Scott Olson

Starbucks Corporation (NASDAQ:SBUX), together with its subsidiaries, operates as a roaster, marketer, and retailer of specialty coffee worldwide.

In today’s article, we will be focusing on three key takeaways from the firm’s latest earnings report. These include the development of demand for the company’s products, the risks associated with China and the targets for 2023.

We published an article on Starbucks earlier this year, titled: “3 Reasons Why We Like Starbucks“. In that article, we rated SBUX’s stock as a “buy”, due to its impressive revenue and EPS growth despite the challenging macroeconomic environment, its attractive dividend and dividend growth and last but not least, its sizeable share buyback program.

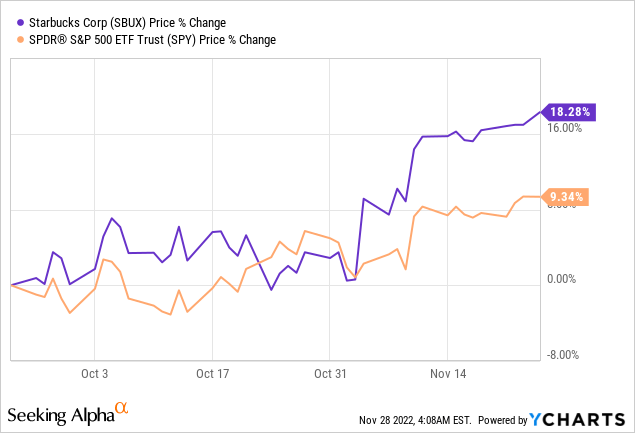

Since our publication, SBUX’s stock price has increased by more than 18%, substantially outperforming the broader market.

So now, let us take a look at the reasons why we remain bullish on the firm going into 2023.

Strong demand

The demand for Starbucks’ products has remained high despite the challenging macroeconomic environment. Consumer confidence in the United States is at extreme lows, while inflation is forcing firms to increase prices in order to maintain profitability.

Despite these headwinds, SBUX has performed well, not only in Q4, but in 2022 in general. Let us look at the segments individually now.

North America

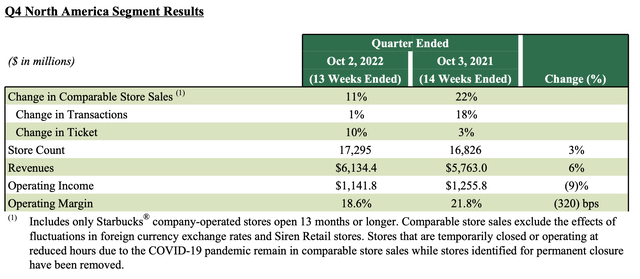

While comparable store sales have slowed compared to the year ago quarter, sales growth has remained in the double-digit territory. This growth has been fueled by both an increase in volume and an increase in the pricing.

In Q4 revenue has reached as much as $6.1 billion in North America.

Q4 results – North America (SBUX)

We believe that these results prove that the demand for Starbucks’ products is relatively inelastic. In our opinion, it is also a proof that Starbucks has a loyal customer base and has a significant competitive advantage against their competitors.

The operating margin of SBUX has however declined in the last quarter. We expected the factors causing this contraction to be temporary in nature and we are foreseeing a margin expansion starting in the second half of 2023. These factors included: “[…] investments and growth in labor including enhanced store partner wages as well as increased spend on new partner training, coupled with higher commodity and supply chain costs due to inflationary pressures […]”.

International segment

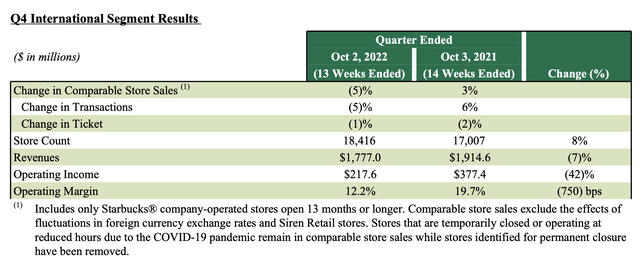

The international segment results have been not as promising as the North American ones. Comparable store sales have declined, as both transactions and ticket amount declined, despite an increasing number of stores.

For the period, revenue has reached $1.777 billion, down 7% compared to the year ago quarter.

Q4 results – International (SBUX)

The primary drivers of the decline were: unfavorable FX environment and the impacts of Covid-19 restrictions in China.

Net revenues for the International segment declined 7% (1% lower on a 13-week basis) over Q4 FY21 to $1.8 billion in Q4 FY22, primarily driven by an 11% unfavorable impact from foreign currency translation, the impact of the extra week in fiscal 2021, as well as a 5% decline in comparable store sales, primarily attributable to COVID-19 related restrictions in China. These decreases were partially offset by growth in our licensed store revenue including higher product sales, royalty revenues and the conversion of the Korea market from a joint venture to a fully licensed market in Q4 FY21, as well as net new store growth of 8% over the past 12 months.

We believe that both the relative strength of the USD compared to other currencies and China’s zero Covid policy are likely to keep negatively impacting the firm’s financial results in the near term. However, we believe that towards the end of 2023, these factors are likely to have a less significant impact than today.

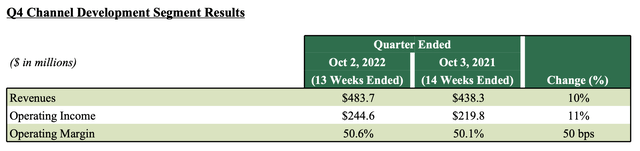

Channel development segment

This is the smallest segment of the firm, with revenues being less than $500 million.

Q4 results – channel development (SBUX)

Regardless, the revenue growth and the expansion of the operating margin, despite the macroeconomic challenges, are impressive.

Net revenues for the Channel Development segment grew 10% (16% on a 13-week basis) over Q4 FY21 to $483.7 million in Q4 FY22, driven by growth in the Global Coffee Alliance and global ready-to-drink business, partially offset by the extra week in Q4 FY21.

Operating income increased to $244.6 million in Q4 FY22 compared to $219.8 million in Q4 FY21. Operating margin of 50.6% expanded from 50.1% in the prior year, primarily due to business mix shift.

All in all, we believe that SBUX has a loyal customer base and a substantial competitive advantage, due to its wide brand recognition and global footprint, against its competitors. Even in times of economic uncertainty, the demand for their products has remained high. For these reasons, we remain bullish on the firm.

But as the international segment has not been doing too well, we have to take a closer look at one of the main drivers: China.

Risks associated with China

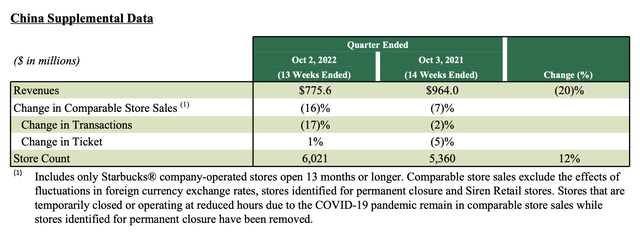

China has been having a very strict zero-Covid policy. This has resulted in not only a decrease in supply, but also a decline in demand across many sectors and industries. It has also had a negative impact on SBUX’s financial figures. Comparable store sales have declined by as much as 16%, while revenue has declined by 20%.

China supplemental data (SBUX)

So what do we expect, and how will this policy develop in the future?

Lockdowns and quarantines have kept making the lives of workers more and more difficult, which has led to dissatisfaction and in several instances also to unrest among workers.

Several international politicians have expressed their opinions and raised their concerns, saying that such a strict policy is not sustainable. Plus, at the same time, the policy has not been working as cases have been continuously rising. On the 11th of November, there has been an announcement stating that China tweaks its zero-Covid policy. This loosening up includes 20 modifications to their previous policy, including, but not limited to:

[…] Travellers arriving from abroad, for example, will have to quarantine for eight days, down from ten. Airlines will no longer face a suspension of flights if they carry too many covid-infected passengers. Inside China people considered “close contacts of close contacts” of covid carriers will no longer need to quarantine. And the new guidelines forbid mass testing unless it is unclear how infections are spreading in an area. […]

In our opinion, this development signals that China is listening and understands the limitations of their policies and, most importantly, they are willing to make them better. While restrictions may keep negatively impacting the supply and demand in the near future, we expect a significant improvement going into 2023.

2023+ targets

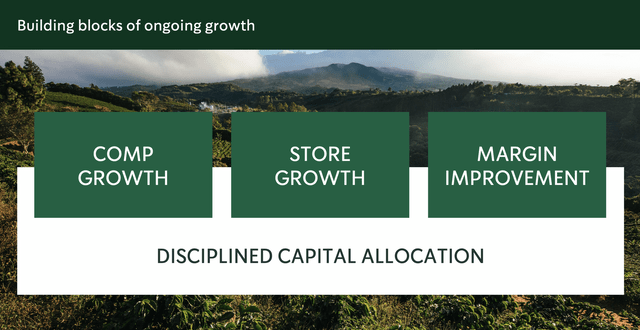

Starbucks is aiming to achieve a 15% to 20% EPS growth between FY23 and FY25. Their growth strategy is built on three primary pillars, as presented on their latest Investor Day and discussed in the earnings call. These pillars are: comp growth, store growth and margin improvement.

Building blocks of growth (SBUX)

Global and U.S. comp growth is estimated to be in the range of 7% to 9% between FY23 and FY25, while the growth in China is expect to reach 4% to 6% in FY25.

In the same period, global store growth is forecasted to be around 7%, 3%-4% growth in the U.S and as much as 13% in China.

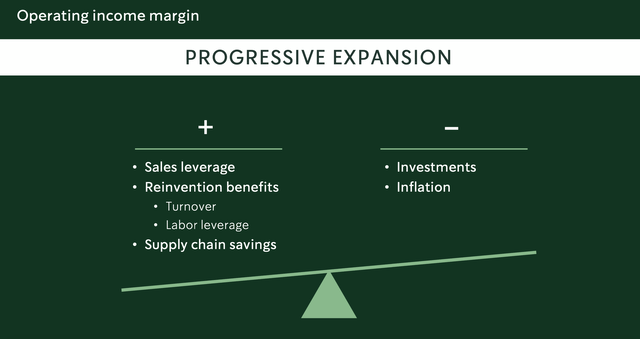

The operating income margin is expected to expand progressively, as a result of sales leverage, reinvention benefits and supply chain savings.

Operating income margin (SBUX)

All together, these three pillars are expected to lead to a substantial EPS growth in the mid-term.

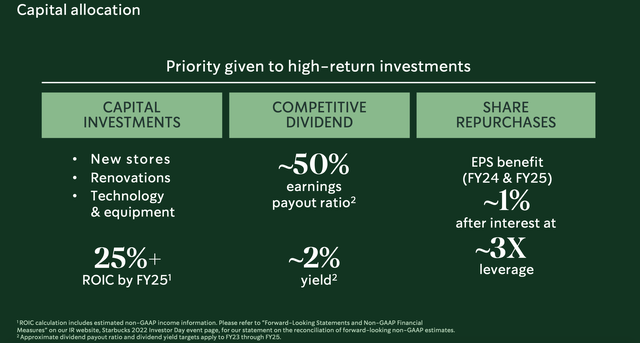

In our opinion, the goals and targets that have been set by the firm appear realistic and achievable. The slide below shows the firm’s capital allocation strategy, which could enable this estimated growth.

Capital allocation (SBUX)

To sum up

SBUX has presented impressive results and growth figures, despite the macroeconomic headwinds, including poor consumer sentiment, the negative impacts of Covid-19 restrictions in China and the unfavorable FX environment.

China appears to be slightly easing on their zero-Covid policy, which could be a catalyst for many stocks.

The firm’s 2023+ target appear realistic and achievable, while potentially providing attractive returns to investors.

We maintain our “buy” rating.

Be the first to comment