sanfel/iStock Editorial via Getty Images

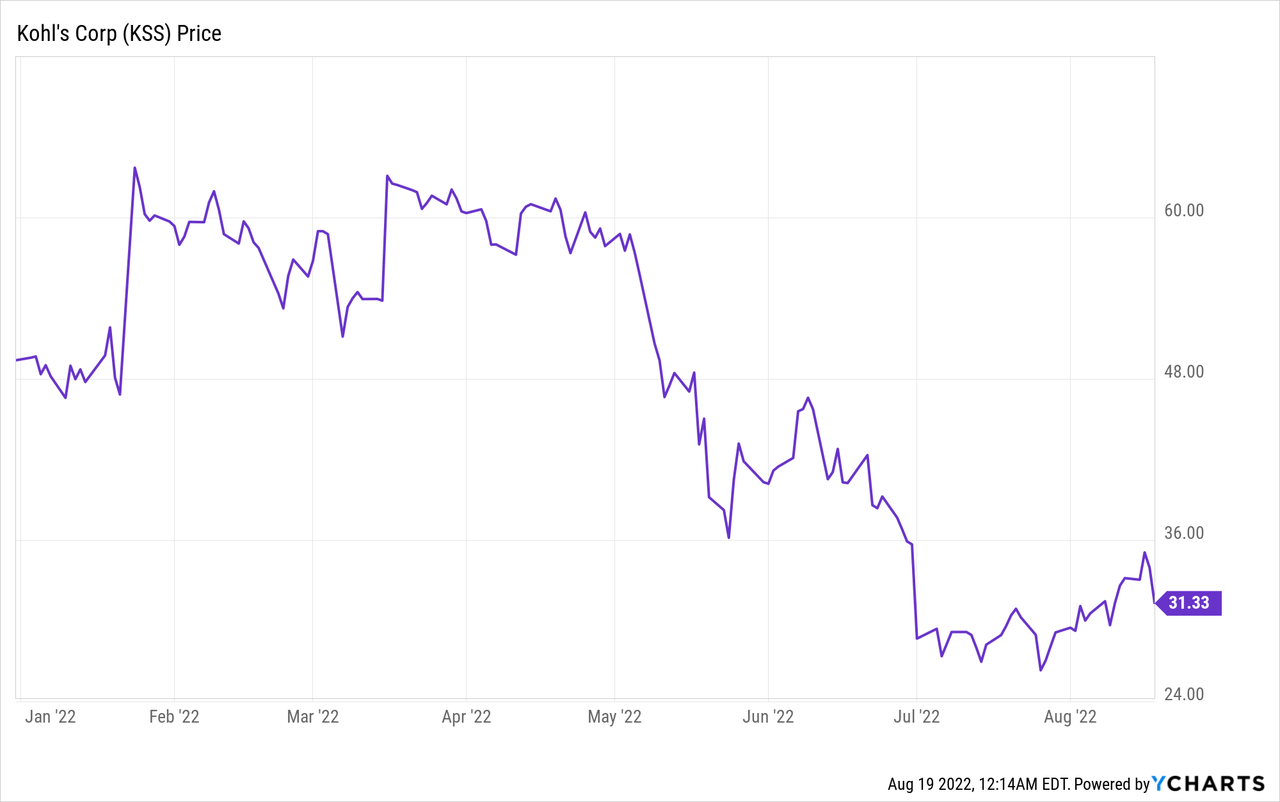

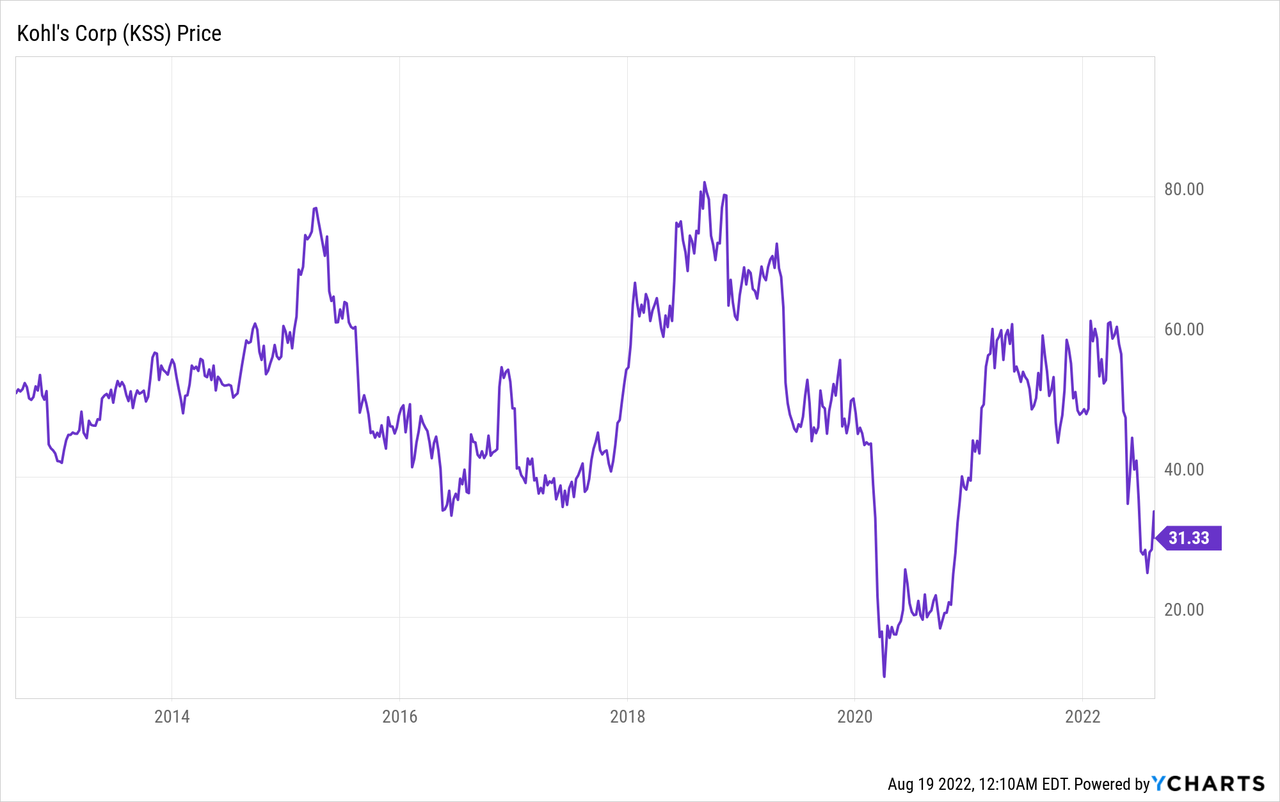

Just four months ago, Kohl’s (NYSE:KSS) stock sat above $60, as investors salivated about the prospect of a leveraged buyout at around $70 per share. However, the stock lost more than half of its value over the ensuing three months, as high inflation and other macro factors drove an abrupt sales slowdown, causing margins to contract dramatically and torpedoing any near-term chance of a buyout.

After rallying in recent weeks along with other discretionary stocks, Kohl’s stock retreated again following the company’s Q2 earnings release on Thursday. While earnings were roughly in line with analysts’ vastly reduced expectations, Kohl’s slashed its full-year 2022 EPS guidance by more than 50%.

Thus, 2022 is shaping up to be an ugly year for Kohl’s. That said, unique short-term factors largely explain the company’s current struggles. I continue to believe that Kohl’s is implementing a sound long-term strategy that will enable a rebound in sales, earnings, and cash flow over the next 2-3 years. That gives Kohl’s stock tremendous upside potential for risk-tolerant investors willing to ride out near-term volatility.

An abrupt trend change

During 2021, Kohl’s (like many of its peers) made a remarkable comeback. Net sales rebounded to just 2% below the company’s fiscal 2019 performance. And with demand outstripping supply, Kohl’s cut back on discounting, driving impressive margin expansion. This helped it post record adjusted EPS of $7.33: up 51% from fiscal 2019.

Entering 2022, Kohl’s projected that full-year sales would grow 2%-3%, returning to pre-pandemic levels. Moreover, management expected top-line momentum to accelerate as the year progressed, largely due to the company’s plan to open another 400 Sephora shops in its stores during the spring and summer. Kohl’s estimated that full-year 2022 EPS would come in between $7.00 and $7.50: roughly in line with fiscal 2021.

However, Kohl’s started off on the wrong foot, as unseasonably cool weather in the northern U.S. weighed on sales of spring merchandise during Q1. Net sales declined 5.2% in the period and adjusted EPS plummeted 90% to just $0.11.

During Kohl’s Q1 earnings call, management noted that sales trends had improved in May as the weather had turned more favorable. Nevertheless, the company cut its full-year guidance, calling for 0%-1% sales growth and adjusted EPS of $6.45-$6.85.

