Justin Sullivan

The Home Depot, Inc. (NYSE:HD) operates as a home improvement retailer. In August, 2022, we have published an article on Seeking Alpha, titled: “Home Depot: Q2 Results May Have Been Interpreted Too Optimistically“.

In that article, we have rated the firm’s stock as “hold” and we have highlighted the following reasons for our argumentation:

- Strong top- and bottom-line results in Q2 have been accompanied by a decreasing number of transactions and rapidly increasing inventory.

- Macroeconomic indicators, including housing starts, building permits and consumer confidence are all signaling a slowing housing market, which could lead to declining demand for HD’s products.

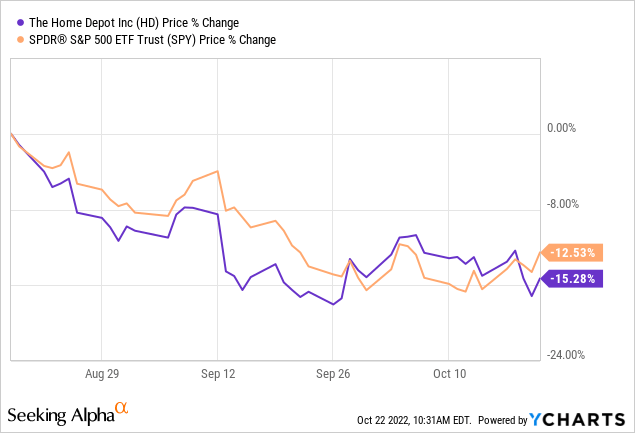

Since then, the price of HD’s stock has declined by as much as 15%, underperforming the broader market.

Today, we are going to give an update on the previously studied macroeconomic indicators to see, what to expect from the Q3 results. Further, we are going to take a closer look at HD’s valuation using the Gordon Growth Model as many choose to invest in HD for their growing dividends.

Macroeconomic indicators

Since our last writing, the analysed macroeconomic indicators have not seen a substantial improvement.

Consumer confidence

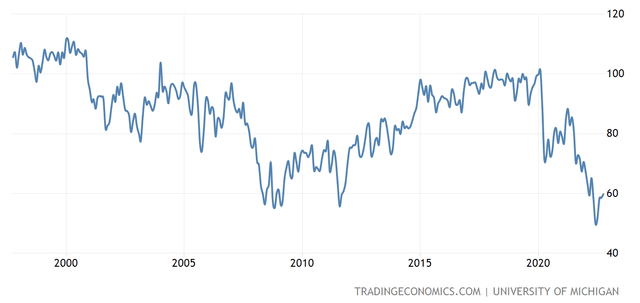

While consumer confidence has improved somewhat from its July lows, it still remains at extremely low readings.

Consumer confidence (tradingeconomics.com)

In our opinion, while the Fed keeps increasing the interest rate and the inflation readings remain high, consumer confidence is not expected to dramatically improve.

We earlier claimed that poor consumer confidence is likely to keep hurting the demand for durable, non-essential goods. In the third quarter, some earnings reports have already confirmed our thesis. For example, Whirlpool (WHR) reported worse than expected results, both top- and bottom-line. The firm has also lowered its guidance for the full year.

For this reason, we believe that the demand for HD’s products in the third quarter is also not likely to be strong.

United States housing starts

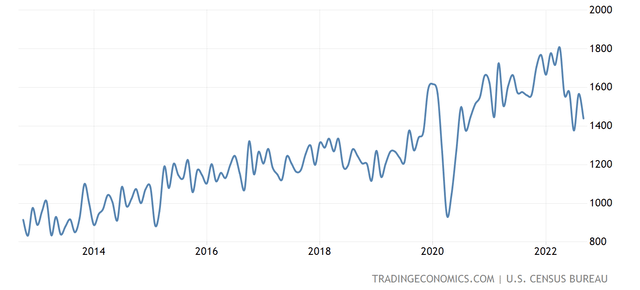

While housing starts have also seen a bounce in the past months, the latest reading is pointing to further decrease.

Housing starts (tradingeconomics.com)

The number of housing starts is often closely linked to the mortgages rates. As the Fed keeps increasing the interest rate, mortgages keep becoming more and more expensive, leading to a declining demand for new housing units. The declining demand for new units could also indirectly impact the demand for HD’s products.

To sum up, we believe that HD’s financial performance is likely to remain negatively impacted by the current macroeconomic environment. As the above-mentioned readings have not significantly improved since our last writing, we do not expect that the third quarter results of the firm are going to be stronger than the Q2 results.

In this environment, naturally our next question is: is our “hold” rating still appropriate then?

To answer this question, we are going to use the Gordon Growth Model to determine the intrinsic value of the firm, based on its dividend payments and dividend growth.

