Jun/iStock via Getty Images

Thesis

Investing in STAAR Surgical (NASDAQ:STAA) is investing in a well-run company led by a great CEO with a proven history of leading companies onto a strong path. STAAR Surgical has a dominant position in its industry. Growth since 2015 has been great. Revenue has been growing at double-digit rates in major geographies across 75 countries like the U.S., China, Japan, Europe, and Asia Pacific, and is expected to keep growing at that breakneck pace. STAA Surgical currently has zero-debt, is cash-rich and has been a profitable company since 2016, and has increased its operating income 44 times since the current CEO took over just 7 years ago. The strong balance sheet and business fundamentals mean that the current high inflation environment has little impact on its business. Finally, the valuation is at the lowest it has ever been in its history, thanks to the derisking environment which is making STAA investable now in my opinion.

Business Overview

STAAR Surgical is not a new company. For 40 years, it has dedicated itself to ophthalmic surgery, designing, developing, manufacturing, and marketing implantable lenses for the eye with companion delivery systems. STAA’s 575 full-time employees sell EVO ICL and Visian ICL family of lenses in more than 75 countries and had sold more than 2,000,000 implantable Collamer lens (ICLs) worldwide. The official vision of the company is:

Our goal is to position our refractive lenses throughout the world as primary and premium solutions for patients seeking visual freedom from wearing eyeglasses or contact lenses while achieving excellent visual acuity through refractive vision correction. We also make lenses for use in surgery that treats cataracts.

They have two key products, the implantable Collamer lens (ICLs) and the intraocular lenses (IOLs). These lenses are intended to provide visual freedom for patients, lessening or eliminating the reliance on glasses or contact lenses. The ICL segment of STAA’s business is also the most profitable, generating the most revenue.

STAA’s website

STAAR introduced its first versions of the implantable Collamer lens (ICLs), made of silicone, in 1991. In 1996 STAAR began selling the Visian ICL® outside the U.S. Made of STAAR’s proprietary biocompatible Collamer® lens material, the ICL is implanted behind the iris and in front of the patient’s natural lens to treat refractive errors such as myopia, hyperopia, and astigmatism. The ICL received CE Mark in 1997, permitting sale in countries that require the European Union CE Mark, and it received FDA approval for the treatment of myopia in the U.S. in December 2005. More recently in 2022, STAA announced that the U.S. Food and Drug Administration (FDA) has granted approval of the EVO/EVO+ Visian® Implantable Collamer® Lens (“EVO”) for the correction of myopia and myopia with astigmatism. An estimated 100 million U.S. adults ages 21 to 45 who have myopia are potential candidates for EVO, a biocompatible implantable lens that corrects distance vision. More on this later.

The other product STAA sells is the intraocular lens (IOLs). STAA developed, patented, and licensed the first foldable intraocular lens (IOLs) for cataract surgery. Made of pliable material, the foldable IOL permitted surgeons for the first time to replace a cataract patient’s natural lens with minimally invasive surgery. The foldable IOL became the standard of care for cataract surgery throughout the world.

Investing In STAA Is Investing in Caren Mason

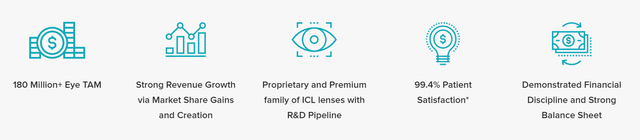

According to STAA, it has attractive value propositions.

STAAR Website

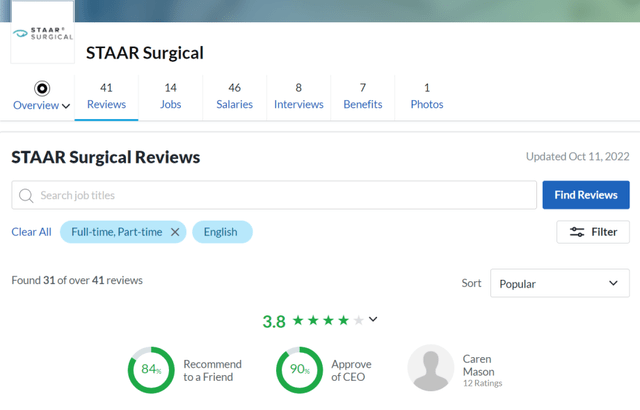

The most important reason, however, is none of these (though I will touch on them later). The main reason investors should consider STAA lies in the leadership of CEO Caren Mason.

