Brad Barket

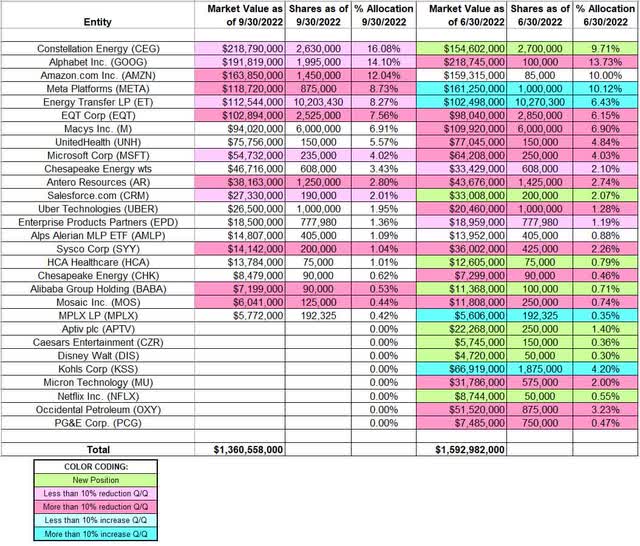

This article is part of a series that provides an ongoing analysis of the changes made to David Tepper’s 13F portfolio on a quarterly basis. It is based on Appaloosa Management’s regulatory 13F Form filed on 11/14/2022. Please visit our Tracking David Tepper’s Appaloosa Management Portfolio series to get an idea of his investment philosophy and our previous update for the fund’s moves during Q2 2022.

This quarter, Tepper’s 13F portfolio value decreased from $1.59B to $1.36B as many positions were reduced or sold. The number of holdings decreased from 32 to 29. The top five positions are Alphabet, Meta Platforms, Amazon.com, Constellation Energy, and Macy’s. They add up to ~50% of the portfolio. To know more about Tepper’s distress investing style, check out the book Distress Investing: Principles and Technique.

New Stakes:

None.

Stake Disposals:

Occidental Petroleum (OXY): OXY was a 3.23% of the portfolio stake established in Q4 2020 at prices between ~$8.90 and ~$21.30. H2 2021 saw a roughly one-third selling at prices between ~$23.20 and ~$32.90 while next quarter there was a ~15% stake increase at prices between ~$22 and $33. There was a ~85% reduction over the last two quarters at prices between ~$31 and ~$71. The disposal this quarter was at prices between ~$57 and ~$75. The stock currently trades at $70.28.

Micron Technology (MU): MU was a ~2% of the portfolio position. The original large stake was built in Q3 2019 at prices between $39.50 and $51. There was a one-third increase in Q4 2019 at prices between $42 and $55.50. The next three quarters had also seen a ~50% increase at prices between ~$34.50 and ~$60. There was a ~93% selling over the last six quarters at prices between ~$54 and ~$97. The elimination this quarter was at prices between ~$49 and ~$65. The stock currently trades at $58.41.

Note: MU is a frequently traded stock in Tepper’s portfolio.

Kohl’s Corp (KSS): The 4.20% KSS position saw a ~170% stake increase last quarter at prices between ~$29 and ~$61. It was sold this quarter at prices between ~$25 and ~$36. The stock is now at $31.93.

Aptiv PLC (APTV): The 1.40% of the portfolio stake in APTV was purchased last quarter at prices between ~$86 and ~$120. It was sold this quarter at prices between ~$78 and ~$111. It is now at ~$106.

Netflix Inc. (NFLX), Caesars Entertainment (CZR), PG&E Corp (PCG), and Walt Disney (DIS): These small (less than 0.5% of the portfolio each) stakes were disposed during the quarter.

Stake Increases:

None.

Stake Decreases:

Constellation Energy (CEG): CEG is currently the largest position in the portfolio at ~16%. It was established last quarter at prices between ~$53 and ~$67 and the stock currently trades well over that range at ~$97. There was a minor ~3% trimming this quarter.

Note: Constellation Energy is Exelon’s (EXC) power generation and marketing business that was spun off in February.

Alphabet Inc. (GOOG) (GOOGL): GOOG is currently the second largest 13F position at ~14% of the portfolio. It has been a significant presence in the portfolio since Q1 2012 and the original purchase was at prices between ~$14.50 and ~$16.25. The stake has wavered. Recent activity follows: Q1-Q3 2020 saw a ~40% reduction at prices between ~$53 and ~$86. That was followed with a ~60% reduction over the last six quarters at prices between ~$87 and ~$151. The stock currently trades at $97.60. There was marginal trimming this quarter.

Amazon.com (AMZN): The large (top three) ~12% AMZN stake was purchased in Q1 2019 at prices between ~$75 and ~$91. The next three quarters saw a ~75% stake increase at prices between ~$84.50 and ~$101. There was a ~50% selling from Q1 to Q3 2020 at prices between ~$84 and ~$177. Q4 2020 saw an about turn: ~40% stake increase at prices between ~$150 and ~$172. There were two-thirds selling over the next three quarters at prices between ~$148 and ~$187. Q1 2022 saw a ~20% stake increase while this quarter there was similar selling The stock currently trades at $93.41.

Meta Platforms (META): META is a top-five 8.72% of the portfolio stake established in Q3 2016 at prices between $114 and $131 and increased by ~50% in the following quarter at prices between $115 and $133. H2 2017 saw a stake doubling at prices between $148 and $183. The position has since wavered. Recent activity follows. Q1-Q3 2020 had seen a ~40% selling at prices between $146 and $304 while next quarter saw a ~14% stake increase. The five quarters through Q1 2022 had seen a ~55% selling at prices between ~$187 and ~$382. The stock is currently at ~$111. Last quarter saw a ~12% increase while this quarter there was similar trimming.

Note: META has seen several previous roundtrips in the portfolio. The latest was a 3.28% of the portfolio position established in Q1 2016 at prices between $94 and $116 and sold the following quarter at prices between $109 and $121.

Energy Transfer LP (ET): Energy Transfer Partners merged with Energy Transfer Equity and the resulting entity was renamed Energy Transfer LP (ET). The transaction closed last January, and terms were 1.28 shares of ETE for each ETP. Tepper held shares in both and those got converted to ET shares. There was a stake doubling in Q4 2019 at prices between $11 and $13. Next three quarters saw the stake again doubled at prices between $4.55 and $13.75 while Q2 2021 saw a ~45% selling at prices between ~$7.70 and ~$11.35. The stock is now at $12.36, and the stake is at 8.27% of the portfolio. Last quarter saw a ~12% increase while this quarter there was marginal trimming.

EQT Corp. (EQT): EQT is a 7.56% of the portfolio position built over the two quarters through Q3 2021 at prices between ~$16 and ~$23. There was a ~50% reduction over the last three quarters at prices between ~$20 and ~$50. The stock is now at ~$43.

Microsoft (MSFT): The ~4% MSFT stake was built in 2020 at prices between $152 and $232. The two quarters through Q2 2021 had seen a ~45% selling at prices between ~$212 and ~$272. Q1 2022 saw a ~25% stake increase at prices between ~$275 and ~$335 while last quarter there was a roughly one-third reduction at prices between ~$242 and ~$315. The stock currently trades at ~$248. This quarter saw a ~6% trimming.

Antero Resources (AR) and Sysco Corp (SYY): The 2.80% stake in AR was established in Q1 & Q3 2021 at prices between ~$6 and ~$19. There was a ~55% reduction over the last three quarters at prices between ~$17 and ~$48. The stock currently trades at $37.27. SYY is a ~1% stake established in Q2 2020 at prices between ~$40 and ~$62. The position has seen selling since. Last three quarters saw a ~75% reduction at prices between ~$71 and ~$90. The stock is now at $86.45.

Salesforce, Inc. (CRM): CRM is a ~2% of the portfolio position established this quarter at prices between ~$156 and ~$221 and the stock is now at ~$153. There was a minor ~5% trimming this quarter.

Alibaba Group Holding (BABA) and Mosaic Company (MOS): These small (less than ~0.60% of the portfolio each) stakes were reduced during the quarter.

Kept Steady:

Macy’s, Inc. (M): The large ~7% Macy’s stake was almost doubled in Q3 2021 at prices between ~$16 and ~$25. There was a ~45% stake increase next quarter at prices between ~$22 and ~$37. Last two quarters saw a ~40% reduction at prices between ~$17.50 and ~$28. The stock is now at $23.65.

UnitedHealth (UNH): UNH is now a 5.57% of the portfolio position. The stake was built in Q4 2020 and Q1 2021 at prices between ~$305 and ~$377. Last five quarters saw a ~45% selling at prices between ~$367 and ~$546. The stock currently trades at ~$538.

Uber Technologies (UBER): UBER is now a ~2% of the portfolio position. The original large stake was purchased in Q2 2021 at prices between ~$44 and ~$61. Q4 2021 saw that stake almost sold out at prices between ~$36 and ~$48. The position was rebuilt next quarter at prices between ~$29 and ~$44.50 but was again sold down last quarter at prices between ~$20.50 and ~$36.50. The stock currently trades at $28.50.

Chesapeake Energy (CHK) & wts: The ~4% stake was kept steady this quarter. The original position is from the conversion of senior debt they held as the company emerged from Chapter 11 bankruptcy in Q1 2021. Since then, both the common and warrant stakes were reduced substantially.

Alps Alerian MLP ETF (AMLP), Enterprise Products Partners (EPD), HCA Healthcare (HCA), and MPLX LP (MPLX): These small (less than ~1.50% of the portfolio each) stakes were kept steady this quarter.

The spreadsheet below highlights changes to Tepper’s 13F stock holdings in Q3 2022:

David Tepper – Appaloosa LP’s Q3 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment