Marje/E+ via Getty Images

This article was coproduced with Cappuccino Finance.

Market turmoil is in full force. Energy prices (oil, natural gas, etc.) are fluctuating, and the U.S. 10 Year Treasury yield rose above 4% for the first time since October 2008.

The stock market is jumping around based on inflation news, dropping 4% in one day to hit the new low for the year, but, rallying the very next day when headlines improve. It’s really hard to guess what the stock market will do these days.

During times like these, putting money in a high-quality REIT is one of the best ways to invest money. A REIT with a strong balance sheet and solid asset portfolio will continue to pay a dividend regardless of whether the market is in turmoil or not, and the stock price will appreciate once the bull market returns. Piedmont Office Realty Trust (NYSE:PDM) is a great example of such a stock.

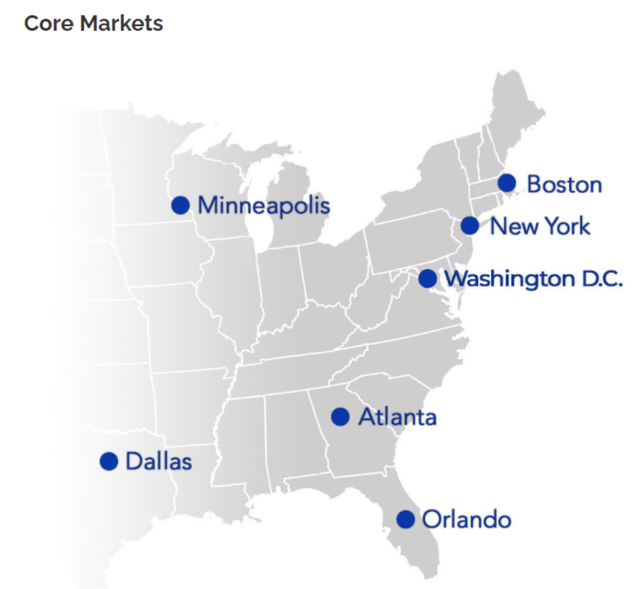

Piedmont Office Realty Trust focuses on owning, managing, and developing class A office properties in the U.S. Their core markets consist of Minneapolis, Boston, New York, Washington D.C., Atlanta, Dallas, and Orlando.

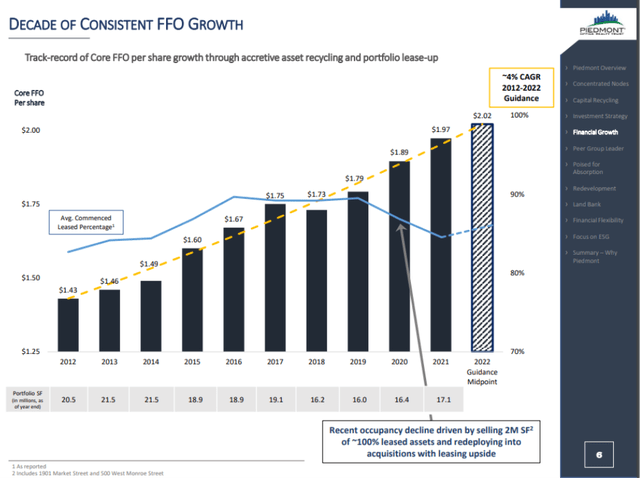

With their proven business model and strong fundamentals, Piedmont has been growing steadily over the past decade or so. Core FFO per share steadily grew from $1.43 in 2012 to $1.97 in 2021, and it is expected to grow another ~4% to $2.02 in 2022.

In the last quarter, Piedmont recorded solid operational and financial performance. 2Q 2022 was the fourth quarter in a row with new tenant leasing exceeding 200,000 square feet, demonstrating that office space performance is recovering from the pandemic.

They completed more than 50 lease transactions (~724,000 square feet) in the quarter, which was larger than the previous quarter’s volume. The second-generation rent was higher by 3% and 12% on a cash and accrual basis, respectively.

