DNY59

The end of June marks the end of the first part of 2022. The market’s performance has been disappointing to say the least with the S&P 500 and Nasdaq both in bear market territory. In a way it was long overdue, as most indicators pointed to an overvalued market coupled with a weak economic sentiment. For example, during the first half of 2022, a war was started in Europe, supply chains still did not recover and China imposed new lockdowns, among other things. Nevertheless, a bear market brings along opportunities, as companies get cheaper. Some investors might even argue that most money is made during bear markets, as you will be able to buy quality stocks at a significant discount. I tend to agree with them and try to use the volatility to my advantage. This led to 5 transactions, of which 4 buys and 1 sell.

For the people that have not read my previous articles: I am a 25-year-old investor from the Netherlands who is trying to start early so that I will have the option to retire early or at least earlier (the current retirement age is 67 in NL and is trending upwards). If you are interested in previous updates on my portfolio, you can find them here:

June Update

During June the market hit bear market territory to mark one of the worst half years in market history. This has had a negative effect on the total value of my portfolio and so far I am down around 15% YTD in USD, which is a slight outperformance compared to the S&P500. Part of the reason why my performance is slightly better is that my portfolio is more value-oriented than the benchmark. In my opinion, certain types of stocks, such as unprofitable stocks with high PEs, are more of a gamble than a calculated risk, albeit the risk/reward ratio is more favorable in low-interest environments. I do not expect the low-interest environment to return in the foreseeable future and thus will be cautious when investing in these kinds of stocks.

In the coming months, I will continue to re-evaluate my portfolio. I think that the current environment favors a more active management style as the market can change in a heartbeat, leaving you out to dry. During June I did not have a lot of time for this, as I was busy wrapping up my final exams of the year. Fortunately, I passed the last exam and am now awaiting the result of the last report. I did evaluate my fast fashion/retail stocks. This led to the sale of Associated British Foods (OTCPK:ASBFY)(OTCPK:ASBFF), which is active in the fast-fashion, grocery, agriculture, and sugar industry among other things. To replace ABF I bought Inditex Group (OTCPK:IDEXY) (OTCPK:IDEXF), the owner of multiple fashion brands of which Zara is the largest. The reason why I made the switch to Inditex is that it has been a stronger company over the past few years. I expect this to continue as the company has a strong supply chain and a collection of diverse brands, all with their own specific target group and value offering.

Readers that have read previous updates are aware that I am also competing in an investment competition. Over the past few months, we have been in the first position, but recently we got overtaken by another group. Unfortunately, for the past two weeks, the top 3 has been kept secret and therefore I am not able to tell you our current position. The investment association does this to make the competition more interesting and to keep you, as an investment group, in the dark. As the competition is still ongoing I can not elaborate more about positions or strategies but will provide more information next month.

Transactions

Rules

|

Core |

Value |

Small-cap growth |

|

|

Buy |

|

||

|

Reconsider |

|

|

|

|

Sell |

|

1st of June

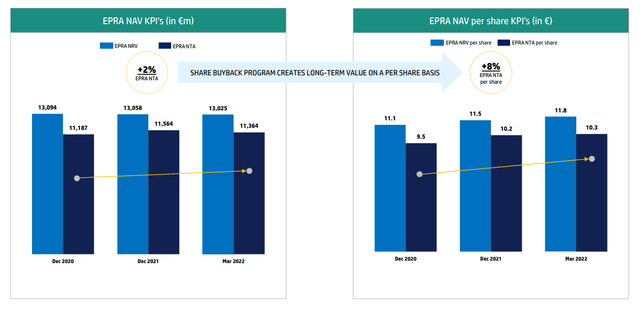

Aroundtown (OTCPK:AANNF) – Bought 69 shares for €4.35 each: Last month I wrote that Aroundtown owns a portfolio of high-quality properties, mainly in Germany and the Netherlands, and that the company is severely undervalued. Since then, the company’s share price has continued to crater. Even though the current economic environment is not necessarily favorable to the company, I expect the positive effects of inflation to outweigh the risks that rising rates brings with them. In theory, the company’s property valuations and rent should increase with rising inflation, which is partly negated by the negative effects of higher interest rates on cap rates. Nevertheless, the company’s real estate is worth approximately €10 per share, and if we would adjust this downwards, based on higher rates, to €8, the company is still trading at less than half of this. Management seems to agree that this undervaluation is too excessive, as it continues to buy back shares to lower the discount and increase ownership of the remaining shareholders. As I have confidence in the resilience of the Dutch and German real estate markets, I will continue to add money to Aroundtown and other European real estate companies.

EPRA NRV and NTA over time (Aroundtown)

16th of June

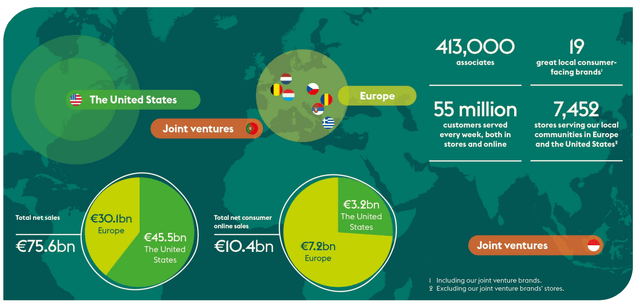

Ahold Delhaize (OTCQX:ADRNY)(OTCQX:AHODF) – Bought 10 shares for €25.26 each: I also added more shares to my position in Ahold Delhaize in June. For the people that are unfamiliar it is a grocer that has operations in the US and Europe. The company is active in both the US and Europe but reports in Euro which should be beneficial given the fact that the USD has appreciated significantly over the past few months. In my opinion the company is a defensive stock that should be relatively stable during market downturns, although inflation could impact margins in the coming short- to mid-term. Furthermore, analysts expect that the company will no longer list Bol.com (an e-commerce platform that is similar to Amazon (AMZN) and is active in the Benelux) as a separate company on the Amsterdam Stock Exchange. This will most likely have a negative effect on the company’s share price in the short term. However, given the fact that we will still need to buy groceries during bad economic times, should limit the downside of the company.

Revenue division Ahold (Ahold-Delhaize)

CTPNV – Bought 18 shares for €10.98 each:

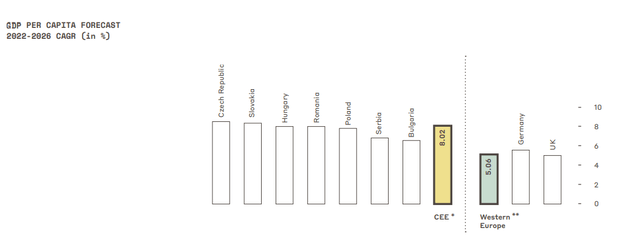

CTPNV is another European real estate company that I added shares to this month. CTPNV focuses on logistics properties in Central and Eastern Europe, although it recently also bought a portfolio of logistics properties in the Netherlands and Germany. With the purchases in the Netherlands and Germany the company’s properties are now located all over Europe, from the Black Sea all the way to the North Sea. This gives the company an advantage over competitors as the company can serve as a one-stop shop for logistics warehouses in Europe. This gives customers the possibility to get all their properties at once, which is easier than dealing with multiple parties. Additionally, with the large footprint in Central and Eastern Europe, the company is active in a region that, before corona, grows significantly faster than Western Europe and the US. At the same time, the market for E-commerce in these countries is still small, which should serve CTPNV well in the coming years.

28th of June

Associated British Foods – Sold 43 shares for GBP 16.58 each:

During the month of June, I compared my fast fashion/retail stocks with other companies in the sector. I do this every once in a while to make sure that my companies are the best in their respective sector or trade at a significant undervaluation, which makes them more attractive than the best in class. When I compared Associated British Foods to some of the other companies in the fast fashion sector (the company gets the majority of revenue from its Primark brand), I found that it wasn’t the best in class and that the undervaluation wasn’t much larger than that of other companies in the sector, which made it better to sell the stocks.

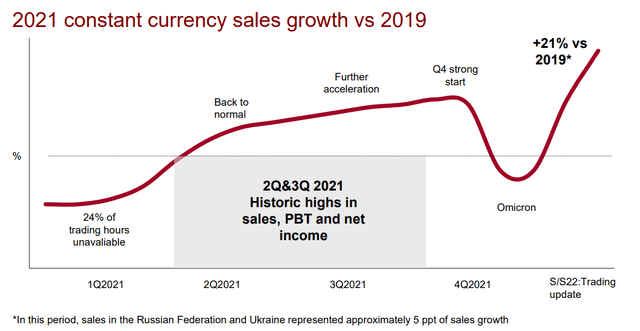

Industria de Diseno Textil (Inditex) – Bought 50 shares for €21.79 each:

The replacement of Associated British Foods is Inditex. Inditex is the owner of multiple clothing brands that include Zara, Massimo Dutti, and Pull & Bear. The company is the largest in the fast-fashion industry and has a very strong supply chain, which makes it easier for them to quickly adjust to new consumer needs. The company recently finished its store optimization process and should see the results of this in the coming years. I wrote a more in-depth article about the company which you can find here.

Inditex revenue growth (Inditex)

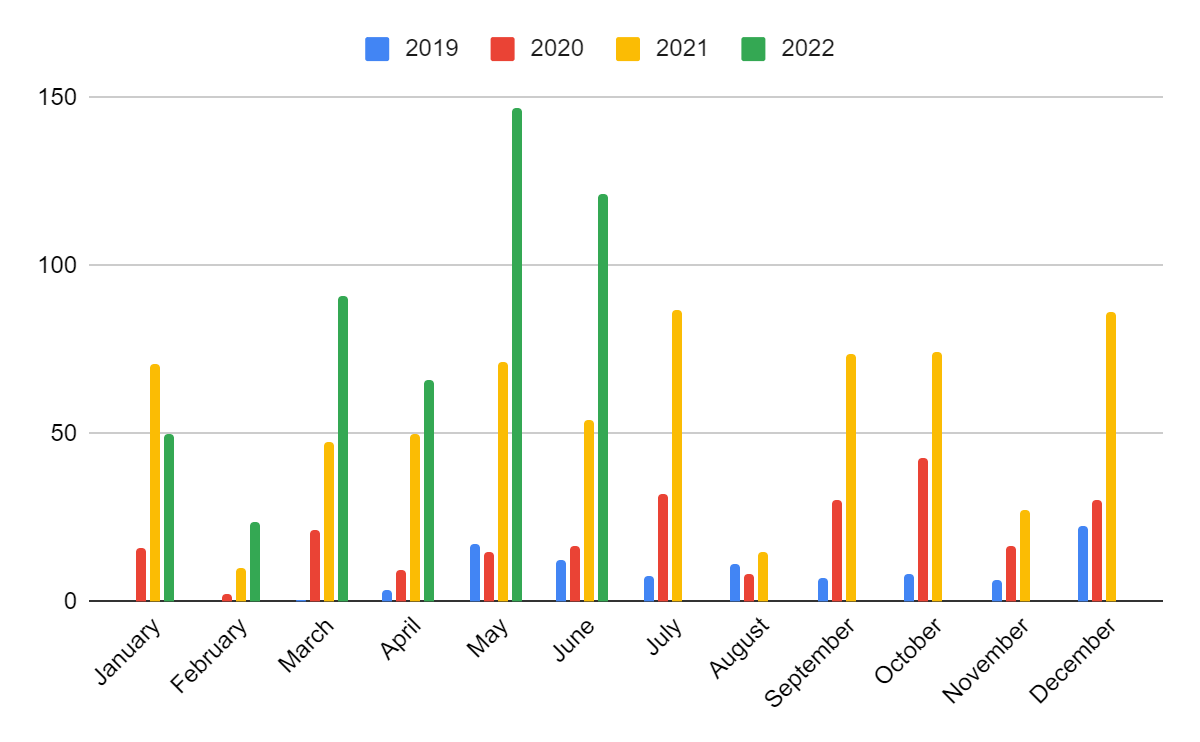

Dividends

During the month of June, I received a total of $137.66 in dividends, which was the second-highest ever (trailing last month). The reason why May and June were significantly higher than other months is due to the fact that some European stocks pay annually instead of quarterly and thus I receive the entire dividend payment during these months. Furthermore, compared to last year the payment of Fresenius was made in June instead of May, which boosted my dividends in the month of June even further.

|

Company |

Dividend 2021 |

Dividend 2022 |

Difference |

|

Visa (V) |

$1.60 |

$2.63 |

$1.03 |

|

€9.82 ($11.65) |

€0 |

-€9.82 ($11.65) |

|

|

Johnson & Johnson (JNJ) |

$3.18 |

$0 |

– $3.18 |

|

Fresenius (OTCPK:FSNUY) (OTCPK:FSNUF)** |

$0 |

€36.80 ($37.37) |

€36.80 ($37.37) |

|

Brookfield Asset Management (BAM) |

$0 |

$0.71 |

$0.71 |

|

Enbridge (ENB) |

$7.46 |

$37.00 |

$29.54 |

|

Intel (INTC) |

$3.82 |

$7.41 |

$3.59 |

|

Jerash Holdings (JRSH) |

$3.90 |

$0 |

-$3.90 |

|

Reinsurance Group of America (RGA)* |

$7.00 |

$0 |

-$7.00 |

|

TJX Companies (TJX) |

$4.16 |

$7.43 |

$3.27 |

|

AT&T (T) |

$2.08 |

$0 |

-$2.08 |

|

3M Company (MMM) |

$7.40 |

$0 |

-$7.40 |

|

L3Harris (LHX) |

$4.08 |

$8.81 |

$4.73 |

|

NETSTREIT (NTST) |

$2.60 |

$13.08 |

$10.48 |

|

Cboe Global (CBOE) |

$3.36 |

$7.49 |

$4.13 |

|

Prudential Financial (PRU) |

$8.05 |

$15.36 |

$7.31 |

|

ATCO Ltd. (OTCPK:ACLLF) |

CAD 5.83 ($4.73) |

$0 |

-CAD 5.83 ($4.73) |

|

Interactive Brokers (IBKR) |

$0.02 |

$0.37 |

$0.35 |

|

Total |

$75.09 |

$137.66 |

$62.57 |

* was paid in May this year

** was paid in May last year

Dividends per month over the last 4 years (Author)

In June Morgan Stanley announced a dividend increase of 11%, which boosts the quarterly dividend by $0.075. The dividend increase and new purchases increased my forward dividend yield to €949.20 ($964.59), which is up approximately $30 compared to last month.

|

Company |

Increase in dividend quarterly |

Dividend per share pre-raise |

Dividend per share post-raise |

|

Morgan Stanley (MS) |

$0.075 |

$2.80 |

$3.10 |

Sector Overview

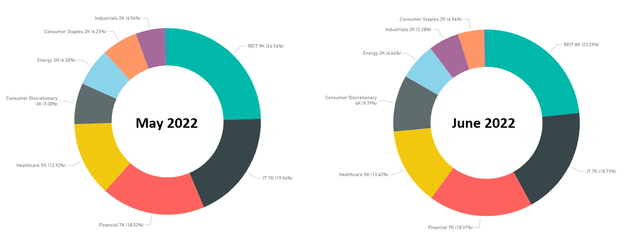

Compared to last month, my sector allocation only changed a little bit. The allocation to REITs and real estate companies went down and this was mainly due to the fact that my European real estate companies fell significantly during the month of June. The drop was mainly driven by fear of a recession and ongoing rate hikes (although this hasn’t come to fruition yet in Europe). At the moment this does not worry me as the current environment (high inflation, and still relatively low rates) are beneficial for real estate owners. Besides the allocation to real estate, we also see a change in my allocation to the consumer discretionary sector. This was mainly driven by the replacement of Associated British Foods and the subsequent addition of new capital to Inditex.

Current Holdings

| Qty Held | Portfolio % | Days Since Latest Buy | |

| Abbvie (ABBV) | 16 | 6.62% | 224 |

| Enbridge | 55 | 6.44% | 237 |

| VICI Properties (VICI) | 73 | 6.21% | 144 |

| Reinsurance Group of America (RGA) | 18 | 5.95% | 125 |

| L3harris | 8 | 5.28% | 158 |

| CBOE Global | 16 | 4.94% | 153 |

| Ahold (OTCQX:ADRNY) | 63 | 4.56% | 18 |

| Visa | 8 | 4.56% | 49 |

| Prosus (OTCPK:PROSY) | 23 | 4.27% | 49 |

| Vonovia (OTCPK:VONOY) | 46 | 3.91% | 54 |

| TJ Maxx (TJX) | 25 | 3.90% | 81 |

| CVS Health (CVS) | 13 | 3.45% | 159 |

| Prudential Financial | 13 | 3.44% | 182 |

| Netstreit | 65 | 3.43% | 144 |

| CTPNV | 107 | 3.41% | 18 |

| Fresenius&CO KGAA | 40 | 3.35% | 94 |

| Aroundtown | 375 | 3.25% | 33 |

| Morgan Stanley | 15 | 3.18% | 63 |

| Inditex | 50 | 3.16% | 6 |

| Brookfield Asset Management | 22 | 2.73% | 49 |

| Broadcom (AVGO) | 2 | 2.64% | 466 |

| Armada Hoffler (AHH) | 70 | 2.51% | 165 |

| Intel Corporation (INTC) | 20 | 2.04% | 158 |

| CoreCard (CCRD) | 29 | 1.82% | 94 |

| CareCloud (MTBC) | 126 | 1.21% | 49 |

| Power REIT (PW) | 25 | 0.97% | 111 |

| Linkfire | 1121 | 0.91% | 133 |

| StoneCo (STNE) | 35 | 0.76% | 228 |

| Interactive Brokers | 4 | 0.56% | 48 |

| The Hut Group (OTCPK:THGHY) | 189 | 0.53% | 181 |

| Tezos (XTZ-USD) | 50 | 0.20% | 494 |

| Hedera Hashgraph (HBAR-USD) | 680 | 0.12% | 466 |

| Bitcoin (BTC-USD) | 0 | 0.08% | 466 |

| Binance (BNB-USD) | 0 | 0.02% | 494 |

Going Forward

In the coming months, I will be adding capital to my portfolio although this might not be as regularly as normal. During the month of July and August, I will visit Eastern Europe and Houston, so I will have less time to keep an eye on the stock market. For the month of July, I am looking at the following companies/group of companies:

European real estate

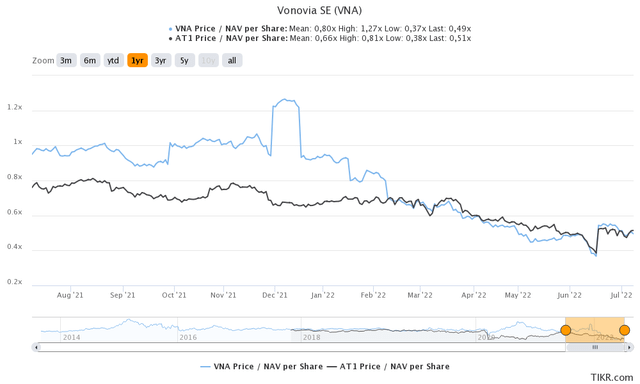

The European real estate sector has sold off recently and it isn’t uncommon to find companies that trade at less than 50% of their reported Net Tangible Assets (NTA). I am not claiming that the NTA of all these companies is completely accurate as different appraisers use slightly different valuation methods and/or cap rates.

However, if we look at a company like Vonovia that now trades at approximately 45% of NTA, while it used to trade close to the estimated fair value. Not a lot has changed over the past months, the ECB hasn’t done any rate hikes and inflation will boost the rent (and most likely increased property valuations), although the company did move from development to hold to development to sell. Nevertheless, this does not justify a drop of more than 30% YTD. Therefore, I am looking to add to Vonovia, Aroundtown, and CTPNV.

Overview price to estimated NAV (note this is different than company reported NAV) (Tikr.com)

Inditex

I added Inditex this month and the company is one of the best-performing companies in the fast-fashion industry. The company still trades at a significant discount to my fair value estimate and I don’t expect that to change in the coming month. Given the arguments stated under transactions and in my recent article, I am looking to add to my position in Inditex.

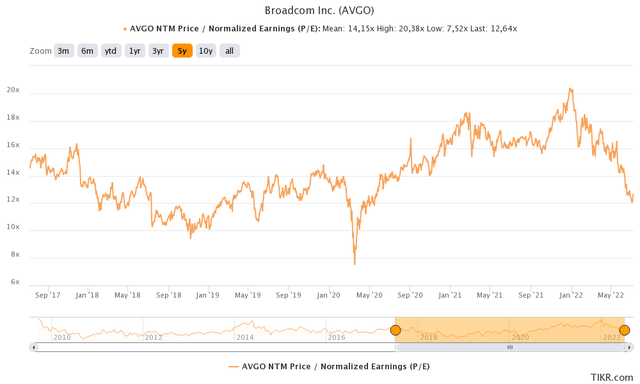

Broadcom

Broadcom is my smallest dividend growth position and one that I have been looking to add to for a while. The reason why my stake in the company is relatively small is that it continues to trade above my estimated fair value. Some investors might argue that you have to pay a premium for quality stocks but from what I have experienced during my relatively short stint as an investor is that most stocks will revert to fair value over time (which I currently estimate to be around $506). This is exactly what happened during the past few weeks with Broadcom and therefore I am willing to add to my position at the current levels.

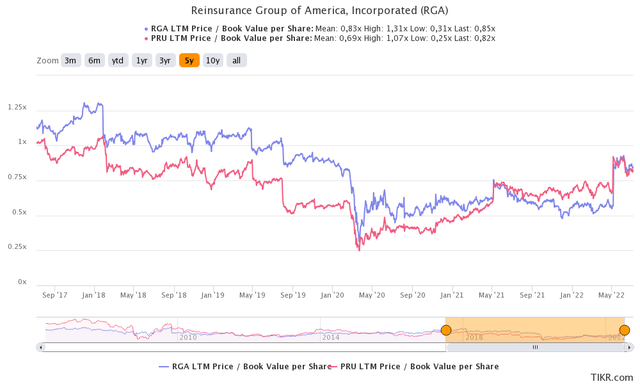

Insurance companies

Last month I mentioned that I was going to re-evaluate my insurance companies. Unfortunately, due to exams and other responsibilities, I did not have enough time to finish this analysis. As a result, I will finish the analysis during the month of June and will most likely close on of the two positions that I have in insurance companies (Prudential or Reinsurance Group of America).

RGA and PRU LTM bookvalue per share (Tikr.com)

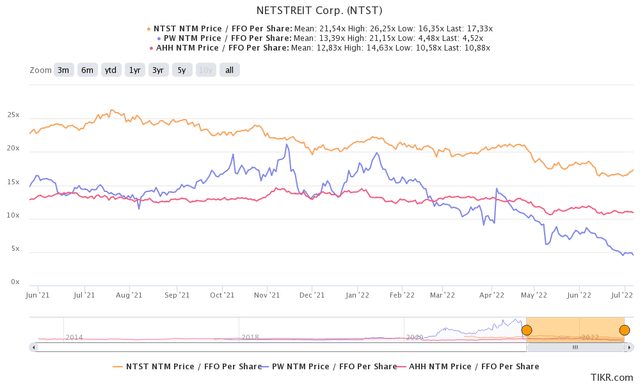

Small-cap REITs

Another group of companies that I will look into is small-cap REITs. At the end of June, I had a stake in three small-cap REITs: Armada Hoffler, Power REIT, and Netstreit. I am planning to look into the growth of the different sectors, the governance structures, and overall performance. I will also compare them to some other small-cap peers such as Alpine Income (PINE), CTO Realty (CTO), and Newlake Capital Partners (OTCQX:NLCP). Once the analysis is done I am planning to cut the weakest company and limit my exposure to two small-cap REITs.

small-cap REITs P/FFO (Tikr.com)

Conclusion

June marked the end of the first half of 2022, which was one most investors would rather forget. The stock market was down significantly during the first half of 2022 and things can only go up from here. Fortunately, it isn’t all bad news as a cratering stock market gives you the possibility to buy the same company at a lower price. Personally, I used the cratering stock prices to increase my dividends and as a result, my dividends this month came in at $137.66 pre-tax. My new forward dividend yield is currently approximately €950 ($965), which was mainly due to new capital put to work.

In the coming months, I will be a little less active in the stock market due to my holiday, but I will continue to add a substantial amount to my portfolio as well as re-evaluate my current positions.

I hope you enjoyed the update about my progress, and I would love to hear your thoughts on my portfolio and what you would like to see in future updates.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment