ZoltanGabor

This article is part of a series that provides an ongoing analysis of the changes made to Fundsmith’s 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 8/15/2022. Please visit our Tracking Terry Smith’s Fundsmith 13F Portfolio series to get an idea of their investment philosophy and the fund’s moves during Q1 2022.

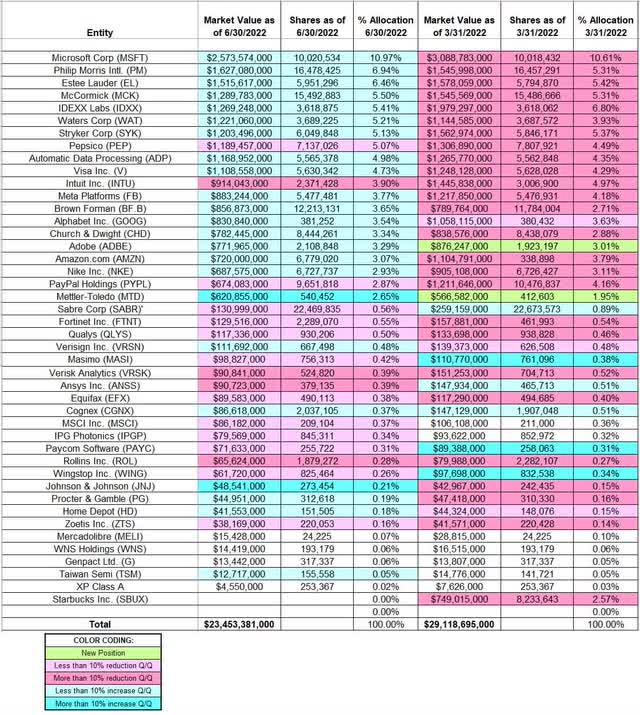

This quarter, Fundsmith’s 13F portfolio value decreased ~20% from $29.12B to $23.45B. The number of holdings decreased from 44 to 43. The top three holdings are at ~25% while the top five are close to ~37% of the 13F assets: Microsoft, Philip Morris International, Estee Lauder, McCormick, and IDEXX Labs.

Note: Their flagship Fundsmith Equity Fund (2010 inception) has returned 15.8% annualized compared to 11.2% for the MSCI World Index through 6/30/2022. However, they have underperformed the index substantially this year: Negative 17.8% vs Negative 11.3% for the MSCI World Index.

New Stakes:

None.

Stake Disposals:

Starbucks Inc. (SBUX): The 2.57% SBUX stake was built in 2020 at prices between ~$58 and ~$103. 2021 saw incremental buying while last quarter saw a ~30% reduction at prices between ~$79 and ~$117. The disposal this quarter was at prices between ~$70 and ~$92. The stock currently trades at $82.94.

Stake Increases:

Microsoft Corp (MSFT): MSFT is currently the largest position at ~11% of the portfolio. The stake was built during the five-year period from 2013 to 2018 at prices between ~$27 and ~$115. Since then, the activity had been minor. There was a ~23% selling last quarter at prices between ~$276 and ~$335. The stock currently trades at ~$256. This quarter saw a marginal increase.

Philip Morris International (PM) and Stryker Corp (SYK): These two stakes were built during the last decade through consistent buying every quarter. The 6.94% PM stake was established at prices between ~$60 and ~$120. Last quarter saw a ~20% selling at prices between ~$89 and ~$112. The stock is now at ~$95. This quarter saw a marginal increase. SYK is a 5.13% of the portfolio position purchased at prices between ~$50 and ~$275. There was a ~20% reduction last quarter at prices between ~$245 and ~$278. The stock currently trades at ~$204. This quarter saw a minor ~4% increase.

Estee Lauder (EL): The top three 6.46% EL stake was established in 2016 at prices between ~$75 and ~$95. 2018 saw a two-thirds stake increase at prices between ~$125 and ~$158. Since then, the activity had been minor. There was a ~20% selling last quarter at prices between ~$250 and ~$372. The stock currently trades at ~$248. This quarter saw a minor ~3% increase.

McCormick Corporation (MCK): MCK is a large 5.50% of the portfolio position built during the 2018-19 timeframe at prices between ~$108 and ~$177. The time period since had also seen minor buying. There was a ~18% reduction last quarter at prices between ~$245 and ~$311. The stock currently trades at ~$364. This quarter saw a marginal increase.

Note: they have a ~6.2% ownership stake in the business.

IDEXX Labs (IDXX): IDXX is a 5.41% of the portfolio position established during the 2015-16 timeframe at prices between ~$63 and ~$120. Since then, the position had remained relatively steady although adjustments were made in most quarters. There was a ~15% trimming last quarter at prices between ~$466 and ~$631. The stock currently trades at ~$344. There was a marginal increase this quarter.

Waters Corp (WAT): WAT is a 5.21% of the portfolio stake built during the 2015-2017 timeframe at prices between ~$115 and ~$200. Next two years also saw incremental buying. There was a ~23% selling in H1 2020 at prices between ~$175 and ~$240. Since then, the activity had been minor. There was a ~18% reduction last quarter at prices between ~$307 and ~$365. The stock currently trades at ~$298. This quarter saw a marginal increase.

Note: they have a ~6% ownership stake in Waters Corp.

Automatic Data Processing (ADP): The 2013-19 timeframe saw consistent buying in ADP at prices between ~$52 and ~$173. Q1 2020 saw a ~40% selling at prices between ~$112 and ~$181 while in the next quarter there was a ~70% increase at prices between ~$128 and ~$160. Since then, the activity had been minor. Last quarter saw a ~22% reduction at prices between ~$196 and ~$245. The stock is now at ~$239 and the stake is at ~5% of the portfolio. There was a marginal increase this quarter.

Visa Inc. (V): Visa is a 4.73% of the portfolio position established over the last decade through consistent buying in most years. The build-up happened at prices between ~$30 and ~$245. Last quarter saw a ~18% selling at prices between ~$191 and ~$235. The stock currently trades at ~$198. This quarter saw a marginal increase.

Meta Platforms (META): The 3.77% META stake was built in 2018 at prices between ~$125 and ~$210. The stake had remained steady since although adjustments were made in most quarters. There was a ~20% reduction last quarter at prices between ~$187 and ~$339. The stock currently trades at ~$160. This quarter saw a marginal increase.

Brown-Forman (BF.B): BF.B is a 3.65% of the portfolio stake built in 2019 at prices between ~$45 and ~$68. 2021 saw a ~50% stake increase at prices between ~$67 and ~$81 while last quarter there was a ~28% selling at prices between ~$62 and ~$72. The stock is now at $71.64. This quarter saw a minor ~4% increase.

Alphabet Inc. (GOOG) (GOOGL): GOOG is a 3.54% of the portfolio position purchased in Q4 2021 at prices between ~$133 and ~$151. There was a ~9% trimming last quarter. The stock currently trades well below their purchase price range at ~$109. This quarter saw a marginal increase.

Note: The prices quoted above are adjusted for the 20-for-1 stock split in July.

Church & Dwight Inc. (CHD): The 3.34% CHD position was built during the three quarters through Q2 2021 at prices between ~$72 and ~$93. There was a ~28% selling last quarter at prices between ~$95 and ~$104. The stock currently trades at $84.18. There was a marginal increase this quarter.

Adobe Inc. (ADBE): ADBE is a 3.29% of the portfolio position purchased last quarter at prices between ~$412 and ~$564 and the stock currently trades below that range at ~$368. This quarter saw a ~10% stake increase.

Amazon.com Inc. (AMZN): The ~3% AMZN stake was built in H2 2021 at prices between ~$160 and ~$186. Last quarter saw a ~20% selling at prices between ~$136 and ~$170. The stock is now at ~$128. There was a marginal increase this quarter.

NIKE Inc. (NKE): The 2.93% NKE stake was built in H1 2020 at prices between ~$67 and ~$105. There had been minor buying in most quarters since. Last quarter saw a ~23% reduction at prices between ~$118 and ~$166. The stock is now at ~$106. This quarter saw a marginal increase.

Mettler-Toledo (MTD): The 2.65% MTD stake was purchased over the last two quarters at prices between ~$1098 and ~$1675 and the stock currently trades at ~$1195.

Cognex Corporation (CGNX), Home Depot (HD), Johnson & Johnson (JNJ), Procter & Gamble (PG), Taiwan Semi (TSM), and Verisign Inc. (VRSN): These very small (less than ~0.5% of the portfolio each) positions were increased this quarter.

Stake Decreases:

PepsiCo (PEP): The ~5% PEP stake was built over the last decade through consistent buying during most quarters. The buying happened at prices between ~$65 and ~$170. There was a ~25% reduction last quarter at prices between ~$154 and ~$176. The stock is now at ~$171. This quarter also saw a ~9% trimming.

Intuit Inc. (INTU): INTU is a fairly large ~4% of the portfolio stake built during the 2017-18 timeframe at prices between ~$115 and ~$225. Since then, the position had remained relatively steady although adjustments were made in most quarters. Last three quarters have seen a ~50% reduction at prices between ~$353 and ~$695. The stock currently trades at ~$420.

PayPal Holdings (PYPL): The bulk of the 2.87% PYPL position was built in the 2015-16 timeframe at prices between ~$32 and ~$44. The next two years saw incremental buying and since then the position had been kept relatively steady. There was a ~20% reduction last quarter at prices between ~$94 and ~$195. The stock currently trades at ~$91. This quarter also saw a ~8% trimming.

ANSYS Inc. (ANSS), Equifax Inc. (EFX), Fortinet Inc. (FTNT), IPG Photonics (IPGP), MSCI Inc. (MSCI), Masimo Corporation (MASI), Paycom Software (PAYC), Qualys Inc. (QLYS), Rollins Inc. (ROL), Sabre Corp (SABR), Verisk Analytics (VRSK), Wingstop Inc. (WING), and Zoetis Inc. (ZTS): These very small (less than ~0.6% of the portfolio each) positions were decreased this quarter.

Note: they have a ~7% ownership stake in Sabre Corp.

Kept Steady:

Genpact Ltd. (G), MercadoLibre (MELI), WNS Holdings (WNS), and XP Class A: These minutely small (less than 0.1% of the portfolio each) positions were kept steady this quarter.

The spreadsheet below highlights changes to Fundsmith’s 13F holdings in Q2 2022:

Terry Smith – FundSmith’s Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Fundsmith’s 13F filings for Q1 2022 and Q2 2022.

Be the first to comment