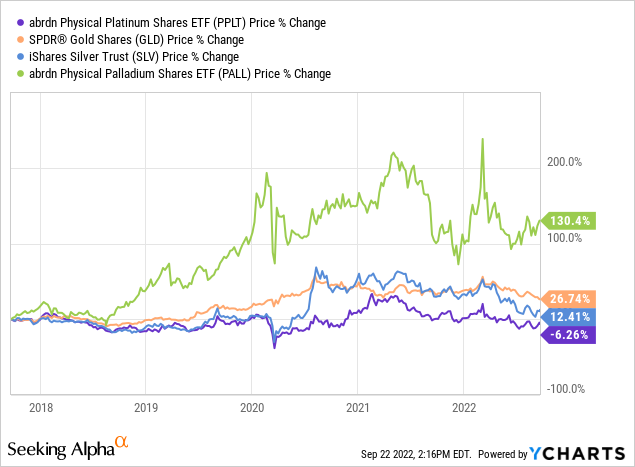

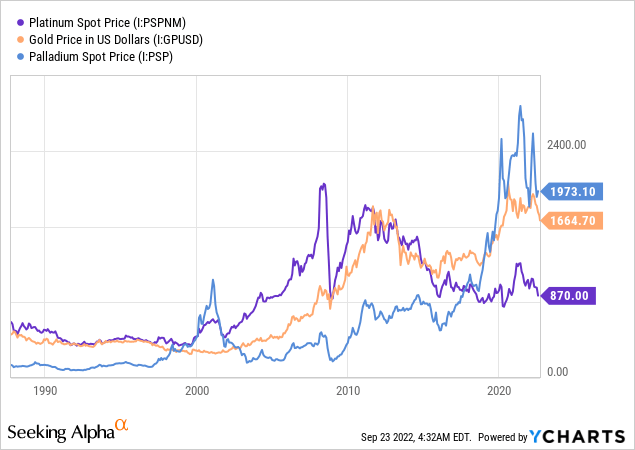

Several years ago, I wrote a couple of bullish articles on platinum, specifically through ownership of the Aberdeen Standard Physical Platinum ETF (NYSEARCA:PPLT), which charges 0.6% annually to manage and store bullion on behalf of stakeholders. Initially, prices rose for about a year, then reversed lower wiping out all gains during 2021-22. In effect, platinum prices have basically gone nowhere, flatlining for a good decade running. This stagnant result has occurred in the face of a very strong advance in sister-PGM palladium.

YCharts – Precious Metals Price Change, 5 Years

Today, in terms of valuation and supply/demand analysis, I categorize platinum as the second-best precious metal bullion idea for long-term buyers, after silver. Rising silver demand in industrial uses like solar panels, plus its monetary influence in coins historically, means total demand is getting close to outstripping inventories and new mine supply. You can read my positive silver views and logic in articles during August through iShares Silver (SLV) here and ProShares Ultra Silver (AGQ) here.

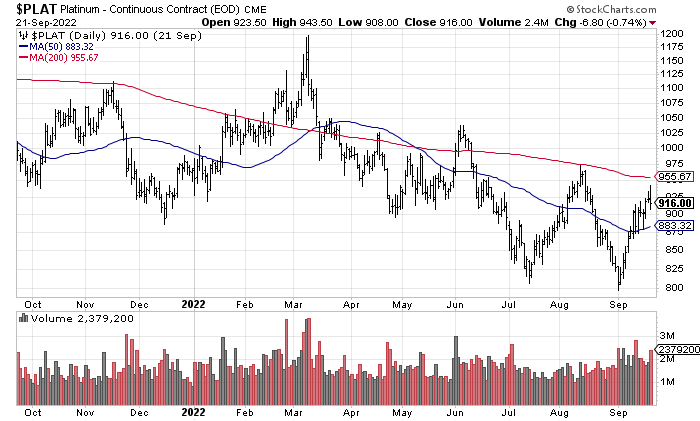

StockCharts.com – Platinum Nearest Futures, 1 Year of Daily Changes

Why Bullish?

