DieterMeyrl

Since my last update on the GDX in August, the ETF has fallen significantly, seeing one of its most intense periods of weakness relative to the price of gold since the panic liquidation seen during the Covid crash of March 2020. The weakness in the GDX has been in part caused by the rise in oil prices, which has eaten into earnings and cash flows. The good news is that on most valuation metrics (price to book value, sales, EBITDA, and operating cash flows, the GDX is trading below its March 2020 lows. We have seen some recent weakness in oil prices relative to gold, which should provide support to earnings and cash flows.

The GDX ETF

The VanEck Vectors Gold Miners ETF is the oldest, largest, and most liquid gold mining ETF which tracks the performance of the NYSE Arca Gold Mining Index. Despite the recent crash in Newmont’s (NEM) share price, it remains the largest company on the index with a weighting of 13%, closely followed by Barrick Gold (GOLD). The GDX is more diversified than the iShares MSCI Global Gold Miners ETF (RING) where these two stocks comprise 19% and 14% respectively. This comes at the expense of a slightly higher expense ratio of 0.52% versus RING’s 0.39% and a lower dividend yield of 2.2% vs 3.1%. That said, we should see the GDX’s dividend continue to rise in line with the underlying NYSE Arca Gold Mining Index, which has risen back to multi-year highs of 2.9%.

Cost Pressures May Have Peaked

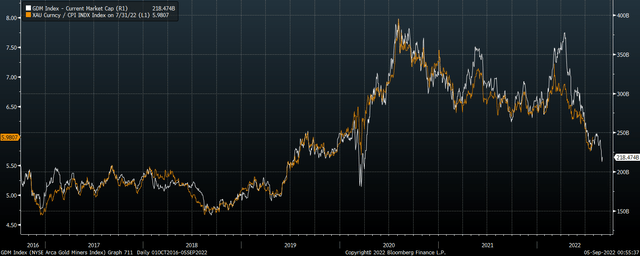

As I noted in my previous article, the GDX has a history of underperforming the price of gold, largely due to the rise in share issuance in the underlying companies on the index. For this reason, it is more useful to compare the gold price against the market capitalization of the underlying NYSE Arca Gold Mining Index. On this metric, since the 2020 peak the sector has lost a staggering 37% of its value relative to the price of gold.

In large part this underperformance reflects the rising price of oil, which is an important part of the cost structure for gold mining companies. Gold mining stocks tend to track the performance of the real price of gold rather than the actual price of gold, as when inflation is rising and gold prices are falling, the GDX tends to perform poorly as rising costs eat into profits. This can be seen in the chart below, which shows the market cap of the underlying index versus the real price of gold.

Gold Mining Sector Market Cap Vs Real Gold Price (Bloomberg)

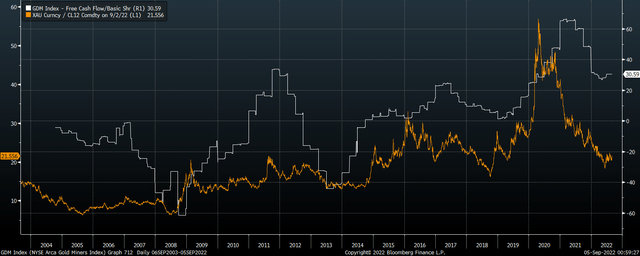

The good news is that while gold prices have come under pressure in recent months, oil prices have fallen even faster. This should provide some relief to gold miners’ cash flows. As the chart below shows, the gold-to-oil ratio is closely correlated with free cash flows, which appear to be bottoming out after their fall from the 2021 peak.

Free Cash Flows Vs Gold/Oil Ratio (Bloomberg)

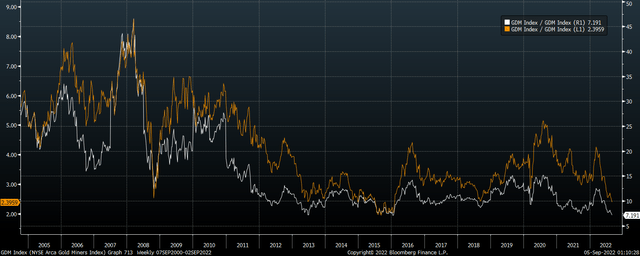

Valuations At Below The 2020 Lows

From a longer-term perspective, GDX valuations are now looking highly attractive once again. This is particularly the case when looking at enterprise value metrics as they take into account the improvement in debt ratios seen over the past decade. As the chart below shows, both EV/sales and EV/operating cash flow ratios are below their 2020 crash levels, and close to their 2015 bear market lows.

Orange Line: EV/Sales. White Line: EV/Cash Flow (Bloomberg)

Of course, strong long-term shareholder returns will only materialize if these revenues and cash flows translate into free cash flows, which will depend on whether miners can keep their capex costs down, but there has been a clear shift in the industry towards a focus on cost reduction and shareholder returns and away from all-out revenue expansion as was the case a decade ago. This has been reflected in the increase in dividend payments in the sector, with the NYSE Arca Gold Mining Index now offering a respectable dividend yield of 2.9%. As this article by Daniel Thurecht explains, Barrick gold appears committed to raising its dividend payouts, and the yield on the stock is now above 5%.

A Global Panic Creates Short-Term Risks, But Long-Term Opportunities

The main risk facing the GDX in the short term comes from another global panic which causes a collapse in risk assets and a self-reinforcing surge in the dollar. The more the Fed maintains its hawkish stance in the face of falling inflation expectations, the greater the risk of this occurring. While gold usually tends to outperform most stocks during such times, gold mining stocks have a history of underperforming. That said, history also shows that every debt-deflation event paves the way for increased levels of government spending and central bank money creation, which should ultimately be positive for gold prices and the GDX.

Be the first to comment