Based on reviews on Glassdoor, CEO Caren Mason has a 90% approval rating, which is great in my book.

Glassdoor

She has decades of relevant industry experience, having served as the CEO of other healthcare-related companies such as Verinata Health, Quidel Corporation, MiraMedica and EMed Technologies. When she was at Generic Electric, she was the General Manager of the Women’s Healthcare business for General Electric Healthcare. More importantly to me, Caren is no stranger to turning around a struggling business. She was brought into Quidel Corporation as its CEO from 2004 to 2009 to right the ship. According to Ophthalmology Innovation Source, during her tenure at Quidel, she “engineered a four-year turnaround and delivered significant top-line growth, profitability, growth capital and valuation for the company“. Towards the end of her tenure at Quidel, the company improved so much that Forbes recognized the rapid immunoassay and molecular diagnostics test company as one of the 200 Best Small Companies for two consecutive years in 2007 and 2008.

However, is she really such a great CEO? I prefer to let the numbers do the talking. I will share 4 reasons-by-numbers to assess this CEO.

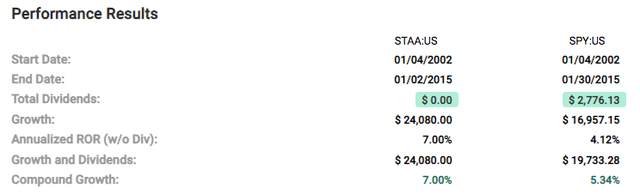

1. Stock Performance Soared > 6 Times

In the period before Caren Mason, STAA was not exactly a stellar performer. The stock price never went past $20 and the shares were trading under $10 for the most part. Between 2002 and 2015, it recorded an annualized rate of return of just 7%.

Fast Graph

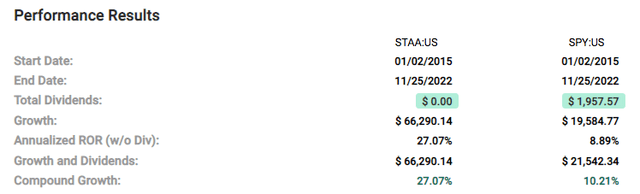

However, once Caren Mason took over, the company started turning around – fast. The stock grew at an annualized rate of return of 27% from 2015 to 2022. $10,000 invested in STAA in 2015 would have increased more than 6 fold to $66,290.14 by 25 November 2022.

Fast Graph

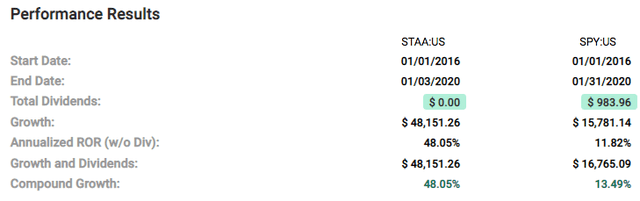

In the giddy euphoria of 2021, the share price went as high as $157. Yet, STAA is not simply a product of the pandemic. It is certainly no meme stock that is without solid fundamentals. It definitely is not a “growth-at-any-cost” kind of company either. Considering the period before the pandemic between January 2016 and January 2020, STAA’s performance was even better, boasting a remarkable 48% compound growth rate.

Fast Graph

2. Operating Earnings Increased 44x

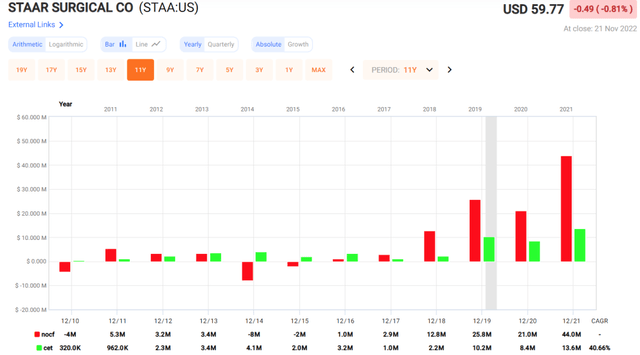

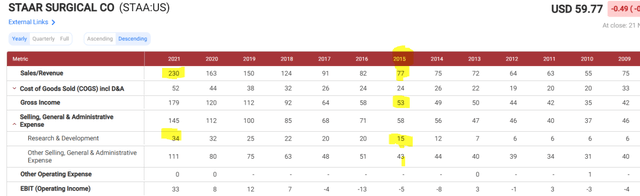

The business was on a steady decline under the previous management. Operating earnings were falling steadily from $5.3 million in 2011 to a loss of $8 million in 2014, the year before Caren took over.

Fast Graph

Once she took over in 2015, she prioritized improving the profitability of the company. Operating income improved almost immediately. She narrowed the loss of $8 million in 2014 to just a loss of $2 million in 2015. Then, from 2016 to 2021, the operating income increased by a staggering 44 times from $1 million in 2016 to $44 million in 2021.

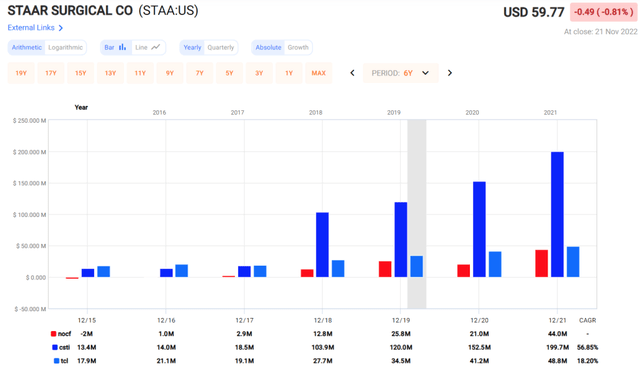

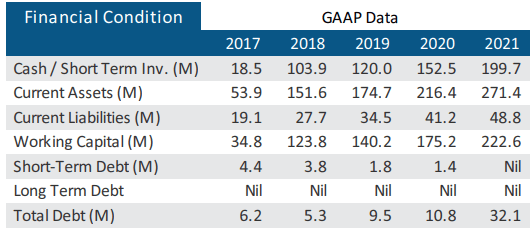

3. Cash Stash Increased 15x and $0 Debt

STAA’s net operating income improved so much that as of 2021, the net operating income alone is almost sufficient to pay off all the current liabilities. The improving bottom line meant that the company was able to build up a significant cash stash from just $13.4 million in 2015 to $199.7 million in 2021, a 15x increase in 7 years.

Fast Graph

While doing so, STAA manages to have ZERO short-term and long-term debt as of 2021.

Argus Research

4. Making The Right Capital Allocation Calls

An excellent CEO must be an excellent asset allocator. In his 1987 letter to investors, Warren Buffet said, “the heads of many companies are not skilled in capital allocation, and … it is not surprising because most bosses rise to the top because they have excelled in an area such as marketing, production, engineering, administration or, sometimes, institutional politics.”

When Caren Mason took over as CEO, it was “easy” for her to show evidence of a turnaround by cutting costs. However, that was not what she did. Instead, she invested heavily in the right places to improve the competitiveness of STAA’s business.

A) Investing To Maintain Its Moat

Under her leadership, she prioritized investments in research and development, and rightly so. R&D expenses started to increase immediately. The amount spent on R&D in the first 3 years under the CEO Caren was already more than the total amount the previous CEO spent on R&D in 6 years.

Fast Graph

It was a challenging time to take over the business in 2015. STAA’s ICL lens is made from a material known as Collamer, and the patents that underlie the specific formulation and manufacturing methods for Collamer were to expire by the end of 2016, with the last blocking patent expiring in 2017. Yet, the company was able to successfully file patent applications covering new lens designs, and new lens delivery systems. As of December 31, 2021, STAA owned approximately 65 United States and foreign patents and had 27 patent applications pending. The company relies more on trade secrets than patents and believes that no particular patent is so important that its loss or expiration would materially adversely affect its operations as a whole.

According to research from Future Marketing Insights and the company’s 10K (page 4), STAAR Surgical is the dominant player in the implantable Collamer lens industry. Only one posterior chamber phakic IOL (PIOL) has been given FDA marketing and sales approval in the U.S., and that is the implantable Collamer lens made by STAAR Surgical. All these translate to the fact that STAA has a wide moat in the field of implantable Collamer lens, not just globally but in the U.S. too.

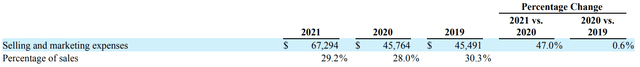

B) Investing In Sales And Marketing

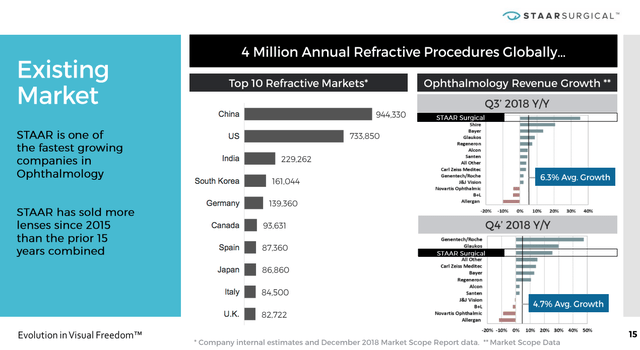

In a STAAR Surgical 2019 Investor Presentation slide (below), the company proudly stated that it sold more lenses since 2015 than in the prior 15 years combined.

STAAR Investor Presentation

STAA achieved that incredible feat by increasing spending on selling and marketing. Prior to 2015, the amount spent on Selling and Marketing ranged between $30 million to $40 million. As of December 2014, STAA was selling to 60 countries globally. Since Caren took over, Selling and marketing expenses increased. In 2021, these expenses increased 47.0% from 2020 due to increased advertising and promotional activities among other things. By 2022, it was selling to 75 countries, including China which is one of its fastest-growing markets, and certainly the largest.

10K

In the third quarter of 2022, the global ICL unit reported growth upwards of 40% year over year, highlighted by unit growth in China up 52%, the U.S. up 63%, Japan up 40%, South Korea up 49% and Asia Pacific distributor markets up 47%, and an expanding global marketing team, as well as regional marketing personnel, are needed to support the promotion and growing sale of STAA’s products.

The more recent investment in brand ambassadors like global entertainment celebrity Joe Jonas and NBA player Max Strus demonstrates the company’s direction in targeting the younger 21-35 crowd. In this digital age where everyone is glued to their blue-light emitting screens, the percentage of the younger population with myopia is increasing.

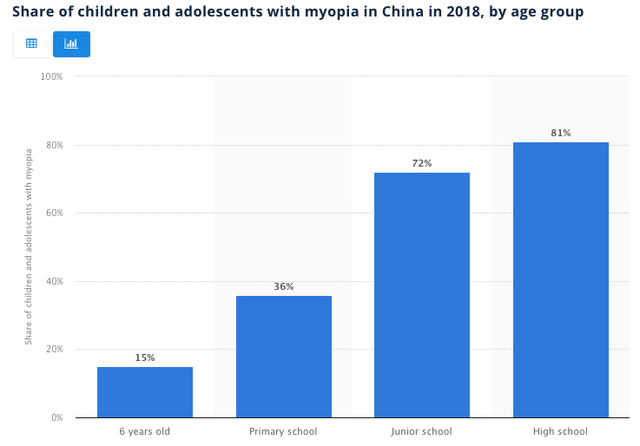

Take for example China, STAA’s single largest market. From the chart below, it is easy to see that the potential market that STAA wants to tap into is huge.

Statista

And in STAA’s second-largest market, Japan, it is reported that 19 out of every 20 teenagers are myopic. Recognizing and targeting this growing potential market is necessary to educate them about STAA’s products.

C) Cutting Off A Key (But Lower Margin) Business Segment

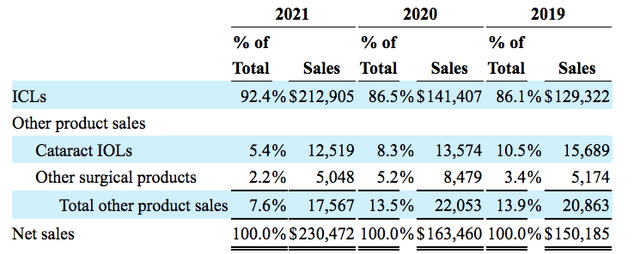

Good capital allocation is NOT just about spending money wisely; it is also about trimming off poor-performing areas. STAA has two business segments – ICL and IOL. The IOL segment brings in way less revenue and STAA has been gradually moving away from this to focus on ICLs segment.

STAA 10K 2021

Sales of cataract IOLs accounted for approximately 5.4% of fiscal 2021 total sales, 8.3% of fiscal 2020’s total sales, and 10.5% of fiscal 2019 total sales. In the most recent quarter, the cataract IOLs segment brought in just 5% of total sales. Caren and her team’s strategy to focus on the higher margin ICLs segment was made abundantly clear in her Q3 2022 earnings call prepared remarks,

Today it is vital that STAAR focus on the significant growth opportunities we have with our premium EVO products. At the same time, our low margin Other Products business, which… consists of cataract IOLs, IOL injectors and injector parts, has faced increasing supply chain challenges. As a result of third-party materials and supply chain challenges that only affect our Other Products business, we will no longer be able to support Other Products as we have historically. We will continue to support customers of Other Products through the end of 2023.

Cutting off an underperforming segment is never easy, but I think that is definitely the right call.

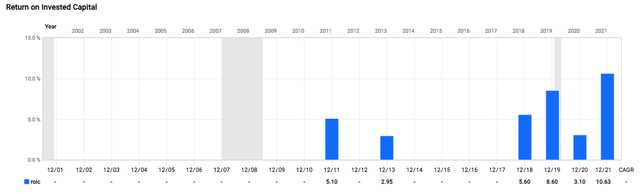

D) Improving ROIC And Other Performance Metrics

According to this report by the Harvard Business Review, top-performing CEOs care about returns on invested capital. Looking at the chart below, it is clear that in the period after Caren Mason came on board in 2015, the company started posting consistent returns on invested capital, much better than all the years prior to 2015.

Fast Graph

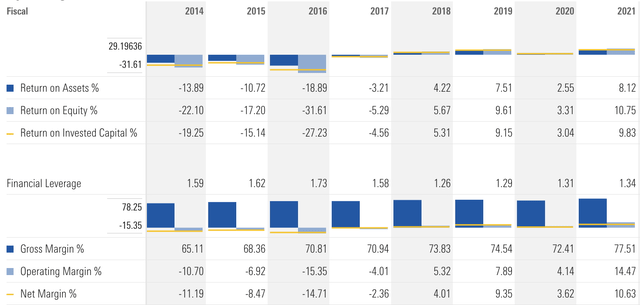

STAA’s performance metrics have improved vastly since Caren Mason took the helm. Not just ROIC has turned positive, the same goes for ROA and ROE. Profitability measures improved too. Gross margin improved from 65% in 2014 to 77% in 2021, operating margin jumped from -10.7% in 2014 to 14.47% in 2021, and net margin turned positive from -11.19% in 2014 to 10.63% in 2021.

Morningstar

Other Reasons To Invest in STAA: It Fares Well Against Its Competitors

The company listed several in the graphic below, such as the huge total addressable market available to it, how it has been growing revenue and market share, has almost 100% customer satisfaction, and has a solid balance sheet, etc.

STAAR Website

I will just elaborate on one aspect: STAA fares well against its competitors. I get a little worried when a company sells just 2 main products because if the margins are so fantastic (77% gross margins) competitors will come in.

The segment below is what STAA says about its competition against its main ICL product.

In the refractive market, our ICL technology competes with other elective surgical procedures such as laser vision correction (e.g., LASIK) for those consumers who are looking for an alternative to eyeglasses or contact lenses to correct their vision.

We believe our primary competition in selling the ICL to patients seeking surgery to correct refractive conditions lies not in similar products to the ICL, but in laser surgical procedures. Alcon (formerly a part of Novartis), Johnson & Johnson (formerly Advanced Medical Optics or AMO), Bausch Health Companies (formerly Valeant, Bausch & Lomb or B+L), and Carl Zeiss Meditec AG, all market lasers for corneal refractive surgery and promote their sales worldwide.

I will offer two reasons to support my statement that “STAA fares well against its competitors“.

