Sundry Photography

Introduction

Danaher Corporation (NYSE:DHR) is one of my favorite dividend growth investments. I bought the stock despite its very low yield as it’s a proven total-return star with one of the best business models I’ve ever witnessed – yes, really. The company has strong pricing power, it has a dominant position in healthcare and advanced industrial segments, and the ability to provide investors with outperforming total returns on a long-term basis. In this article, we’re going to discuss all of this, including the just-released earnings. These earnings were great. Yet, they still pressured the stock. I think that’s a great thing as I’m looking to add more exposure in the weeks and months ahead.

What Danaher Is All About

Danaher is one of the companies with a massive footprint in the industries it serves, a $189 billion market cap, but a profile that’s still flying under the radar – at least among retail investors and traders.

This is partially to blame on its $0.25 per share quarterly dividend, which means the dividend yield is a mere 0.41%. That’s not something to write home about as a $10,000 investment gets you $41 in annual dividends.

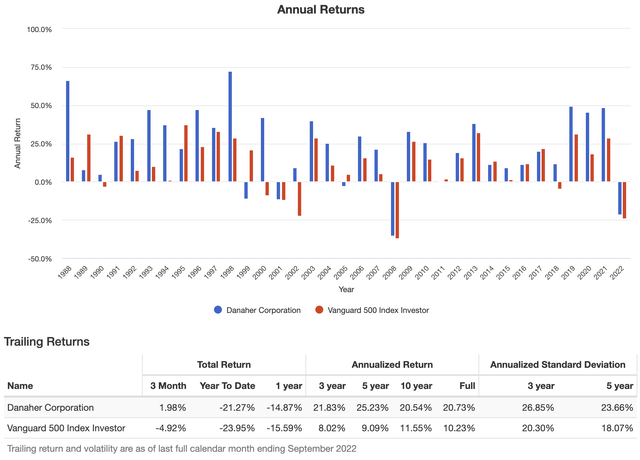

Going back to 1988, DHR shares have returned 20.7% per year, outperforming the S&P 500 by 10 points per year. This outperformance has not faded as the table below shows. Moreover, the company has done all of this without exposing investors to above-average volatility, which is terrific.

Portfolio Visualizer

While I do like to buy stocks with a decent yield, I believe investors who aren’t within 5 years of retirement should own stocks like DHR. A low-volatility outperformer beats most “boring” high-yield stocks.

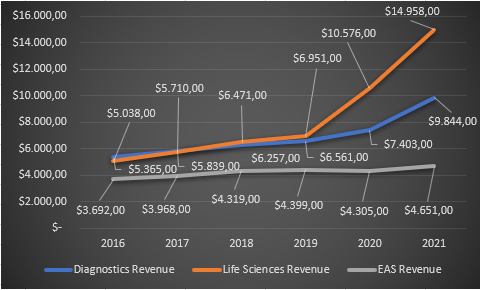

In the case of Danaher, it’s backed by a portfolio of high-quality Life Science companies, Diagnostics, and Environmental & Applied Solutions.

MarketScreener

The company generates roughly 39% of its revenue in the United States, followed by 19% in Western Europe, 18% in high-growth (emerging) markets, 14% in China, and “others”.

In its biggest segment, Life Sciences, the company…

[…] offers a broad range of instruments and consumables that are primarily used by customers to study the basic building blocks of life, including genes, proteins, metabolites, and cells, in order to understand the causes of disease, identify new therapies, and test and manufacture new drugs and vaccines.

These products include genomics, lab automation, mass spectrometry, microscopy, gene and cell therapy, and everything related.

Diagnostics accounted for 33% of 2021 sales. When combined with Life Sciences, it gives the company roughly 84% healthcare exposure, which is why DHR is officially characterized as a “healthcare” company.

The Diagnostics segment offers clinical instruments, reagents, consumables, software, and services that hospitals, physicians’ offices, reference laboratories, and other critical care settings use to diagnose diseases and make treatment decisions.

In its Environmental & Applied Solutions segment, the company owns various companies focused on issues like water quality, product identification (packaging and related software), and others.

This segment will be spun-off in the fourth quarter of 2023, as announced by Danaher in September. After the announcement, Heavy Moat Investments broke down the company’s segments (in this article), making the case for a sale of spin-off shares next year.

Seeking Alpha – Heavy Moat Investments

For now, my opinion is that I will likely keep the shares based on my knowledge of that segment. However, I will cover this spin-off in greater detail next year.

Now, let’s dive into the company’s 3Q22 earnings, which reveal a lot more about the company’s edge.

3Q22 Was Great, For Many Reasons

As always, I’m starting this part by mentioning the headline numbers that hit the wires first after the earnings announcement.

In 3Q22, the company did $7.66 billion in revenue. That’s 5.9% higher compared to the prior-year quarter and $490 million higher than expected. Needless to say, that’s one of the biggest earnings beats I’ve witnessed this quarter.

It provided a path to $2.56 in adjusted EPS, which beat analyst estimates by $0.31.

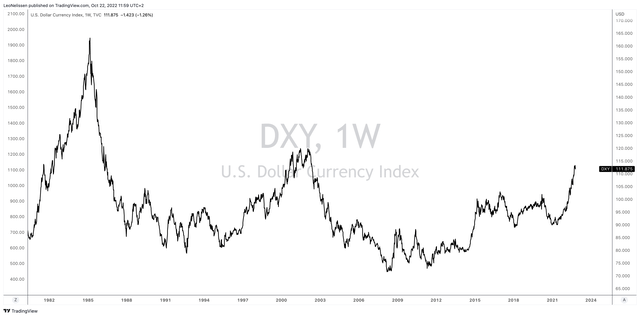

With that in mind, one of the reasons why I mentioned the company’s geographic breakdown is because the dollar has a major impact on DHR’s sales. While corporate treasuries can hedge expected cash flows like bonds, wages, and related, they cannot hedge the forex impact on day-to-day sales.

This year, the dollar is running hot. The greenback is currently at $111 as a result of severe weakness in the eurozone and the United Kingdom, and the fact that the Federal Reserve is draining dollars from the “system”.

TradingView

As a result, the company’s core revenue growth was 10.0%. Currency translations provided a 550 basis points headwind. Acquisitions added 150 basis points.

Needless to say, these numbers indicate high demand, which was confirmed by company comments:

Geographically, we continue to see strong demand across the developed markets despite current macroeconomic and geopolitical events. North America’s core revenue was up high teens with all three segments delivering double-digit or better core revenue growth. Core revenue in Western Europe grew high single digits with customer activity and funding levels remaining healthy.

Moreover, despite high inflation, the company was able to improve its core operating margin by 50 basis points, driven by cost management, productivity gains, and pricing.

Especially pricing was strong. This is what pricing looked like in the company’s segments:

- Life Sciences: +5.5%

- Diagnostics: +1.0%

- EAS: +9.0%

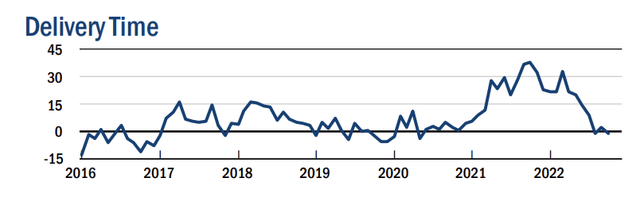

While the operating environment remains “dynamic”, the company experienced fewer supply chain disruptions in the quarter. This includes lower freight costs and smoother logistics.

The chart below shows the delivery times of the Empire State Manufacturing Index, which indicates that things are going back to normal. Hence, I expected Danaher to comment on that as well, which it did.

New York Fed

Danaher also saw improvements in material availability. While it still struggles to get certain electronic parts, overall availability is getting better.

When looking at the company’s segments, growth was everywhere.

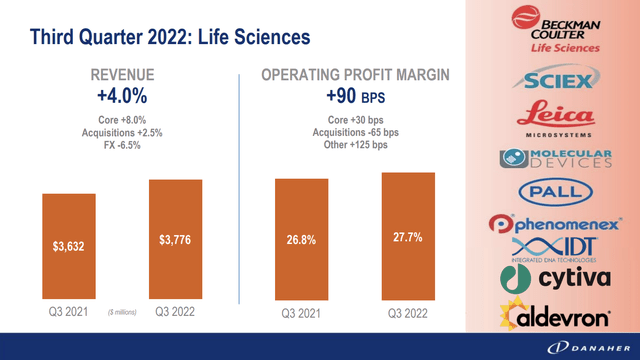

Life Sciences saw 4.0% revenue growth, based on 8.0% core revenue growth, which is truly fantastic, 2.5% acquired growth, and 6.5% FX headwinds. Operating margins rise by 90 basis points, despite a 65 basis points headwind related to acquisitions.

Danaher Corp.

According to the company:

They [referring to its businesses] collectively delivered double-digit base business core revenue growth, led by SCIEX, Leica Microsystems and Beckman Coulter Life Sciences. Funding levels remains strong globally, and we saw solid customer demand across most major end markets.

These comments make sense. Funding levels in healthcare are, generally speaking, anti-cyclical and one of the reasons why DHR enjoys stability. Even in recessions.

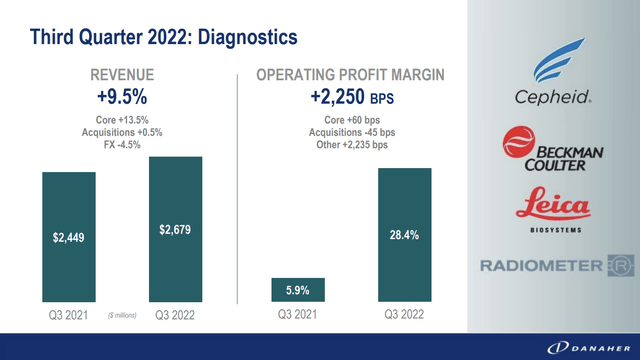

Diagnostics saw 9.5% revenue growth. That’s despite 4.5% currency headwinds as core revenues grow by 13.5% Operating profit margin rose by 2,250 basis points – from 5.9% to 28.4%. That’s not a typo but an outlier quarter.

Danaher Corp.

According to the company:

Leica Biosystems grew mid-teens in the quarter, driven by strength in core histology and advanced staining. As customers seek to improve productivity within their labs, we’re seeing strong early momentum for Leica innovation, BOND-PRIME, a fully automated advancing platform.

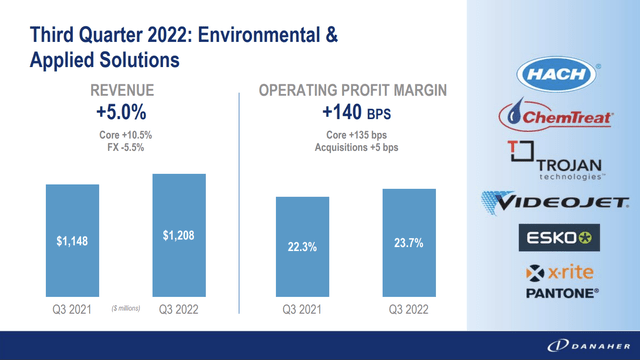

Environmental & Applied Solutions, led by companies like Hach, Trojan, VideoJet, Esko, and X-Rite grew revenues by 5.0%. Forex headwinds were 5.5%. Core revenue growth was 10.5%.

Danaher Corp.

Operating profit margins rose by 140 basis points to 23.7%.

Water quality was up mid-teens, and product identification grew low single digits. Electronic identification, marking and coding was up low single digits and packaging and color management grew mid-single digits. Videojet was up low single digits, in part due to a difficult year-over-year comparison as the business grew low double digits in Q3 last year.

While the stock price is weakening as a result of economic difficulties and overall market weakness, I believe that the third-quarter results, so far, were great. Anti-cyclical demand growth was strong in the healthcare segments, while even the more cyclical EAS segment saw secular growth thanks to its advanced businesses.

It also helps that the outlook was good.

What’s Next?

One thing that can ruin a good quarter is a bad outlook. However, that wasn’t the case. Danaher expects to deliver high single-digit core revenue growth in its base business. The company expects a high single to low double-digit core revenue growth headwind from COVID-19 testing, resulting in core revenue growth being flat to down low single digits in the fourth quarter.

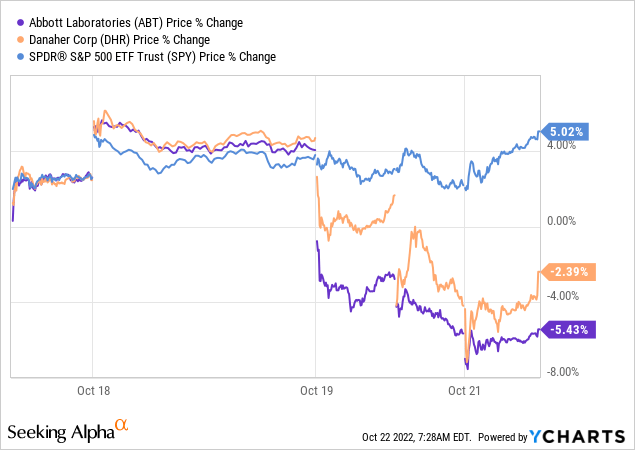

COVID headlines are a reason why the company’s stock has lost some steam. This was fueled when Abbott (ABT) reported that COVID-related sales were down, on top of severe supply chain challenges.

Abbott Laboratories faced “a very challenging quarter… probably our most challenging,” CEO Robert Ford said Wednesday on an earnings call. The company, like its medtech peers, is grappling with hospital staffing shortages, foreign-exchange rate fluctuations and continued supply chain disruptions.

While Danaher does not suffer as much from supply chain issues, Abbott’s earnings dragged down DHR shares before DHR reported its earnings.

Personally, I don’t care too much about these developments. The pandemic is ending, which will hurt diagnostics a bit. That is now being priced in, allowing investors to focus on Danaher’s other strengths, which go well beyond anything related to COVID.

Additionally, the company expects 4Q22 adjusted operating profit margins of roughly 30%.

Moreover, the company confirmed its core revenue guidance on a full-year basis:

Now for the full year 2022, there is no change to our previous guidance of high single-digit core revenue growth in our base business. We now expect high single-digit overall core revenue growth, which is up from our prior expectation of mid-single digits as a result of our strong COVID-19 testing performance in the third quarter.

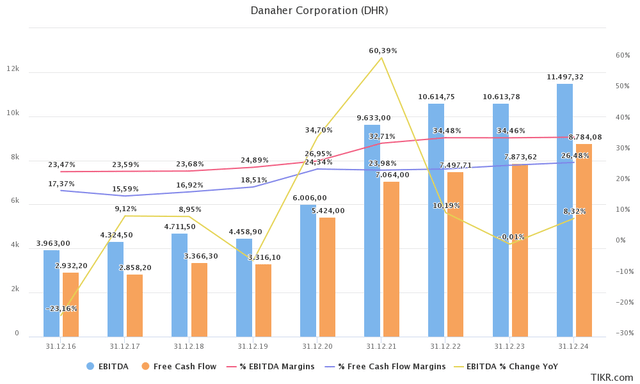

Needless to say, the bigger picture remains bullish. While 2023 will see slower EBITDA due to high growth in 2020-2022, the company will maintain high EBITDA margins and return to faster growth in 2024. Meanwhile, free cash flow is expected to continue to grow to $7.9 billion next year, indicating a 4.1% free cash flow yield and a 27% free cash flow margin. That’s 10 points above pre-pandemic levels.

These estimates also include ongoing economic weakness. In July, the company was still expected to do $11.1 billion in 2023 EBITDA.

TIKR.com

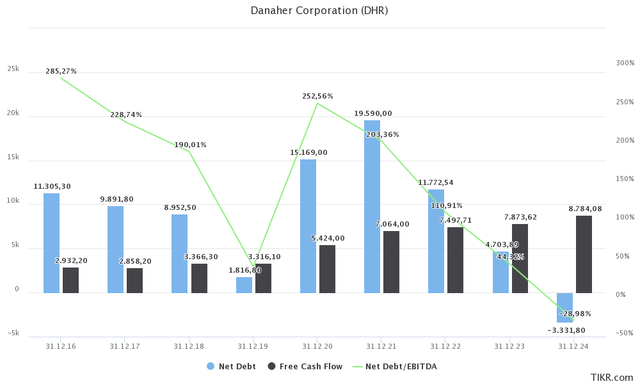

Moreover, the company’s net debt situation is getting increasingly healthy. The power of the Danaher business model is that the company buys companies that complement its existing business. It integrates these companies, allowing it to boost free cash flow. Free cash flow is then used to reduce debt, setting the company up for another major deal. Meanwhile, it spins off non-core assets every now and then.

TIKR.com

Hence, if we exclude future M&A deals (these are impossible to predict, so nobody tries doing that), we see that the company could be net cash positive in 2024. In 2023, net debt could be close to $4.7 billion.

FINVIZ

That said, DHR shares are down roughly 25% year-to-date, trading 26% below their all-time high.

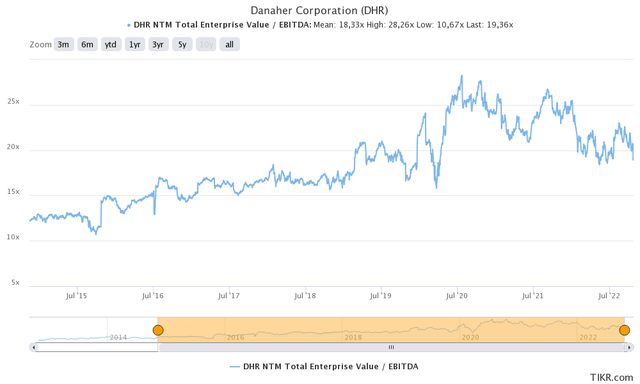

The company is now trading at 18.4x 2023E EBITDA, based on its $189 billion market cap, $1.7 billion in preferred equity, and $4.7 billion in 2023E EBITDA.

While this valuation is at pre-pandemic levels, it’s not what people consider to be “cheap”. However, that makes sense. The company is now running a business with >30% EBITDA margins. That’s up from the low 20% range when the company was trading below 14x EBITDA. Moreover, sales growth is high enough to provide long-term sustainable double-digit earnings growth. There’s really no reason to let this company drop to levels that may seem cheap.

TIKR.com

If the company drops to the $200-$220 area, I will be buying more aggressively as the company has become one of my smaller holdings. I am looking to add at least 50% to the position this year.

Takeaway

Danaher is having a tough time this year. COVID (testing) tailwinds are slowly fading, supply chains were an issue, and the mix of high inflation, slower economic growth, and a hawkish Fed are pressuring market sentiment – and the company’s valuation.

However, Danaher remains on track. The company continues to deliver rock-solid organic sales growth thanks to secular tailwinds and strong pricing. Moreover, the company is witnessing easing supply chain issues and high demand despite the recession.

I remain very bullish and will significantly expand my DHR position this year.

Its business model remains superior, and I have little doubt that DHR will continue to be the total return “beast” it has been since its IPO.

(Dis)agree? Let me know in the comments!

Be the first to comment