bymuratdeniz

Fellow Investors,

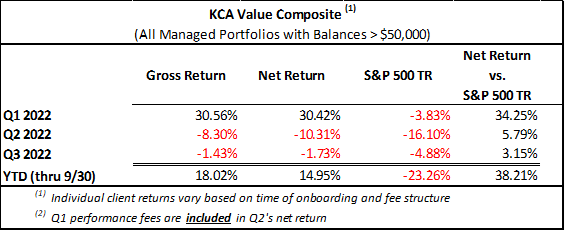

Kingdom Capital Advisors (KCA Value Composite) returned (-1.73%) net of fees in the third quarter, vs. (–4.9%) for the S&P and (–4.6%) for the Russell. This marks KCA’s third consecutive quarter outperforming our benchmark, the S&P500. Year to date, the KCA Value Composite has returned 14.95% net of fees, over 38% outperformance vs. all major indices.

Kingdom Capital

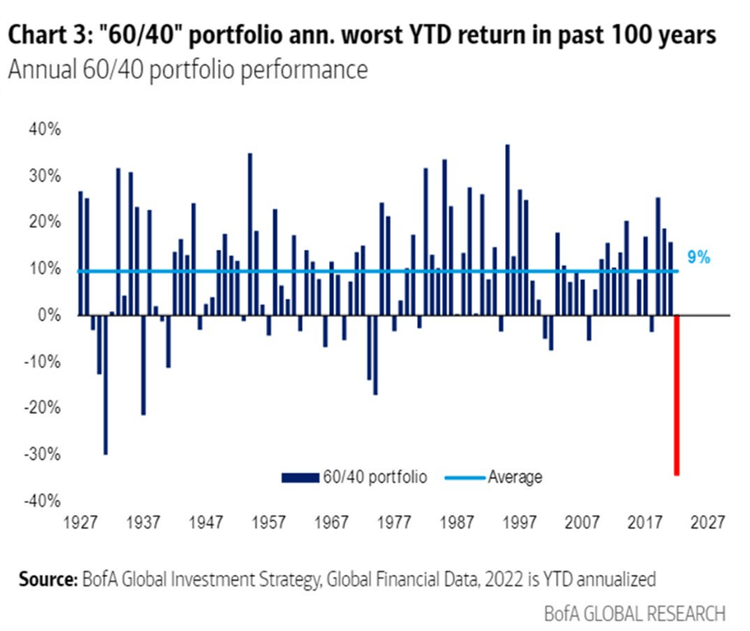

Investing in 2022 remains extremely difficult. The classic 60/40 portfolio allocation (60% stocks and 40% bonds) has declined substantially year to date. In fact, according to Bank of America, the 60/40 portfolio allocation strategy has had its worst performance in the past 100 years:

BofA Global Investment Strategy

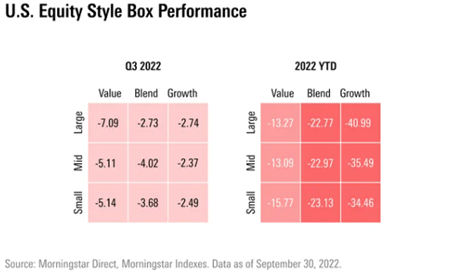

While we wish to report strong growth in account balances, we are content to protect principal while looking for opportunities in the broader market carnage. Our focus on value stocks has proven prudent and we continue to fade growth investments:

Morningstar Direct

Strategy and Positioning

At the end of Q3, approximately 90% of capital was invested with 10% held in cash. We maintained our largest five positions, though we opportunistically rebalanced throughout the quarter. We remain encouraged with the business execution of our top holdings, despite the volatile backdrop.

We continue to selectively hedge certain macro risks, both at the index level and relative to our specific stocks. One example – we utilized put options against the Invesco DB Commodity Index Tracking ETF (DBC) to partially hedge our exposure to energy prices.

Looking ahead to Q4, we are closely monitoring several interesting macro developments:

-

The continued release of the U.S. Strategic Petroleum Reserve (SPR) has been credited with lowering oil prices, and we are curious to see what happens once this drawdown is curtailed. To compound matters, OPEC+ members agreed to reduce output by two million barrels per day starting in November. Unit Corporation (OTCPK:UNTC), Pardee Resources (OTCPK:PDER), Arch Resources (ARCH), and other smaller positions we hold all positively benefit from increases in energy prices, providing some nice upside in the event resource prices spike again in Q4.

-

A common refrain is that the economy is headed for recession in 2023 and many believe we are already there. Our two pieces recently published on Seeking Alpha for A-Mark (AMRK) and CreditRiskMonitor (OTCQX:CRMZ) highlighted the defensive nature of these investments, and we expect further macro deterioration to benefit these businesses.

We also opened smaller catalyst-driven trading positions including some SPAC warrants, an auto supplier priced for bankruptcy, a Real Estate Investment Trust (REIT) conversion, and more.

Portfolio Commentary

Below is a brief update on a few of the core positions in our current portfolio. Investors have complete transparency into all positions and are encouraged to contact us with specific questions at any time.

-

Dole PLC (DOLE): Cementing itself as the worst performer of our core positions, Dole’s stock price continued its march lower during the third quarter. The stock is now down ~50% from when we profiled it on Seeking Alpha last November. Despite some currency hedges, Dole has suffered from the historic strength of the dollar as their sales into weaker currencies like the Euro and GBP have lost relative value. Dole’s underlying asset value remains strong, and we look forward to the current headwinds eventually converting to tailwinds when the dollar normalizes. We overestimated the “margin of safety” on this position but continue to believe results will normalize and the underlying value of the business will shine through. Notably, Czech activist investor Jan Barta filed a 5.2% stake during the third quarter, expressing his belief that the company shares are undervalued and he intends to engage with the Board of Directors to correct the mispricing.

-

Polished (POL): A substantial percentage of Q3 portfolio declines resulted from our investment in Polished. In a single press release, the company issued guidance toward continued sales growth despite the tough supply chain and macro environment, but also announced a vague audit committee investigation regarding a whistleblower complaint. The price of common shares and warrants went spiraling. Our extensive groundwork since the announcement has indicated there are no accounting concerns, though labor law violations are likely to be uncovered through this investigation. While we don’t know what the ultimate outcome will be, we believe the sell-off is disproportionate to the offense, and prices will recover once more clarity is provided.

-

Arch Resources (ARCH): Arch continues to experience a more favorable macro backdrop than we expected when we initiated a position at the beginning of the year. Forward prices for coking coal continue to hover around $300/ton. If Arch produces their full 10-million-ton capacity at these prices in 2023, they will essentially earn their entire current valuation, before accounting for additional significant income from thermal coal. Their debt has been dealt with, the convertible note is mostly settled, and internal liquidity hurdles cleared. All that remains is returning capital to shareholders via buybacks and dividends.

-

Saga Communications (SGA): A new investment in Q3, Saga has historically traded at a significant discount to fair value due to “super voting” shares in the hands of their CEO. After his recent passing, his super voting shares converted to common and control of the business reverted to shareholders. We expect this change in control to result in more shareholder-friendly actions, already evidenced by a $2 special dividend declared in Q3, payable in Q4. Daniel Tisch’s investment fund, Towerview, is the largest shareholder and already filed with the SEC indicating they may engage the company about pursuing a sale of the assets. We expect a sale would unlock substantial upside.

-

Good Times Restaurants (GTIM): Small restaurant operator GTIM has slowly traded down throughout 2022 and we recently started accumulating shares. The company has consistently generated cash throughout their public history and has shown strong resilience in the face of spiking labor and commodity costs; however, it now trades at an implied valuation under $20 million. Due to the company’s strong cash position, they have bought back shares recently at prices 50% lower than where they failed to tender shares in 2021. We believe as price pressures ease GTIM earnings power will inflect even higher and rerate shares substantially.

Business Update

Mike and I continue to seek out patient investors interested in our actively managed small-cap strategy. Many investors remain hesitant given the macro deterioration and our limited track record; however, we look forward to further substantiating the advantages of our fund.

In Q3 we continued actively posting our work to Seeking Alpha, publishing writeups on Polished, Wheeler Real Estate Investment Trust (WHLR), Saga Communications, and an introspective look at our old GameStop (GME) investment. We also had the opportunity to join Andrew Walker’s “Yet Another Value Podcast” to discuss our Unit Corporation investment thesis. Additionally, our CreditRiskMonitor investment was highlighted by Snowball Research in their July 2022 “Project X” issue. We have some more efforts in the works that we look forward to sharing once published.

We appreciate you entrusting us with your investment. Mike and I have invested most of our net worth with Kingdom Capital and will continue to steward your capital as we do our own.

Sincerely,

David Bastian

Chief Investment Officer

DISCLOSURES

This document is not an offer to invest with Kingdom Capital Advisors, LLC (“KCA” or the “firm”).

The statements of the investment objectives are statements of objectives only. They are not projections of expected performance nor guarantees of anticipated investment results. Actual performance and results may vary substantially from the stated objectives. Performance returns are calculated by yHLsoft, Inc. dba Advyzon.

An investment with the firm involves a high degree of risk and is suitable only for sophisticated investors. Investors should be prepared to suffer losses of their entire investments.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the firm described herein may differ materially from those reflected or contemplated in such forward-looking statements.

This document and information contained herein reflects various assumptions, opinions, and projections of Kingdom Capital Advisors, LLC (“Kingdom Capital Advisors” or “KCA”) which is subject to change at any time. KCA does not represent that any opinion or projection will be realized.

The analyses, conclusions, and opinions presented in this document are the views of KCA and not those of any third party. The analyses and conclusions of KCA contained in this document are based on publicly available information. KCA recognizes there may be public or non-public information available that could lead others, including the companies discussed herein, to disagree with KCA’s analyses, conclusions, and opinions.

Funds managed by KCA may have an investment in the companies discussed in this document. It is possible that KCA may change its opinion regarding the companies at any time for any or no reason. KCA may buy, sell, sell short, cover, change the form of its investment, or completely exit from its investment in the companies at any time for any or no reason. KCA hereby disclaims any duty to provide updates or changes to the analyses contained herein including, without limitation, the manner or type of any KCA investment.

Positions reflected in this letter do not represent all of the positions held, purchased, and/or sold, and may represent a small percentage of holdings and/or activity.

The S&P 500 is an index of US equities. It is included for information purposes only and may not be representative of the type of investments made by the firm. The firm’s investments differ materially from this index. The firm is concentrated in a small number of positions while the index is diversified. The firm return data provided is unaudited and subject to revision.

None of the information contained herein has been filed with the U.S. Securities and Exchange Commission, any securities administrator under any state securities laws, or any other U.S. or non-U.S. governmental or self-regulatory authority. Any representation to the contrary is unlawful.

Be the first to comment