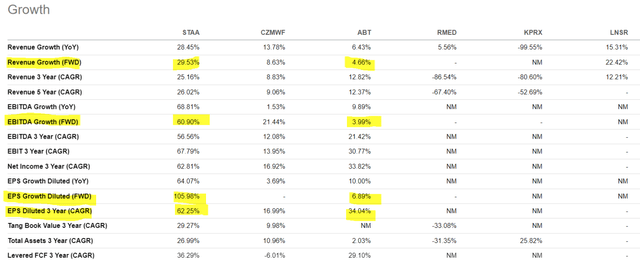

Firstly, the fact that revenue growth for STAA outpaced all the competitors shown below (Carl Zeiss Meditec, Abbott, and major LASIK players) speaks volumes about its demand among consumers.

Seeking Alpha

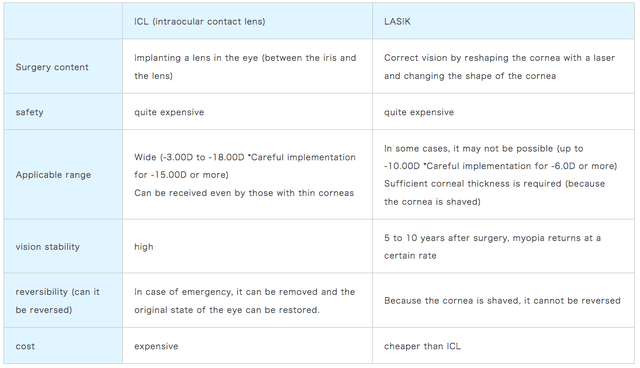

Secondly, numerous studies comparing the efficacy, patient satisfaction and side effects (like dry eyes) of the three predominant procedures ICL, SMILE and LASIK show favorable results for STAA’s ICL.

The following table from an eye clinic in Japan presents the comparisons between ICL and LASIK clearly. The table summarises some key points well, like the ICL’s advantage over LASIK for severe myopia patients for longer-term vision stability, and the reversibility of that procedure to restore the original state of the eye.

Japan Eye Clinic

STAA also stated competition from Asia with similar products.

Phakic implants that compete with the ICL are also available in the marketplace. The two principal types of phakic IOLs are (1) posterior chamber designs like the ICL, and (2) iris clip anterior chamber PIOLs like the Artisan® and Artiflex® lenses made by Ophtec. We believe the ICL has compelling clinical advantages over the other lenses, which are reflected in our strong market share of the global phakic IOL market. The ICL is the only foldable, minimally invasive PIOL approved for sale in the U.S. In addition, competitors from Asia are beginning to appear in the market with their low-cost version of a posterior chamber implantable contact lens, increasing the level of competition.

My view as someone who wears spectacles is this: I will avoid any surgery of any kind regarding my eyes as I treasure my eyesight too much to let someone insert something into my eyeballs for an elective procedure; it is not a necessary, life-of-death matter. However, if I ever decide to go for this elective surgery with phakic implants, I will choose the best possible product because I treasure my gift of sight.

As the pioneer in the business with decades of experience and tons of research backing its products, STAA is well-positioned to cater to this growing market of consumers seeking to correct their vision whether it is for aesthetic or cosmetic reasons, or to correct a severe eye condition.

Valuation: It Has Finally Reached An Attractive Level

If I invest in STAA, I know I will be investing in a well-run company led by a great CEO. I know I will be investing in a company that is dominant in its industry and is growing sales at double-digit rates in its major geographies. And I know I will be investing in a zero-debt, cash-rich company with increasing operating income.

A great company may not be selling at a great price; I get that. Now, I am not saying that STAA is cheap, not in the traditional sense with the usual metrics. I am coming from a risk-reward perspective. Let’s discuss this further.

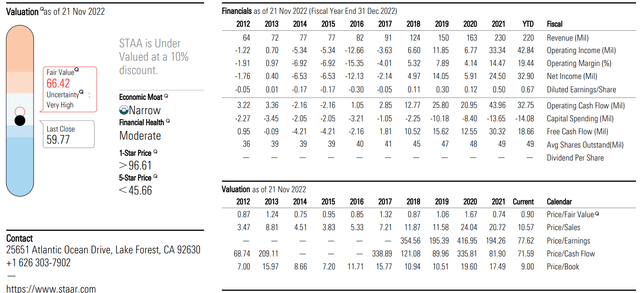

Analysts from Morningstar believe that STAA is currently 10% undervalued and that its fair value could be $66.42.

Morningstar

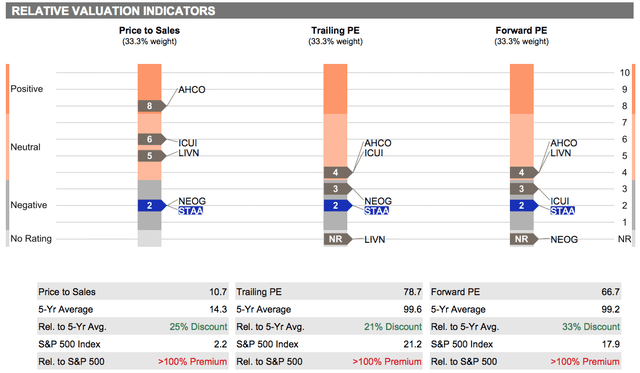

When I compare STAA’s current valuation against its own past 5-year average, whether I look at PS, trailing PE or forward PE, STAA has definitely become cheaper by 21% to 33%.

Refinitiv Stock Report

However, is STAA cheap enough to buy? What if the derisking environment continues to worsen? The share price has fallen 61% since the high it reached in September 2021, and there is definitely the possibility that it can fall further.

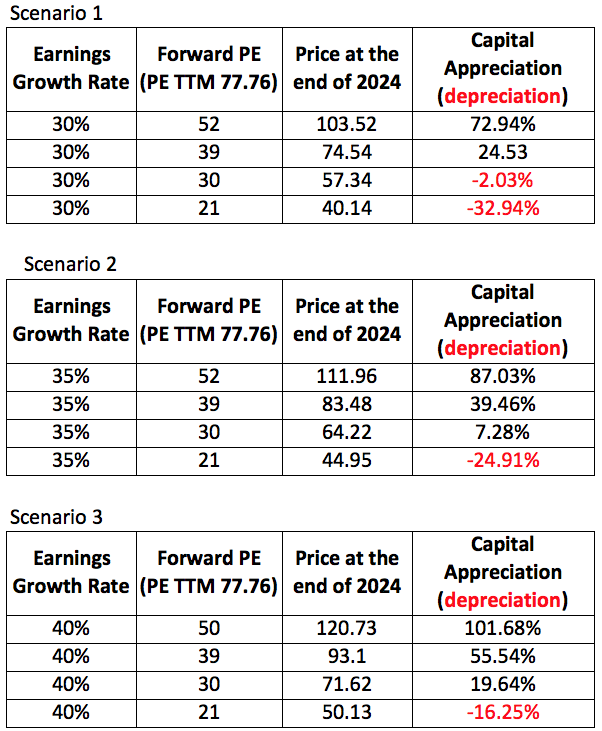

To me, the fundamental is crucial to fueling positive, future growth. STAA is currently trading at a PE (TTM) of 77.76, which is crazy expensive. The questions to ask are: How fast must STAA grow in order to command a reasonable valuation multiple? Can STAA grow into its valuation fast enough?

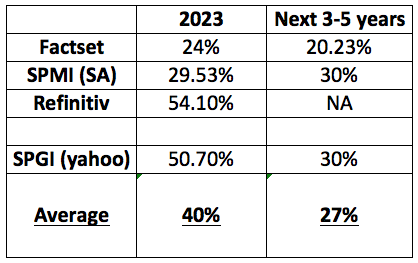

Analysts are expecting the following revenue growth from STAA:

Author’s compilation

In the Q3 2022 earnings call, CFO Patrick Williams believes that STAA can achieve 30% net revenue growth in 2023 so I will take 30% as a proxy for the base case for earnings growth. Using Fast Graph, I projected the following 3 scenarios. In Scenario 1, I assumed that the earnings grow at 30% per year. I assume that derisking continues and PE falls, and depending on where they fall (range of 21 to 52), holding STAA for 2 years could yield results ranging from a loss of 31% to a gain of 72%. To me, this means the upside is twice that of the downside. In the best-case scenario in my assumptions in Scenario 3, if earnings can grow at 40% per year, holding STAA for 2 years could yield results ranging from a loss of 16.25% to a gain of 101%, meaning the upside is 6 times that of the downside.

Author’s Projection Using Fast Graph

So long as the growth rates are able to sustain at 30% or higher, the downside is limited while the upside is 2 to 6 times more than the downside. Looking across the three scenarios, I like the odds. This risk reward seems favorable to me.

2 Key Catalysts That Can Sustain Or Even Supercharge Growth

1st Catalyst: China Growth

With Covid mostly in the rearview mirror, elective surgeries will get more traction. In the Q3 2022 Q&A section, the CEO said,

So I think what we are hearing is that our big customers are hospitals, our clinics are very, very much looking forward to 2023. There is a belief that’s on social media hasn’t been validated yet, that in fact, the COVID lockdown principle will be changed and more favorable in terms of freedom of movement within China. So I think bottom line, we kind of look in 2023 for a resumption of great demand

There will always be news about lockdowns in China, like the recent one on Foxconn, but on the whole, the situation has improved vastly as indicated by this article written in November 2022.

2nd Catalyst: U.S. Growth

STAA started commercialising EVO ICL procedures in California, Colorado, Missouri, Texas and Utah in April 2022, and the reported growth in Q2 and Q3 2022 has already been impressive. STAA achieved strong year-on-year ICL unit growth in the U.S., increasing by 36% in Q2 and up 63% in Q3. The company projects ICL unit growth in the U.S. will further accelerate in Q4 to approximately 100% year-over-year. Since FDA’s approval of STAA’s EVO ICL product 7 months ago, the company has trained and certified over 550 U.S. surgeons on EVO and is expected to meet or exceed its goal of training and certifying 600 U.S. surgeons on EVO by the end of 2022. Moreover, the recent opening of the first company-operated EVO Experience Center in California on 10 November in its corporate headquarters, equipped with advanced visualization and communications technology, will provide additional support for U.S. ophthalmologists to get familiar with STAA’s products, allowing for in-person and virtual training, medical education and practice development programs.

Having this headstart in the huge market of the United States is not just a growth catalyst. In addition to spurring greater growth by having the first-mover advantage in the U.S., this growing segment will decrease the geographical concentration risk of having half the current sales coming from China.

Final Observation: Big Investors Are Getting On Board

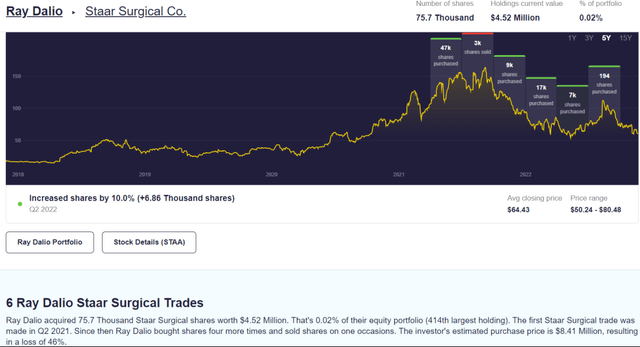

You may be surprised to see names like Ray Dalio, Jim Simons, Ken Griffin and Joel Greenblatt among the STAA shareholders.

Stockcircle

Ray Dalio started buying STAA in Q2 2021 and he has been buying STAA heavily at prices far above the current price of $60. As STAA only makes up 0.02% of his portfolio, I would not read too much into it. However, it is comforting to know that investing in STAA means one is investing alongside whales such as the above. It also means these billion-dollar investors were seeing value in STAA even when it was trading at higher prices.

Stockcircle

Conclusion

Warren Buffett said,

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

And I think STAAR Surgical is such a business. Investing in STAAR Surgical is investing in a well-run company led by a great CEO with a proven history of leading companies onto a strong path. Investing in STAAR Surgical is investing in a company that has a dominant position in its industry with a huge TAM. Investing in STAAR Surgical is investing in a company that is growing sales at double-digit rates in major geographies across 75 countries like the U.S., China, Japan, Europe, and Asia Pacific. Investing in STAA Surgical is investing in a zero-debt, cash-rich company with increasing operating income, and hence the current high inflation environment has little impact on its business. Valuation is the lowest it has ever been in its history, thanks to the derisking environment which is making STAA investable now in my opinion. And that lower valuation is supported by improving fundamentals, expanding margins, and continued growth. Yes, STAA is not cheap by any conventional measure. Yet, if it is able to continue growing revenue and earnings at a rate of 30% to 40% for the next few years, which is a rate lower than what most analysts are forecasting, the odds of seeing rewards outweigh the downside risks. I intend to initiate a long position soon and accumulate if derisking continues to drive valuation down.

Be the first to comment