tamara_kulikova

I don’t invest in ETFs for various reasons and hence I don’t pay much attention to the different ETFs out there. However, there is one ETF I am paying attention to – the VanEck Morningstar Wide Moat ETF (BATS:MOAT). On Monday, 19th September 2022, the ETF was rebalanced once again, and we take the opportunity and look at the ETF. We look at the stocks that were added and the stocks that were removed and explain why investors are facing some downside risk right now.

Removed Stocks

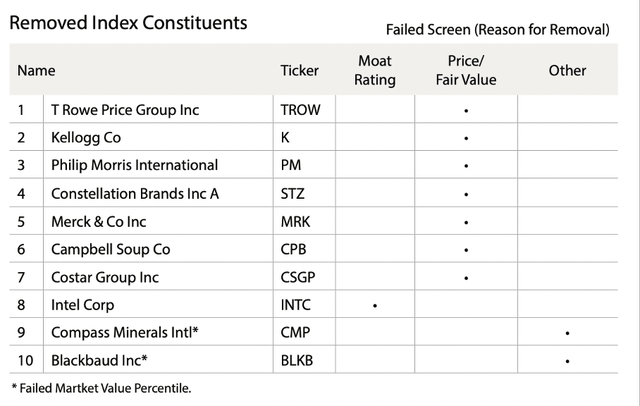

After Morningstar (MORN) removed 14 stocks in its last rebalancing in mid-June, it now removed 10 stocks from the ETF. When looking at the list, we find Compass Minerals International (CMP) once again – a stock that already made the list last time. And while I also argued in April that Compass Minerals is not a good investment anymore (at a point when the stock was trading for $65) the assessment might be different when the stock is trading below $40. We all know that price is playing an important role in any investment decision.

VanEck MOAT ETF Quarterly Statement

When looking at the ten removed stocks, we can identify several consumer staples companies – like Kellogg Company (K), Constellation Brands Inc (STZ) or Campbell Soup Co (CPB). And these are companies and stocks that outperformed the S&P 500 (SPY) year-to-date. And I get why Morningstar restructured the way it did, but considering the looming recession (when looking at the Real Gross Domestic Product, it is already here) consumer staples might not be such a bad idea to invest as these businesses are rather resilient in case of a recession.

And one final pick is interesting. While Intel (INTC) is – in my opinion – one of the better bargains we can find in the market right now, Morningstar removed the stock from the ETF and index. But it was not removed due to the price/fair value ratio (like most other stocks) – it was removed due to the moat rating. And while I see some risks for Intel and clearly acknowledge the company is struggling, I still consider Intel a high-quality business with a wide economic moat around.

Added Stocks

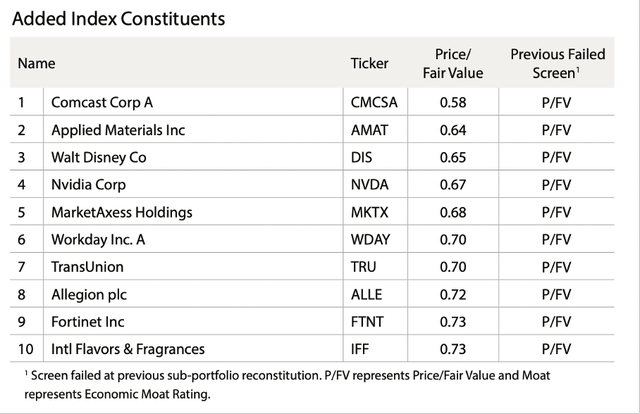

While Morningstar removed ten stocks from the ETF it also added ten stocks. And at least when looking at the price/fair value ratio we are looking at ten deeply undervalued stocks (according to Morningstar). These ten added index constituents are including names like Walt Disney Corporation (DIS), Nvidia Corporation (NVDA) or International Flavors & Fragrances (IFF).

VanEck MOAT ETF Quarterly Statement

It will probably be no surprise for you that I once again don’t agree with every decision Morningstar is making. For most of the stocks I have no opinion as I never covered them, but Nvidia Corporation is not really undervalued in my opinion. The stock might be trading at fair value or maybe slightly below fair valued, but certainly not at 0.67 times its fair value. And in case of International Flavors & Fragrances I would also be sceptic if it is such a great bargain. In my last article I rated the stock as hold, but the stock dropped more than 20% in the meantime.

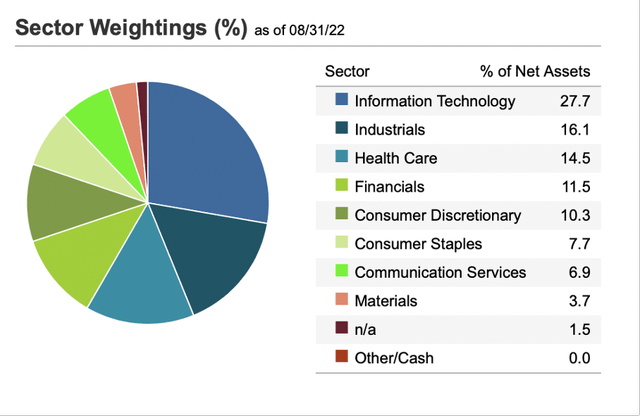

Still Heavily Focused on Three Sectors

When trying to identify a pattern for the added stocks, we can see a focus on technology companies – including Applied Materials Inc. (AMAT) and Workday Inc. (WDAY). It is therefore not surprising that the ETF is still heavily focused on technology stocks, which make up more than one fourth of the entire portfolio (27.7%). And together with industrial stocks and healthcare stocks, almost 60% of the assets in the ETF are stemming from just three sectors. Industrials are making up 16.1% of all net assets and healthcare companies are making up for 14.5% of all net assets. Of course, we can find more companies with a wide economic moat in health care or information technology than in consumer discretionary or materials for example.

But being too concentrated in a sector could create a problem and when a sector might be hit hard by a bear market and recession as it could led to steeper drawdowns for the ETF.

One Problem Remains

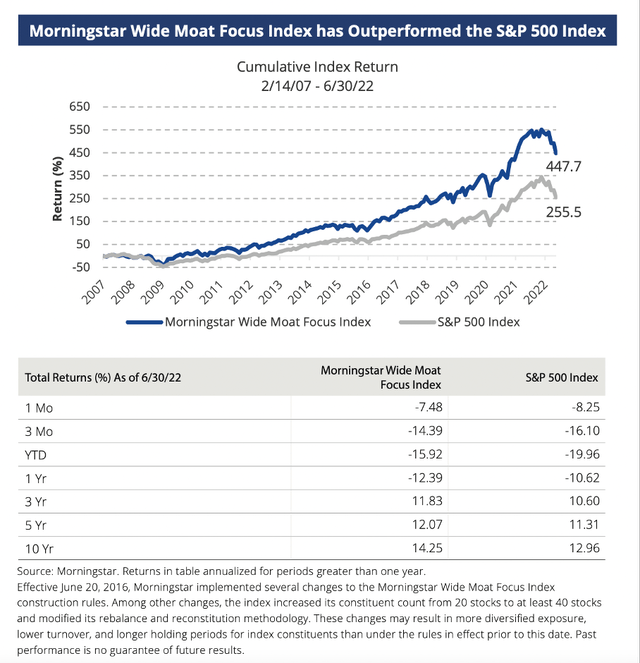

When looking at the performance of MOAT between 2007 and 2022, the ETF clearly outperformed the S&P 500 in many ways. Not only was the annualized return 12.05% for MOAT, while the annualized return for the S&P 500 was only 8.83% (cumulative returns). Maximal drawdown during these 15 years for the S&P 500 was 50.95% while the maximal drawdown for MOAT was “only” 42.43%.

VanEck “Moat Investing – Built for the long term”

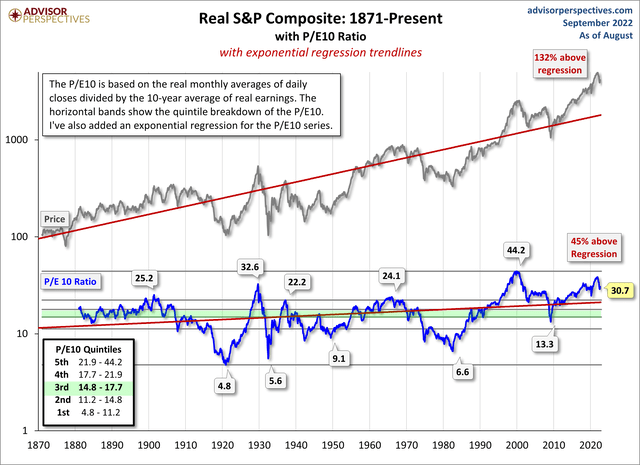

Despite the outperformance in the last 1.5 decades, one problem remains: I consider the U.S. stock market still extremely overvalued. The stock market got a little cheaper in the last few quarters and some stocks can already be seen as bargains, but many stocks remain overvalued. When the U.S. stock market will decline – and it seems like the bear market has already begun – the MOAT ETF will decline as well. We can make the argument that Morningstar will probably do a good job identifying companies and stocks that are trading below intrinsic value and might face less downside than the S&P 500.

Nevertheless, it is not the best time to invest in the U.S. stock market and MOAT is solely investing in the United States. In my last article about MOAT, I finished with the following conclusion:

And overall, I don’t think the MOAT ETF is a bad investment, but I don’t think solely investing in the United States is a good idea over the medium term as the US stock market (and many individual stocks listed in the United States) is trading above the intrinsic value. This is making a steep correction likely in the years to come and even if Morningstar is doing a great job to pick stocks, which are not overvalued, the ETF might be trading for a premium right now.

And although we witness already a 20% correction in the United States since the article was published – exemplified by the S&P 500 – there is much more downside ahead.

When looking at the reconstituted index sub-portfolio, which is listing 40 companies, we see stocks trading clearly below its intrinsic value. The ETF is trying to identify companies and stocks trading below its intrinsic value and therefore it should be no surprise to see these stocks on the list. But when looking at the price/fair value ratios for these 40 companies ranging from 0.46 for Meta Platforms (META) – an assessment I am agreeing with as Meta Platforms is insanely undervalued – to 0.81 for KLA Corporation (KLAC) with all the other stocks in between, it is implying that the entire stock market is deeply undervalued.

There are several stocks on the list I also see as undervalued – aside from the above-mentioned Meta Platforms, I would also see Gilead Sciences (GILD) or 3M Company (MMM) as undervalued. But it would be dangerous to draw the conclusion that the U.S. stock market, which was trading for a CAPE ratio of 30.7 by the end of August 2022, is cheap. It is not like you can just pick any company right now and invest in. We still must identify bargains very carefully.

Conclusion

The VanEck Morningstar Wide Moat ETF remains the only exchange traded fund I watch closely. But I don’t watch it to invest in the ETF, but I rather use the index as a suggestion what stocks to pay closer attention to as they might be undervalued and have a wide economic moat around the business. An investment in the ETF is not a good idea in my opinion at the time as I consider the ETF – similar to the whole U.S. stock market – as overvalued. And Morningstar trying to pick undervalued stock doesn’t change the downside risk I am seeing in the quarters ahead.

Be the first to comment