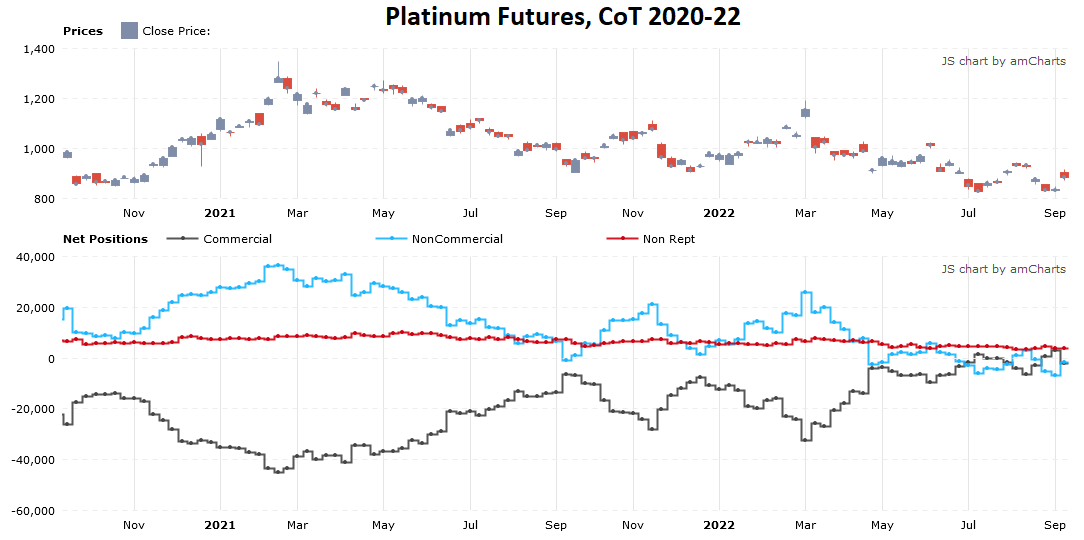

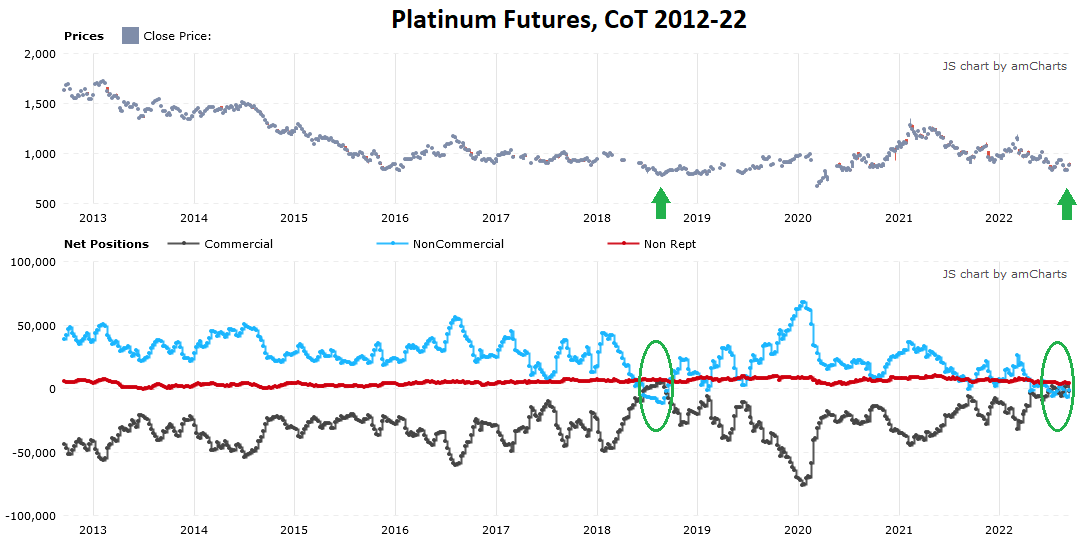

The rationale to buy platinum now is mostly technical in nature. The sentiment setup in the futures marketplace in September is basically the most bearishly positioned by speculative traders since August 2016, the last major bottom (excluding the panic COVID-19 liquidation of all assets in March 2020). Conversely, commercial traders and brokers (working for miners and end-users) are sitting on the most bullish net positive futures holding in recent memory. Below is a chart of the Commitment of Traders [CoT] report from the CME/COMEX exchange through September 13th, 2022. I have marked with green circles and arrows the price bottom argument, mimicking 2016’s ultra-pessimism by traders and hedge funds.

Tradingster Website – Platinum Futures CoT, 2 Years Tradingster Website – Platinum Futures CoT with Author Reference Points, 10 Years

If commercials are willing to be net long vs. almost continuous net short positioning, they must feel confident platinum supply/demand and trading forces cannot pull price any lower. This is a tremendously bullish development, and I purchased a stake through PPLT to piggyback September’s stronger-than-usual commercial outlook.

Aberdeen Platinum Chart

Further evidence of a brighter future brewing for Aberdeen’s platinum bullion product is a momentum reversal could be taking shape. A number of the momentum indicators I track did not move lower with the PPLT trust price lows of late August and early September. In particular, the Negative Volume Index and On Balance Volume readings held their lows from July, circled in green below.

Other positives include a quick reversal in price back above the important 50-day moving average, and a super-low Average Directional Index score over 14 days. Readings close to 10 in the ADX can pinpoint a lack of selling pressure, where better balance in share/trust selling and buying has developed.

StockCharts.com – PPLT with Author Reference Points, 1 Year of Daily Changes

Final Thoughts

When you cross excessive pessimism by short-term traders with improving momentum indications, a smart buy entry proposition is usually at hand. I was already growing quite bullish on precious metals as a hedge against the economic/political instability building all over the world. With the Federal Reserve close to pushing the U.S. economy into a tailspin from its late response to inflation, a strong buy signal for all precious metals, including platinum, will come with the realization yet more money printing is approaching in 2023. Just like the COVID-19 pandemic decision to turn on the printing presses propelled a monster rally in precious metals, the looming pivot to support the economy may support all kinds of flight-to-safety and monetary hedging demand for platinum.

In addition, the long-term outlook for platinum is quite positive, as many catalytic converters are switching designs from more expensive palladium to platinum. The odds of a catch-up move in platinum to palladium and gold (where platinum has traditionally traded at a higher price than both before 2018) could send this precious metal above $2000 an ounce in coming years. From $900 an ounce currently, today may be the perfect time to acquire platinum bullion in your portfolio through PPLT.

YCharts – Traditional Premium for Platinum vs. Gold/Palladium, Monthly Chart 1987-Present

If I am wrong, we will know it soon. I would consider using a sell-stop level under $800 per ounce for platinum, the multi-year low reached 3 weeks ago. Similarly, a drop in PPLT below $76 would cause me to rethink the bullish thesis and potentially liquidate my stake.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment