mabus13

Copper futures trade on the CME’s COMEX division, but the most active market for copper and other nonferrous metals is the London Metals Exchange or LME. While futures allow for delivery and settlement during active months determined by the exchange, the LME three-most contracts permit delivery each business day, increasing producer and consumer hedging flexibility. Aside from copper, aluminum, nickel, lead, zinc, and tin forwards trade on the LME.

Copper reached a record high of $5.01 per pound in March 2022. Since then, the price has corrected, reaching a low of $3.15 in July. At the $3.40 level on Oct. 25, copper futures were consolidating and digesting the correction from the high.

The most direct route for a risk position in copper is via the COME futures or LME forwards. The United States Copper Index Fund LP (NYSEARCA:CPER) and the iPath Series B Bloomberg Subindex Total Return ETN (NYSEARCA:JJC) follow copper prices higher and lower.

Copper and decarbonization

In May 2021, Goldman Sachs’ analysts called copper “the new oil.” The research analysts outlined that decarbonization does not occur without the red nonferrous meta. “A surge in green capex-combined with the lack of copper mining projects will lead to a multi-year bull market in copper.”

Copper is a critical component in electric vehicle and wind turbine production. Meanwhile, bringing new production online takes the better part of a decade. The new mining projects face numerous challenges, including rising energy and labor costs, tortuous permitting processes, environmental considerations, and political risks.

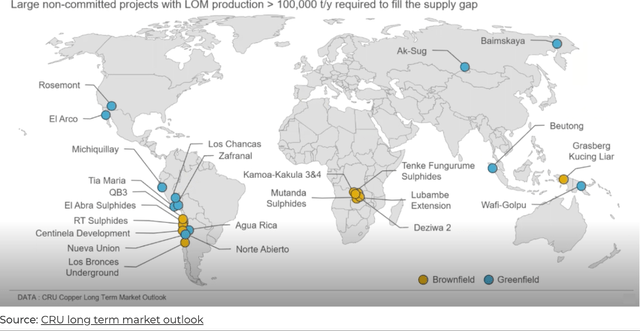

Map of Current Copper Mining Projects (Mining.com)

As the map shows, while some of the new mining projects are in copper-rich Chile and South America, other reserves in Africa are in the Democratic Republic of Congo, a historically challenging political environment for mining companies. The DRC’s long history of corruption precludes many Western mining companies and financial institutions from investing or lending the necessary capital.

The bottom line is that new supplies will only be available later this decade or in the early 2030s. Meanwhile, LME copper stocks have been trending lower.

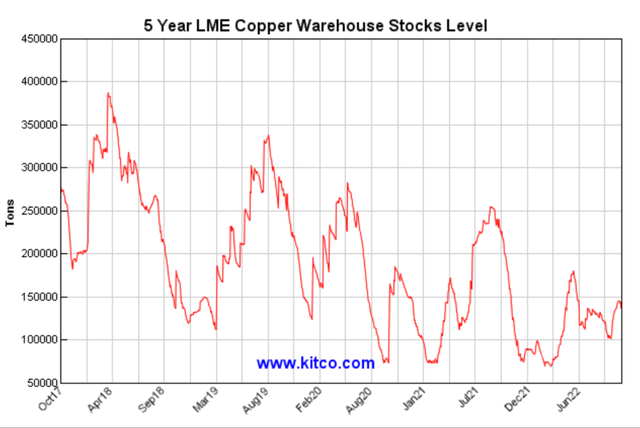

Chart of LME Copper Inventories (LME/Kitco)

The chart highlights the trend of lower highs in worldwide London Metals Exchange copper inventories over the past five years.

As copper demand increases, supplies are decreasing, creating a deficit, and pushing prices higher.

A correction from the high

Goldman Sachs’ 2021 research report pushed copper futures and forwards to record highs in 2021 and early 2022.

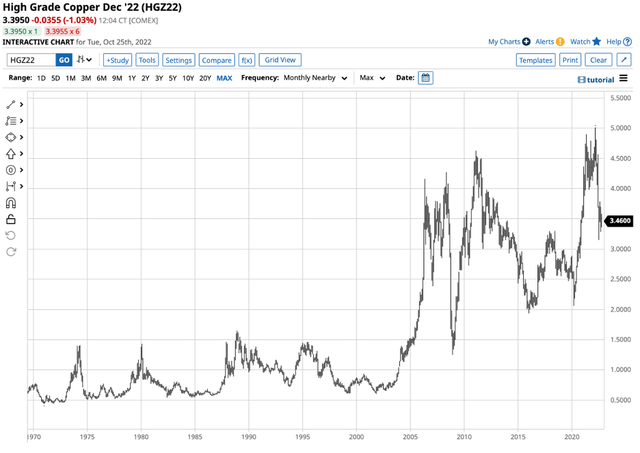

Long-Term Chart of COMEX Copper Futures (Barchart)

The chart dating back to the late 1960s highlights that COMEX copper futures rose to a record $4.6255 in 2021 and reached a higher high of $5.01 per pound in March 2022. LME prices also rose to record peaks in 2021 and 2022.

Meanwhile, Goldman Sachs forecasts that copper prices will rise to $15,000 per ton later this decade, and at that level, COMEX futures prices would move to over the $6.80 per pound level.

Copper corrected from its most recent high in March 2022, reaching a low of $3.15 in July.

Bull markets rarely move in straight lines

COMEX copper futures fell 37.1% from the March 2022 high to the July 2022 low. On Oct. 25, December COMEX copper futures settled at $3.3970 per pound level, closer to the July low than the May high.

Bull markets rarely move in straight lines, and corrections can be brutal, shaking the confidence of the most committed bulls. However, substantial corrections in markets with significant supply and demand factors underpinning prices create compelling opportunities.

Copper dropped to $3.15 per pound at the most recent July low and has been consolidating over the past three months. Meanwhile, as the long-term chart illustrates, the price action continues to reflect a pattern of higher lows this century. In 2008, nearby copper futures fell to $1.2475 per pound. In early 2016, the low was $1.9365, in March 2020, copper futures fell to a higher low of $2.0595. While copper has declined by over 37% from the March 2022 high, the bullish long-term pattern of higher lows remains firmly intact.

Three reasons to consider copper

Three compelling factors point to a return of higher highs in the COMEX copper futures and LME copper forward markets:

- Goldman Sachs’ supply and demand forecasts, including rising worldwide demand and falling supplies, are compelling reasons why copper’s price will come storming back from below the $3.40 per pound level.

- The highest global inflation since the early 1980s is pushing production prices higher for existing copper mines, putting upward pressure on prices.

- Geopolitical turmoil is impacting trade and logistics, which increases the cost of producing, transporting, and processing copper into refined products.

While it’s impossible to pick bottoms in short or medium-term bear markets, I favor buying copper at the current price level. However, leaving plenty of room to add to long positions on further declines is prudent. The lower copper falls, the more compelling the case for a long position becomes in the current environment.

The surge in traditional energy prices and climate change concerns will foster rising copper demand over the coming years.

Comparing CPER and JJC

There are many opportunities for those looking for copper exposure in portfolios. The world’s leading mining companies tend to outperform the commodity’s price during rallies and underperform when the metal corrects lower. Freeport McMoRan (FCX) and Southern Copper (SCCO) are two of the world’s copper mining giants, with Glencore (OTCPK:GLNCY), BHP Billiton (BHP), and Rio Tinto (RIO) significant producing companies.

LME forwards and COMEX futures allow for direct investment in copper prices. An ETF and ETN product do an excellent job tracking copper prices as the United States Copper Index Fund LP (CPER), and the iPath Series B Bloomberg Subindex Total Return ETN (JJN) follow copper prices higher and lower.

- At $20.48 per share, CPER is the ETF with more than $160.3 million in assets under management. CPER trades an average of 139,546 shares daily and charges a 1.08% management fee.

- At $17.04 per share, the JJC ETN has more than $56.4 million in assets under management. JJC trades an average of 36,842 shares daily and charges a 0.45% management fee.

The last significant rally in nearby COMEX copper took the price from $2.0595 in March 2020 to $5.01 in March 2022, or 143.3% higher. The subsequent correction sent the price 37.1% lower to $3.15 per pound in July 2022.

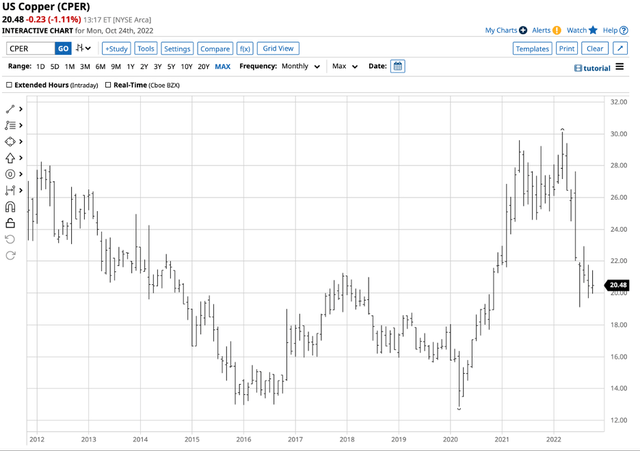

Chart of the CPER ETF Product (Barchart)

CPER rose from $12.87 to $30.12 before correcting to $19.11 per share over the same period. The rally took CPER 134% higher during the rally and 36.6% lower during the correction.

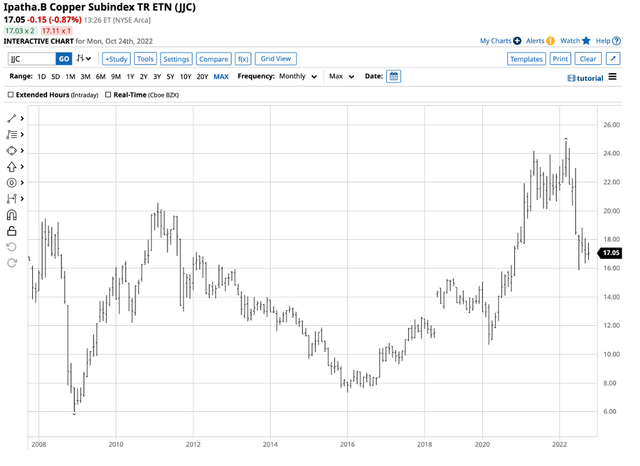

Chart of the JJC ETN Product (Barchart)

The JJC ETF rose from $10.67 to $24.87 per share and dropped to $15.86 over the same period. JJC rose 133% during the rally and fell 36.2% as copper corrected.

The ETF and ETN products did an excellent job tracking copper prices. While CPER is more expensive from an expense ratio perspective, it offers more liquidity than JJC. I view the ETF and ETN as acceptable products, given their performance since the 2020 lows.

Copper has long been an infrastructure building block but has become an energy commodity, increasing the metal’s demand. I expect copper to continue making higher lows and higher highs, making the recent correction and current consolidation period the perfect time to consider adding copper exposure to portfolios. When buying copper, leave plenty of room to add on further declines as rising interest rates and a strong US dollar are not bullish for the path of least resistance or prices. However, a greener path for energy production and consumption and the copper supply situation favors a return to a bullish trend sooner instead than later.

Be the first to comment