Justin Paget

I love investing in the REIT sector for several reasons, from the tax structure to the larger than market average dividends. I have favored the net lease sector in my own portfolio, but one of the sectors that I have been looking to add to is the industrial sector. I have written about a couple of industrial REITs in recent months, including Prologis (PLD) and Terreno Realty (TRNO). Both have somewhat rich valuations and a long history of rapid dividend growth. Today’s article will be on one of their industrial REIT competitors, STAG Industrial (NYSE:STAG).

Investment Thesis

STAG Industrial is an industrial REIT with a market cap of $6.3B. They have a solid balance sheet and portfolio of real estate, with a tenant base of many large companies. Shares are down 25% YTD, which has brought the valuation closer to fair value. Shares now trade at 16.3x price/FFO, which is slightly above the average multiple of 14.9x. In my previous article on STAG, I rated it a sell in early January as the valuation was too rich in my opinion and the lack of dividend growth, especially compared to competitors, was enough to make me look elsewhere.

STAG has a monthly dividend, which is a bonus, and shares now yield 4.2%. This is higher than many industrial REIT peers, but the lack of dividend growth was the main reason I sold my shares at the end of 2021. The dividend growth could increase, but as long as the dividend increases remain small, I will remain on the sidelines.

The Business

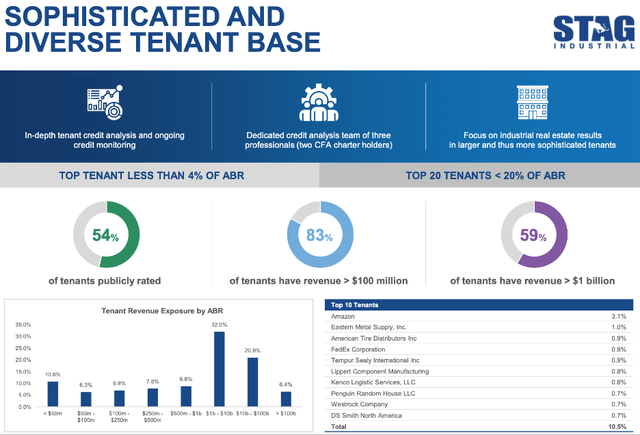

While I’m not bullish on STAG as an investor, I will be the first to admit that the company has built a solid portfolio of industrial real estate. While the top 10 tenant list includes a couple of well-known companies like Amazon (AMZN) and FedEx (FDX), they only account for 10.5% of rents. The top 20 tenants account for less than 20% of ABR, so they have a well-diversified tenant roster.

STAG Tenants (stagindustrial.com)

They also have a conservative balance sheet, and it shows when you look at their debt maturities. They carry 95% fixed rate debt, which is a plus in a rising interest rate environment. The debt is well-laddered, with approximately 21% maturing before 2024. When they can borrow in the 3 to 4% neighborhood, they are borrowing at costs well below inflation, which is another plus to consider in this high inflation environment. However, the valuation isn’t much to get excited about in my opinion, even after a 25% selloff YTD.

Valuation

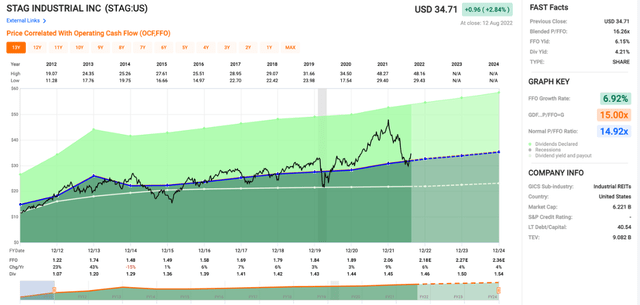

STAG is close to fair value in my opinion. With shares at 16.3x price/FFO, they are slightly above the average multiple of 14.9x today. Some authors have argued that we will see multiple expansion, which would certainly drive attractive returns for investors, but I wouldn’t count on it. Over time, STAG has pretty closely tracked the 15x multiple, as you can see below.

FFO/share growth is projected to be in the mid-single digits for the next couple of years, which has been the case since 2015. While the valuation is more attractive than the last time I wrote about STAG, it’s not attractive enough to start a position again in my mind. The other reason that I have no position is the lackluster dividend growth history for STAG.

Dividend Growth?

One of the main reasons I decided to sell STAG along with the elevated valuation at the time was the lack of dividend growth. I liked the monthly dividend, but the small dividend hikes were frustrating. The monthly dividend has grown a little more than $0.02 since the company switched to the monthly payout in 2013.

While I don’t think STAG is in any danger of a dividend cut, I would recommend investors looking to add exposure to the industrial REIT sector look at some potential alternatives. While the starting yield might be lower, you are likely to find a couple of options with much better dividend growth. For comparison, Terreno Realty (TRNO) recently hiked its quarterly dividend 17% from $0.34 to $0.40. In a recent article, I explained why I plan to add Terreno to my Roth IRA in the coming months. One of the primary reasons is the rapid dividend growth that is set to continue for years to come.

Conclusion

STAG Industrial is one of a few companies that chooses to pay out monthly dividends, a definite bonus for investors in my mind. The company also has a solid balance sheet and real estate portfolio. The valuation at 16.3x price/FFO is much closer to fair value than it was when I wrote my first article on the company, and that is why I’m switching from a sell to hold. However, the lack of dividend growth is why I will remain on the sidelines for now, despite a safe 4.2% yield.

Be the first to comment