Unfortunately, the improvement didn’t last long. On July 1, in conjunction with terminating its strategic review process, Kohl’s updated its Q2 sales outlook, calling for a high-single-digit sales decline, rather than its previous forecast of a low-single-digit decrease. While the company didn’t provide any additional guidance updates at the time, it was clear that the sales slowdown would have a severe negative impact on Kohl’s earnings, both for the second quarter and the full year.

Investors got a fuller picture of the damage this week. Net sales fell 8.5% on a 7.7% comp sales decline in Q2. Total revenue dropped 8.2% to $4.1 billion. Gross margin contracted to 39.6% from 42.5% a year earlier, while SG&A expenses increased 3.4%. That caused EPS to plunge 55% year over year to $1.11. For the full year, Kohl’s now expects sales to fall 5%-6% and EPS to crater to just $2.80-$3.20: an even steeper guidance reduction than analysts had anticipated.

What’s going on here?

The sharp downturn in Kohl’s performance this year may not have been predictable in advance, but it is being driven by easy-to-understand factors.

First, middle-income consumers have traditionally been Kohl’s core demographic. Inflation is straining those households’ budgets, forcing them to reduce discretionary spending. (Management noted that higher-income consumers are still increasing their spending at Kohl’s.)

Second, CEO Michelle Gass has been positioning Kohl’s as a casual and active lifestyle brand. However, apparel spending has shifted towards “dress-up” clothing this year, thanks to a boom in weddings and a gradual return to the office.

Third, global supply chain problems caused many items to arrive late in 2021, leading to missed sales. That led retailers like Kohl’s to place orders for 2022 further in advance, making them less nimble when demand trends turned.

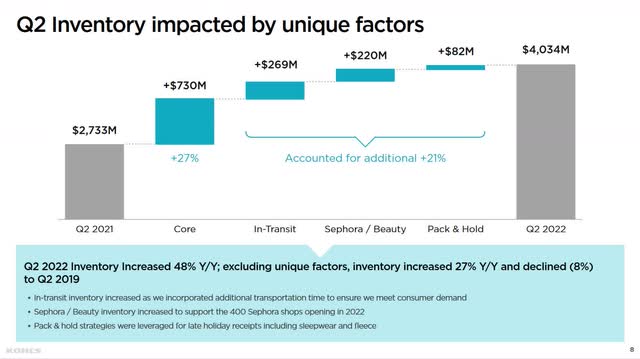

Thus, Kohl’s entered the second quarter with core inventory up 16.5% year over year (and total inventory up 40%), forcing it to increase promotional activity to drive sales and clear excess merchandise. Despite those efforts, it ended the quarter with inventory levels up even more (27% on a “core” basis and 48% overall). This overhang will weigh on gross margin for a few more quarters.

Source: Kohl’s Q2 2022 Earnings Presentation (slide 8).

Kohl’s struggles largely mirror what’s going on at Target (TGT). On Wednesday, Target reported that its operating margin crashed to just 1.2% last quarter, down from 9.8% a year earlier, as the retail giant ramped up discounts to clear out unwanted merchandise.

But Target is benefiting from its food and essentials merchandise categories, which accounted for nearly half of its sales last year. Strength in those areas helped keep Target’s top line growing last quarter, while also driving a steady flow of store traffic to support discretionary category sales. By comparison, Kohl’s almost exclusively sells discretionary merchandise, so store traffic has fallen as consumers cut back.

Kohl’s has the right strategy

From a long-term perspective, Kohl’s current issues don’t seem worrisome. Inflation will cool off sooner or later. (Sooner, in my opinion, but I’m no macro expert.) The Fed’s efforts to tame inflation could cause a recession, but that wouldn’t last forever, either. In any case, middle-income consumers will eventually need to refresh their wardrobes, helping Kohl’s recoup its 2022 sales declines.

Additionally, “casualization” is a long-term trend in American fashion. Kohl’s decision to stand for something (or at least try) will serve it better over the long haul than trying to capitalize on a short-term jump in demand for dressy apparel. Lastly, Kohl’s has already adjusted its orders and promotional plans to reduce inventory.

Kohl’s current struggles also validate its aggressive investments to open Sephora boutiques in its stores. Beauty products are replenishment items and drive consistent traffic (similar to food and other essentials, albeit on a smaller scale). Moreover, sales in the Sephora shops are mostly incremental to Kohl’s revenue, as the company had a very small beauty business previously.