Valuation

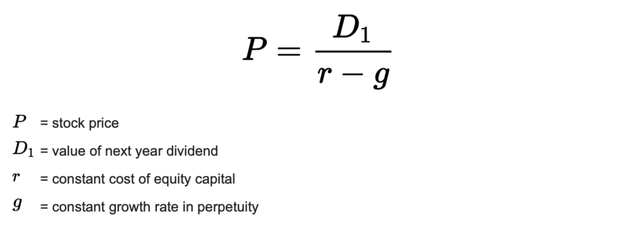

The Gordon growth model is a relatively simple and widely recognized dividend discount model, used to value the equity of dividend paying firms. The following formula described the model:

Gordon Growth Model (wallstreetprep.com)

The main assumption of this model is that the dividend grows indefinitely at a constant rate. Due to this criterion, the growth model is particularly appropriate for firms that are:

1.) Paying dividends

2.) In the mature growth phase

3.) Relatively insensitive to the business cycle

A strong track record of steadily increasing dividend payments at a stable growth rate could also serve as a practical criterion if the trend is expected to continue in the future.

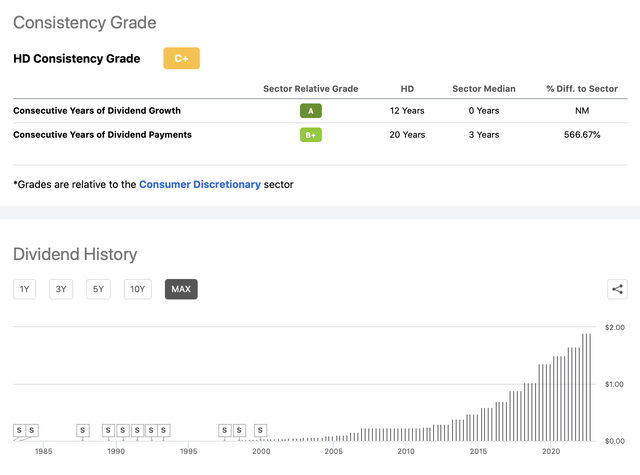

While one could argue that HD’s business is sensitive to the business cycle, we believe that it has a strong track record of dividend payments and has demonstrated its commitment to return value to its shareholders even during times of downturns.

Dividend history (Seeking Alpha)

Due to this fact, we believe that the GGM could be a suitable method to value HD’s stock.

To estimate the intrinsic value of HD’s stock we have to define the required rate of return and the constant growth rate in perpetuity.

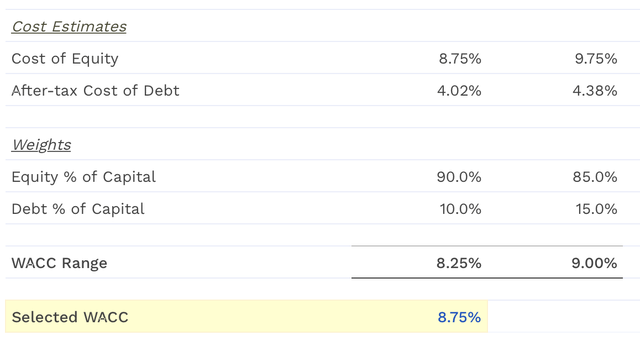

For the required rate of return, we normally prefer to use the firm’s weighted average cost of capital [WACC], which is about 8.75%, in HD’s case.

WACC (finbox.com)

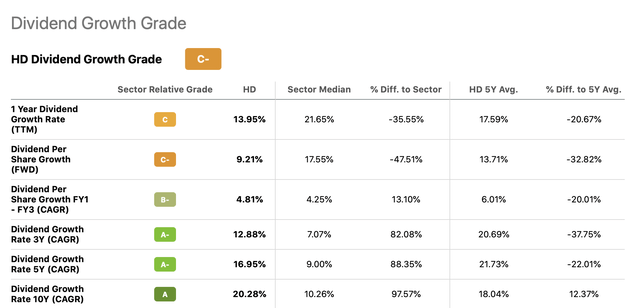

For the constant growth rate in perpetuity, we are going to use a range of values, based on historic dividend growth rates.

Dividend growth (Seeking Alpha)

While it is often tempting to use higher growth rates, we have to remember that this assumptions has to hold in perpetuity. Therefore, we normally use growth rates from the lower end of the range. We believe for HD a range of 4% to 6% could be appropriate.

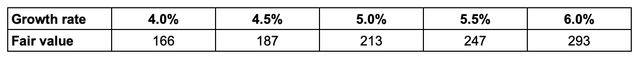

Using these assumptions, the calculation yields the following results:

Fair value in USD/share (Author)

Home Depot is currently trading around $275 per share, which is at the higher end of the range. We believe at these price levels, there is little room for upside. For this reason, in our opinion, at the current price levels in the current macroeconomic environment the stock is not attractive for dividend growth investors.

Conclusion

The macroeconomic environment has not improved since our last writing. For this reason, the demand for HD’s products has likely remained weak in the third quarter and also likely to remain so in the coming quarters.

Other firms selling durable, discretionary goods have also seen a decline in the demand for their products. For example, Whirlpool, which has missed on both top- and bottom-line estimates in the third quarter.

We also believe that the valuation in the current market environment is relatively high, providing little upside form the current price levels, based on the Gordon Growth Model.

For these reason, we downgrade HD from our previous “hold” to “sell”.

Be the first to comment