Joe Raedle

There have been many epic “blow-ups” in the tech sector over the past year, but few have been as visible as Peloton (NASDAQ:PTON). Peloton shined brightly during the pandemic, when gyms closed and upper-middle class consumers splurged on the comfort of home gyms. Peloton dealt with quarter after quarter of backlog and shortages, and revenue growth persistently exceeded 2x y/y each quarter.

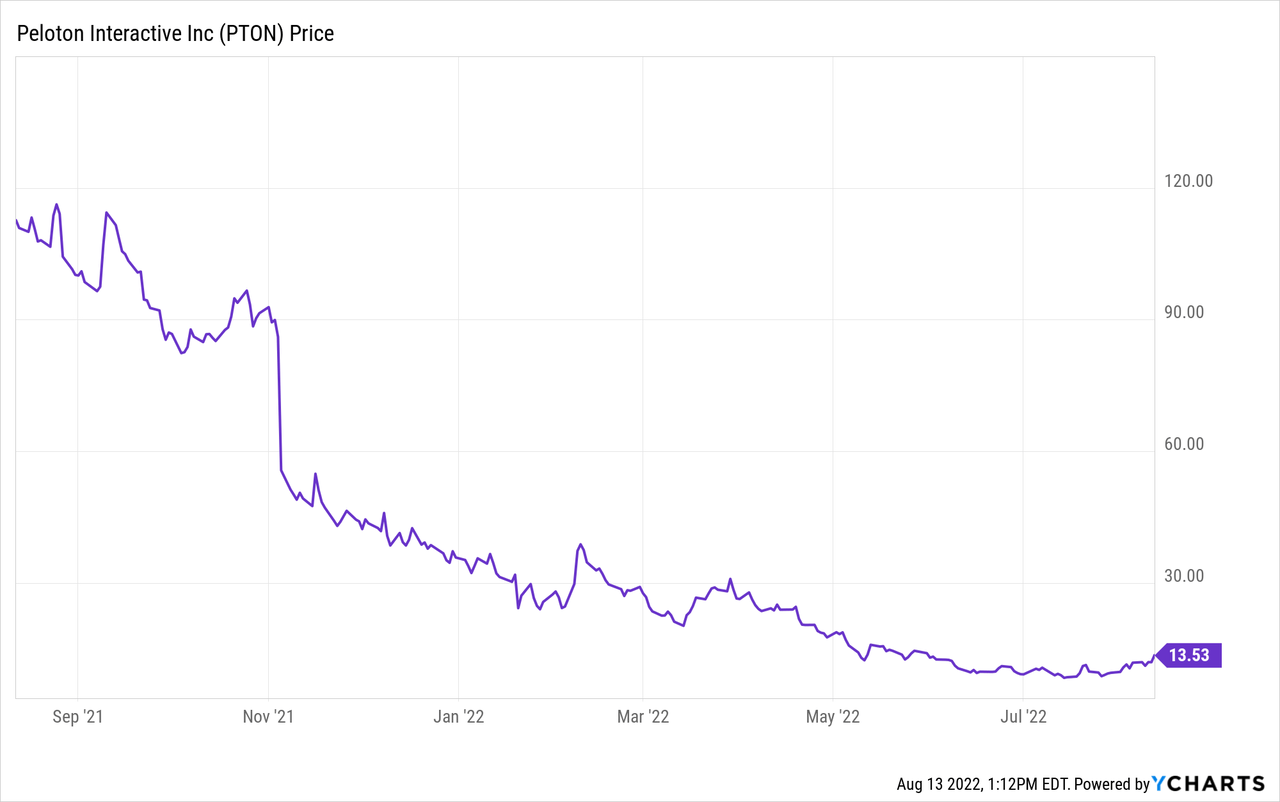

Fast forward to today, and the story has dramatically changed. The lift to Peloton’s sales proved to be one-time, and the company’s investments in supply chain capacity and corporate overhead now look hasty and overdone. Shares of Peloton shed more than 90% versus all-time highs, and are down more than 60% in 2022 alone. The question for investors now is: when does the bleeding stop?

Peloton is now in turnaround mode. The company has a new CEO as of February, Barry McCarthy – who previously served as CFO of Spotify (SPOT) and Netflix (NFLX), both exemplary subscription businesses. The signal to the market is clear: Peloton needs a seasoned finance leader to help turn its P&L upside down and adapt it more toward a subscription-based business model.

When I last wrote on Peloton last September, the stock was starting on its way down and trading north of $110 per share. I had cautioned that Peloton looked incredibly expensive at 6x forward revenue, especially when revenue growth had started showing signs of slowing down. Now, however, reflecting the combination of Peloton’s much lower share price, its cohesive turnaround plan, and the continued growth (albeit slower) of its connected fitness subscriber base, I’m finally upgrading my view on Peloton to bullish.

Recent upward momentum in this stock indicates that investors are finally starting to recognize that Peloton’s turnaround drivers may work, and that its current share price doesn’t at all give credit for those actions. I’ve made decent profits over the past few weeks selling short-dated puts on Peloton, and on the next major dip I plan to build a longer-term stake in this name.

The turnaround plan

First of all – what is Peloton doing to turn its business upside down? There are a number of factors at play.

McCarthy, Peloton’s new CEO, sees himself as a turnaround artist. In the shareholder letter prefacing Q2 earnings, he wrote as follows:

Turnarounds are hard work. It’s intellectually challenging, emotionally draining, physically exhausting, and all consuming. It’s a full- contact sport. That’s why I want to begin this Shareholder Letter with a shout out and sincere thank you to the employees of Peloton who are working hard to make this company successful. I also want to thank our 7 million Members whose passion for Peloton gives meaning and purpose to our work.

Turnarounds also are incredibly stimulating and engaging, the decisions never more consequential, the urgency ever present, the teamwork never more central to the mission […]

My goal for Peloton is to become a global connected fitness platform with 100 million Members. That’s equivalent to roughly half the world’s global gym memberships. It’s a long, long way from where we sit today. But we sit at the epicenter of technology-enabled fitness, a long-term secular growth trend. Who doesn’t want to live a healthier, happier, longer life? We will share more about how we plan to participate in that growth in the months and years ahead.”

One of the first moves that the company is making is to boost prices, which was announced on August 12. This is a reversal of the company’s earlier course of action to lower prices to reduce barriers to entry for new members. The company’s Bike+ price will rise from $1,995 to $2,495; while the Tread product goes from $2,695 to $3,495.

These moves, needless to say, are necessary to combat raw material inflation and especially the large boost in logistics costs. Peloton expects total gross margins to jump from 19% in Q2 to 31% in Q3, primarily driven as a result of these price increases.

While substantial price jumps are always uncertain situations, I think this is a smart move on Peloton’s part. The earlier price reduction likely helped to pull in a bunch of price-conscious customers into the base (sort of like a one-time promotion), while remaining future customers are likely high-income consumers for whom the $500/$800 increases in Bike+ and Tread, respectively, hopefully won’t change purchasing behavior. Note as well that even before hardware price increases, Peloton already boosted the price of its All-Access subscription plan from $39/month to $44/month in June, which it said had a negligible effect on churn.

Additionally on top-line initiatives to restore growth, Peloton is planning to broaden its distribution to third-party retailers. This may offset some of the margin benefits of the price increases, but hopefully give Peloton more bang for its marketing spend by positioning its products in front of far more customers.

In terms of cost-reduction efforts, Peloton’s ultimate goal is A) to return to FCF positive by next year FY23, and B) to cut out $800 million of annual opex by FY24 (To put that number in scope, that’s a sizable chunk of Peloton’s current ~$3.6 billion annual revenue run rate). In mid-August, the company announced it was laying off roughly 800 employees and enacting several store closures. It’s also taking a laser eye on marketing spend, changing its ROI measurement from spending based on hardware gross margins to customer lifetime value based on subscriptions.

The subscription base remains strong; FaaS

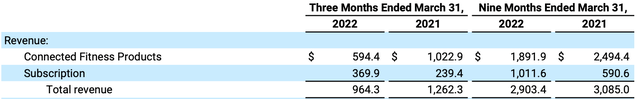

One thing that is key to point out is that while hardware revenue is down (in Q2, hardware revenue fell -42% y/y to $594.4 million), Peloton’s subscription base is still standing firm. This helps to advance the idea that while much of Peloton’s pandemic-era sales were one-time, the customers it brought on will generate a steady base of subscription fees.

Peloton Q2 revenue (Peloton Q2 shareholder letter)

As seen above, subscription revenue saw very healthy growth in Q2 – up 54% y/y to $369.9 million. Note that we should start seeing acceleration in subscription revenue starting in Q2 from the June price increases.

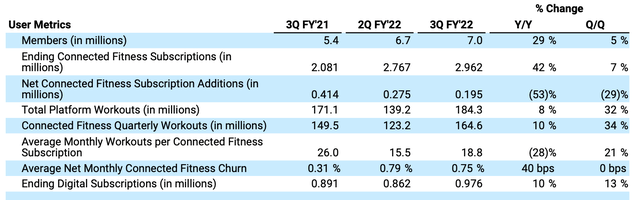

The number of Connected Fitness subscription members also continues to increase – up by 0.2 million subscribers (7%) sequentially, and up 42% y/y, to end the March quarter at a total of 2.96 million subscribers. Churn has also stabilized in the ~75bps range (and as previously noted, management has noticed only a slight uptick in churn resulting from the price increases).

Peloton subscription metrics (Peloton Q2 shareholder letter)

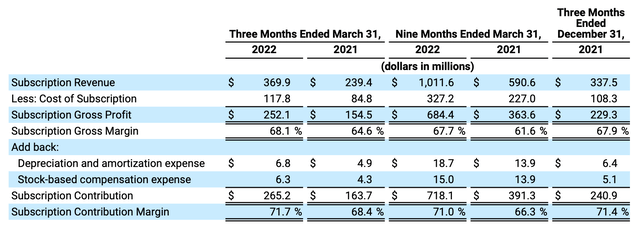

Note as well that, as seen in the chart below, subscription contribution margins are up by 330bps y/y to 71.7%, as music licensing costs and other subscription COGS components benefit from economies of scale:

Peloton subscription margins (Peloton Q2 shareholder letter)

It’s clear that Peloton is detaching itself from hardware and focusing on the subscription model. CEO McCarthy has noted that the company is continuing to test out a potential FaaS (“fitness as a service”) model where customers rent instead of purchase their Peloton equipment. Currently, potential customers can sign of for the “One Peloton” club that comes with a Bike and an all-access subscription membership for $89/month and a one-time $150 delivery fee. Customers also have the option to “buy out” their bikes throughout their membership, similar to a car-lease agreement.

Peloton’s shift in this direction will have the intended impact of reducing its reliance on lumpy, lower-margin hardware revenue and shifting toward a higher-margin subscription base.

Valuation and key takeaways

At current share prices near $13, Peloton trades at a $4.56 billion market cap and a $4.54 billion enterprise value, with a roughly equivalent amount of cash and debt on its balance sheet. This represents a 1.2x EV/FY23 revenue multiple against Wall Street’s $3.67 billion revenue consensus for FY23 (the year ending in June 2023, representing 2% y/y growth; data from Yahoo Finance). Recall that there was once a time when Peloton traded at a double-digit multiple of revenue.

In my view, the market hasn’t yet given enough credit to the turnaround initiatives that Peloton and its new leadership have set in motion. Ride the upward rebound here.

Be the first to comment