Cecilie_Arcurs/E+ via Getty Images

Introduction

With this article, I don’t aim to explain Omega Healthcare Investors (NYSE:OHI) business model or why I think this is a great stock. For this, I recommend reading this and this article. I instead want to look at the problems the stock had the last 2.5 years and see if they could repeat and further pressure the stock.

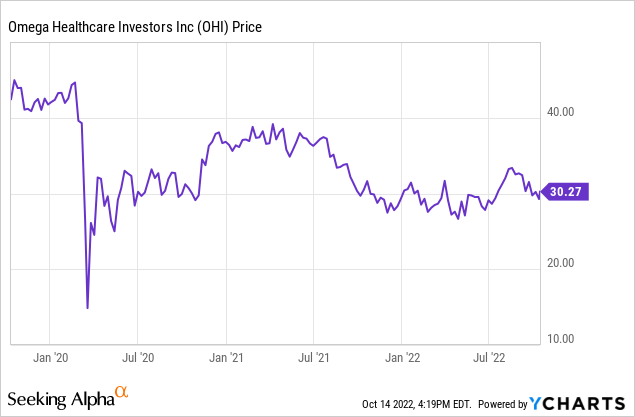

Omega Healthcare Investors shares haven’t done much in the last five years, with its share price being down by 5% on a price return basis. If we look at the total return, Omega Healthcare Investors did a bit better, generating a 6% total return annually. A big part of this “not so amusing” performance is due to the Covid-19 pandemic, which brought several problems for its tenants. In March 2020, the share price dropped as much as 60%. Since then, the stock recovered almost entirely but had to give up the gains leading to a new low in April of this year. Due to relatively positive Q1 and Q2 earnings, Omega Healthcare Investors has recovered again, now down 33% from its pre-pandemic high.

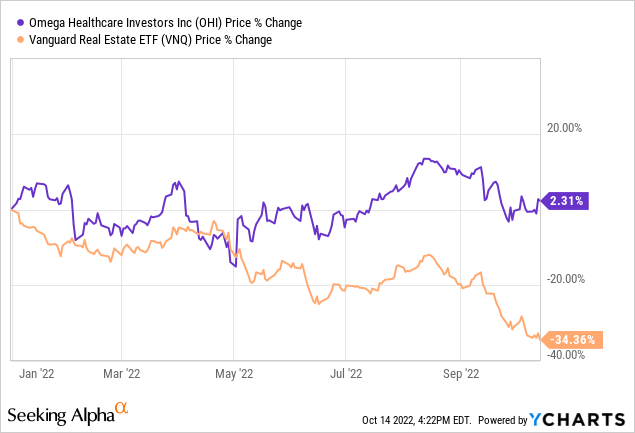

Surprisingly, Omega Healthcare Investors is one of the best-performing REITs this year, up 2.3% YTD.

In this article, I want to elaborate on why Omega Healthcare Investors dropped that much in the first place and had to give up much of its recovery rally.

What happened since the start of the pandemic?

OHI’s tenants operate within the skilled nursing facilities (SNF) or senior housing (SH) segments, known to be low-margin businesses. This leaves not much room for management mistakes or negative external influence. With OHI’s 60% drop at the beginning of the pandemic, the market anticipated the vulnerability of its tenants to Covid-19. This vulnerability is due to the people commonly using SNF or SH: older people. These are the most at risk when infected with Covid-19, leading to a lower occupancy rate for OHI’s tenants. In December 2019, the average occupancy rate was 83.6%. In the most recent quarter, this rate dropped to 75.1%. Furthermore, labor shortages have contributed the rest to this challenging situation.

“I’m sure we will have more: they might be small, they might be bigger, but … there’s no doubt we’re going to be having these discussions for a few more quarters, just no doubt in my mind,”

This is a quote by CEO Taylor Pickett from the Q4 2021 earnings call transcript.

Looking at a recent quote by him from the latest earnings call, he wasn’t wrong:

“However, our financial results continue to be impacted by nonpayment of rent by a few operators, and with both facility occupancy and profitability still meaningfully below pre-pandemic levels, the risk of further operator issues remains,”

In the last earnings report in August, the management presented continued progress of the restructuring discussions with one of its most prominent tenants, Agemo. Agemo, next to other notable names like Guardian or Gulf Coast, couldn’t meet its rent and mortgage obligations due to the struggle of the pandemic. As of August this year, this hasn’t changed. However, the market was positively surprised that OHI could beat the estimates in Q1 and Q2 and continue the dividend. This sent shares rallying until August. Since then, OHI has declined slightly but remains meaningful above its May lows.

How things could turn out in the following months

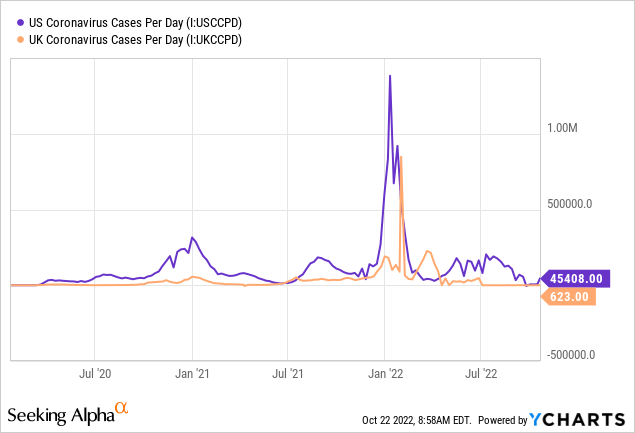

Beginning with the main problem, Covid-19, things are set up to get worse from here. As you can see in the chart, Covid-19 cases spiked in the winter, with a peak in January 2021 and 2022. This will probably repeat itself in January 2023.

This means occupancy rates will likely suffer again, even though I think the impact will be less than in 2020 and 2021 due to lower mortality of Covid-19. Considering this, I believe that Covid-19 isn’t the most significant risk for OHI’s tenants anymore, but it’s still there.

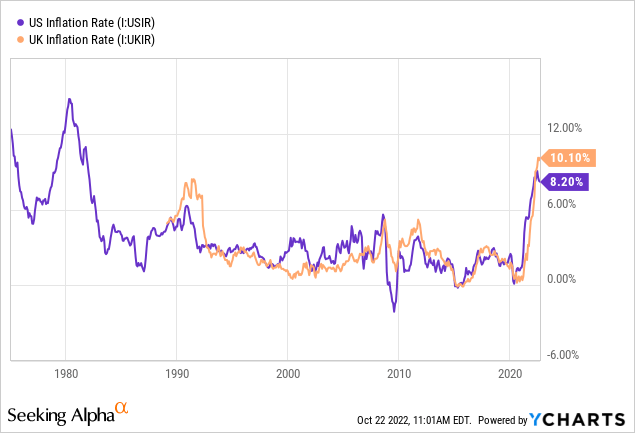

Inflation presents a new threat to the operators of SNF and SH as it is at a 40-year high right now.

As I said earlier, these are low-margin businesses, making them vulnerable to external factors. Higher costs will further shrink these margins, and the fact that more than 50% of OHI’s tenant’s revenue comes from Medicaid isn’t going to help. Medicaid payments should improve due to the Inflation Reduction Act. But this Act will not start before 2023, and as far as I understood it, the Medicaid payments aren’t to increase as much as inflation drove up the costs. Especially because SNF and SH are very much exposed to inflation due to the variety of products they need to operate. So, I see further margin pressure for OHI’s tenants, dampening the hopes of a fast resumption of rent and mortgage payments. There are similarities to see in Medical Properties Trust (MPW) right now, in which tenants operating in the healthcare system are also struggling.

In the beginning, I said that OHI’s tenants had problems with being short-staffed. Since the pandemic’s start, the job market has fundamentally changed for younger people. The demand for remote jobs has risen significantly, and many people have changed their mindset about work-life balance. According to OAL, a legal association called O’Connor Acciani & Levy, there are three main reasons for understaffed SNF or SH:

- High turnover due to overstressed staff

- Stress and emotional pressure for constant overtime and a constant need to keep working

- A lack of available registered or certified nursing staff with adequate education and training

The pandemic showed that segments in which the staff tends to be ‘overstressed’ have a tremendous outflow of staff because fewer people want to be exposed to that stress anymore. I maintain that this development will accelerate when SNF and SH operators don’t increase wages enough for their staff to battle inflation. Most SNF and SH operators probably can’t do this right now. So I think that the staff problem will continue for an unforeseeable time.

Conclusion

Because Covid-19 cases are set up for a comeback and SNF and SH operators have to deal with higher costs and a probably worsening staff problem, I think the story about OHI’s tenant’s problems repeats itself. Therefore, OHI’s share price could continue to struggle. I wouldn’t wonder if we see the May lows of around $25 again. That’s why I rate OHI a “hold”. I bought the first tranche of my position in April at $26 and will wait for the stock price to get to that level again or for the problems to clear up before buying more shares. Until then, I will take the dividend as compensation. For everyone who doesn’t have any shares of OHI yet, the first buy at current prices will be rewarding if held for the long term. So my advice, as I do it myself: if you already have shares, wait for the May lows or for the problems to clear up. If you haven’t bought any shares yet, I recommend buying a small portion of your planned position size. So you can still receive the almost 9% dividend yield while being protected from further downfall in share price.

Be the first to comment