Strong Balance Sheet and Conservative Leverage

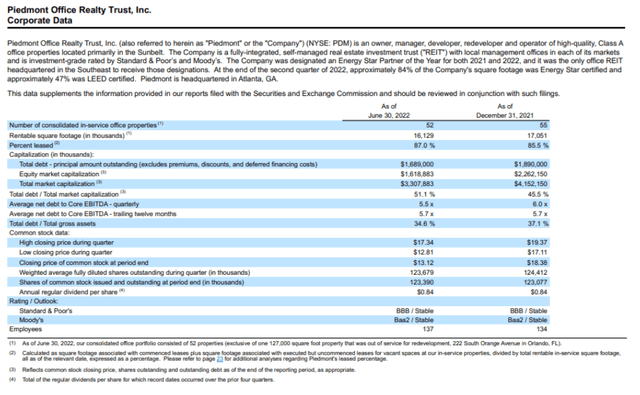

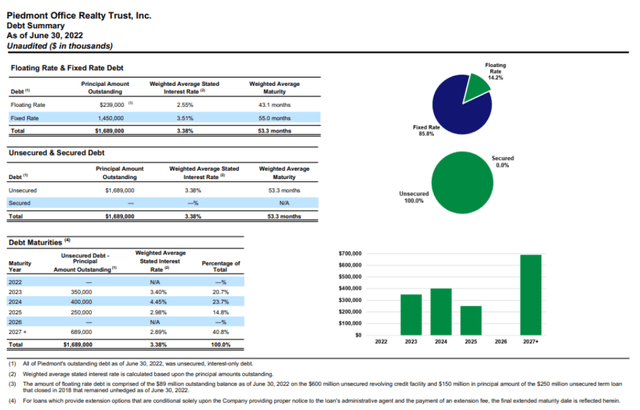

Piedmont maintains a conservative financing strategy, targeting a debt-to-asset ratio between 30% and 40% and a debt to EBITDA ratio around a low 6x. Currently, the debt-to-asset ratio is 34.6%, and debt to core EBITDA ratio is at 5.5x.

Also, over 85% of their debt is at a fixed rate, which is very beneficial in this environment of increasing interest rates. Additionally, their debt is very well spread across the next several years.

Well-managed leverage and a strong balance sheet have served as Piedmont’s backbone, allowing them to acquire target properties and to develop/redevelop properties to add value to their portfolio. It is not surprising to see that the REIT has received an investment grade rating from credit agencies, and I expect that to be the case in the near future.

Given that concerns about a recession are increasing, and the real estate market is expecting uncertainty, this strong balance sheet and conservative leverage give the shareholder an extra layer of protection.

1180 Peachtree Acquisition

Piedmont’s management is very excited about the acquisition of 1180 Peachtree. 1180 Peachtree is one of the most iconic properties in Atlanta, and it is certainly a high-quality asset that fits well into Piedmont’s portfolio.

The building is currently leased to an impressive roster of tenants (professional services and financial firms) with rents that are 20% below market rates, presenting a huge upside in the future.

The debt metric will initially be negatively impacted by the acquisition since the mortgage note will push up the leverage ratio. However, this impact is expected to be temporary and last only until the offsetting dispositions are completed. The sale of two Cambridge assets will be sold, and the $100 M gain from the disposition will be protected by a 1031 exchange.

Diversified Portfolio

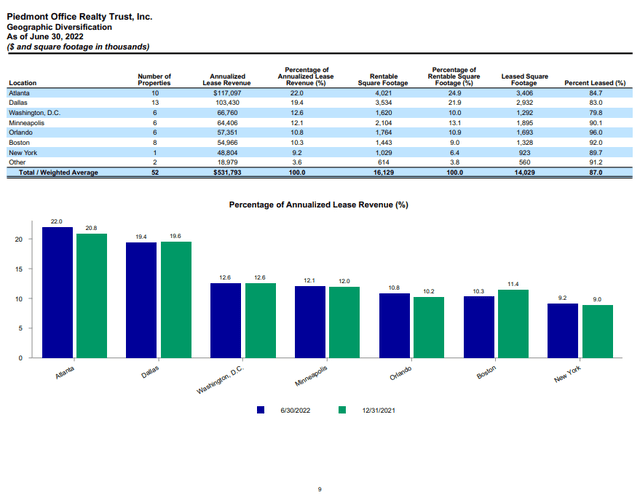

Piedmont has strategically built a portfolio that is diversified both geographically and industry-wise to reduce risk.

Geographically speaking, their properties are in seven major cities in the U.S. (Atlanta, Dallas, Washington D.C., Minneapolis, Orlando, Boston, and New York), and they are well distributed (top market Atlanta only represents 22%).

This insulates Piedmont if a city starts to struggle, because a local economic slump won’t severely impact the overall leasing activity.

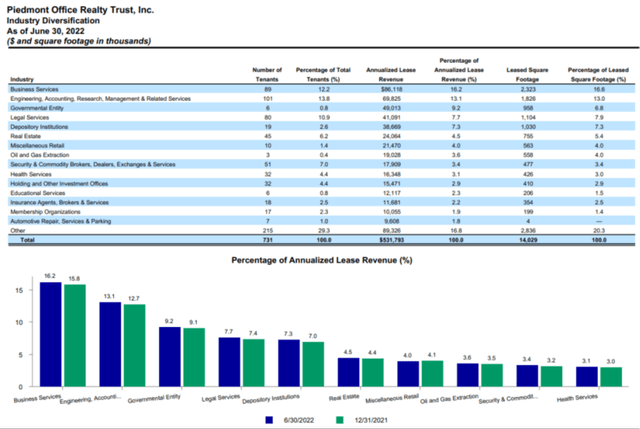

Also, the tenant’s industry distributions look favorable as well. Top tenant industries are business services, engineering, accounting, R&D, and legal services, and each of those top categories represent only between 10.8% and 12.2%. Therefore, underperformance by one industry won’t drastically impact Piedmont’s performance.

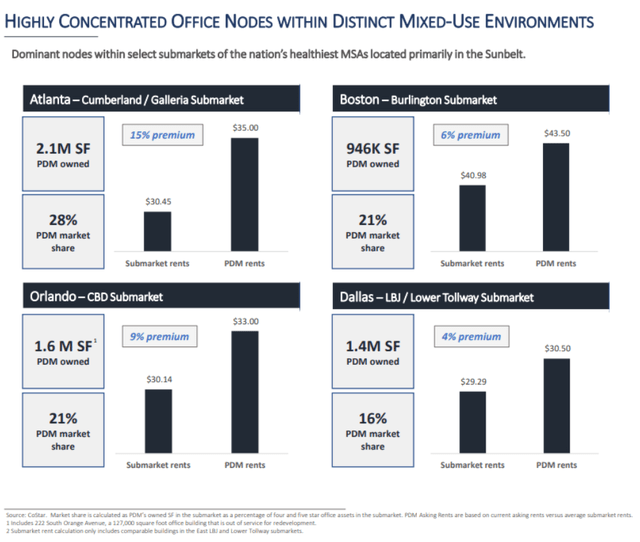

Such a diversified portfolio wouldn’t be as valuable if the properties were mediocre. This is certainly not the case for Piedmont. Their properties are among the most desirable office spaces in their submarkets, so their properties command a substantial premium. Their properties rent at 4-15% higher than the submarket averages, which clearly demonstrates the quality of their assets.

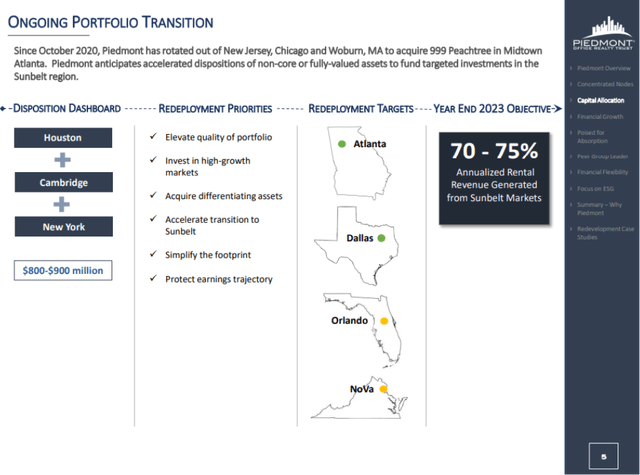

Also, they continue to execute their plan to improve the quality of their assets. Piedmont is rotating out of properties in non-core markets or fully valued assets and using the dispositions to fund targeted investments. These transitions will elevate the overall quality of the portfolio, increase the operating efficiency by simplifying the footprint, and protect their growth trajectory.

Dividend Yield and Safety

Currently, Piedmont’s dividend yield is very attractive at 8.30%. Stock price has dropped 45% over the past twelve months, due to market volatility, fear of a recession, and increasing interest rates.

Given their strong portfolio and operational performance, I think their stock price is oversold, and their share is greatly undervalued. Therefore, the current dividend yield is signaling a great buying point for a savvy investor.

Additionally, their dividend is very well protected at this point. Cash dividend payout ratio is only 44.47%, and AFFO payout ratio is 61.99%. FAD payout ratio is also at 64.89%. These metrics demonstrate that there is a significant cushion between the dividend and their profit.

Their strong operational performance, stable balance sheet, and well diversified portfolio also protect the safety of Piedmont’s dividend. I don’t expect Piedmont to experience any great financial hardship or find themselves in a position of being unable to pay the dividend anytime soon.

Valuation

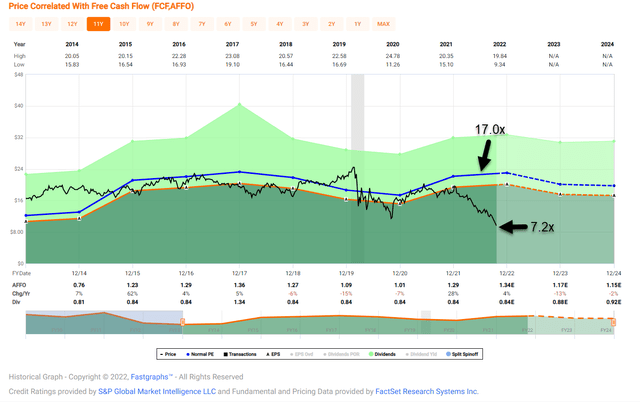

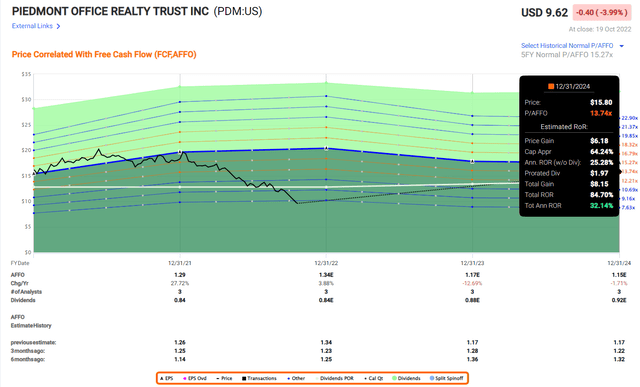

The recent drop in their stock price made the valuation of Piedmont very attractive. P/AFFO of 7.39x and P/FFO of 4.96x is simply too cheap given Piedmont’s portfolio and operational strength.

These values are almost half of their 5-year averages, and both numbers are also far below the sector medians, demonstrating that Piedmont is severely undervalued.

The iREIT Alpha Ratings Tracker shows that the margin of safety for Piedmont is at 34%. This figure also reiterates how severely Piedmont stock is undervalued.

Given the quality of assets in their well-diversified portfolio and operational strength, I believe Piedmont will continue to grow in the long run. A shareholder will be rewarded handsomely with generous dividend now along with stock price appreciation.

Risk

As many of us know, interest and mortgage rates have been increasing, and many experts are expecting the real estate market to slow down in the near term.

These fluid conditions could negatively affect Piedmont’s operation. Dispositions could get delayed, and the capital availability for new investment may get tighter. Therefore, their growth trajectory might be negatively impacted by this macrotrend.

On a related topic, the high inflation and interest environment will cause an economic slowdown, ultimately triggering a recession. An economic slowdown could lower demand for Piedmont’s properties, causing the profit margin to retract.

Conclusions

Piedmont is positioning themselves very well for growth. Their portfolio is well diversified, and the management has a great plan to improve the quality of their portfolio.

The stock price drop in the past twelve months has made their valuation look very attractive and created a very high dividend yield (8.7%). Given their strong balance sheet and solid operational performance, I don’t think they will have any problems extending their growth into the future.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment