Gorlov/iStock via Getty Images

Investment Thesis

SWK 10Y Stock Price

Seeking Alpha

Stanley Black & Decker (NYSE:SWK) has catastrophically underperformed against the wider market destruction, since it continued to plunge by -64.45% since hitting its peak of $216.08 in May 2021. With a tragic -$21.26B loss in enterprise value thus far, it is uncertain when SWK will recover from this blood bath. The housing market remains a highly cyclical sector, with things expected to enter a new ice age as the Feds aggressively hike interest rates through 2023.

Investors that enter now for its stellar 53 years of dividend payouts should be able to stomach more downsides from current levels, since the worst of the recession is not even here yet. One would be well advised to wait for the $60s for an improved margin of safety, though the SWK stock is unlikely to record similar pandemic highs in the short term. Patience is warranted, speculatively by 2024, once macroeconomics improves and housing market sentiments normalize.

SWK Continues To Suffer From The Raging Inflation & Inventory Correction

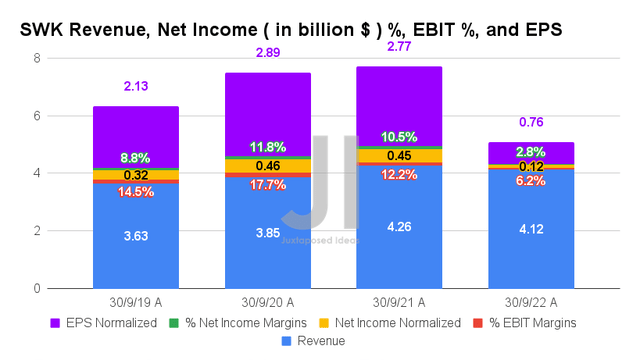

S&P Capital IQ

In its recent FQ3’22 earnings call, SWK delivered sobering news with $4.12B in revenues and 6.2% in EBIT margins, indicating a notable QoQ decline of -6.37% and -3 percentage points, respectively. Thereby, impacting its profitability with adj. net incomes of $0.12B, adj. net income margins of 2.8%, and adj. EPS of $0.76, significantly worsened by the tougher YoY comparison.

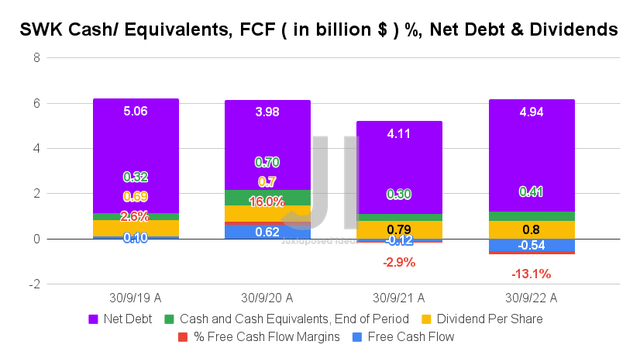

S&P Capital IQ

Therefore, it is not surprising to see SWK continually report negative Free Cash Flow (FCF) generation of -$0.54B and FCF margins of -13.1% in FQ3’22, given its compressed margins thus far. Nonetheless, the management has reported positive cash flow by September and expected to perform similarly through FY2023. Therefore, we may potentially see a moderate stock recovery by FQ4’22, with market analysts estimating $428.33M of FCF generation then.

Furthermore, dividend payouts remain safe despite SWK’s massive debts of $5.35B, since $3.26B is repaid in FQ3’22, only $500M is due 2025, and the rest remarkably well staggered through 2060. Though inventory remains elevated at $6.34B by the latest quarter, we are not overly concerned since these are non-perishable products and would easily be top and bottom lines accretive upon sale, significantly aided by the price increases and sustained professional demand thus far.

Combined with the $2.33B reported for share repurchases and the $472.9M of annual dividends paid out over the last twelve months (LTM), SWK very much remained a dividend king, returning much value to its long-term investors despite the recent destruction in stock prices.

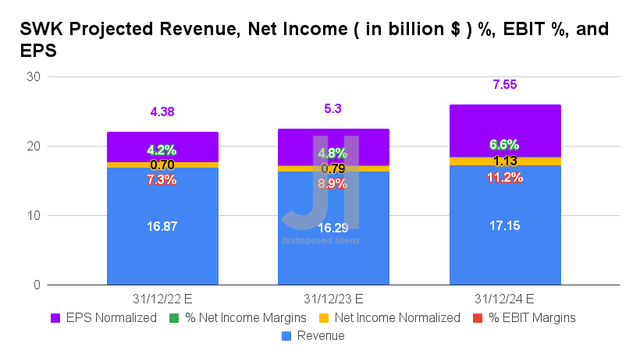

S&P Capital IQ

Nonetheless, SWK is expected to report a notable deceleration in revenue and net income growth at a CAGR of 3.2% and -13.2% over the next three years, against pre-pandemic levels of 8.2%/9.4% and hyper-pandemic levels of 4%/16.9%, respectively. It is apparent that the management’s decision to overly stock its warehouse is not going well, given the massive -9.5% YoY inflationary impact on its gross margins by FQ3’22, due to the ongoing retail demand destruction. However, we expect these to be temporary headwinds, since the rising costs are market-wide issues and not limited to SWK alone.

In the meantime, SWK’s strategic decision in planned production curtailments and inventory destocking has obviously inflated its fixed plant costs and massively impacted its FY2022 profitability by -22.5% to EPS of up to $4.65, against previous guidance of $6 and estimates of $5.44. With the housing sales expected to dry up over the difficult winter as the Feds aggressively hike interest rates through 2023, it is no wonder that the SWK stock has been thoroughly decimated by -59.86% YTD against the S&P 500 Index’s decline of -21.39% at the same time.

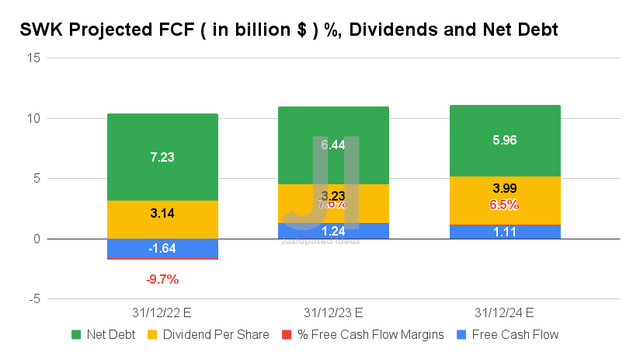

S&P Capital IQ

Furthermore, SWK’s profitability is expected to moderately deteriorate over the next few years, with EBIT/ net income/ FCF margins of 13.5%/8.8%/7.5% in FY2019, 13.9%/11.1%/0.9% in FY2021, and finally to 11.2%/6.6%/6.5% by FY2024.

However, we must also highlight the continued growth in SWK’s annual dividend payouts to $3.99 by FY2024, indicating dividend yields of 5.34% then, based on current share prices. The company’s B+ dividend safety quant rating is also impressive, bolstered by the fact that its forward yield is significantly above its 4Y average yield of 1.99% and the sector median of 1.68%.

So, Is SWK Stock A Buy, Sell, or Hold?

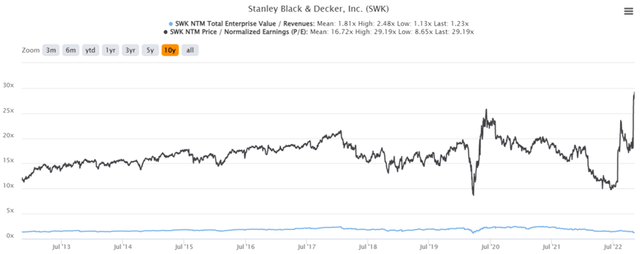

SWK 10Y EV/Revenue and P/E Valuations

S&P Capital IQ

SWK is currently trading at an EV/NTM Revenue of 1.23x and NTM P/E of 29.19x, lower than its 10Y EV/Revenue mean of 1.81x though massively elevated from its 10Y P/E mean of 16.72x. The stock is also trading at $74.64, down -62.53% from its 52 weeks high of $199.20, nearing its 52 weeks low of $70.24. Nonetheless, consensus estimates remain somewhat confident about SWK’s prospects, due to their price target of $82.00 and a 9.86% upside from current prices.

It is evident by now that the recent destruction has only provided bottom-fishing dividend hunters with a highly attractive entry point to this particular dividend king, which has been impressively growing its dividend payouts for the past 53 years. Investors that buy in now are looking at 2011 levels of ridiculous cheap. One would be well advised to load up at the next dip, since FQ4’22 may herald the start of its slow turnabout.

Naturally, the eventual recovery is speculative since there are still moderate risks of further retracements ahead. Though 61.5% of analysts are projecting a 50 basis points hike for the Fed’s next December meeting, we are less hopeful, since early signs still point to similarly elevated inflation rates for October PPI/CPI reports. Combined with the Fed’s recent hawkish commentary, SWK may potentially further retrace to the $60s, assuming another inline 75 basis points hike. Investors with higher risk tolerance could nibble at those levels for an impressive 6.13% dividend yield by FY2024. In the meantime, portfolios should also be sized appropriately in the event of volatility through H1’23, as the world bears the brunt of a full-blown recession.

Be the first to comment