PeopleImages

Introduction

It’s only been 11 months since I posted my first analysis on FedEx Corporation (NYSE:FDX), where I gave the company a “neutral” rating. The low rating was not a result of poor fundamentals of FedEx, but rather the valuation of the company and the small margin of safety it provided at the time:

Neither earnings nor stock chart performance is pointing towards the business being undervalued, but instead towards it being fairly valued.

I then said that I thought a suitable margin of safety would be found close to its 200-day moving average. Should the stock fall to such low valuations, a broader market crash would likely have to occur, or some drastic fundamental changes would have been necessary:

I would only expect the price of the stock to fall that low in the case of a broader market crash, or if some drastic fundamental changes should occur, which is unlikely.

10 months later, a broader market crash combined with weak earnings has brought the stock down to what I believe are attractive prices.

Weak Earnings

FedEx stock fell after the release of its Q1 2023 earnings, where its top- and bottom-line results missed analysts’ expectations. Following the earnings announcement, the company also announced major plans to cut costs in the face of the weaker-than-expected business environment.

The company announced a program to accelerate cost savings toward $4 billion by 2025. They further said they would continue to focus on revenue quality and yield management to mitigate the effects of volume declines.

The top line came in at $23.2b, showing growth of 5.6% year-over-year. The bottom line saw a decrease of -21%, resulting in quarterly net income of $875 million.

The weak earnings led to an immediate share price drop of -21%, which is still far from fully recovered today.

Although the company was reluctant to provide short-term estimates due to the volatile markets, I still believe that long-term organic growth remains intact. The company still has its moat, the industry will continue to grow albeit slower than originally expected in the short term, and they continue to reinvest back into the company.

Valuation

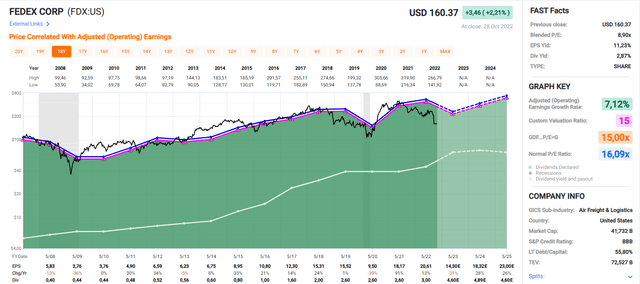

The sudden change from expecting positive EPS 2023 growth to negative was alarming. I think a reaction to such figures was inevitable, but its current valuation does not seem sustainable.

The company is well below the standard 15x earnings multiple, which has been a good guideline for intrinsic value. The average earnings multiple for FedEx has been 16. Given that long-term fundamentals remain intact, and debt hasn’t increased, I see no reason why it shouldn’t be assigned a ~15 multiple again.

A return to a multiple of 15 would indicate that returns of 35% are possible. As earnings are expected to increase in late 2023, even greater returns could be achieved.

Stock Chart

Quick disclaimer: technical analysis in itself is not a good enough reason to buy a stock, but combined with the company’s fundamentals, it can greatly narrow your price target range when you buy.

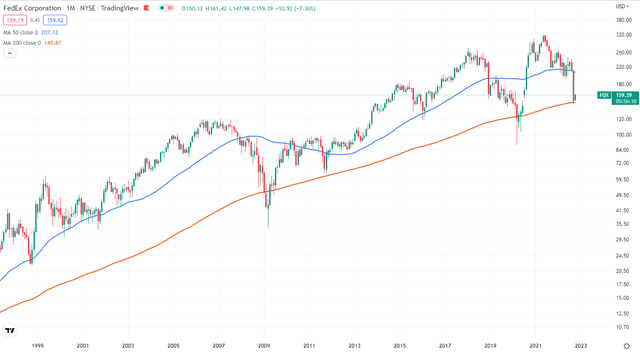

FDX stock is now finally below its 50-day moving average and briefly touched the 200-day moving average. As mentioned in my previous article on FedEx, I saw the 200-day moving average as a strong support area. This has been true so far, with the stock currently rallying after a brief dip to the moving average.

I believe the stock is currently in an accumulation area. I find it unlikely that it would go much below the 200- moving average. The worst seems to be behind the company, with short-term expectations already significantly lowered. When growth eventually returns, which is estimated to be in 2024, a single-digit P/E does not seem sustainable.

Final Thoughts

As outlined in my previous article, the fundamentals of FedEx are solid. I personally don’t mind short-term volatility, as that is when the opportunities arise. I believe that FedEx should be a potential candidate to be further researched, as it has fallen to such prices that I would consider having an appropriate margin of safety. The company should continue to grow in the long run while reducing costs in the short term. The company is now trading well below its average – and the standard – earnings multiple of 15, both of which indicate that capital gains of ~60% over the next 2 years are possible.

The stock chart also shows sign of support, with the stock being close to its 200- moving average. A return to its 50- moving average shows that high capital gains of +40% are possible as well.

Finally, I also find it encouraging to see, that an insider at FedEx has also bought shares. Remember, insiders have many reasons to sell a stock, but only 1 reason to buy – they also see it as being undervalued.

I, therefore, change my rating from “neutral” to “buy.”

Be the first to comment