As a result, stores where Sephora opened last year are now seeing a high-single-digit sales lift compared to those without Sephora. Kohl’s plans to open another 250 Sephora shops in 2023, and it is working with Sephora to design a smaller prototype for its remaining 300-plus locations. That supports its goal of building a $2 billion beauty business by 2025.

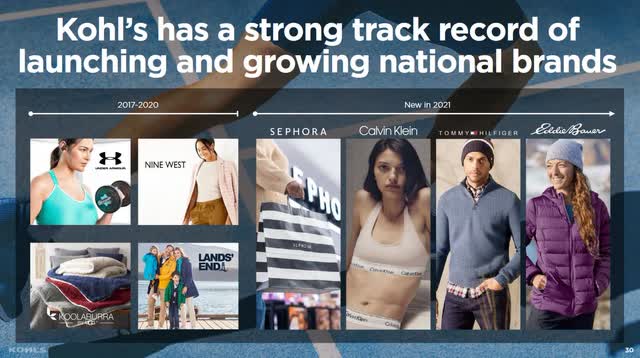

Kohl’s sales gains among higher-income households are also promising, even though they aren’t making up for lower spending by middle-income consumers yet. Kohl’s has upgraded its merchandise assortment with more premium brands in recent years (e.g., Under Armour (UA) (UAA), Lands’ End (LE), Eddie Bauer, Tommy Hilfiger, Calvin Klein, and now Sephora). While many of these brands don’t carry the cachet they once did, they will still move Kohl’s image upmarket over time, helping the brand broaden its reach.

Source: Kohl’s 2022 Investor Day Presentation (slide 30).

Finally, Kohl’s work on developing smaller-format store concepts could pay off handsomely over time. Not only will it be able to expand in urban areas where it previously struggled to find appropriate sites, but Kohl’s will also have opportunities to reduce real estate costs by relocating to smaller stores as leases on certain large-format locations expire.

Don’t fear the short-term pain

Kohl’s stock fell 8% on Thursday after the earnings report, closing at $31.33. Many shareholders are angry, frustrated, demoralized, or a combination of all three: particularly given that multiple parties expressed interest in buying the company for more than twice the current share price just 4-5 months ago.

Taking a step back, though, Kohl’s stock has gone through multiple euphoria/fear cycles just in the past decade. This is the third time the stock has lost at least half of its value in a year or less since 2015. Each of the previous times, Kohl’s shares have come roaring back before long.

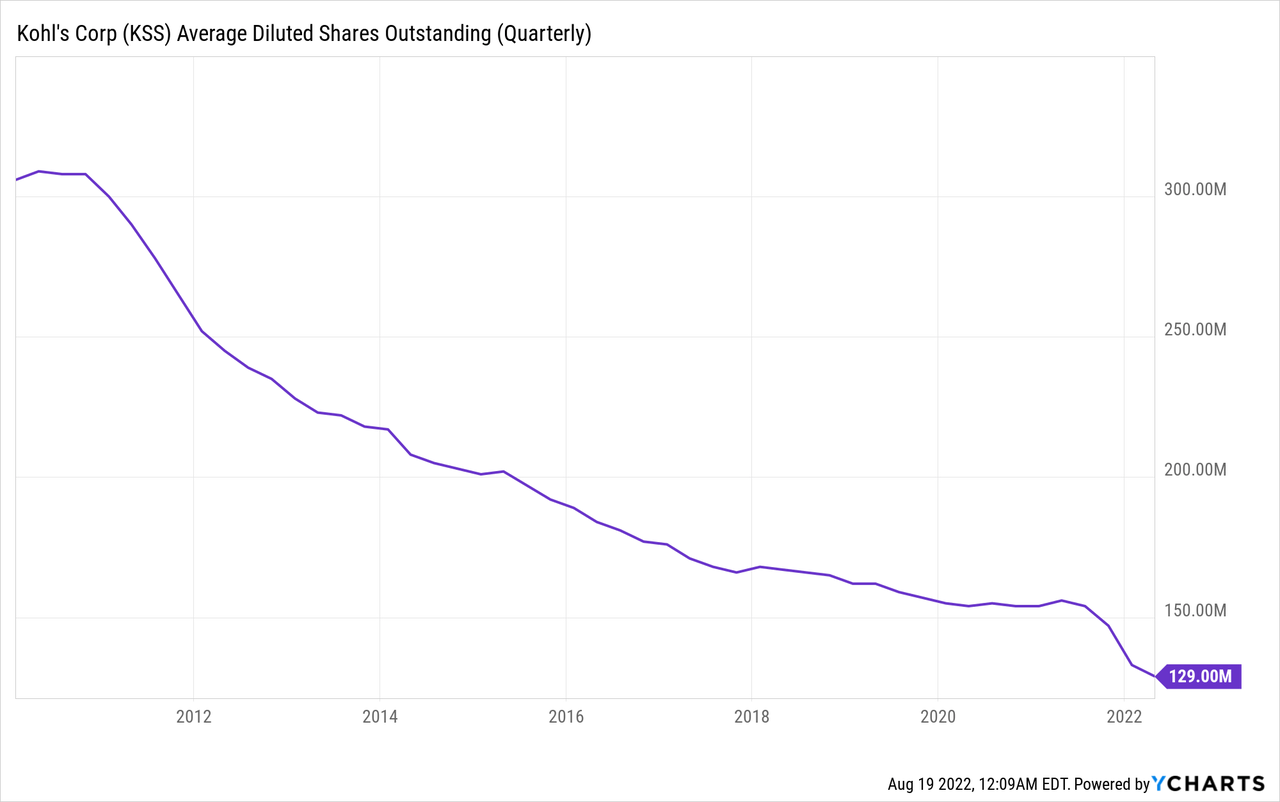

Kohl’s launched a $500 million accelerated share repurchase (ASR) program on Thursday to capitalize on the near-term weakness in its share price. At current prices, that would enable it to buy back 16 million shares, reducing its share count to around 115 million by year-end (assuming some offset from stock-based compensation): down from around 155 million in early 2020 and over 300 million a decade earlier.

If Kohl’s sales and profitability recover over the next few years, as I expect, the company’s aggressive buyback activity since mid-2021 will turbocharge its EPS growth. Kohl’s has also signaled interest in opportunistic sale-leaseback deals to fund additional share repurchases if the stock price remains depressed.

In an analysis last November, I estimated that Kohl’s EPS could reach $9 by 2024, lifting the stock into triple-digit territory. The setback this year may delay Kohl’s in reaching that earnings figure by a year or so. But by 2025, Kohl’s will probably have fewer than 100 million shares outstanding, well below the 120 million I assumed in my prior analysis. As a result, Kohl’s could reach $9 in EPS with sales around 2019 levels and a 7% operating margin (at the low end of its target range).

I expect Kohl’s earnings multiple to remain pressured as its earnings recovery progresses. Investors won’t easily forget how quickly the company’s fortunes changed this year. So I no longer believe that shares would surpass $100 on EPS of $9. But if EPS does reach $9 within a few years, the shares would more than double from here even at a very conservative 8x multiple. A sustained low multiple would also magnify the impact of share buybacks, enabling faster long-term EPS growth that would benefit shareholders in the long run.

Key risks

The biggest long-term risk for Kohl’s shareholders is that the company’s strategic initiatives (most notably the Sephora rollout) fail to revive store traffic and sales. While Kohl’s could mitigate the impact of permanently lower sales by cutting costs, it would likely have to settle for meaningfully lower margins. In this scenario, Kohl’s stock could be dead money (or worse) for many years to come.

Kohl’s also faces near-term risk from its decision to go ahead with the $500 million ASR despite recording negative free cash flow of $1.1 billion in the first half of fiscal 2022. Working capital pressure and front-loaded CapEx have driven this outflow. As a result, Kohl’s had just $222 million of cash and equivalents on hand as of July 30, and it had already drawn $79 million on its credit facility. Kohl’s is dipping even further into its credit facility to fund the ASR.

Kohl’s should generate at least $1 billion of free cash flow in the second half, enabling it to repay the credit facility borrowings and then some. And if necessary, it could probably sell or borrow against some of its real estate on short notice. Nevertheless, in a black swan scenario, Kohl’s aggressive capital allocation strategy could come back to haunt shareholders.

Additionally, if the Fed struggles to tame inflation over the next couple of years (or sparks an economic meltdown in trying to do so), Kohl’s middle-income consumers could be forced to slash discretionary spending further. That would obviously have a severe negative impact on sales and profitability.

I view these risks as very manageable, especially when stacked up against Kohl’s long-term earnings potential. Kohl’s current troubles will pass. Within a few years it will be reaping the full benefit of its Sephora upgrades, new brand partnerships, small-format expansion, and other growth initiatives. That will help EPS reach new heights, with Kohl’s stock not far behind.

Be the first to comment