Solid revenue growth likely to continue with uncertainty from DST business

SS&C Technologies (SSNC) reported 4Q19 adjusted organic growth of 4.7%, above market expectations and management guidance. In my view, the momentum is likely to continue into FY20, given its market-leading position, strong sales force and increasing outsourcing demand for back- and middle-office functions from alternative investment, especially private equity.

The highly expected cross-selling opportunities from DST’s large customer base (61 million investor accounts) did not materialize in FY 19. The revenue from this acquired business was almost flat in FY19. I believe the challenge was two-fold. First, management focused efforts on margin improvement through automation, workforce restructuring as well as a cultural shift. After all, cutting costs without curbing revenue growth is a delicate business. Second, DST’s existing customers have already had offerings from SSNC’s competitors and high switching costs have posed a hurdle in conversion.

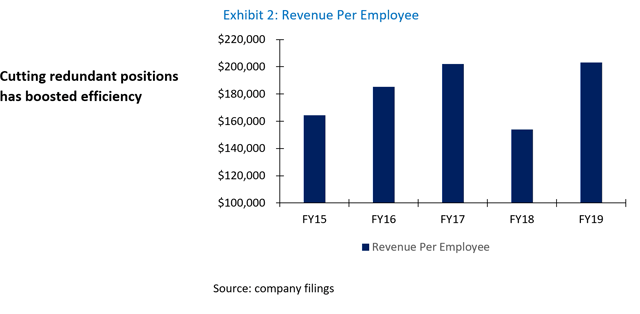

Since the margin and revenue per employee rose back to the pre-acquisition level, driven by synergy realization and cost control, I think management now has more capacity to work on the conversion of DST’s clients to SS&C’s outsourcing platform where it offers a full suite of products.

Source: company filings

I think the company is well-positioned to capitalize on the conversion opportunity with improved execution and focus. The benefits (lower overall cost) of SS&C’s bundled products, strong brand awareness and the compatibleness of its systems with mutual funds encourage DST’s clients to migrate (a process that takes 5-6 months) to SS&C platforms from the current system (only offering investor accounts processing). With a conservative assumption of $20,000 per investor account, DST’s clients could potentially add as much as $3 trillion assets to SS&C’s AUA, which is the current addressable market for cross-selling and, if successful, could translate to $1 billion in revenue. However, the short-term impact on earnings is still unclear, given the time-consuming process. Highlighting the challenge was the wide range (0.5% to 3.9%) in management guidance for FY20 organic revenue growth.

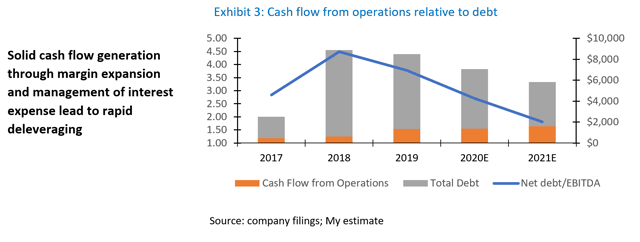

Strong cash flow generation enables rapid deleveraging

SSNC generated $1.3 billion cash flow from operations and paid down $1.1 billion net debt in FY19, pushing Net debt/EBITDA down to 3.77x, which I believe will continue to decline to less than 2x in FY21 and position the company for another major acquisition if it maintains mid-digit organic revenue growth.

Valuation below historical average with potential upside

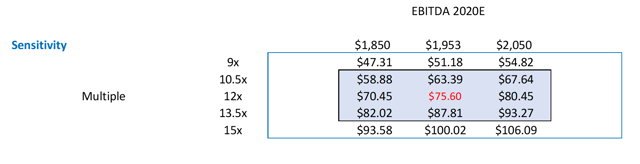

On the multiple side, the stock is currently trading at 10.6x EV/EBITDA as of Feb. 28th, compared to 11.4x on Feb. 25 (prior to market selloff) and 12x two-year historical average. On the earnings side, the market consensus estimates FY20 EBITDA at $1.916B vs. my estimate of $1.953B. I believe the upside potential outweighs the downside risks given that both a severe market meltdown (leading to earnings recession) and an economic recession (leading to multiple contraction) seem unlikely at this point.

Source of trading multiples and consensus: Bloomberg

Conclusion

Overall, I view SS&C as a solid long-term investment because of its high margin (40+ %) and differential advantage, supported by its large client base, a strong brand, and industry-leading technologies. I am confident that, given SS&C’s disciplined approach and strong execution, the integration of DST Systems (a potential major catalyst) will put SS&C on track to grow market share and improve operating margins while continuing to gain traction in legacy business (alternative investments), where there are opportunities for consolidation and substantial room for growth (P/E and real-estate). I would also like to point out the downside risk; that is, the valuation is highly correlated to the overall market, so a certain level of volatility is expected in the current market condition.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment