bfk92

How can a company have a 35% dividend yield? A few different ways. For example, this could even happen when a company has increased its dividend, but has still gotten walloped by the market.

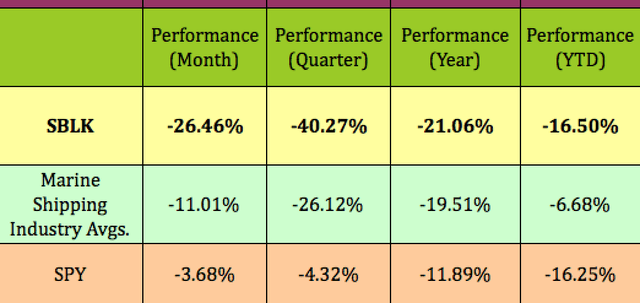

When we last covered Star Bulk Carriers Corp. (NASDAQ:SBLK), in May 2022, it was in the low $30’s range, having risen over 44% in 2022. However, it has reversed course since then, losing ~40% in the quarter, and is now down -16.5% in 2022, similar to the S&P 500’s pullback:

What happened?

Many things – As evidenced by the S&P’s -16% 2022 pullback, investors have generally been spooked by the prospect of a potential recession, brought on by rising interest rates.

Investors also seem to believe that the best days for Time Charter Equivalent, TCE, vessel rates are now in the past.

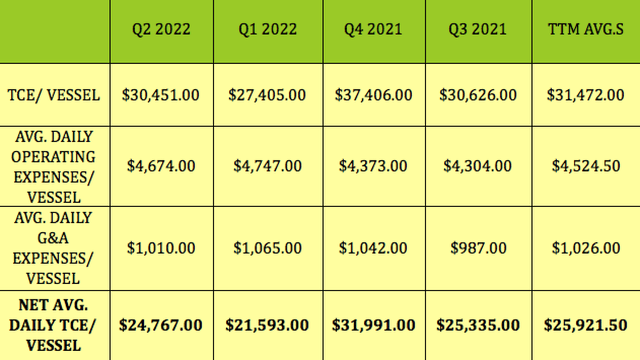

Q4 ’21 had the highest top-line rate, $37.41K, and net TCE daily rate, $31.99K, after which, Q1 ’22 the TCE/vessel rate declined to $27.41K, with a net TCE rate/vessel of $21.59K.

However, in Q2 ’22 the TCE/vessel rate increased ~11% to $30.45K, with a net TCE rate/vessel of $24.77K, up ~15%, vs. Q1 ’22. Clearly, SBLK’s revenues are lumpy – this isn’t a “set it and forget it” high dividend stock.

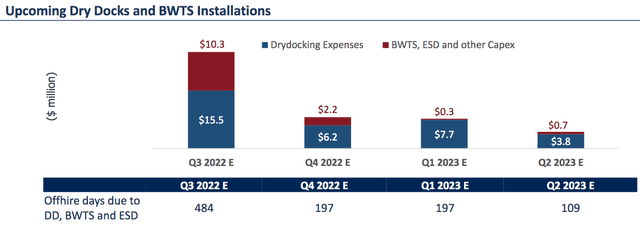

Another factor for SBLK is that, in Q3 ’22, it’ll have higher dry docking and BTWS, Ballast Water Treatment Systems, expenses of $25.8M, and 484 off-hire days, which will lower the amount of cash it will have to pay a quarterly dividend for that quarter.

However, look forward to Q4 ’22, and into Q1-2 2023, and you’ll see that SBLK will have much lower dry docking and BTWS expenses in Q4 2022 – Q2 2023.

These expenses should drop from $25.8M in Q3 ’22, to just $8.4M in Q4 ’22. They’ll drop further in 2023, to $8M in Q1, and down to just $4.5M in Q2:

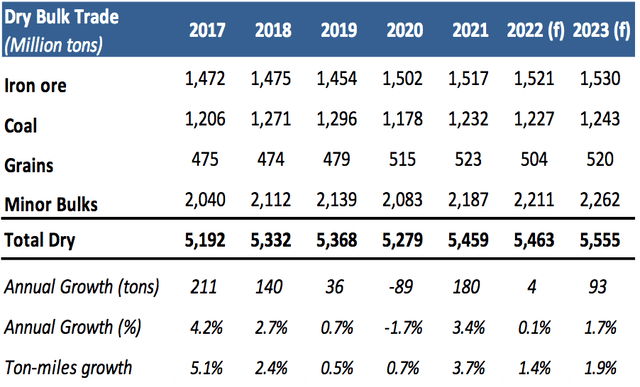

The projected growth for dry bulk freight is just 0.1% in 2022, with ton-miles growth of 1.4%.

Growth is projected to rise to 1.7% in 2023, with ton-miles growth up 1.9%. That’s down from the big 3.4% rise in 2021, as the world’ reopened, but higher than in pre-pandemic 2019, which had growth of just 0.7%.

Profile:

Star Bulk is a global shipping company that provides transportation services of dry bulk cargoes. On a fully delivered basis, the Star Bulk fleet is the largest dry bulk fleet among U.S. and European companies, comprised of 128 modern vessels built in world-class shipyards and with an average age of ~10.1 years.

The fleet’s composition is highly diversified, ranging from Supramax vessels to Newcastlemax vessels, and has a total capacity of more than 14 million DWT. Star Bulk’s vessels transport major bulks which include iron ore, minerals and grain, and minor bulks such as bauxite, fertilizers and steel products. (SBLK site)

SBLK’s fleet is geared toward larger vessels, with 54.6% in Newcaslemax and Capesize. The larger vessels have continued to be in higher demand in this strong market.

Earnings:

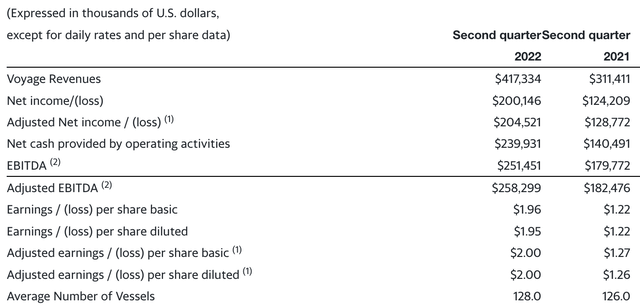

SBLK had very strong Q2 2022 earnings, with a 34% rise in Revenues, record operating cash flow, a 42% surge in Adjusted EBITDA, and a 59% jump in Adjusted diluted EPS:

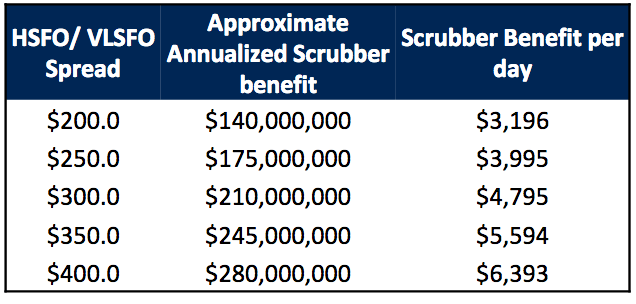

As management has upgraded the fleet, with 120 vessels fitted with scrubbers, the high spreads between High Sulfur Fuel Oil, HSFO, and Very Low Sulfur Fuel Oil, VLSFO, have also provided a tailwind.

Fleet owners with scrubber-equipped vessels, can save a lot of $ when this spread is high. SBLK had an average Hi5 spread of $323/ton realized during Q2, of which SBLK retains 93% on average of the Hi5 benefit.

SBLK site

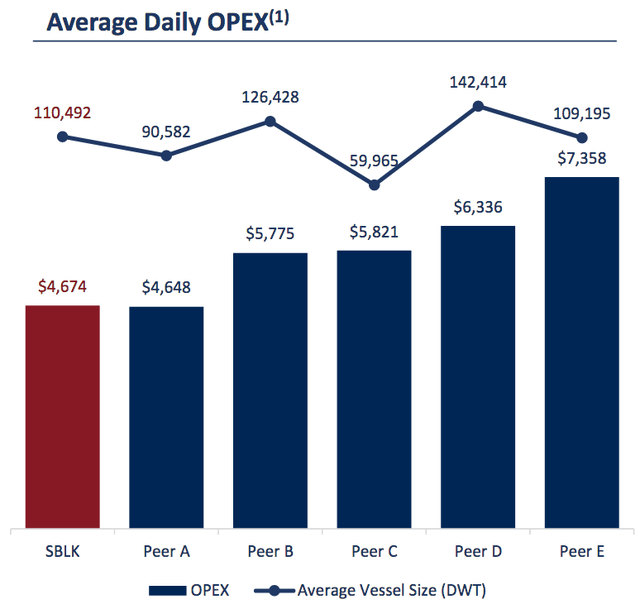

SBLK’s operating expenses are in the lowest tier of its industry, further aiding its bottom line:

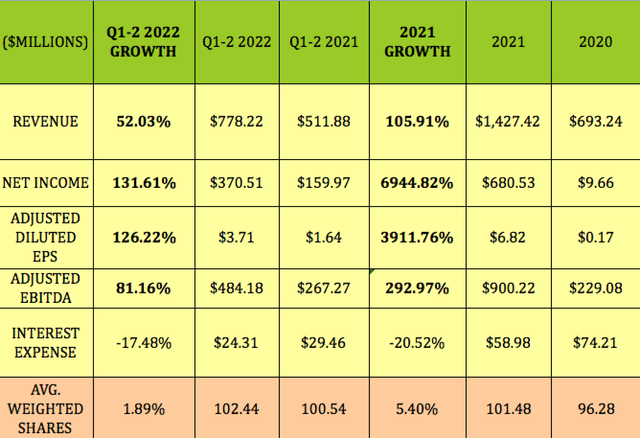

For the 1st half of 2022, Revenue jumped by 52%, while Adjusted EPS rose 126%, and Net Income surged by over 131%. Adjusted EBITDA was up 81%., while Interest Expense continued to fall, down -17.5% in Q1-2 2022.

This continued the very strong growth seen in full year 2021, albeit at a slower, but still strong pace:

Dividends:

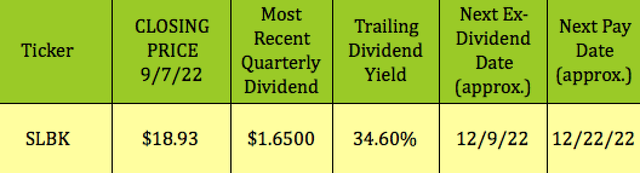

SBLK should go ex-dividend next on ~12/9/22, with a ~12/22/22 pay date. Due to its price pullback, and very high dividends over the past 4 quarters, it has a bodacious trailing dividend yield of 34.6%. However, it’s impossible to forecast what its forward dividend yield will be, since SBLK pays a variable quarterly dividend.

SBLK’s management began a new dividend policy in 2021, which resulted in much higher payouts.

“As of May 2021, the current dividend policy provides that the Board may declare a dividend in each of February, May, August and November in an amount equal to (A) Star Bulk’s Total Cash Balance minus (B) the product of (i) the Minimum Cash Balance per Vessel and (ii) the Number of Vessels.” (SBLK site)

As it happened, that net amount worked out to $1.65/share again in Q2 2022.

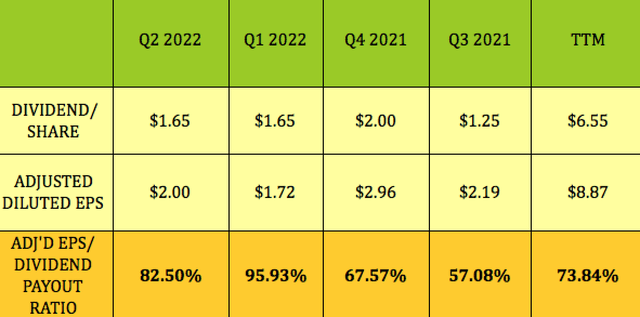

Analyzed on an adjusted EPS basis, SBLK’s dividend payout ratio is a bit lumpy – it has ranged from as low as 57%, in Q3 ’21, up to ~96% in Q1 ’22, with a trailing average of 73.84%:

Profitability & Leverage:

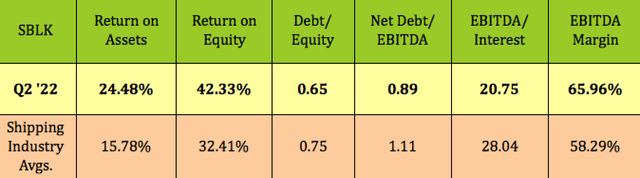

SBLK’s strong earnings over the past 4 quarters have resulted much higher than average ROA and ROE, in addition to a higher EBITDA margin. As you’ll see in the next section, management has been chipping away at SBLK’s debt load – Net Debt/EBITDA and Debt/Equity leverage are both below industry averages. EBITDA/Interest coverage improved to 20.75X in Q2 ’22, vs. 17.93X in Q1 ’22.

Debt & Liquidity:

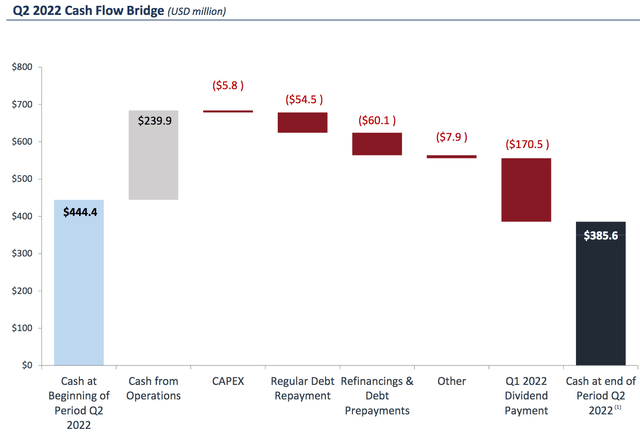

SBLK had its strongest cash flow ever in Q2 2022, generating Operating Cash Flow of ~$240M, with a cash balance of ~$386M, as of 6/30/22, after paying out $171M in dividends, and ~$115M in debt repayments and refinancings.

Refinancings: Management has been very active in refinancing this summer. they estimate that the following refinancings will result in an annual savings of $4M in interest costs.

Management entered into an agreement in late June ’22 with ING Bank N.V., London Branch, for an additional amount of $100M under the existing ING $210.6 million Facility, bringing the total to $310.6M. The additional amount of $100M was used to refinance the outstanding amounts under the lease agreements with China Merchants Bank Leasing for 7 vessels, with the balance used to pay off the outstanding loan amount for the vessel Madredeus under the HSBC $80M Facility.

In July, management entered into a loan agreement with Citibank for a $100M loan in 2 tranches. The 1st tranche of $48.3M was used in July, to replenish the funds used in June for the extinguishment of the outstanding amounts under the lease agreements with CMBL for the vessels Star Sirius, Laura, Idee Fixe, Kaley and Roberta. The 2nd tranche of $51.7M is expected to be drawn in late August, in order to refinance the aggregate outstanding amount of $42.7M under the lease agreements with CMBL of the vessels Star Apus, Star Cleo, Star Columba, Star Dorado, Star Hydrus, Star Pegasus and Star Pyxis. Both tranches of the Citi $100M Facility will mature 5 years from their drawdown, and are secured by the 12 aforementioned vessels. (SBLK site)

On August 3, 2022, SBLK entered into a loan agreement with Skandinaviska Enskilda Banken AB, “SEB”, for a loan of up to $42M in 3 tranches, were used to refinance the aggregate outstanding amount of $29.3 million under the HSBC $80M loan, and the $15.7M outstanding under the NTT $17.6M Facility.

On 8/4/22, SBLK entered into a new loan agreement with ABN AMRO Bank N.V. , in order to refinance the outstanding amount of $67.9M under the ABN $115M Facility.

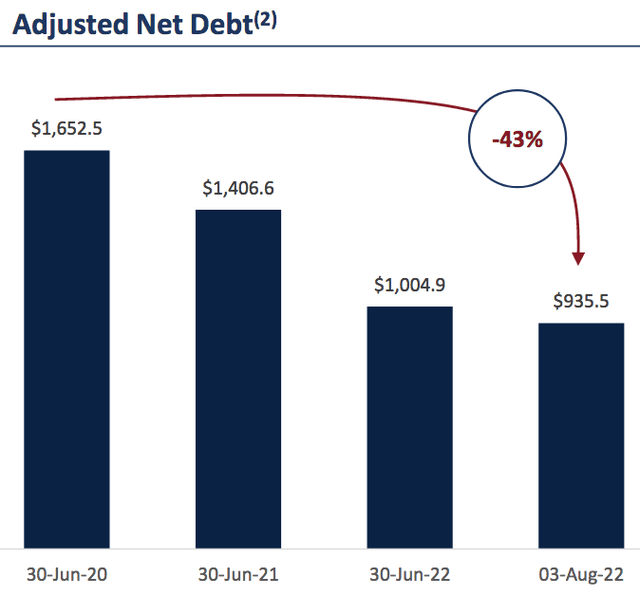

Debt Paydowns: In the past ~2 years, management has paid down ~43% of SBLK’s debt, bringing it to $935.5M, as of 8/3/22. As noted in the earnings section, interest expense fell 17.5% in Q1-2 ’22, and 20.5% in 2021.

Valuations:

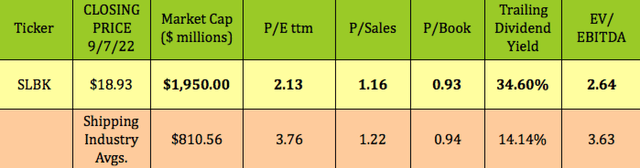

With the market not expecting these high dry bulk shipping rates to continue, it’s not surprising that SBLK trades at a discounted P/E of 2.13X, vs. the shipping industry average P/E of 3.76X.

Analysts’ Price Targets:

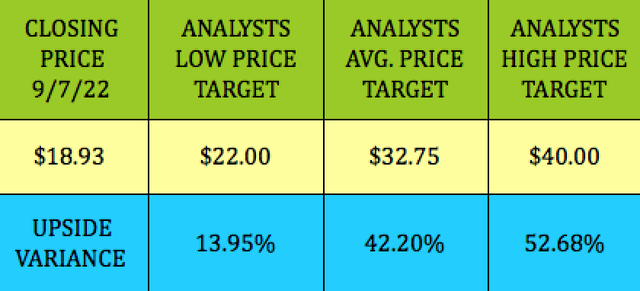

In July 2022, Jefferies Research initiated a Buy rating for SBLK, with a $30.00 price target.

At its 9/7/22 $18.93 closing price, SBLK was ~14% below analysts’ lowest price target of $22.00, and 42% below the $32.75 average price target.

Parting Thoughts:

Looking ahead to the Q3 ’22 variable dividend payment, it’ll most likely be lower than the $1.65/share that SBLK paid in Q1 and Q2 2022.

Management estimated that, as of early August, SBLK had covered 61% of its fleet’s available days for Q3 ’22 at a daily rate of $29,000/day, vs. $30,450/day in Q2 ’22. However, the Q3 ’22 drydocking/BWTS expenses are projected to be ~$25.8M, higher than those in Q2, so that will cut into cash available for dividend payments.

Looking forward past Q3 ’22, though, we can expect lower drydocking/BWTS expenses, which should support SBLK’s earnings and dividend payments. The big question is where rates will be then.

We rate SBLK a speculative BUY – don’t bet the ranch. You might consider selling out of the money put options below SBLK’s price/share, in order to have a lower breakeven.

If you’re interested in other high yield vehicles, we cover them every Friday and Saturday in our articles.

All tables by Hidden Dividend Stocks Plus, except where otherwise noted.

Be the first to comment