JHVEPhoto

Investment Thesis

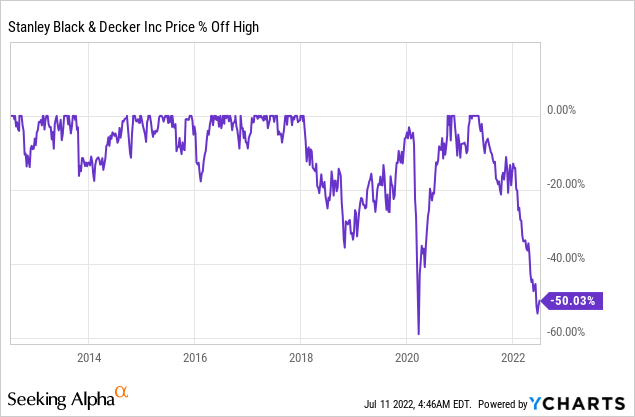

Stanley Black & Decker, Inc. (NYSE:SWK) belongs to a small group of companies labelled dividend kings. A group of companies who stand out for their rock-solid stability through hard times. Rarely do they go on sale, as the market treasures their reliability in tough times, but in the instance of SWK, the company is now down 50% from its recent high. With a payout ratio around 30%, investors can still expect SWK to churn out that quarterly compensation, while waiting for the stock to reverse its current collapse.

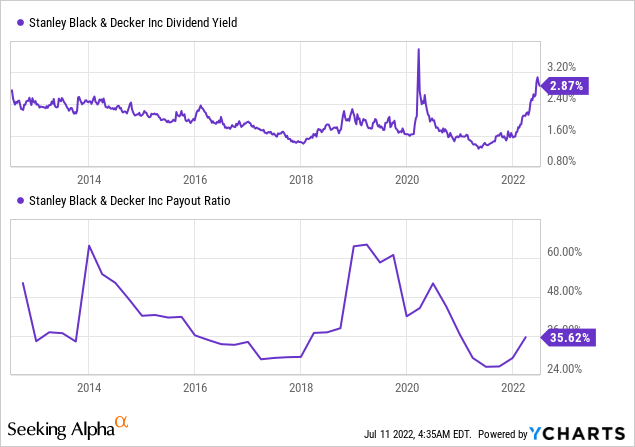

The dividend yield is currently at a decade high outside the Covid-19 market crash, underlining the market having gone too far in punishing the company. Q1-2022 performance showed strong revenue growth, but still came short of expectations, with management having to downwards revise the EPS outlook for FY2022 substantially, causing the obvious question as to what will happen with the current consensus EPS estimates for FY2023 and beyond. There is a likelihood those will have to come down during the upcoming earnings as inflation continues to run strong, but even so, the forward P/E ratio stands at 11.2 and forward 1y at 9.6.

As such, there is a margin of safety in this instance, even if forward expectations will suffer before the business environments turn to the better. For those going long today, it requires patience, as I believe the market will want certainty before allowing the stock to regain its steps.

Who Is Stanley Black & Decker

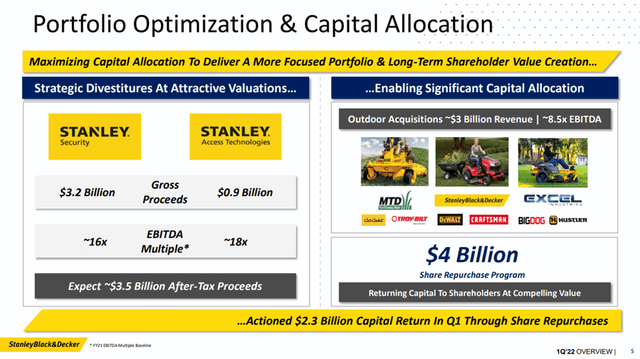

Stanley Black & Decker can trace its roots back all the way to 1843, having gone through numerous mergers and acquisitions since then, most noticeable the 2010 merger between Stanley and Black & Decker in order to become the company it is today. While mostly on the buying side of market activity, the company has completed one large divesture in recent times, the plan for Swedish based Securitas AB to purchase SWKs electronic security business, as communicated in December 2021, for $3.2 billion. The associated discontinued operations secured a revenue of $1.6 billion with a net income of $89 million for SWK during FY 2021.

Even more recent, in April 2022, SWK sold its automatic door business to Allegion (ALLE) for $900 million, acting as the last part of the security divesture transactions. Revenue from divestures, frees up capital for acquisitions, such as when the remaining 80% of MTD was agreed to, also during December 2021, for $1.5 billion. Back in November of 2021, SWK also closed a much smaller acquisition at the price of $373.6 million to acquire the company Excel Industries, a manufacturer of premium turf care equipment. Going hand in hand with the later deal for MTD, who manufacturers outdoor equipment, such as lawn mowers.

Stanley Black & Decker is most famous for its do-it-yourself power tools segment, but if we dive into the most recent 10-K (FY2021), there is a more diverse offering, although fairly concentrated. Revenue is secured via sales connected to power tools both professional and DIY, fastening tools, hydraulic tools as well as outdoor equipment such as mowers. Revenue is distributed via a lot of brands such as DeWalt, Black+Decker, Irwin Industrial Tools, Craftsman, Mac Tools, MTD as well as a number of international brands such as Facom, Sidchrome, USAG and Guiqiang.

FY2021, the company secured $15.6 billion in revenue for a net income of $1.7 billion, well ahead of FY2020’s revenue of $13 billion and net income of $1.2 billion. The company has a total of around 71.000 employees.

SWK splits its revenue into Tools & Storage, $12.8 billion in revenue, Industrial, $2.4 billion in revenue and Corporate overhead, $336 million in revenue. The geographical breakdown shows 60% of sales is in the US, 21.3% in Europe, 8.5% in Asia and the remaining 10.3% in Canada and rest of the Americas.

Revenue for FY2022 is expected to come in at $18.95 billion with FY2023 expected to be $19.76 billion. This corresponds to a growth of 21.3% and 4.3% respectively.

In the last three months, SWK has experienced fourteen downwards revisions for full year revenue as well as seventeen downwards EPS revisions – only receiving one upwards revision for its revenue. So, let’s have a look at how the company has performed in recent times.

Q1-2022 Performance And FY2022 Outlook – The Soft Spot

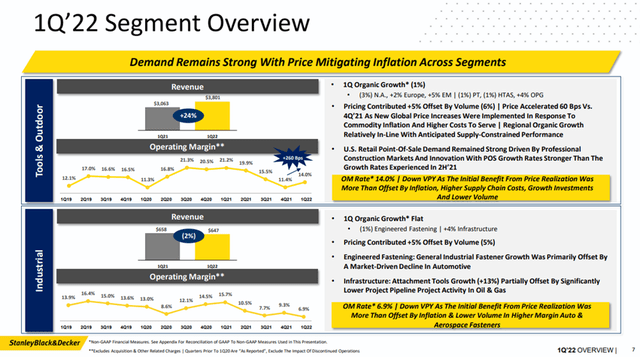

The company reported its Q1-2022 performance on April 28th. Revenue came in at $4.4 billion, 20% growth YoY but $220 million below expectations. Management explained revenue was being pressured by temporary electronic component issues, as we’ve seen across multiple industries in the most recent couple of years, where supply chain issues have run rampant.

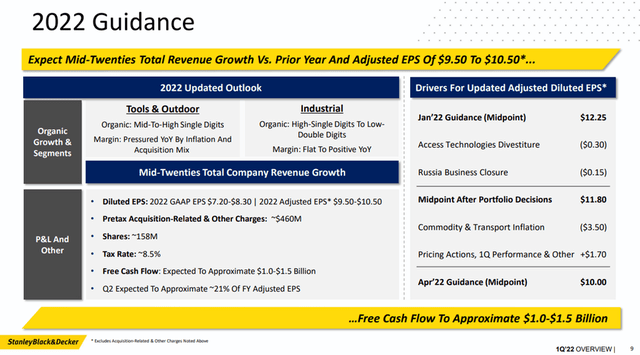

Additionally, management downwards revised GAAP EPS guidance from $10.10-10.70 to $7.20-8.30, as a result of inflation worries, causing the stock to drop 8% intraday. As a consequence of the Q1 performance, management guided FY revenue growth to be in the mid 20’s, while current forward consensus estimates are the previously mentioned 21.3%, suggesting the market doesn’t believe in the company being able to live up to its own guidance.

All in all, the Q1-2022 results and adjusted outlook left Wall Street disappointed, striking a more critical tone, with the downwards adjusted forward expectations soon following.

During the earnings call, the word “inflation” came up more than thirty times, and in combination with the need to integrate new businesses in form of the recent acquisitions, it’s fair to say that market participants are a bit weary. Management stated the need to offset inflation via pricing strategy, as also evident by the operating margin being down YoY, although up 260 basis points QoQ.

Now, turning to cash flow. As a result of our lower full earnings guidance and higher inventory values at year-end due to the additional wave of inflation we experienced in the last 60 days, we expect free cash flow to now be in the range of $1 billion to $1.5 billion. This range does still reflect a modest working capital reduction year-over-year. We still plan to complete our $4 billion share repurchase program. However, since we see a lower cash flow performance in 2022 for the reasons just articulated, we will defer the remaining portion of — or $1.7 billion until 2023. We continue to pursue a disciplined capital allocation approach that aims to balance share repurchase activity with a commitment to dividends and strong investment-grade credit ratings. We are committed to the completion of this repurchase program in 2023.

Don Allan, CFO, earnings call (emphasis supplied).

As a consequence of the adjusted free cash flow outlook, management also stated they expect to push some of the planned share buyback activity in to 2023. Jim Loree, CEO, concluded the earnings call by saying that there is no question the company is currently facing one of the more challenging business environments in recent times.

On a positive note, we did see what appears to be a positive set of trades, getting a good deal on both divestures and acquisition related activities.

Taking The Long Perspective

That leaves investors with a bit of good and a bit of bad. Management has divested a business unit, acquiring and expanding another, which should drive long-term value for the company. On the other hand, the short-term outlook is very uncertain due to the usual suspect, inflation and lack of knowledge as to where the economy is heading. Usage of long- and short-term impact here is of course my own choice of wording, but in a situation as the one here, I believe it’s about taking the high-level perspective on the business. The company dates back to 1843, having survived an immense number of recessions, so let’s just say there is an overwhelming likelihood the company will also be here after the one we might potentially face this time.

A natural question is then whether the company is in good shape – lets zoom out.

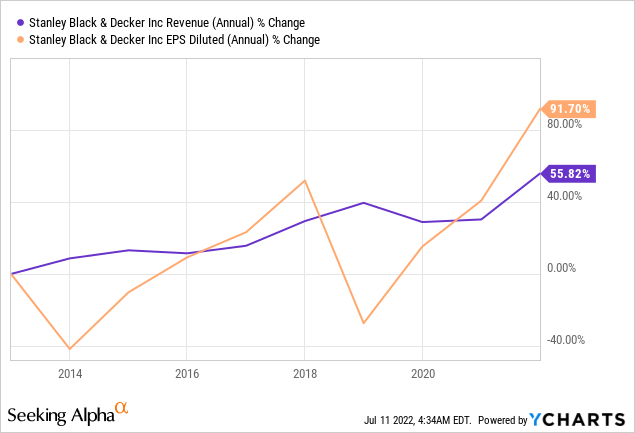

Age hasn’t stopped Stanley Black & Decker from growing its revenue substantially over the past decade, with EPS growth outpacing revenue growth. Speaking of age, Stanley Black & Decker is also amongst the small group of companies able to label themselves as dividend kings. This title is reserved for companies who have managed to pay a growing dividend for at least fifty straight years, and currently, that streak has reached fifty-four years in the case of SWK. Accounting wise, income can change with depreciation policies and the like, but dividends is cash that has to be paid out, and having grown that dividend for more than five decades speaks to the resilience of the business.

While there is concern about the outlook for this fiscal year, earnings are estimated to be back on track for FY2023 with a 16.9% growth on top of an expected 6.4% decline in EPS for this year. That FY2023 outlook may have to be revised, but carrying such an extended history of operations, it appears to be a question of time before the company is back on track.

It’s quite impressive the payout ratio remains so low on average, despite being such a mature company, however not exactly unusual for the dividend kings. That payout ratio should be expected to trend higher given the outlook for this year, but as quite evident from the payout fluctuations, SWK is a cyclical business.

Two negatives to point out, would first of all be the long-term debt development, having grown considerably in recent years as interest rates were low. FY2021 EBITDA/Debt ratio stands at 2.7 with TTM EBITDA/Debt ratio coming in at 4.5, a level I would like to avoid seeing turn higher. Currently, the company carries an A- credit rating from fitch, and I prefer my investments to keep their debt levels in control. As such, while the buyback program appears timely due to the depressed share price, it’s also aggressive considering the relative size of its current debt load, and associated exposure to interest rate hikes.

Some of the pressure could be alleviated by management continued its divesture strategy, as exemplified by the recent announcement to sell its oil & gas business. However, that only works if management then utilizes the proceeds to retire debt. Should earnings contract considerably, the credit rating outlook may change, but being an A- rated company, I don’t see any risks for its status as investment grade.

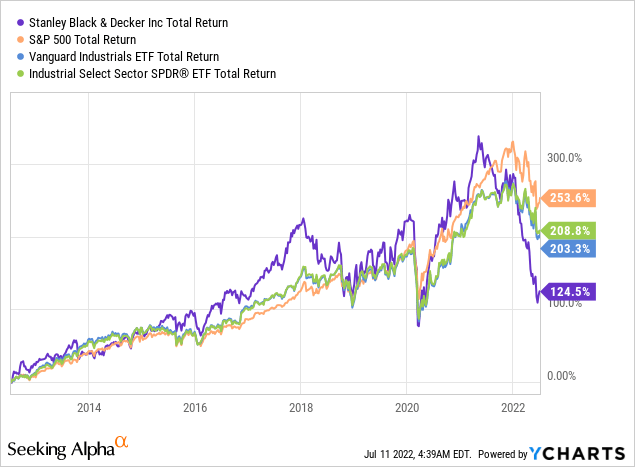

Secondly, we can observe return levels, as the company has been within reach of the S&P 500 index for most of the past decade, with the current market pullback, having been very tough on the overall performance.

Had we measured the performance up until 2021, Stanley Black & Decker would have outpaced the S&P 500, as well as its peers. For now, we are staring at a gap which hasn’t been larger in the past decade, causing me to assume that gap will have to be narrowed at one point, pointing in favor of SWK, as little suggests this company won’t be around for the long haul.

The very source of SWK’s long-term viability, stems from its long list of respected brands amongst both the DIY and professional segment. Still driving innovation within for instances batteries, cordless offerings, etc., all from an umbrella of ESG awareness. On top of that, comes strategic acquisitions to broaden the portfolio in search of relevance amongst customers.

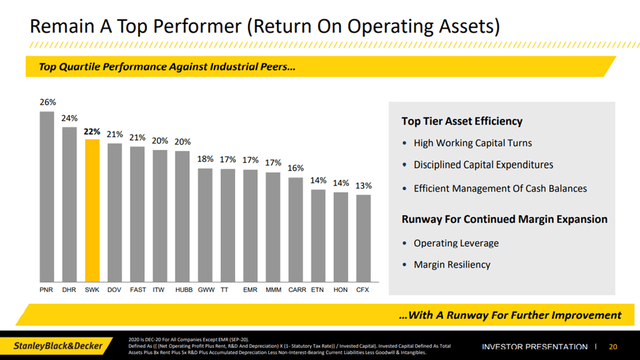

Stanley Black & Decker is a disciplined company, belonging to the top tier of its peer group in terms of capital efficiency and ability to drive returns. Underlining this, is the fact that acquisitions are only conducted if they are in line with the existing long-term financial targets, to ensure the portfolio isn’t undermined by accumulating weaker assets. Unfortunately, the company does have a history of exhibiting impairment charges in relation to completed acquisitions, meaning management executes this strategy with mixed results seen over a longer period. I do, however, see value in shoring up and focusing the portfolio of assets.

Valuation

Given Stanley Black & Decker’s maturity as a company, the price to earnings metric is a very reasonable gauge into its valuation, while allowing for a relative comparison extending several years back.

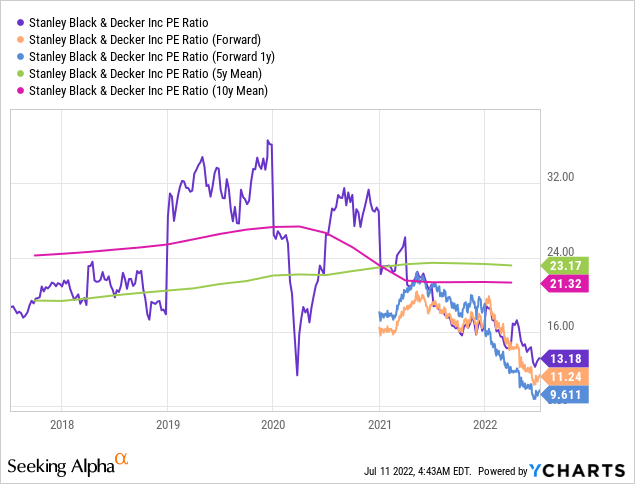

At a first glimpse, SWK is anything but expensive, as its current P/E ratio comes in at just above 13, with a forward P/E of 11.2 and forward 1y P/E of 9.6. In fact, SWK can then quickly appear very appetizing. I would however urge a bit of constraint as I previously mentioned the forward earnings expectations, coming in rather hot with significant growth expected for especially FY2023.

I wouldn’t be surprised if the forward expectations in terms of earnings will have to come down substantially. Management said it themselves, the business finds itself in one of the more difficult environments in recent times, and input inflation is causing difficulties. However, even if forward earnings are reduced considerably, it wouldn’t elevate the P/E ratio to anywhere near the five or ten year means.

Speaking of the long-term means, I don’t agree that a mature business such as SWK, growing its revenue on average 5% annually in the recent decade, should trade at a P/E multiple above 20. Those levels are reserved for fast growing companies, and SWK isn’t it. As such, I expect a P/E ratio more in line with the general market, perhaps to the higher side, deserving that small notch for being a dividend king. The S&P 500 has traded at an average P/E of roughly 19-20 in the recent decades, but that average also having been increased by the index trading at a higher average P/E in recent years leading up to the current market pullback.

Seeing SWK trade at a P/E ratio of 17-18 isn’t a stretch as I see it, but I don’t believe the company should be expected to return to trading above P/E ratios of 20 anytime soon. Additionally, given the uncertainty tied to the forward earnings, I wouldn’t expect the stock to make a rapid return to previous levels in the current situation – for that to happen, we need to see how the company handles the current environment in the upcoming quarters.

All those observations aside, SWK remains a very stable business, that has weathered a tremendous number of global recessions, and today appears timely for investors to go long the stock, although it most likely requires patience, despite the ongoing collapse in the stock price perhaps suggesting a quick return to previous highs.

Conclusion

Stanley Black & Decker is trading 50% off its recent high, something it hasn’t done in the previous decade outside of the Covid-19 market crash. The P/E ratio comes in at 13.2 compared to the five-year mean of 23.2 and ten-year mean of 21.3. On a forward basis the P/S ratio is 11.2 and forward 1y the ratio is 9.6. All signals’ points towards the business being undervalued, and I also find this being a situation of a broken stock and not a broken company. However, as evident from the latest earnings call, the business is finding itself in a tough environment with inflation causing issues in terms of securing satisfactory margins, while revenue also disappointed slightly despite being up 20% YoY.

There is a likelihood that forward earnings expectations will have to come down, deflating what could appear to be an immediate recovery in the share price. The company currently carries strong ratings from the credit companies, but that could also change over the coming quarters as the company has increased its debt load substantially, increasing vulnerability towards growing interest rate payments during a time where working capital is difficult to manage due to the fluctuating business environment. This would only be an issue in a scenario where earnings suffer significantly, and being an A- rated company, I don’t observe any risks to the longevity of the company.

I find that Stanley Black & Decker remains a solid company for those taking a long-term perspective, but I don’t expect much short-term positive action in terms of the share price as the market will most likely be awaiting the coming quarters.

Be the first to comment